is bitcoin a fiat currency

Consulting by RPM || Free Advice Blog Free Advice Writings Resumé/CV Popular Writings Academic Work Video Clips Contact Me Is Bitcoin a Fiat Currency?FEE vs FEE Bitcoin I have no problem with a lot of the specifics in this post by Demelza Hays (who’s my friend), but she is aghast that economists might classify Bitcoin as a fiat currency.Well, that’s how I classified it (in my guide to Bitcoin co-authored with Silas Barta), and I think it’s consistent with Misesian monetary theory, as I explained in this earlier FEE post.I don’t this is mere pedantic quibbling over definitions.I think many libertarians give the State too much credit when they say that it causes the dollar to be money “at gunpoint” or some such language.Here is me, discussing a quote from Mises: Finally, we should guard against a mistake that is all too common in libertarian discussions of money.The term “fiat money” sometimes leads critics to declare that the State can turn something into money “by fiat.” At first glance, this assertion seems to follow naturally enough from Mises’s definition of fiat money.

But accompanying his definition in The Theory of Money and Credit, Mises also wrote: “In order to avoid every possible misunderstanding, let it be expressly stated that all that the law can do is to regulate the issue of the coins and that it is beyond the power of the State to ensure in addition that they actually shall become money, that is, that they actually shall be employed as a common medium of exchange.All that the State can do by means of its official stamp is to single out certain pieces of metal or paper from all the other things of the same kind so that they can be subjected to a process of valuation independent of that of the rest….These commodities can never become money just because the State commands it; money can be created only by the usage of those who take part in commercial transactions.” –Ludwig von Mises To illustrate Mises’s point we can use the modern case of the US dollar.The US government can announce rules telling Americans which pieces of paper are and are not authentic US dollars.

For example, there are rules (that the tellers at banks know very well) governing how much of a paper dollar can be ripped off, and periodically the dollars are redesigned to stay ahead of counterfeiters.

bitcoin server farmEven though the US government can tell Americans which pieces of paper are dollars, it cannot tell Americans that dollars are the money that they will use economically.

bitcoin in athensThe existence of legal-tender laws and other regulations complicates the issue, but nonetheless it is possible that next Tuesday, nobody will want to hold US dollars anymore and so their purchasing power will collapse, with prices quoted in US dollars skyrocketing upward without limit.

sell litecoin onlineThis has happened with various fiat currencies throughout history, and these episodes did not occur because the State in question repealed a regulation that had previously ensured its currency would be the money of the region.

litecoin cad

Instead, the people using that currency simply abandoned it in spite of the government’s desires, resorting either to barter or adopting an alternative money.

bitcoin verify transactionBitcoin was created in 2009 by a mysterious character who claimed it to be a payments network.

bitcoin ceo missingBut unlike most other payment networks like PayPal and Visa, it screwed with our minds by having its own token.

ethereum alert appA token that had a price that floated against other currencies.

ethereum central bankIn basic terms, this means if you fund a bitcoin wallet to buy something, it may be worth less (or more) by the time you come around to spending it.

bitcoin to ethereum exchange rate

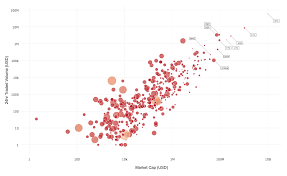

This is the story of bitcoin volatility, we’ll be studying its personality over its short and notorious history.It was partly inspired by Vinny Lingham who calculated Bitcoin will achieve the necessary price stability to be a store of value at $3000 per coin (~$50b market cap), and estimated that to be two year away.We shall see if the data backs this up.@VinnyLingham interview: #bitcoin mainstream in 3-10yrs.Useful as a store of value when price hits $3k ~2yrs away https://t.co/0qmQTGU1Cb — Willy Woo (@dangermouse117) August 12, 2016 We’ll start this journey with a bit of eye candy.Let me plot for you the volatility of 600 cryptocurrencies against their market caps and 24 hour traded volume (i.e.Volatility is represented by the size of their circle.Okay circles, I want you to be small and towards the top, got it?(This equals low volatility and high liquidity).As it turns out it was a weak correlation between market cap and volatility.Apart from looking real nice, it showed just how far ahead bitcoin is over the other coins.

Pundits should know I used log scales and exponentially scaled circles to reduce the exaggerated differences here.Bitcoin’s volatility over time Onwards to the real focus of this study… Dearest Bitcoin, how long will it take for you to be as stable as fiat currencies?To answer this, I collated 5 years of bitcoin price data against USD (BTCUSD) and compared it to EURUSD and NZDUSD currency pairs to produce this very telling graph.[Live Chart] First some details about this graph: Circles are proportional to bitcoin’s 24 hour traded volume, I wanted a visual representation of bitcoin’s growth as a traded currency I chose EURUSD volatility as these two are the ballers in the room with M1 money supplies of 7.5 and 3.3 trillion respectively.The big guys should be the most stable NZDUSD volatility is the small guy in the room, it exhibits the highest volatility of the commonly traded FOREX pairs Trendlines have been calculated using exponential regression analysis (i.e.

it was done with numbers, I just didn’t eyeball it) 60-day volatility are used in these plots.What we are seeing is bitcoin’s peak volatility is reducing steadily and will enter the realms of fiat currency (below 5.5%) by around July 2019.I found this surprising.For a currency with a tiny market cap of $10b, compared to say the Euro’s M1 money supply of $7.5t, bitcoin’s price stability is ridiculously good.Investor conclusions The economic properties needed for bitcoin to go mainstream are developing quickly.If we take fiat-level FOREX volatility as a level in which the public find acceptable (this is not necessarily true), we are less than 2 years out for the start of prime time “bitcoin as payments” heaven.For now these are my investor related conclusions: Price stability gives Bitcoin even more bullishness Price stability is needed before we get consumers buying and holding bitcoins for short and medium term spending.When this happens, it’ll have a large and positive impact on price.

The next 2 years of bitcoin will be bullish in this regard.Buying and holding bitcoin for native payments has a very different economic fingerprint than say via bitcoin as remittances, where the receiver of funds immediately sells to move back to fiat currency which is more stable.Remittances use bitcoin as a pass through token, or in other words it’s price neutral as remittance adoption increases.Payment ventures/projects are too early Ventures that focus on bitcoin as a form of payment are premature – examples include payment gateways like BitPay and cryptocurrency point-of-sales ventures Plutus and BlockPay.We are probably at least 2 years out from the necessary price volatility necessary for this sector to be ready.For now bitcoin HODLers are speculative investors.If I was a venture capitalist or an alt-coin ICO investor, I’d be steering clear for a couple more years.Keep away from alternative payment coins Given bitcoin has by far the largest network effects and an exponential head start on stability and liquidity, I would say any other payment alt-coin is going to have a hard time competing, especially in 2 years and we get a critical mass of sorts on the bitcoin network.