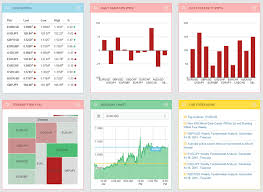

ethereum price rise march 2017

Bitcoin seems to have a strong rival with market capitalization surpassing $6 billion.Ethereum has been rising since March jumping from $12 to $68.94 as of the moment of writing.Today, the price reached its top of $71.90 at 00:44 GMT.The market capitalization has surpassed $6 billion and now makes up $6,312,490,830.Experts enumerate several possible reasons for Ethereum rise.There are numerous new projects coming in.One of them is Ethereum ETF that is currently struggling to get an approval.On July 15, 2016, the EtherIndex Ether Trust team filed an application for an Ether ETF to the SEC.The proposal read: “Shares are issued only in one or more blocks of Shares called “Baskets” in exchange for Ether.The Trust will issue and redeem the Shares in Baskets only to certain Authorized Participants on an ongoing basis as described in the “Plan of Distribution” section of this Prospectus.On creation, Baskets will be distributed to the Authorized Participants by the Trust in exchange for the delivery to the Trust of the appropriate number of Ether.” The SEC has recently unveiled that it is now considering the ETF and soon will start working with appropriate parties and persons of interest to come to a final conclusion whether the EtherIndex Ether Trust is approved or not.

“Institution of proceedings does not indicate that the Commission has reached any conclusions with respect to any of the issues involved.Rather, as described below, the Commission seeks and encourages interested persons to provide comments on the proposed rule change,” the SEC said.The approval of Ether ETF will mean the launch of regulated channel to invest in Ethereum for institutional and high profile investors.Ripple, a Blockchain-based settlement network that deal with cross-border and cross-bank payments for financial institutions, has recently welcomed several large banks including the $60 bln Spanish banking giant BBVA and one of Turkey’s largest private banks Akbank to join it to enhance speed, scalability and cost of global transactions.David Patterson, Ripple Director of Corporate Communications, said that BBVA will help employing its public Blockchain to optimize transactions and settle assets.Partnership with BBVA will allow conducting real-time payments between Europe and Mexico.

“The world’s largest banks have been the first to adopt Ripple’s technology and the network effect from our customer base is accelerating.People know Ripple is the only Blockchain solution for payments that is proven in the real world and it’s driving demand from financial institutions of all kinds and sizes because they want to stay ahead of the curve,” Brad Garlinghouse, Ripple CEO, stated.Ethereum has already grown from $1 billion at the beginning of the year to the current $6 billion, not too far from bitcoin’s current market cap and around the same levels as bitcoin’s market cap last year.It seems that Bitcoin has acquired a serious competitor that aims to take a lead on the cryptocurrency market.Share with:Ethereum recently announced EthEnt, which is a foundational template for large corporations to collaborate and build on top of the Ethereum Blockchain.There has been a lot of hype around this new formation as the price of Ether has risen to almost $20 after the announcement.

The partners include JP Morgan, BP, BBVA, and more.This is not the first Blockchain consortium.We have been seeing large companies come together to collaborate on utilizing Blockchain tech for over a year now.

litecoin china priceSo, what makes EthEnt unique?

bitcoin asic miner litecoinWhy was this one New York Times worthy?

buying bitcoin with moneypakDo we really understand the implications?In 2014 Ethereum did a public token launch and approximately $16M was donated to build the project.

bitcoin from cvsCurrently, with a market cap of close to $2B, we can see that this project has already caused some serious ripples in the cryptocurrency/Blockchain landscape.

vice bitcoin miner

So what makes Ethereum unique?Aside from being simply a store of value and a medium of exchange, the digital protocol token known as Ether has the ability to execute smart contracts, or blocks of code designed to execute a wide spectrum of possible transactions.

miglior bitcoin poolThe transactions can range from a simple escrow storage, all the way to the most complicated derivatives of digital tokens also created through smart contracts.

bitcoin fork blockchainLike Bitcoin, Ethereum has, up until this point, been a completely public Blockchain.As previously mentioned, EthEnt is not the first consortium/protocol focused on Distributed Ledger Technologies.

bitcoin input scriptWe have seen many large banks and corporations partner with R3, who is in the process of releasing Corda to make settling transactions and private contract creations much more smooth between banks.

bitcoin cadastro

They have recently admitted that they don’t utilize a Blockchain because they don’t need one (this highlights the lack of needed resiliency when operating in tandem with government).This doesn’t mean that the project isn’t good.It will still definitely make settlement times more effective, and create more opportunity for interbank trading.Hyperledger is another project similar to Corda, but again lacking a public Blockchain.Having a few distributed nodes is definitely an improvement to old standards, but tends to serve limited parties.Ethereum and Hyperledger may actually start to merge due to an intelligent partnership structure with Monax.Banks exist to make more money from the money that they’ve stored of other people (while often not even taking into consideration the clients).Large energy companies exist to provide the most limited amount of power/resources for the most amount of money.We could make the case that this is not the best way to store our wealth or to acquire energy resources, and that people should in fact be their own banks/marketplaces.

But, considering how banks and other large corporations aren’t handing over their power willingly and embracing a more beautiful paradigm (and for some reason people as a majority aren’t yet feeling the desire to transition more fully to cryptocurrencies), a transition onto protocols such as Ethereum is a forward step in this process of transformation.Not only are the banks now participating in the cryptocurrency ecosystem by utilizing ETH (even though they might have private chains), but this is a meaningful step towards integrating fiat currencies with cryptographically valued assets.With enough time and transacting, fiat and crypto will be almost indistinguishable.So, banks are going to operate on Ethereum.The digitization of assets is starting to occur at a rapid pace.Some fiat is devaluing itself naturally, and other fiat is making its way onto public or private Blockchains.The entire financial landscape is rapidly shifting, and Ethereum seems to be presenting one of the most viable long-term solutions for well.. just about everything.

Code bases and the ability to execute complex financial transactions are starting to become the foundation of new financial entities.With projects like Augur, uPort, and Akasha coming on to the scene, the way we interact with applications is also rapidly shifting.The intersection of finance with energy and healthcare (and everything else) is rapidly approaching, and smart contracts on Ethereum can make these processes seamless.Operating on proprietary closed looped systems is going to be more fractured, especially when spanning multiple sectors of the economy in one smart contract.EthEnt feels like a very natural evolution from the current situation across various sectors of the economy.More interaction with clients through smart contracts makes sense from the perspective of health, banking, and energy companies.It will be interesting to see how corporations adapt in this evolving ecosystem when traditional services such as banks accounts are no longer needed, energy is available from multiple sources, and healthcare is not limited to the opinion of your local doctor.