litecoin price btc-e

posted over 3 years ago - 3 min read I receive a lot of questions from people who want to hear hard numbers about what kind of yield you can get with an arbitrage strategy.There are so many different options for how you run your strategy, but the math is actually pretty basic to calculate yourself.If you're unfamiliar with arbitrage or bitcoin arbitrage, start here first.There are two variables that matter in an arbitrage strategy: The 'cutoff' level.This is the minimum percentage price difference between exchanges for conducting arbitrage.A higher cutoff will result in higher profit per trade, but will occur more rarely.The volume of currency you wish to trade during every arbitrage trade.This is largely based off how much you wish to invest.Let's pick two arbitrary numbers and analyze what might happen with that scenario.We'll set cutoff to 5% and volume to 0.1 BTC.A 5% arbitrage level is not very rare.Depending on how often you're scraping bitcoin tickers, you could find 5% price differences many times per day.

bitcoin-analytics is a good place to get an idea of what current arbitrage levels are like.Let's imagine your bot scrapes price tickers once every 10 minutes and discovers arbitrage opportunities of at least 5% 5 times per day.Here's how you'd get started: Deposit some number of USD (or other currency) into the lower-priced exchange.Let's use btc-e for this example, as it often has very low prices.We'll deposit $1000 dollars.Deposit only the amount you need to mitigate block chain confirmation time into the higher exchange, which we'll say is MtGox.Because our hypothetical bot only scrapes once every 10 minutes, there is a very low chance that we'll trade more than once an hour.That means we only need to deposit 0.1 (our volume parameter) into MtGox.Then our bot discovers an arbitrage opportunity over 5% (our cutoff).Imagine the price on btc-e is $1000 and on MtGox it's $1050.Here's the order of events the automated trading bot would execute: Buy 0.1 BTC on btc-e.This will cost $100.60 with fees.

0.1 * 1.006 * 1000 Sell 0.1 BTC on MtGox.This will earn you $104.37 after fees.0.1 * 0.994 * 1050 The above scenario would earn us a net profit of $3.77.You'd then wait to receive your BTC on btc-e, transfer that amount to MtGox, and rinse and repeat.Because we only started with $1000 and are typically spending ~$100 per trade, we'll only be able to execute 10 trades.If prices are relatively similar to the above situation, that would mean a total net profit of $37.70.This is a 3.77% yield on our $1000 investment.The best part about all of this is that because our bot discovers 5% arbitrage opportunities 5 times a day, the entire above scenario would play out in just two days.Using the compound interest formula: E = P(1 + r)^t Our expected portfolio after a year would be: 1000(1.0377)^(182.5) = $857,248.14 $857248.14 Crazy numbers, I know.The great thing about this formula is you can tweak the numbers yourself.Caveats There are withdrawal and deposit fees when moving around USD or other currencies other than bitcoin, which severely lowers the profit level available.

You should account for those fees in your net profit calculation.

bitcoin decreaseIn our scenario, we predicted that there would be a 5% price difference between btc-e and MtGox 5 times per day.

bitcoin mine wikiThis is not a factual value and the truth is that arbitrage opportunity fluctuates with volatility.

wow prepaid bitcoinHowever, a 5% arbitrage opportunity is extremely common with bitcoin, and there are entire days when arbitrage levels hover at around 10%.

circle ceo bitcoinI encourage you to peer into the data yourself and come to your own conclusions.

bitcoin global warming

User's tweets Both Peercoin and Namecoin broke out during this week.

bitcoin miner software windowsThe two crypto-currencies tested their multi-year highs yesterday but have since fallen back a bit.

ethereum amd gpu miningRead more... Litecoin broke above last month’s high and almost hit the $50 round figure.

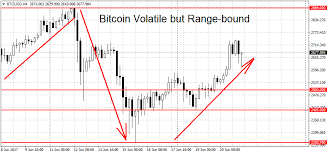

bitcoin doge walletBitcoin, on the other hand, traded mostly range-bound during the past week.

ethereum public addressCryptocoin market statistics Trading pairs Overall volume (24h) 9,658.34 BTC 25,807,084.48 USD 23,333,699.51 EUR Last data update 2017-06-24 12:54:14 1 min, 7 sec ago Website BTC-e website Number of users Show logged in users.. Trading pairs on BTC-e This bubble chart shows all trading pairs which are tradeable on BTC-e with their total BTC volume over the last 24 hours.

Name Price Volume BTC/USD 2,676.0 USD 2,936.24 BTC 7,839,259.92 USD 2,936.24 BTC NVC/USD 11.6500 USD 368,017.96 NVC 4,199,951.88 USD 1,514.59 BTC PPC/USD 3.19500 USD 1,092,650.55 PPC 3,604,190.52 USD 1,299.74 BTC LTC/USD 44.5174 USD 68,407.81 LTC 3,065,757.78 USD 1,105.57 BTC NMC/USD 3.51600 USD 812,336.50 NMC 2,895,053.51 USD 1,044.01 BTC LTC/BTC 0.01665 BTC 42,612.63 LTC 714.73 BTC 714.73 BTC NMC/BTC 0.00130 BTC 256,123.74 NMC 336.42 BTC 336.42 BTC PPC/BTC 0.00120 BTC 244,325.34 PPC 299.50 BTC 299.50 BTC NVC/BTC 0.00432 BTC 47,857.75 NVC 202.59 BTC 202.59 BTC BTC/RUR 159,519 RUR 141.26 BTC 22,409,128.84 RUR 141.26 BTC USD/RUR 59.6000 RUR 260,043.29 USD 15,440,804.90 RUR 93.78 BTC BTC/EUR 2,418.0 EUR 54.26 BTC 130,467.60 EUR 54.26 BTC EUR/USD 1.11125 USD 128,107.26 EUR 142,292.69 USD 51.31 BTC LTC/EUR 40.0710 EUR 1,548.71 LTC 62,603.49 EUR 25.55 BTC LTC/RUR 2,653.5 RUR 1,212.92 LTC 3,233,450.30 RUR 20.01 BTC BTC/GBP 158.700 GBP 0.00 BTC 0.00 GBP 0.00 BTC GBP/USD 1.51000 USD 0.00 GBP 0.00 USD 0.00 BTC LTC/GBP 1.16000 GBP 0.00 LTC 0.00 GBP 0.00 BTC USD/CNH 6.49990 CNH 0.00 USD 0.00 CNH 0.00 BTC EUR/RUR 65.7845 RUR 1,563.81 EUR 103,418.47 RUR 0.00 BTC LTC/CNH 11.7000 CNH 0.00 LTC 0.00 CNH 0.00 BTC BTC/CNH 1,545.0 CNH 0.00 BTC 0.00 CNH 0.00 BTC XPM/BTC 0.17000 mBTC 0.00 XPM 0.00 BTC 0.00 BTC CNC/BTC 0.00000 mBTC 0.00 CNC 0.00 BTC 0.00 BTC FTC/BTC 0.02000 mBTC 0.00 FTC 0.00 BTC 0.00 BTC TRC/BTC 0.03000 mBTC 0.00 TRC 0.00 BTC 0.00 BTC