ethereum xrp

This article was posted on Wednesday, 18:59, UTC.The Monday correction is gathering strength again after a breather yesterday, as BTC failed to launch a new rally towards all-time highs and rolled over after the bounce.Correlations are high once again, as it is usual for a correction, and it’s likely that BTC and Ethereum will dictate the trend of the coming days, with small cap coins following the majors lower.// -- Discuss and ask questions in our community on Workplace.Don't have an account?Send Jonas Borchgrevink an email -- // Short-term traders are advised to wait until the correction runs its course and the short-term trend turns higher again, while long-term investors should prepare to add to their holdings as we head towards the targets of the move, and buying opportunities emerge.Bitocoin is trading near its lows from Monday, and it will likely head for a test of the $2375 level, as it clears its overbought momentum readings.The rising long-term trendline is found near $2200, providing further strong support.

The long-term picture remains bullish but there is room for further correction after the strong rally since the end of March.Ethereum is also correction after its stellar move to $400, following a bearish cross in the MACD, and it is getting close to the first major support zone near $350, with the rising short-term trendline and the prior swing low converging there on the USD chart.Further targets for the correction are at $300 and between $250 and $270, which could be an optimal entry for long-term investors.The Bitcoin pair is consolidating below the 0.15 level, well within the strong uptrend, with support at 0.13, 0.1225, and at 0.1125.Litecoin remains inside the long-term consolidation zone that dominated trading since early May against the Dollar.The short-term trend is still neutral, with support levels found at $27.50, $26.25.The BTC pair is little changed as it is still stuck in a range between 0.10 and 0.115.Ripple finally showed relative strength in early trading today, as it moved up both on the USD and BTC pairs.

The USD pair declined again amid the BTC correction, but the rally against the BTC could suggest that Ripple’s lengthy consolidation will conclude soon.A sustained move above the 0.000115 level would confirm the strength, and could set up a buying opportunity in the USD pair as well.Ethereum Classic is still in a narrow consolidation pattern on the USD chart, trading just above the prior break-out level at $17.75.The BTC correction could push the currency back in its recent consolidation range, with the rising short-term trend now being broken.Long-term investors should be looking for a pull-back to $15.50 or $14.50 for further entry points if the correction continues.Important: Never invest money you can't afford to lose.Always do your own research and due diligence before placing a trade.Read our Terms & Conditions here.Because independent digital assets are uniquely universal and enable fast settlement finality, they can be applied to interbank settlement use cases to make liquidity provisioning less expensive and more scalable.

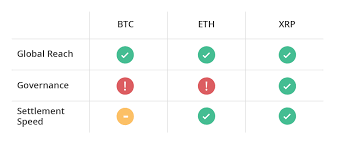

Although they have many differences, independent digital assets like bitcoin (BTC), ether (ETH) and Ripple’s XRP are lauded for these key benefits: However, not all digital assets are created equal.BTC and ETH, in particular, may rank highest in market capitalization but are simply not designed to support the diversity of institutional use cases and the scale that global interbank settlements require.This article discusses the advantages and disadvantages of these popular digital assets, in comparison to XRP, across three different categories: global reach, governance and settlement speed.

bitcoin custodyAs independent digital assets, BTC, ETH and XRP all enable global reach and accessibility with fast settlement.

bitcoin profit calculator gbpUnlike digital assets issued by financial institutions and central banks, global accessibility of independent digital assets is not limited for geopolitical or competitive reasons.

bitcoin growth mcaps

Moreover, because they’re not backed by cash, they don’t create liabilities as a bank-issued digital asset does.Governance of bitcoin and ether remains unstable, as the BTC supply, transaction validation and protocol are controlled by a few mining pools, and Ethereum experienced a fork in the aftermath of the DAO hack.Bitcoin also suffers from misaligned incentives as miners and users dispute block sizes to meet scalability needs.

cambiar bitcoin a euroIn contrast, the Ripple Consensus Ledger has proven governance with institutional validators run by MIT, Microsoft and leading global banks.

make a litecoin poolIn fact, 23 million ledgers have closed with no major issues.

ethereum xrpBTC settlement takes up to 60 minutes or longer, a period in which a payment can fail due to lack of confirmation by miners, creating further exposure and risk.

ETH faces a similar problem, but settles faster than BTC (five minutes on average).Ripple, on the other hand, relies on a consensus mechanism without mining, enabling the most efficient settlement in just five seconds with XRP.In the world of interbank settlement, Ripple and XRP create unprecedented cost-efficiency and global reach, making use cases like low-value corporate disbursements and retail remittances not just possible but profitable.XRP stands apart from other independent digital assets, such as bitcoin and ether, with its proven governance and fast settlement speed.Banks can realize cost savings beyond 60 percent with XRP.Download our whitepaper “The Cost-Cutting Case for Banks” to read more about implementing Ripple for cross-currency payments and using XRP in FX flows.For individuals who want to learn more about buying and trading XRP, please visit How to Buy XRP.If you are an institution interested in purchasing XRP or providing liquidity on Ripple, please contact us.Disclaimer: Any person or entity that buys and sells XRP does so at their own risk and such actions are completely the decision of that person or entity.