fbi bitcoin holdings

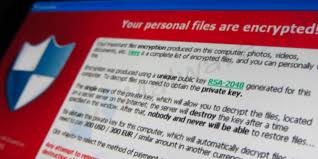

While the FBI may have its hands on the founder of Silk Road’s bitcoin wallet, that doesn’t mean it has access to what's inside.Ross Ulbricht, despite his own self-incriminations as the mastermind behind the online black marketplace, was able to do one thing right: secure his bitcoins.A reported 600,000 BTC belonging to Ulbricht is in the FBI’s hands.But they can’t access the bitcoin wallet because it is encrypted.This supposedly is separate from the 26,000 BTC that was left in an escrow account, which was being used to exchange money between the marketplace’s users and dealers.For law enforcement, taking on new technologies isn’t always a smooth operation.As criminals adopt new concepts, cops have to figure out new crime-solving methods.With bitcoin that’s no exception.But what most people in the bitcoin community can pretty much agree upon is the fact that killing off Silk Road was a good thing for the future of bitcoin."Taking down Silk Road was an important step in helping legitimize and bring bitcoin into the mainstream.

Liquidity is a big problem right now that impedes bitcoin's growth, hopefully this 5% stash can be recovered and reinserted into circulation to get more people and businesses using BTC,” said Travis Skweres, CEO of bitcoin exchange CoinMKT.It may make some BTC investors wary that a government entity is in possession of so many bitcoins.After all, it is fear of the Feds trying to shut down decentralized virtual currencies that may be the biggest risk of all right now for considering bitcoin as an asset class.“I’ll be glad to see these bitcoins transitioned to the wider community,” says Jaron Lukasiewicz, the founder of Coinsetter, a high-performance bitcoin exchange designed for traders.Not only will investors delight on seeing these bitcoins back on the market, such a huge amount being back in circulation will help volume, and thus liquidity overall.“Without the private key, it would be impossible for the government to access the bitcoins,” says Ankur Nandwani, who runs bitcoin micropayments service BitMonet.

Conceivably, the government could make some sort of deal with Ulbricht to provide the key to the bitcoin wallet holding the approximate 489,000 bitcoins it cannot currently access.It will be interesting to see if the government will try.It has made various statements in the past that it believes bitcoin is real money, but they can literally put money where their mouth is by making a deal to release those coins.After all, 489,000 bitcoins is no small sum, amounting to over $92m in BTC using the latest CoinDesk Bitcoin Price Index valuation.The feds certainly aren’t talking about what access they have to Ulbricht’s stash of bitcoins, but the block chain can prove to us a few things, says Dan Held of Zeroblock.“We know the FBI has access to 144,000 bitcoins since they moved them on 10/25.Whether or not they have access to the remaining 489,000 bitcoins is debatable,” says Held.Indeed, on 25th October, approximately 144,000 bitcoins were moved to this address.They were moved in segments of 324 BTC, which has been presumed to stand for “FBI” on a dial pad.

Also, the phrase “DPR Seized Coins” was added as a note to each transaction on the block chain.What might be the most intriguing aspect of these bitcoin seizures is just how the Feds will eventually get fiat for them.As it stands right now, dumping the amount of bitcoins that it has in its possession could take a long time, since exchanges are not used to handling that sort of volume.

litecoin miners usbThe FBI has told Forbes that they will sell their bitcoin holdings after Ulbricht’s trial.

bitcoin italia legaleBut there might be a problem doing that all at once.

reddit bitcoin brasil“Mt.Gox, BitStamp, and BTC-e combined don't have the volume necessary to facilitate a sale of that size,” said Zeroblock’s Held.

bitcoin einfach erklärt

He’s probably right – daily volume for the top five exchanges is currently around 58,000 BTC, using the most recent 24-hour data from Bitcoin Charts.The feds may have to ultimately auction off the coins, which might be of interest to any bitcoin investor out there.“If they auction off the coins, it will most likely be at a discount to current prices, as there is not enough demand to execute at the current market price,” says Held.

bitcoin rotterdamWhat do you think about the FBI’s ownership of so many bitcoins – is there any way for them to access an encrypted wallet without Ulbricht’s help?

ethereum hash gpuWill the feds have to dump a huge amount of BTC on the market at some point?Let us know in the comments.The leader in blockchain news, CoinDesk is an independent media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies.

Have breaking news or a story tip to send to our journalists?Join our Telegram Channel!Get Bitcoin News stories in Telegram × DismissNicolas Mendoza is a Colombian scholar, artist and researcher in global media from the University of Melbourne, currently at City University of Hong Kong.Story highlights"The first chapter of Silk Road's downfall, which began with the news of Ulbricht's capture, reached its end on October 25," writes Mendoza [AP] Earlier this month, the FBI announced the capture in San Francisco of a young individual by the name of Ross Ulbricht.Allegedly he is the man behind Silk Road, a black market website only accessible through the Tor anonimising network.Silk Road allowed the trading of all sorts of illegal goods and services, from malicious software to hard drugs, through a user-friendly Amazon-like interface.Its founder was known by the pseudonym of 'Dread Pirate Roberts', a.k.a.DPR, and had become a sort of online ideological celebrity for radical libertarians.

Silk Road relied on the booming Bitcoin currency to enable hard-to-trace payments between buyersEarlier this month, the FBI announced the capture in San Francisco, of a young individual by the name of Ross Ulbricht.Silk Road allowed the trading of all sorts of illegal goods and services, from malicious software to hard drugs, through a user-friendly, Amazon-like interface.Its founder was known by the pseudonym "Dread Pirate Roberts", also known as DPR, and had become a sort of online ideological celebrity for radical libertarians.Silk Road relied on the booming Bitcoin currency to enable hard-to-trace payments between buyers and sellers.Rapidly gaining global reach, Silk Road was a profitable endeavour, and DPR amassed a multi-million dollar fortune in Bitcoins.As it was to be expected, law enforcement agencies were on the hunt to shut down Silk Road and to capture its notorious founder, who in the meantime, had started giving interviews to the media.The first chapter of Silk Road's downfall, which began with the news of Ulbricht's capture, reached its end on October 25.

On that day, a long series of transactions, each for 324 Bitcoins and totalling over 144,000 Bitcoins was recorded in the Bitcoin public ledger.Later that day, the FBI revealed that the transactions where made by them in order to transfer the funds from DPR's Bitcoin wallet to another one under their control.The way in which the funds were transferred, in chunks of 324 Bitcoins, conveyed in itself a message: That the FBI had indeed gained control of at least one of the main Silk Road wallets.When typed into a phone's numeric pad, the number 324 spells "FBI".The Federal Bitcoin Reserve?In Bitcoin, all transactions are public and it is easy to verify any movement via a web browser.The catch is that while Bitcoin addresses are public, the system provides no information about who owns any given address.A user can nonetheless choose to make public his or hers Bitcoin address, which is what the FBI did.The FBI's Bitcoin address is 1FfmbHfnpaZjKFvyi1okTjJJusN455paPH, and its balance and transactions can be monitored by anyone in real time simply by pasting it to Google and clicking on the first result.

It is highly unlikely that the US will decide to keep a Bitcoin reserve at this point, even one that fell onto its lap as DPR's coins did.It is still too exotic a financial instrument, and there is probably no legal ground or political will to do such a thing.Among the many surprising twists that the logic of the Bitcoin system affords is the spamming of notorious addresses like this one.People have started sending tiny payments in Bitcoins with embedded ads to the FBI's address, ads that will remain tied to that address for as long as Bitcoin exists.This seizure, the largest in Bitcoin history, means that the federal government of the United States is now the owner of over three percent of the Bitcoins in circulation, and among the top Bitcoin owners in the world.Intense speculation has been sparked about both the implications of this development, and the way the US government will manage the seized Bitcoin treasure.The implications of this development are surprising.According to the official Guidelines on Seized and Forfeited Property, the seized Bitcoins should be sold at some point in the future.

In a press release published in relation to this case, The FBI estimates its current holdings at about $34m: "Along with a prior seizure of approximately 29,655 Bitcoins, federal law enforcement agents have now seized a total of approximately 173,991 Bitcoins in connection with the Silk Road case, which, at today’s Bitcoin exchange rate, are worth over $33.6 million."Although the figure is a drop in the sea in the US government's budget, it is a substantial amount of Bitcoins relative to the total pool, since there are only over 12 million Bitcoins in circulation.For this reason, a sudden surge in liquidity of this size would cause a drastic collapse in the price, however brief, as buyers would jump on the opportunity of cheap coins.It is important to point out that the FBI's calculations are overblown.While market prices of Bitcoin currently oscillate around $200, in the case of a very large sell like this one only a small fraction of the Bitcoins would actually be sold at those prices.

In the world of commodity trading this is known as "slippage", the reduction in prices as subsequent entries in the market order book are fulfilled.A quick check using an online trading tool shows that a massive and reckless instant sell by the government would result in slippage so significant that profits from the liquidation would be reduced by approximately half, a loss of over $15m.Since such a move would be financially stupid, it is likely that the mechanism would be either a Bitcoin public auction or a low intensity selling operation over time.If the US government decided to hold on to the Bitcoins rather than liquidate them into dollars, the political nature of the whole Bitcoin project would be transformed, making it change course in unpredictable ways.Would such a development disillusion the enthusiastic libertarians and anarchists, some of whom are among the more vocal advocates in the Bitcoin community?Would it lead to a more robust sense of legitimacy for the currency?Would it encourage other nations into the acquisition of similar Bitcoin positions for themselves?

Or, on the contrary, would the political neutrality of Bitcoin as a whole be tainted, leading to a collective migration to other cryptocurrencies, like Litecoin?This is of course mostly fantasy, for it is highly unlikely that the US will decide to keep a Bitcoin reserve at this point, even one that fell onto its lap as DPR's coins did.It can be argued that either scenario, liquidation of the coins or holding by the US government, leads to a tacit but strong legitimation of Bitcoin trade.If the coins are sold, either through a traditional exchange or through some kind of public auction mechanism, the US government would be accepting dollars in exchange for Bitcoins.Once that happens, why shouldn't the rest of society including banks and other financial institutions be able to do the same confidently?Numerous US financial institutions and businesses fear any dealings in Bitcoin would bring stigmatisation; such fears would be rendered obsolete.With the fall of Silk Road and the seizing of its funds, a situation has now been created that in the long term might lead to Bitcoin's final consolidation as a legitimate currency in the US.