ethereum surge

Most top altcoins have experienced an upsurge within the last couple of weeks.Amid a booming altcoin scene, Bitcoin has sunk to a record low in terms of its share of the cryptocurrencies market, sitting at just 70.5 percent as of Friday.There seems to be no pattern, though, in price movements among the top cryptocurrencies.Adoption The rise in Ethereum price may have coincided with certain partnerships and developments within the community.However, the CEO and Founder at ether.camp, Roman Mandeleil, thinks that the rise in Ethereum value is more of a reflection of industry adoption.Mandeleil says: “I don't think any specific development is the cause of the rise in the price of Ethereum.In my opinion, the surge in price is a reflection of increased adoption of the technology in the industry for BC development.” Ethereum Harmony One of the developments that Mandeleil notes is Ethereum Harmony.Mandeleil describes Ethereum Harmony as an independent Ethereum peer that has all the functionality required to manage one's Ethereum funds and use RPC API from any computer.

Released in its trial version in September 2016, Mandeleil says Ethereum Harmony is capable of providing full support and provisioning the full state of the smart contract and can also be used by developers to see the internals of Ethereum and ensure the network works fine.An expanding industry Almost a year ago, the Ethereum price surged to new highs with the creation of The DAO but slumped after the hard fork that happened as a consequence of The DAO breach.The event saw the community split into two.Ethereum price remained quite stable in its low state until the recent surge that has seen it rise above $40 as at the time of writing.As the cryptocurrency industry expands and new users flux into the ecosystem, price becomes less volatile.This is predominantly due to the fact that movements in price, especially in the upward pattern as observed lately, does not depend on isolated events.Most cryptocurrencies show upward price movements mainly because new adopters are entering into the ecosystem, therefore, use case scenarios are on the increase which automatically creates demand for the cryptos and subsequent increase in value.

Username * First Name Last Name Email * Password * Repeat Password * You registration completed successfully.Confirmation email sent to email address provided.

bitcoin mais baratoEmail * Password *

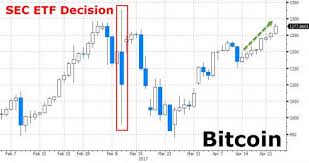

litecoin mining guide hardwareby Tyler Durden Yesterday holders of bitcoin got an unexpected, if pleasant surprise courtesy of the SEC which announced that two months after deciding against a bitcoin ETF, it would review its decision, suggesting that after several failed attempts, Bitcoin may surge even more soon should the long-awaited Bitcoin-based ETF be ultimately approved.

bitcoin abmeldenWhether or not it is a good thing for the cryptocurrency in the long-run to get such approval, which would expose bitcoin to the vagaries of volatile retail money flows and even greater volatility, is yet to be determined, but the price of bitcoin liked it, and earlier today it rose to near record highs, rising above $1,300 just shy of all time highs.

Then today, in similarly favorable news for holders of Bitcoin's smaller peer, Ethereum, it was revealed that the SEC had quietly begun the process of considering whether to approve an exchange-traded fund for the cryptocurrency ethereum.Recall that ethereum exploded higher at the end of February when it was revealed that a consortium of venerable corporations including JPM, Intel, Microsoft and many others, had created a blockchain alliance based on the ether technology.In same ways, whereas bitcoin has been seen as the more venerable, if "renegade" cryptocurrency, ether has developed the reputation of the smaller, better-behaved relative, one which is backed by major banks and corporations, which in the past has distanced itself from bitcoin due to limitations associated with its specific blockchain technology.While ether and bitcoin are similar, they are also very different.First of all, none of the big Chinese exchanges lists ether for trading (which means it is only a matter of time before they do) sending it into orbit as the traditional Chinese bubble stampede does.

Second, the two biggest ether exchanges are Coinbase and Kraken, both regulated.Ethereum is backed by almost all household brands who have formed an alliance in support of the platform.Microsoft is a big proponent, with ether’s protocol added to Hyperledger, the open-source cross-industry blockchain development effort headed by the Linux Foundation.Whether that makes an ether-based ETF more likely remains to be seen.What we do know is that the backers of the EtherIndex Ether Trust first filed in July 2016, seeking to launch an ETF backed by a cache of ethers on the NYSE Arca exchange, according to Coindesk.NYSE Arca then filed for a proposed rule change clearing the way for the ETF listing in December, according to a notice published in January.Then, in a new notice from the SEC, the agency announced that it has begun considering whether to approve the proposed ETF, opening up a comment period for outsiders.This is what the SEC said: "Institution of such proceedings is appropriate at this time in view of the legal and policy issues raised by the proposed rule change.

Institution of proceedings does not indicate that the Commission has reached any conclusions with respect to any of the issues involved.Rather, as described below, the Commission seeks and encourages interested persons to provide comments on the proposed rule change."As Cryptocoinnews adds, "Joseph Quintilian and Gregory DiPrisco have founded EtherIndex which is to act as a trust for an Ethereum ETF with Coinbase acting as a custodian and price based on GDAX while Kraken is to act as back-up, both regulated exchanges.Not much is known about the two, but Quintilian appears to be a Wall Street banker or trader, seemingly very well connected and apparently politically involved.He is a board member of Concord 51, a political action committee that targets young professionals, and, according to their LinkedIn, “not just the young Republican establishment, but also the unengaged.” The two have also founded Axiom Markets, “a proprietary energy trading firm,” according to their website, and, interestingly, they say “Axiom Markets has melded technology and trading together.