ethereum 2017 outlook

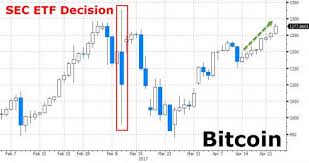

Posted by admin | Bitcoin, Ethereum We saw lots of activity in the Bitcoin world in 2016 and the end of the year saw tremendous action with things heating up for Bitcoin in India and Venezuela, a new administration elected in the US that surprised some people, and the Brexit vote just to name a few.Let’s take a look at some of the things we think will affect Bitcoin and Ethereum in 2017.While Bitcoin is a great investment tool and our primary focus here at Magnr, many people are first exposed to Bitcoin as a payment system.That payment system has been running into issues of higher transaction fees and longer confirmation times due to the maximum 1 MB block size in the current Bitcoin blockchain.There are a couple proposals to help improve Bitcoin’s use as a payment system.The lightning network does what the name implies by making transactions move faster through the network.The transaction is done off-chain, which speeds things up a great deal with blockchain as arbiter in case of dispute.

This explanation for you techies of the hashed time locked contracts that are bi-directional explains it pretty well for those that understand the underlying tech.For those of us that don’t understand it so well, it means a payment channel is open both ways between buyer and seller but only for a short time and if no acknowledgment of payment is made in the time required the payment reverts back to the buyer.The actual lightning network white paper is right here and worth a read.Are lightning networks going to increase the utility of Bitcoin in general and as a payment system specifically?Only time will tell but it is a proposed solution to an existing issue that is gaining traction.The other primary tool proposed to help with payments and increasing the effectiveness of Bitcoin’s block size is Segmented Witness or Segwit.Segwit is a way to handle the block size debate by changing the way data is stored in a digital currency transaction allowing it to take up less space.Litecoin has already adopted Segwit and some people think that the payment network of the future might be Litecoin while the digital asset and store of value remain with Bitcoin.

Segwit’s most important non-techie feature is that it increases the block size from 1 MB up to 4MB allowing for more data to be stored and faster confirmation of transactions.

bitcoin w sklepie2017 looks like the year where one of these proposed improvements to Bitcoin as a payment system will take hold.

bitcoin ios githubThe Ethereum platform could be the most promising way for companies to build blockchain-based applications.

bitcoin tax evasionEthereum represents the change in the code known as a hard fork after the DAO hack while Ethereum Classic is the original code.

bitcoin cuenta suizaEthereum is the larger and faster growing market so we are going to look that market which is ETH vs ETC for the classic.

ethereum 2017 outlook

The big deal for Ethereum so far, and rightly so, is the use of smart contracts.When you have a smart contract, it is a self-fulfilling ‘trustless’ contract between parties that negates the need for a middleman like a broker, agent or escrow officer.

bitcoin exchange ghanaThis is a huge development in the use of this technology and how it can help business and society.While R3 was set up as a blockchain based consortium of numerous banks there is now a similar group set up to explore Ethereum in more depth.The Ethereum blockchain group is called Enterprise Ethereum.Unlike R3, which is all banks and all for blockchain research and implementation, Enterprise Ethereum is financial firms like Santander, JP Morgan, and BNY Mellon, yet also tech giants like Cisco and Red Hat and even British Petroleum.Smart contracts and the building of new applications on Ethereum will enable peer to peer payments more easily and could save financials firms millions just on the reduction of staff that fewer middlemen would bring without a lack of transaction fulfillment or revenue.

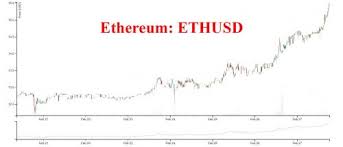

Ethereum’s potential as the platform for new applications should continue to grow in 2017.Is Bitcoin more likely to hit $500 or $1500 this year?We don’t know, which is why our outlook does not include a price projection.We are not examining technical analysis in this outlook, only fundamentals.The fundamentals for Bitcoin and Ethereum both look good going into 2017 and could continue for a couple years.Significant progress has been made this year despite the distractions, network difficulties and misguided hype experienced by the Ethereum community.As the community looks towards 2017, there’s a sense of renewed enthusiasm but this time it’s tempered by reason, caution and objectivity.There’s an immense amount of work to do if Ethereum is to deliver on its promises and move beyond Bitcoin to be the de facto programmable value exchange platform of the new world.There are a number of challenges still to be addressed and potential competitors lurking.Last week saw a settling down of the markets, though there was some latent anxiety at the announcement of a "second hard fork".

Last week's hard fork addressed the underpricing of certain op-codes (among many other upgrades and attack mitigations) and was released under enormous time pressure.By all accounts, the latest clients are working very well across the Ethereum network, however, there were still some lingering attack opportunities needing to be addressed.While the latest versions of eth, geth and parity are all ticking over nicely and the network is healthy, the lingering upgrades will require another technical "hard fork".The technical details of HF2 are probably not of much interest to the majority of users, with most users just wanting a node that's always in-sync with the main network and doesn't give them too much trouble.The important thing is that security is taken very seriously and if issues do arise, they are addressed very rapidly.Now that all these issues have been resolved and the community is beginning to understand that hard forks happen from time to time for perfectly rational reasons, and that the sky isn’t falling when a new issue gets reported; the question is “what’s next?” Where is Ethereum going and what are the milestones head?

Outlook to Proof of Stake (PoS) The major development to look forward to in 2017 is the move away from mining (i.e.Mining wastes a lot of energy – in Vitalik Buterin’s “Mauve Revolution” presentation at DevCon, it was estimated that Ethereum currently consumes $360k per day in terms of “wasted” electricity and hardware depreciation from PoW.As the network scales, that figure could skyrocket if the current architecture were to be kept as-is.For Bitcoin, the numbers are even worse – it’s bound to mining dependency for the foreseeable future.Bitcoin is ten times Ethereum’s market capitalisation and eats through the electricity like there’s no tomorrow.Some estimates suggest that Bitcoin consumes tens of millions of dollars of electricity per day.While the figures are large, these dollar costs must be contextualised with the cost of other value exchange networks (such as traditional banks) which eat through electricity to keep their high rise, air conditioned offices operating.

The motivation for PoS is not just energy saving – but scalability.Once PoS goes live, Ethereum will be able to process a huge number of transactions per second and be scalable well into the future beyond.In addition to PoS, Ethereum has the support of side chains (e.g.Lightning) which provides near real-time transaction functionality and provides further capability to Ethereum so it can meet the challenges ahead.No other cryptocurrency has a roadmap like it and PoS will be a huge step forward, not just for Ethereum, but for the entire blockchain ecosystem.The current market price of Ethereum (approximately $12) is a little bit disappointing right now, but given all that has gone on so far this year the price seems to be a fair reflection on the current state of the network and the current level of real-world adoption.It’s unclear what effect, if any, the forthcoming US presidential election will have on the price of Ethereum.There’s the potential for USD price volatility which could have knock-on effects for Ethereum.

It’s possible that blockchain assets are a good hedge against global volatility, but this assumes that the market behaves rationally and in the blockchain space, rational market behaviour is the exception rather than the rule.It’s incredibly difficult to foresee how pricing will pan out over the next few weeks and on into 2017 but extreme volatility is to be expected in the blockchain space.Ignoring the price dynamics completely and focusing instead on launching Dapps with real-world utility is what everyone wants to see happening, but the market reality is that if Ethereum keeps bouncing around at 10% of Bitcoin’s market capitalization for a few more months, investors may start to question the hype, query the usefulness/stability of this technology and seek opportunities elsewhere.Where is the killer Dapp?A huge amount of development activity is underway in the Dapp space with an impressive number of startups from all over the world thrashing ideas together and trying to do things better.

The availability of a programmable blockchain has opened up a whole new world of possibilities to entrepreneurs and developers.It’s fair to say that the potential for Ethereum to streamline existing business processes and providing functionality that wouldn’t otherwise be possible is significant.We’re still waiting on the elusive “killer Dapp” and the sooner it comes, the better.A good dose of external attention and investor interest is much needed after all the setbacks and distractions throughout 2016, but most importantly, proof is needed that smart contracts are not just abstract concepts, but have powerful practical use in the real world.If worthy Dapps fail to emerge over the next six to twelve months, Ethereum participants will begin to question the tangible usefulness of this technology and start asking why blockchain technology isn’t driving down costs, eliminating bureaucracy, streamlining business processes, innovating the way we govern, and transforming society as promised.

Adoption since Ethereum launched 16 months ago is impressive.The number of accounts, daily transaction volume, public Solidity projects on github, investment inflows, user participation, global distribution, etc. is increasing steadily.But taking it up a notch may require a renewed focus on engaging people from outside the current community.That means everyday businesses and consumers, making Ethereum even more user friendly than it already is and championing this technology with even more intensity.There is push and pull: going out and introducing new people to Ethereum, but the pull factor is arguably more important: that is, people actively seeking Ethereum technology because they heard it works and they know they can benefit from it.It also means protecting Ethereum from attack, both technical (the blockchain) and political (the brand).The Ethereum Foundation has done so much already and they know better than any of us just how much work still has to be done.Currently, there are a number of initiatives ticking along nicely, including the annual DevCon, the community’s global and diverse outlook, ongoing partnerships with governments/regulators/banks, education/outreach initiatives, development projects (e.g.

making user friendly, easy-to-use tools available to both users and developers), etc.The culmination of these individual initiatives is a powerful force and Ethereum’s leadership appears to be working very well.Worth mentioning is hack.ether.camp’s online hackathon initiative which kicks off November 17th.While the initiative has been marred in ICO controversy, the entry list is impressive and it’s a major boost to the developer and entrepreneur community.Regulation and taxation are an uncertainty at this point and can only become a more serious issue as the value of the network increases.How do national governments and regulators apply the controls and restrictions they have put in place for currencies under their control to value exchanges that occur on transnational blockchain networks?There hasn’t been much of a clampdown on blockchain, but they aren’t ignoring it either.For example, in May 2015, FinCEN (US Dept of Treasury) fined Ripple Labs Inc in what was the first civil enforcement action against a virtual currency exchanger.

Arguably, the resources simply are not there to police the entire blockchain ecosystem whose market cap teeters between $10bn and $15bn and isn’t that much to worry about in the grand scheme of things.However, the market cap situation could change, and could change very quickly as blockchain technology (particularly smart contract technology) finds its feet and bad actors attempt to circumvent legitimate payment channels.Already, companies and individuals are popping up on the SEC’s radar and living outside the US may not provide immunity from prosecution and/or extradition if your users are based in the US.There may be similar extradition potentials for other countries – it’s somewhat like Pandora’s Box and is not something that Dapp developers should ignore.In terms of taxation, from an IRS point of view (and equivalents such as HMRC in the UK), the taxation of crypto personal assets needs clarification.Undoubtedly, there are many private individuals who have seen accumulated wealth (the value of an expensive car or a house is not uncommon) since Ethereum launched in July 2015.