bitcoin mine wiki

Jump to: , A quick and dirty mining rig Contents 1 2 3 4 Mining is the process of adding transaction records to Bitcoin's public ledger of past transactions.This ledger of past transactions is called the block chain as it is a chain of blocks.The block chain serves to confirm transactions to the rest of the network as having taken place.Bitcoin nodes use the block chain to distinguish legitimate Bitcoin transactions from attempts to re-spend coins that have already been spent elsewhere.Mining is intentionally designed to be resource-intensive and difficult so that the number of blocks found each day by miners remains steady.Individual blocks must contain a proof of work to be considered valid.This proof of work is verified by other Bitcoin nodes each time they receive a block.Bitcoin uses the hashcash proof-of-work function.The primary purpose of mining is to allow Bitcoin nodes to reach a secure, tamper-resistant consensus.Mining is also the mechanism used to introduce Bitcoins into the system: Miners are paid any transaction fees as well as a "subsidy" of newly created coins.

This both serves the purpose of disseminating new coins in a decentralized manner as well as motivating people to provide security for the system.Bitcoin mining is so called because it resembles the mining of other commodities: it requires exertion and it slowly makes new currency available at a rate that resembles the rate at which commodities like gold are mined from the ground.

bitcoin une monnaieMining a block is difficult because the SHA-256 hash of a block's header must be lower than or equal to the target in order for the block to be accepted by the network.

bitcoin 10 avrilThis problem can be simplified for explanation purposes: The hash of a block must start with a certain number of zeros.

litecoin use gpuThe probability of calculating a hash that starts with many zeros is very low, therefore many attempts must be made.

buying bitcoin locally

In order to generate a new hash each round, a nonce is incremented.See Proof of work for more information.The difficulty is the measure of how difficult it is to find a new block compared to the easiest it can ever be.It is recalculated every 2016 blocks to a value such that the previous 2016 blocks would have been generated in exactly two weeks had everyone been mining at this difficulty.

bitcoin lamborghiniThis will yield, on average, one block every ten minutes.

bitcoin crash july 2014As more miners join, the rate of block creation will go up.As the rate of block generation goes up, the difficulty rises to compensate which will push the rate of block creation back down.Any blocks released by malicious miners that do not meet the required difficulty target will simply be rejected by everyone on the network and thus will be worthless.When a block is discovered, the discoverer may award themselves a certain number of bitcoins, which is agreed-upon by everyone in the network.

Currently this bounty is 25 bitcoins; this value will halve every 210,000 blocks.See Controlled Currency Supply.Additionally, the miner is awarded the fees paid by users sending transactions.The fee is an incentive for the miner to include the transaction in their block.In the future, as the number of new bitcoins miners are allowed to create in each block dwindles, the fees will make up a much more important percentage of mining income.Users have used various types of hardware over time to mine blocks.Hardware specifications and performance statistics are detailed on the Mining Hardware Comparison page.Early Bitcoin client versions allowed users to use their CPUs to mine.The advent of GPU mining made CPU mining financially unwise as the hashrate of the network grew to such a degree that the amount of bitcoins produced by CPU mining became lower than the cost of power to operate a CPU.The option was therefore removed from the core Bitcoin client's user interface.GPU Mining is drastically faster and more efficient than CPU mining.

See the main article: Why a GPU mines faster than a CPU.A variety of popular mining rigs have been documented.FPGA mining is a very efficient and fast way to mine, comparable to GPU mining and drastically outperforming CPU mining.FPGAs typically consume very small amounts of power with relatively high hash ratings, making them more viable and efficient than GPU mining.See Mining Hardware Comparison for FPGA hardware specifications and statistics.An application-specific integrated circuit, or ASIC, is a microchip designed and manufactured for a very specific purpose.ASICs designed for Bitcoin mining were first released in 2013.For the amount of power they consume, they are vastly faster than all previous technologies and already have made GPU mining financially unwise in some countries and setups.Mining contractors provide mining services with performance specified by contract, often referred to as a "Mining Contract".They may, for example, rent out a specific level of mining capacity for a set price for a specific duration.

As more and more miners competed for the limited supply of blocks, individuals found that they were working for months without finding a block and receiving any reward for their mining efforts.This made mining something of a gamble.To address the variance in their income miners started organizing themselves into pools so that they could share rewards more evenly.See Pooled mining and Comparison of mining pools.Bitcoin's public ledger (the 'block chain') was started on January 3rd, 2009 at 18:15 UTC presumably by Satoshi Nakamoto.The first block is known as the genesis block.The first transaction recorded in the first block was a single transaction paying the reward of 50 new bitcoins to its creator.Bitcoin explained in 3 minutes Bitcoin is a cryptocurrency and a digital payment system[13]:3 invented by an unknown programmer, or a group of programmers, under the name Satoshi Nakamoto.[14]It was released as open-source software in 2009.[15]The system is peer-to-peer, and transactions take place between users directly, without an intermediary.[13]:4

These transactions are verified by network nodes and recorded in a public distributed ledger called a blockchain.Since the system works without a central repository or single administrator, bitcoin is called the first decentralized digital currency.[13]:1[16]Besides being created as a reward for mining, bitcoin can be exchanged for other currencies,[17] products, and services in legal or black markets.[18][19]As of February 2015, over 100,000 merchants and vendors accepted bitcoin as payment.[20]According to research produced by Cambridge University in 2017, there are 2.9 to 5.8 million unique users using a cryptocurrency wallet, most of them using bitcoin.[21]Contents 1 2 3 4 5 6 7 8 9 The word bitcoin occurred in the white paper[22] that defined bitcoin published on 31 October 2008.[23]It is a compound of the words bit and coin.[24]The white paper frequently uses the shorter coin.[22]There is no uniform convention for bitcoin capitalization.

Some sources use Bitcoin, capitalized, to refer to the technology and network and bitcoin, lowercase, to refer to the unit of account.[25]The Wall Street Journal,[26] The Chronicle of Higher Education,[27] and the Oxford English Dictionary[24] advocate use of lowercase bitcoin in all cases, which this article follows.Number of unspent transaction outputs The blockchain is a public ledger that records bitcoin transactions.[28]A novel solution accomplishes this without any trusted central authority: maintenance of the blockchain is performed by a network of communicating nodes running bitcoin software.[13]Transactions of the form payer X sends Y bitcoins to payee Z are broadcast to this network using readily available software applications.[29]Network nodes can validate transactions, add them to their copy of the ledger, and then broadcast these ledger additions to other nodes.The blockchain is a distributed database – to achieve independent verification of the chain of ownership of any and every bitcoin amount, each network node stores its own copy of the blockchain.[30]

Approximately six times per hour, a new group of accepted transactions, a block, is created, added to the blockchain, and quickly published to all nodes.This allows bitcoin software to determine when a particular bitcoin amount has been spent, which is necessary in order to prevent double-spending in an environment without central oversight.Whereas a conventional ledger records the transfers of actual bills or promissory notes that exist apart from it, the blockchain is the only place that bitcoins can be said to exist in the form of unspent outputs of transactions.[7]:ch.5 Number of bitcoin transactions per month (logarithmic scale)[31] Transactions are defined using a Forth-like scripting language.[7]:ch.5 A valid transaction must have one or more inputs.[32]Every input must be an unspent output of a previous transaction.The transaction must carry the digital signature of every input owner.The use of multiple inputs corresponds to the use of multiple coins in a cash transaction.

A transaction can also have multiple outputs, allowing one to make multiple payments in one go.A transaction output can be specified as an arbitrary multiple of satoshi.As in a cash transaction, the sum of inputs (coins used to pay) can exceed the intended sum of payments.In such a case, an additional output is used, returning the change back to the payer.[32]Any input satoshis not accounted for in the transaction outputs become the transaction fee.[32]Paying a transaction fee is optional.[32]Miners can choose which transactions to process[32] and prioritize those that pay higher fees.Fees are based on the storage size of the transaction generated, which in turn is dependent on the number of inputs used to create the transaction.Furthermore, priority is given to older unspent inputs.[7]:ch.8 The unit of account of the bitcoin system is bitcoin.As of 2014, symbols used to represent bitcoin are BTC,[note 1] XBT,[note 2] and ₿ (U+20BF, ).[note3][33]:2 Small amounts of bitcoin used as alternative units are millibitcoin (mBTC),[1] microbitcoin (µBTC, sometimes referred to as bit), and satoshi.

Named in homage to bitcoin's creator, a satoshi is the smallest amount within bitcoin representing 0.00000001 bitcoin, one hundred millionth of a bitcoin.[9]A millibitcoin equals to 0.001 bitcoin, one thousandth of a bitcoin.[34]One microbitcoin equals to 0.000001 bitcoin, one millionth of a bitcoin.Semi-log plot of relative mining difficulty.[note4][31] Mining is a record-keeping service.[note5] Miners keep the blockchain consistent, complete, and unalterable by repeatedly verifying and collecting newly broadcast transactions into a new group of transactions called a block.[28]Each block contains a cryptographic hash of the previous block,[28] using the SHA-256 hashing algorithm,[7]:ch.7 which links it to the previous block,[28] thus giving the blockchain its name.In order to be accepted by the rest of the network, a new block must contain a so-called proof-of-work.[28]The proof-of-work requires miners to find a number called a nonce, such that when the block content is hashed along with the nonce, the result is numerically smaller than the network's difficulty target.[7]:ch.

8 This proof is easy for any node in the network to verify, but extremely time-consuming to generate, as for a secure cryptographic hash, miners must try many different nonce values (usually the sequence of tested values is 0, 1, 2, 3, ...[7]:ch.8) before meeting the difficulty target.Every 2016 blocks (approximately 14 days), the difficulty target is adjusted based on the network's recent performance, with the aim of keeping the average time between new blocks at ten minutes.In this way the system automatically adapts to the total amount of mining power on the network.[7]:ch.8 Between 1 March 2014 and 1 March 2015, the average number of nonces miners had to try before creating a new block increased from 16.4 quintillion to 200.5 quintillion.[36]The proof-of-work system, alongside the chaining of blocks, makes modifications of the blockchain extremely hard, as an attacker must modify all subsequent blocks in order for the modifications of one block to be accepted.[37]As new blocks are mined all the time, the difficulty of modifying a block increases as time passes and the number of subsequent blocks (also called confirmations of the given block) increases.[28]

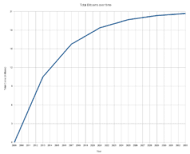

The successful miner finding the new block is rewarded with newly created bitcoins and transaction fees.[38]As of 9 July 2016,[39] the reward amounted to 12.5 newly created bitcoins per block added to the blockchain.To claim the reward, a special transaction called a coinbase is included with the processed payments.[7]:ch.8 All bitcoins in existence have been created in such coinbase transactions.The bitcoin protocol specifies that the reward for adding a block will be halved every 210,000 blocks (approximately every four years).Eventually, the reward will decrease to zero, and the limit of 21 million bitcoins[note 6] will be reached c. 2140; the record keeping will then be rewarded by transaction fees solely.[40]In other words, bitcoin's inventor Nakamoto set a monetary policy based on artificial scarcity at bitcoin's inception that there would only ever be 21 million bitcoins in total.Their numbers are being released roughly every ten minutes and the rate at which they are generated would drop by half every four years until all were in circulation.[41]

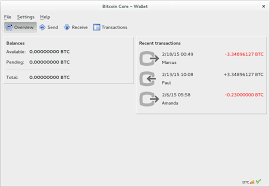

A wallet stores the information necessary to transact bitcoins.While wallets are often described as a place to hold[42] or store bitcoins,[43] due to the nature of the system, bitcoins are inseparable from the blockchain transaction ledger.A better way to describe a wallet is something that "stores the digital credentials for your bitcoin holdings"[43] and allows one to access (and spend) them.Bitcoin uses public-key cryptography, in which two cryptographic keys, one public and one private, are generated.[44]At its most basic, a wallet is a collection of these keys.There are several types of wallets.Software wallets connect to the network and allow spending bitcoins in addition to holding the credentials that prove ownership.[45]Software wallets can be split further in two categories: full clients and lightweight clients.Besides software wallets, Internet services called online wallets offer similar functionality but may be easier to use.In this case, credentials to access funds are stored with the online wallet provider rather than on the user's hardware.[49][50]

As a result, the user must have complete trust in the wallet provider.A malicious provider or a breach in server security may cause entrusted bitcoins to be stolen.An example of such security breach occurred with Mt.Physical wallets store the credentials necessary to spend bitcoins offline.[43]Examples combine a novelty coin with these credentials printed on metal.[52]Others are simply paper printouts.Another type of wallet called a hardware wallet keeps credentials offline while facilitating transactions.[53]The first wallet program was released in 2009 by Satoshi Nakamoto as open-source code.[15]Sometimes referred to as the "Satoshi client", this is also known as the reference client because it serves to define the bitcoin protocol and acts as a standard for other implementations.[45]In version 0.5 the client moved from the wxWidgets user interface toolkit to Qt, and the whole bundle was referred to as Bitcoin-Qt.[45]After the release of version 0.9, the software bundle was renamed Bitcoin Core to distinguish itself from the network.[54][55]

Today, other forks of Bitcoin Core exist such as Bitcoin XT, Bitcoin Classic, Bitcoin Unlimited,[56][57] and Parity Bitcoin.[58]Simplified chain of ownership.[22]In reality, a transaction can have more than one input and more than one output.Ownership of bitcoins implies that a user can spend bitcoins associated with a specific address.To do so, a payer must digitally sign the transaction using the corresponding private key.Without knowledge of the private key, the transaction cannot be signed and bitcoins cannot be spent.The network verifies the signature using the public key.[7]:ch.5 If the private key is lost, the bitcoin network will not recognize any other evidence of ownership;[13] the coins are then unusable, and thus effectively lost.For example, in 2013 one user claimed to have lost 7,500 bitcoins, worth $7.5 million at the time, when he accidentally discarded a hard drive containing his private key.[59]Bitcoin creator Satoshi Nakamoto designed bitcoin to not need a central authority.[22]

Per sources such as the academic Mercatus Center,[13] U.S.Treasury,[10] Reuters,[16] The Washington Post,[19] The Daily Herald,[60] The New Yorker,[61] and others, bitcoin is decentralized.Bitcoin is pseudonymous, meaning that funds are not tied to real-world entities but rather bitcoin addresses.Owners of bitcoin addresses are not explicitly identified, but all transactions on the blockchain are public.In addition, transactions can be linked to individuals and companies through "idioms of use" (e.g., transactions that spend coins from multiple inputs indicate that the inputs may have a common owner) and corroborating public transaction data with known information on owners of certain addresses.[62]Additionally, bitcoin exchanges, where bitcoins are traded for traditional currencies, may be required by law to collect personal information.[63]To heighten financial privacy, a new bitcoin address can be generated for each transaction.[64]For example, hierarchical deterministic wallets generate pseudorandom "rolling addresses" for every transaction from a single seed, while only requiring a single passphrase to be remembered to recover all corresponding private keys.[65]

Additionally, "mixing" and CoinJoin services aggregate multiple users' coins and output them to fresh addresses to increase privacy.[66]Researchers at Stanford University and Concordia University have also shown that bitcoin exchanges and other entities can prove assets, liabilities, and solvency without revealing their addresses using zero-knowledge proofs.[67]According to Dan Blystone, "Ultimately, bitcoin resembles cash as much as it does credit cards."[68]Wallets and similar software technically handle all bitcoins as equivalent, establishing the basic level of fungibility.Researchers have pointed out that the history of each bitcoin is registered and publicly available in the blockchain ledger, and that some users may refuse to accept bitcoins coming from controversial transactions, which would harm bitcoin's fungibility.[69]Projects such as CryptoNote, Zerocoin, and Dark Wallet aim to address these privacy and fungibility issues.[70][71]Bitcoin was initially led by Satoshi Nakamoto.

Nakamoto stepped back in 2010 and handed the network alert key to Gavin Andresen.[72]Andresen stated he subsequently sought to decentralize control stating: "As soon as Satoshi stepped back and threw the project onto my shoulders, one of the first things I did was try to decentralize that.So, if I get hit by a bus, it would be clear that the project would go on."[72]This left opportunity for controversy to develop over the future development path of bitcoin.The reference implementation of the bitcoin protocol called Bitcoin Core obtained competing versions that propose to solve various governance and blocksize debates; as of July 2016, the alternatives were called Bitcoin XT, Bitcoin Classic, and Bitcoin Unlimited.[73]The blocks in the blockchain are limited to one megabyte in size, which has created problems for bitcoin transaction processing, such as increasing transaction fees and delayed processing of transactions that cannot be fit into a block.[74]Contenders to solve the scalability problem are referred to as Bitcoin Classic,[75] Bitcoin Unlimited,[76] and a solution referred to as SegWit2x.[77]

Bitcoin was created[15] by Satoshi Nakamoto,[14] who published the invention[15] on 31 October 2008 to a cryptography mailing list[23] in a research paper called "Bitcoin: A Peer-to-Peer Electronic Cash System".[22]Nakamoto implemented bitcoin as open source code and released in January 2009.[15]The identity of Nakamoto remains unknown, though many have claimed to know it.[14]In January 2009, the bitcoin network came into existence with the release of the first open source bitcoin client and the issuance of the first bitcoins,[78][79][80][81] with Satoshi Nakamoto mining the first block of bitcoins ever (known as the genesis block), which had a reward of 50 bitcoins.One of the first supporters, adopters, contributor to bitcoin and receiver of the first bitcoin transaction was programmer Hal Finney.Finney downloaded the bitcoin software the day it was released, and received 10 bitcoins from Nakamoto in the world's first bitcoin transaction.[82][83]Other early supporters were Wei Dai, creator of bitcoin predecessor b-money, and Nick Szabo, creator of bitcoin predecessor bit gold.[84]

In the early days, Nakamoto is estimated to have mined 1 million bitcoins.[85]Before disappearing from any involvement in bitcoin, Nakamoto in a sense handed over the reins to developer Gavin Andresen, who then became the bitcoin lead developer at the Bitcoin Foundation, the 'anarchic' bitcoin community's closest thing to an official public face.[86]The value of the first bitcoin transactions were negotiated by individuals on the bitcointalk forums with one notable transaction of 10,000 BTC used to indirectly purchase two pizzas delivered by Papa John's.[78]On 6 August 2010, a major vulnerability in the bitcoin protocol was spotted.Transactions were not properly verified before they were included in the blockchain, which let users bypass bitcoin's economic restrictions and create an indefinite number of bitcoins.[87][88]On 15 August, the vulnerability was exploited; over 184 billion bitcoins were generated in a transaction, and sent to two addresses on the network.Within hours, the transaction was spotted and erased from the transaction log after the bug was fixed and the network forked to an updated version of the bitcoin protocol.[89][87][88]

Bitcoin is a digital asset[90] designed by its inventor, Satoshi Nakamoto, to work as a currency.[22][91]It is commonly referred to with terms like: digital currency,[13]:1 digital cash,[92] virtual currency,[9] electronic currency,[25] or cryptocurrency.[93]The question whether bitcoin is a currency or not is still disputed.[93]Bitcoins have three useful qualities in a currency, according to The Economist in January 2015: they are "hard to earn, limited in supply and easy to verify".[94]Economists define money as a store of value, a medium of exchange, and a unit of account and agree that bitcoin has some way to go to meet all these criteria.[95]It does best as a medium of exchange, as of February 2015 the number of merchants accepting bitcoin has passed 100,000.[20]As of March 2014, the bitcoin market suffered from volatility, limiting the ability of bitcoin to act as a stable store of value, and retailers accepting bitcoin use other currencies as their principal unit of account.[95]Liquidity (estimated, USD/year, logarithmic scale).[31]

According to research produced by Cambridge University in 2017, there are between 2.9 million and 5.8 million unique users using a cryptocurrency wallet, most of them using bitcoin.The number of users has grown significantly since 2013, when there were 0.3 to 1.3 million users.[21]In 2015, the number of merchants accepting bitcoin exceeded 100,000.[20]Instead of 2–3% typically imposed by credit card processors, merchants accepting bitcoins often pay fees in the range from 0% to less than 2%.[96]As of December 2014 select firms that accept payments in bitcoin include: A bitcoin ATM in Vienna – Westbahnhof Some U.S.political candidates, including New York City Democratic Congressional candidate Jeff Kurzon have said they would accept campaign donations in bitcoin.[134]In late 2013 the University of Nicosia became the first university in the world to accept bitcoins and also began offering a degree program on the study of digital currencies.[135]Merchants accepting bitcoin, such as Dish Network, use the services of bitcoin payment service providers such as BitPay or Coinbase.

When a customer pays in bitcoin, the payment service provider accepts the bitcoin on behalf of the merchant, directly converts it, and sends the obtained amount to merchant's bank account, charging a fee of less than 1 percent for the service.[136]Bitcoin companies have had difficulty opening traditional bank accounts because lenders have been leery of bitcoin's links to illicit activity.[137]According to Antonio Gallippi, a co-founder of BitPay, "banks are scared to deal with bitcoin companies, even if they really want to".[138]In 2014, the National Australia Bank closed accounts of businesses with ties to bitcoin,[139] and HSBC refused to serve a hedge fund with links to bitcoin.[140]Australian banks in general have been reported as closing down bank accounts of operators of businesses involving the currency;[141] this has become the subject of an investigation by the Australian Competition and Consumer Commission.[141]Nonetheless, Australian banks have keenly adopted the blockchain technology on which bitcoin is based.[142]

In a 2013 report, Bank of America Merrill Lynch stated that "we believe bitcoin can become a major means of payment for e-commerce and may emerge as a serious competitor to traditional money-transfer providers."[143]In June 2014, the first bank that converts deposits in currencies instantly to bitcoin without any fees was opened in Boston.[144]Some Argentinians have bought bitcoins to protect their savings against high inflation or the possibility that governments could confiscate savings accounts.[63]During the 2012–2013 Cypriot financial crisis, bitcoin purchases in Cyprus rose due to fears that savings accounts would be confiscated or taxed.[145]Other methods of investment are bitcoin funds.The first regulated bitcoin fund was established in Jersey in July 2014 and approved by the Jersey Financial Services Commission.[146]Forbes started publishing arguments in favor of investing in December 2015.[147]In 2013 and 2014, the European Banking Authority[148] and the Financial Industry Regulatory Authority (FINRA), a United States self-regulatory organization,[149] warned that investing in bitcoins carries significant risks.

Forbes named bitcoin the best investment of 2013.[150]In 2014, Bloomberg named bitcoin one of its worst investments of the year.[151]In 2015, bitcoin topped Bloomberg's currency tables.[152]According to Bloomberg, in 2013 there were about 250 bitcoin wallets with more than $1 million worth of bitcoins.The number of bitcoin millionaires is uncertain as people can have more than one wallet.[153]Venture capitalists, such as Peter Thiel's Founders Fund, which invested US$3 million in BitPay, do not purchase bitcoins themselves, instead funding bitcoin infrastructure like companies that provide payment systems to merchants, exchanges, wallet services, etc.[154]In 2012, an incubator for bitcoin-focused start-ups was founded by Adam Draper, with financing help from his father, venture capitalist Tim Draper, one of the largest bitcoin holders after winning an auction of 30,000 bitcoins,[155] at the time called 'mystery buyer'.[156]The company's goal is to fund 100 bitcoin businesses within 2–3 years with $10,000 to $20,000 for a 6% stake.[155]

Investors also invest in bitcoin mining.[157]According to a 2015 study by Paolo Tasca, bitcoin startups raised almost $1 billion in three years (Q1 2012 – Q1 2015).[158]Price[note 7] (left vertical axis, logarithmic scale) and volatility[note 8] (right vertical axis).[31]According to Mark T. Williams, as of 2014, bitcoin has volatility seven times greater than gold, eight times greater than the S&P 500, and 18 times greater than the U.S.According to Forbes, there are uses where volatility does not matter, such as online gambling, tipping, and international remittances.[160]The price of bitcoins has gone through various cycles of appreciation and depreciation referred to by some as bubbles and busts.[161][162]In 2011, the value of one bitcoin rapidly rose from about US$0.30 to US$32 before returning to US$2.[163]In the latter half of 2012 and during the 2012–13 Cypriot financial crisis, the bitcoin price began to rise,[164] reaching a high of US$266 on 10 April 2013, before crashing to around US$50.[165]

On 29 November 2013, the cost of one bitcoin rose to the all-time peak of US$1,242.[166]In 2014, the price fell sharply, and as of April remained depressed at little more than half 2013 prices.As of August 2014 it was under US$600.[167]In January 2015, noting that the bitcoin price had dropped to its lowest level since spring 2013 – around US$224 – The New York Times suggested that "[w]ith no signs of a rally in the offing, the industry is bracing for the effects of a prolonged decline in prices.In particular, bitcoin mining companies, which are essential to the currency's underlying technology, are flashing warning signs."[168]Also in January 2015, Business Insider reported that deep web drug dealers were "freaking out" as they lost profits through being unable to convert bitcoin revenue to cash quickly enough as the price declined – and that there was a danger that dealers selling reserves to stay in business might force the bitcoin price down further.[169]According to The Wall Street Journal, as of April 2016, bitcoin is starting to look slightly more stable than gold.[170]

On 3 March 2017, the price of a bitcoin has surpassed the market value of an ounce of gold for the first time and its price surged to an all-time high.[171][172]The legal status of bitcoin varies substantially from country to country and is still undefined or changing in many of them.While some countries have explicitly allowed its use and trade, others have banned or restricted it.Regulations and bans that apply to bitcoin probably extend to similar cryptocurrency systems.[173]The use of bitcoin by criminals has attracted the attention of financial regulators, legislative bodies, law enforcement, and the media.[174]The FBI prepared an intelligence assessment,[175] the SEC has issued a pointed warning about investment schemes using virtual currencies,[174] and the U.S.Senate held a hearing on virtual currencies in November 2013.[19]Several news outlets have asserted that the popularity of bitcoins hinges on the ability to use them to purchase illegal goods.[91][176]In 2014, researchers at the University of Kentucky found "robust evidence that computer programming enthusiasts and illegal activity drive interest in bitcoin, and find limited or no support for political and investment motives."[177]

It will cover studies of cryptocurrencies and related technologies, and is published by the University of Pittsburgh.[178][179]Authors are also asked to include a personal bitcoin address in the first page of their papers.[180][181]In the fall of 2014, undergraduate students at the Massachusetts Institute of Technology (MIT) each received bitcoins worth $100 "to better understand this emerging technology".The bitcoins were not provided by MIT but rather the MIT Bitcoin Club, a student-run club.[182][183]In 2016, Stanford University launched a lab course on building bitcoin-enabled applications.[184]The documentary film, The Rise and Rise of Bitcoin (late 2014), features interviews with people who use bitcoin, such as a computer programmer and a drug dealer.[185]Several lighthearted songs celebrating bitcoin have been released.[186]In Charles Stross' science fiction novel, Neptune's Brood (2013), a modification of bitcoin is used as the universal interstellar payment system.The functioning of the system is a major plot element of the book.[187]

Stross has expressed concerns about the impact of bitcoin within societies.[188][189]In early 2015, the CNN series Inside Man featured an episode about bitcoin.Filmed in July 2014, it featured Morgan Spurlock living off bitcoins for a week, to figure out whether or not the world is ready for a new kind of currency.[190]Cryptography portal Economics portal Free software portal Internet portal Numismatics portal ^ a b As of 2014, BTC is a commonly used code.[2]It does not conform to ISO 4217 as BT is the country code of Bhutan, and ISO 4217 requires the first letter used in global commodities to be 'X'.^ a b The symbol was encoded in Unicode version 10.0 at position U+20BF (₿) in the Currency Symbols block in June 2017.[6]^ ^ It is misleading to think that there is an analogy between gold mining and bitcoin mining.The fact is that gold miners are rewarded for producing gold, while bitcoin miners are not rewarded for producing bitcoins; they are rewarded for their record-keeping services.[35]

^ The exact number is 20,999,999.9769 bitcoins.[7]:ch.8 ^ ^ ^ a b ^ ^ ^ ^ ^ ^ a b c d e f g h i j k ^ ^ a b c ^ a b ^ ^ ^ a b c d e f g ^ a b c ^ a b c d e ^ a b ^ ^ ^ a b c ^ a b c ^ a b ^ a b c d e f ^ a b ^ a b ^ a b ^ ^ ^ a b c d e f ^ ^ ^ a b c d e ^ a b c d e ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ a b c ^ ^ a b c ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ a b ^ ^ ^ ^ ^ ^ ^ ^ ^ a b ^ ^ ^ ^ ^ ^ a b ^ ^ ^ ^ ^ ^ ^ ^ ^ a b ^ a b ^ ^ ^ a b ^ ^ a b ^ ^ a b ^ ^ paypal at Alexa ^ ^ microsoft at Alexa ^ ^ dell at Alexa ^ ^ newegg at Alexa ^ ^ overstock at Alexa ^ ^ expedia at Alexa ^ ^ tigerdirect at Alexa ^ ^ dish at Alexa ^ ^ zynga at Alexa ^ ^ timeinc at Alexa ^ ^ at Alexa ^ ^ virgingalactic at Alexa ^ ^ dynamite at Alexa ^ ^ clearlycanadian at Alexa ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ a b ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ a b ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ a b ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^