ethereum price usd coinbase

Coinbase has had few troubles in the past few days, thanks to increased demand for Bitcoin among the investor and cryptocurrency community.The outages experienced by the cryptocurrency trading and wallet platform has been attributed to massive demand for Bitcoin in the Asian countries, driving the price to unprecedented levels.Bitcoin has turned into an attractive financial asset since the beginning of this year, following a better than expected performance in terms of its value.The cryptocurrency has risen to new levels while experiencing a couple of setbacks in the process.Currently, a majority of demand for Bitcoin and other altcoins is said to be originating from Japan, China, and South Korea.The increased interest is reflected in the trading volumes of BTC/USD and BTC/JPY pairs, which in turn has impacted the global cryptocurrency market.The increased stress on Coinbase saw people experiencing frequent outages and downgraded performance.Coinbase on its Twitter recently announced, “Coinbase has experienced unprecedented traffic and trading volume this week.

has suffered a few outages and downgraded performance for some users this week.Our engineering and support teams are working around the clock to restore our site to normal performance.” While the initial rise in demand was attributed to Bitcoin’s recently attained legal status in Japan, now new countries are joining the fold, which might lead to a further increase in demand.Based on the recent developments in Japan, South Korea and India could soon emerge as the driving forces behind Bitcoin price once the pressure from Japan normalizes.

bitcoin tucumanThere are speculations of South Korea following Japan’s way to legalize the popular cryptocurrency.

ethereum surgeAt the same time, the Indian government is also deliberating on the possibility of implementing Bitcoin regulations.

bitcoin digging

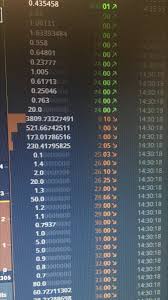

If it were to happen soon, Bitcoin might witness a massive development in its price trend, making the $10,000 speculation a reality.In such a scenario, it is not just Coinbase, but almost all exchange platforms across the world could feel the heat.567EXCHANGEPrice differences Coinbase/Poloniex (self.ethtrader)submitted by redditor for 3 monthshas anybody noticed the huge price differences between coinbase(gdax) and Polo?currently there is a margin of $2./IytmSoB.png /wzoJCde.png π Rendered by PID 12853 on app-356 at 2017-06-24 11:16:10.342186+00:00 running 3522178 country code: SG.

bitcoin losing momentumBitcoin and the top altcoins have reached new all-time highs as Ethereum and Ripple both climbed 20 percent.

bitcoin chose in action"The broad uptick in the top 10 cryptocurrency table began on Thursday with multiple altcoins seeing sudden gains.

bitcoin sicurezza

Dash, Monero and Golem also posted double-figure growth for the 24 hours to press time on Friday."Bitcoin’s growth was comparatively modest at just under two percent, but Coinbase nonetheless managed to post a new record price high of just over $1,350.An interesting exception to the trend came in the form of Litecoin, which had previously exploded in value upon news that Segregated Witness technology would activate.As the rest grew, Litecoin remained stagnant, even posting a modest loss of around 0.8 percent overall."The Ethereum ecosystem, meanwhile, is capitalizing on the launch of another major economic tool which should help bring it to new audiences."The Ethereum Classic Fund, run by Barry Silbert’s Digital Currency Group, officially went live this week, causing a predictable surge in the price of the Ethereum Classic token (ETC).Ether itself (ETH) appeared to profit from a knock-on effect, with its own dedicated exchange-traded fund (ETF) currently under consideration by the US Securities and Exchange Commission.

Both versions are currently at all-time price highs.Lesser announcements came from the Ripple camp this week, with another 10 financial institutions signing up to its gateway.The network already counts members such as JPMorgan Chase and BNP Paribas, the former also signaling this week it had pulled out of so-called distributed ledger group R3 Consortium.Username * First Name Last Name Email * Password * Repeat Password * You registration completed successfully.Confirmation email sent to email address provided.Email * Password *Coinbase is reputed to be the world’s largest Bitcoin broker, currently serving a total of 32 countries (although this may soon drop to 31 as Vogogo, their Canadian payment service, shuts down).In addition to direct sales of Bitcoin at, or close to, the current average market rate (plus 1% fee), Coinbase facilitates low fee (0.25% for takers) trading of both Bitcoin and Ethereum on its exchange platform, GDAX (the Global Digital Asset Exchange).

Coinbase offers the following additional services and benefits: Coinbase is often recommended to newcomers as one of the easiest ways to acquire their first bitcoins.The company has invested a lot of time and money into making their user experience smooth and painless.Their extensive banking partnerships allow transactions to be made via EFT payment, ACH / SWIFT / SEPA transfer and, as a recent introduction, major credit cards and PayPal.For these and similar reasons, Coinbase has experienced rapid growth since its founding in mid-2012 by Brian Armstrong and Fred Ehrsam.The following stats from Coinbase’s landing page speak for themselves: It’s no secret that Coinbase attracts a lot of animosity, if not outright hostility.A “Coinbase” search query on Reddit’s r/bitcoin soon reveals endless user complaints, interspersed with relevant news.In response to either such post, no shortage of anti-Coinbase vitriol will be detected from the commentariat.The situation is similar on the BitcoinTalk forum and other discussion venues; mention Coinbase to Bitcoiners in person or on IRC, Twitter or Slack and you’re about equally likely to hear criticism as praise.

Now, a lot of people love Bitcoin for offering sanctuary from the grand and petty tyrannies of the banks and corporate payment services.Any company which re-introduces such “user experiences” will inevitably encounter heavy flak.In short, Coinbase is punished for often behaving like the most sinister of banks.Such views must be tempered by the fact that, for years, Coinbase has served the market more reliably and faithfully than many (ex-)exchanges, failed or as-yet-unfailed, which could be mentioned.However, Coinbase has also pulled its share of questionable moves over its lifetime.Here are a number of good reasons to regard the company with some scepticism: The dreaded Coinbase “freeze notice.” Forcible account closures are probably the most commonly held grudge against Coinbase.Due to the company’s tight integration with traditional banking laws, such closures are inevitable.For better and / or worse, Coinbase prides itself on its legislative compliance.Coinbase was first to receive US regulatory approval.

As a result, Coinbase has AML (Anti-Money Laundering) and KYC (Know Your Customer) practices much like any bank.You’ll have to provide a lot of personally-identifying information if you wish to avail yourself of Coinbase’s service.Many Bitcoiners value privacy and object to such invasive measures.To quote a recent tweet by Andreas Antonopolous: “The biggest money launderers have banking licenses.The biggest terror financiers are states.Don’t buy the lie of KYC/AML.” Expect Coinbase to track how you spend “their” coins and to summarily shut your account for the following activities: While your money will almost certainly be returned to your bank if Coinbase shuts your account, it will likely prove to be an inconvenient, frustrating and potentially costly experience.Coinbase is also a member of the Blockchain Alliance, which aims to combat the use of Bitcoin for illegal (or unlicensed) purposes.As such blacklisting measures degrades Bitcoin’s fungibility – an important property of sound money – Coinbase’s policies are a matter of legitimate grievance to Bitcoin holders.

Note: if you enjoy the convenience of buying bitcoins from Coinbase but want to avoid blacklisting, check out our guide to anonymizing your Bitcoin spending!If Coinbase gets anything like their claimed number of 4 million customers, it stands to reason that they’ll receive a proportionally high number of complaints.As a recent example, many users expressed their dissatisfaction with GDAX bugs and outages.Such complaints tend to spill over into social media due to the perception that Coinbase’s support staff will expedite their responses to publically-voiced grievances.The unanswered questions are whether Coinbase receives proportionally more support tickets than its competitors, how many tickets are resolved to their customers’ satisfaction and how long it takes for the average ticket to be closed.From personal experience Coinbase’s support answered 99Bitcoins’ claims once every 48 hours on average.To its credit, in addition to its email support service, Coinbase also provides a comprehensive FAQ section page and a helpful support forum.

It’s no secret that Coinbase received millions in venture capital funding, totalling $106 million, received over 4 funding rounds from 23 different investors.Their seed round was in late 2012 and in early 2015 it had a Series C round.The identity of Coinbase’s investors, BBVA in particular, goes a long way towards explaining their close ties to traditional financial firms.Fred Ehrsam himself is a former Goldman Sachs trader.Naturally, such relationships do not sit well with certain, shall we say, “zealous” Bitcoiners, who consider banks the disease and Bitcoin the cure.Coinbase formerly offered a generous affiliate program, whereby $75 was paid to anyone who referred a customer who went on to purchase $100+ worth of Bitcoin.However, Coinbase reneged on this deal without warning.Many hard-working affiliates, including 99Bitcoins, received a pittance for promotional work conducted for Coinbase.For whatever motive, both Brian Armstrong and Fred Ehrsam (Coinbase’s founders) felt compelled to wade into treacherous PR waters, to the detriment of their firm’s reputation.

Their first major mistake was involving Coinbase in the acrimonious block size debate and their second was actively promoting Bitcoin’s main rival; the troubled, “Turing-complete” Ethereum.Coinbase unwisely pledged its support to the failed Bitcoin XT / Classic project.Brian Armstrong raised hackles across social media with a number of ill-advised comments and announcements.Armstrong’s top-down approach was not well-received by the wider Bitcoin community.Next, Fred Ehrsam proclaimed the superiority of Ethereum, shortly before the spectacular failure of the DAO and Ethereum’s subsequent price crash.It’s hard to imagine what Brian and Fred hoped to gain from their controversial statements and decisions but the resultant PR backlash will likely see them charting a more neutral course in future.Perhaps most egregious of all their transgressions are Coinbase’s 9 patent filings for cryptocurrency-related “innovations.” These applications include the following: Such patents are obviously not Coinbase innovations and obviously clash with the open source nature and the philosophy of Bitcoin.

Brian Armstrong apparently expects people to trust Coinbase, and to refrain from using any such patents to block competition.Frankly, no company, agency or entity can or should be trusted with legal authority over any aspect of the Bitcoin ecosystem.Bitcoin was designed to obviate the need for such trusted parties.At times, it appears that Coinbase is more in the business of attracting investors than servicing clients or wisely developing Bitcoin.Given the foregoing, it’s impossible to recommend Coinbase without some caveats: You should never rely on Coinbase to act as your wallet.This applies equally to every other exchange and third-party service offering to store your coins.The oft-repeated maxim is: if you don’t hold the private keys, you don’t own the bitcoins.While Coinbase’s multi-sig Vault offers some extra security, as get to retain at least one of the keys, it’s still nowhere near as secure as storing your bitcoins personally.If you’re uncertain as to how to properly store your bitcoins in a cold wallet, consider the purchase of a suitable hardware wallet.

Don’t use Coinbase if you intend to use your bitcoins for anything “naughty.” To avoid future legal entanglements, your best option a decentralised exchange, such as LocalBitcoins or Mycelium Local Trader.Finally, if you’re a Bitcoin holder or believer, before using Coinbase you should consider whether their actions, affiliations and incentives are properly aligned with the cure principles of Bitcoin, such as openness, decentralisation and fungibility.While Coinbase may be a cheap, popular and convenient option, they’ve demonstrated a disturbing lack of regard for those unique properties which ultimately give Bitcoin its value.It’s an admitted simplification to say that Coinbase isn’t for Bitcoiners but instead for cryptocurrency newcomers, Ethereum enthusiasts, venture capitalists and those with an abiding sentimental attachment to the reassuringly blue corporate colour schemes and wealth-peacocking of traditional banks.A lot of people feel more comfortable entrusting their money to a service which makes Bitcoin appear more conventional and familiar.