ethereum chinese stock exchange

SummaryEthereum now has a market cap over $20 billion, while bitcoin's is around $36 billion.This is the first time that ethereum has surpassed half of bitcoin's market cap, and as of now it has broken this barrier decisively.This is remarkable because ethereum is still getting so much less press than bitcoin.Major financial institutions and technology corporations are lining up in support of ethereum as the digital currency of the future.I suggest to investors that it may be wise to put something like 1% of your portfolio in bitcoin and another 1% in ethereum.Bitcoin has been getting most of the press in this month's stunning digitial currency price boom, as it soars well over $2,000 and holds that level.And as I wrote recently, I think it is a wise hedge -- on your portfolio and even on gold -- to buy a little bit of bitcoin, in case it becomes the go-to safe haven asset of the next generation.But ethereum may well prove to be the real story.Yesterday (May 30) it rose to as high as $224, while bitcoin fluctuated around $2,200.

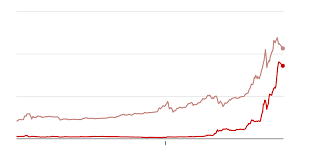

And although the price per "coin" gets the attention and the headlines, what really matters is the total market cap of each digital currency.Ethereum now has a market cap over $20 billion, while bitcoin's is around $36 billion.This is the first time that ethereum has surpassed half of bitcoin's market cap, and as of now it has broken this barrier decisively.The headline prices per coin of bitcoin and ethereum are deceptive, because there are about 16.3 million bitcoins in existence, but there are about 92 million ethereum units.So you have to multiply the ethereum price by about 5.5 to make a fair comparison with bitcoin.For perspective, here is a chart of the ethereum to bitcoin price ratio (not market cap ratio) over the past two years, although this chart cannot even keep up with the ratio's rapid rise as of yesterday: In reality, the ratio in this chart is now above 0.10 as I write.This is remarkable because ethereum is still getting so much less press than bitcoin.When I type "bitcoin" here or in Microsoft Word or in Gmail, the spell checker recognizes the word, but when I type "ethereum," the little wavy red line still appears under it because the spell checker still doesn't recognize it yet.

However, among major financial institutions and technology corporations, there are strong signs that they are lining up in support of ethereum as the digital currency of the future.In late February J.P.Morgan Chase (NYSE:JPM), Microsoft (NASDAQ:MSFT), and Intel (NASDAQ:INTC) were among the group of corporations who launched the Enterprise Ethereum Alliance.Just last week many more leading corporations including Toyota (NYSE:TM), Merck (NYSE:MRK), and State Street (NYSE:STT) joined the group.

dogecoin value right nowOn the day of the February announcement, the ethereum price was $14.55.

bitcoin virus detectionBefore last week's announcement, the price was $123.

bitcoin 2050Now the ethereum price is around $230 as I write.

bitcoin tap faucet

Clearly investors are responding to ethereum's growing corporate connections with many billions of dollars flowing into ethereum in a short period of time.If ethereum can do this well while bitcoin is getting most of the press and the attention, imagine what it could do when ethereum starts getting more headlines.Ethereum is still rather "under-the-radar" for many casual followers of financial markets.

ethereum long term potentialI also strongly believe that the "headline price" has a large effect on investor psychology: ethereum still "looks cheap" since it is just over $200 while bitcoin is over $2,000.

bitcoin consensus protocolThat alone could attract more buyers soon.

ethereal on linuxThis month's bitcoin boom has been fueled mainly by investment flowing in from Asia: China, Japan, South Korea.

local bitcoin arbitrage

Ethereum is gaining more support among US-based corporations.I wonder if, in the future, ethereum and bitcoin may function in practice as regional digital currencies, somewhat akin to the way the US dollar and Japanese yen function today?Of course anyone anywhere will be able to invest and do business in either currency, just like the dollar and yen.But Asian investors may continue to prefer bitcoin, while US investors turn to ethereum.

azioni bitcoinJust a possibility to consider.Action To Take I suggest to investors that it may be wise to put something like 1% of your portfolio in bitcoin and another 1% in ethereum.This is partly a hedge against inflation and market volatility, but it is also partly a hedge against the possibility that bitcoin and ethereum play the role that gold and silver have traditionally played for the next generation of investors.Mind you, I say this as a strong believer in precious metals as a safe haven to preserve one's wealth.

I think 10% of your portfolio in gold is a good idea at all times.Gold has been valued as a store of wealth by civilizations around the world for 6,000 years.But that doesn't mean that investors can't turn to bitcoin and ethereum as a partial alternative for the next 30 years.Consider this: the total market cap of bitcoin is now greater than that of the SPDR Gold Trust (NYSEARCA:GLD).GLD is not the only way to invest in gold, nor is it in my view the most reliable, but it is by far the most popular today.The establishment of GLD in late 2004 had a big effect on the gold price boom in the years afterward.When bitcoin surpasses GLD, that says something.And consider this: the total market cap of ethereum is now greater than the estimated market value of all the world's silver.Ethereum does not have any investment vehicle yet in the regular stock market, even an overvalued one like the Bitcoin Investment Trust (OTCQX:GBTC) or a pending one like the Winklevoss Bitcoin Trust ETF (Pending:COIN).

So one must find another avenue for this investment.I recommend Coinbase to invest in ethereum and bitcoin.It is the world's largest site for buying and selling bitcoin and ethereum, and it is safely registered and regulated in a similar way as your standard brokerage accounts.You set up an account there the same way you do with a brokerage account.And if you choose to use the link in this article and you buy at least $100 worth of ethereum and/or bitcoin, you and I will both get $10 worth of bitcoin free.Hey, every little bitcoin helps!A modest 1% each in bitcoin and ethereum, before most people have even thought about actually buying any, could pay off big time in the years ahead.I would just hate to only have gold as my safe haven and then watch ethereum or bitcoin take off as the asset that rises 10x in value instead.I prefer to hedge my bets on the possible safe havens of the next generation, at least a little bit.Disclosure: I am/we are long ETHEREUM, BITCOIN, PHYS.I wrote this article myself, and it expresses my own opinions.