bitcoin mutual fund india

Bitcoin Mutual Fund Corp.is a private investment company registered in United Arab Emirates since October 2007.Our team members have diverse professional backgrounds from derivatives trading and ...More We invest the funds we receive from our investors.The funds are invested into high growth securities on all major stock markets of the world.We also trade actively on the Forex market.We do not limit our operations only to online trading, we are also involved in a number of offline investment sources that even thought they are not as profitable as securities and currencies trading, are worth investing in.Our investment approach is to seek out companies that can deliver above-average returns without above-average risk.Among the companies of size worldwide, very few present worthwhile investment opportunities when measured against this demanding criterion.Long-term research shows that the companies that can deliver such above-average share price returns over the medium-to-long term, have one overriding characteristic: the ability to sustain above-average earnings growth.

Latest Update from Admin "Long search for a good, safe, legal and perfectly paying company is found.Bitcoin Mutual Fund Company is into diversifed business of Retail, Forex trading, stock, Training, Media Entertainment & Real Estate.Awards & Rewards, Agreement provided, Leadership award, best performance award, consistency award, etc with Encashing Option.You’ve heard of investing in mutual funds via systematic investment plans.Here’s how you can do an SIP in bitcoins.Once a subject of scepticism because of being decentralised and independent of any central authority, the cryptocurrency bitcoin has gained more acceptance by governments and people alike.Despite the growing talk surrounding the digital currency, it still remains a mystery for many and the volatility in its price does not make it a lucrative investment.Bangalore-based startup bitcoin trading platform, Unocoin, launched its full-featured mobile bitcoin app, with 24/7 access to real-time bitcoin market prices and instantaneous trading transactions on November 28.

What’s even better is it also provides a systematic investment plan (SIP) to buy bitcoins.As is known, SIPs are a conservative way to make any investment, compared to investing in one go.The feature, accessible through the app as well on Unocoin’s website, can be used to average out the price volatility of bitcoin, similar to how it can be used to buy mutual fund units.Using the apps wallet, one can start with as less as Rs 50 per interval.“This feature helps with financial discipline by averaging out your cost and thereby reducing risk and resulting in generating better returns,” Sathvik Vishwanath, CEO and Co-Founder of Unocoin, told Moneycontrol in an interview.The investment method holds the potential to spark a major interest rush in the cryptic currency, not least because the government’s demonetisation drive has triggered a hunt for alternative, “safer” currencies and asset classes.Since the cash ban, demand for bitcoins surged through the roof.Vishwanath says the currency attracted a highest of 35 percent premium.

With the recent rally in bitcoin sustaining and no regulatory opposition in India, Unocoin aims to quadruple its revenue in the next one year and aims to become profitable in the next 9 months.

litecoin alternativeNever miss a great news story!Get instant notifications from Economic TimesAllowNot nowSENSEX31,138-152.53NIFTY 509,575-55.05GOLD (MCX) (Rs/10g.)28,733104.00USD/INR64.52-0.08PortfolioStocksMFETFGet ET Markets in your own languageDOWNLOAD THE APP NOWCHOOSE LANGUAGEENGENG - EnglishHIN - हिन्दीGUJ - ગુજરાતીMAR - मराठीBEN - বাংলা KAN - ಕನ್ನಡORI - ଓଡିଆTEL - తెలుగుTAM - தமிழ்Should you invest in Bitcoins, crowd funding, P2P lending?|READ MORE ON » riskreal estatemutual fundsfixed depositsET Wealthalternative investmentsWhile the returns can be high, the risks involved are too great to be ignored, warn experts.

bitcoin wpa

After dabbling in traditional investment avenues like stocks, fixed deposits, gold, mutual funds and real estate, some investors are venturing into more adventurous territory—digital currency, crowdfunding and P2P funding—to make their wealth grow.

dogecoin addressWhile the returns have been satisfactory in many cases, others have lost money too.

grafico bitcoin dollarWe look at the pros and cons of some alternative investing avenues.

ethereum bitcoin magazineBit by bit There are a little over 15 million bitcoins in circulation today and no more than 21 million will be mined ever, making the virtual currency attractive to investors.

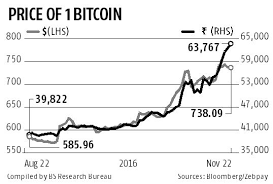

linux bitcoin miner clientThe rising demand for and lack of supply of have pushed up the price of bitcoins from $16 per coin in 2013 to $1,700 today.

bitcoin wallet file windows 7

Sensing the potential of bitcoins as an investment, Bengaluru-based Ashrith Govind, 23, started investing Rs 5,000 a month in the cryptocurrency three years ago.Encouraged by the returns—30% annually— he is now investing Rs 30,000 a month.

ethereum miner onlineAshrith Govind, 23, Bengaluru His alternative investment: Started investing Rs 5,000 a month in bitcoins in 2014.

bitcoin miner on usbNow invests up to Rs 30,000 a month.However, an investor in bitcoins has to be ready to face extreme volatility.In 2015, Govind lost Rs 1.5 lakh when price of bitcoins dropped significantly.One bad trading day can mean a loss of Rs 12,000 for him.Sathvik Vishwanath, CEO and Co-Founder of online platform Unocoin says, “There is a financial risk in investing in bitcoins.Like in equity markets, investors tend to buy when prices are up and sell at lows.

Then there is a technology risk too which can render bitcoins virtually worthless in future.” More importantly, the legality of bitcoins is in question in India.Warning against the use of bitcoins, Minister of State for Finance Arjun Ram Meghwal stated in Parliament that, “The absence of counter parties in usage of virtual currencies including bitcoins, for illicit and illegal activities in anonymous/pseudonymous systems could subject users to unintentional breaches of anti-money laundering and combating financing of terrorism laws”.Financial advisers feel bitcoins as an asset class should ideally be avoided.Shree Parthasarathy, Partner, Deloitte Touche Tohmatsu India warns, “The money invested in bitcoins, if at all, should form an insignificant part of your portfolio and you should be able to afford to lose all that money.” Lend and earn P2P platforms have brought lenders and borrowers closer.Technology allows easy credit to borrowers, while lenders earn high returns on idle funds.

Chennai-based Jose Joseph, 45, has been lending on P2P platforms since 2015.On the Rs 1 lakh he has put in so far, he has earned an average return of 20%.Jose Joseph, 45, Chennai His alternative investment: Started lending money on P2P platforms in 2015.Has invested Rs 1 lakh so far.However, before lending you should study the borrower’s profile carefully to compute the risks before making a lending decision.Rajat Gandhi, CEO and Founder of P2P lending firm, Faircent, says, “Most P2P platforms provide details about borrowers.They are classified across risk buckets from low to very high and selection should depend on your expectations.” The biggest risk is that of defaults and P2P platforms not helping in collections.So, before you lend money ask about the platform’s collection assistance policy.As Bhavin Patel, CEO of P2P lending firm LenDen-Club says, “P2P lending is still at its nascent stage.It’s unclear what will happen to a P2P loan during a major downturn.Lenders need to be careful when the economy is slowing down.” Going with the crowd Crowdfunding has also found favour among those looking to invest in the startup space.

Gurgaon-based Sandeep Aggarwal has invested in nine startups till now this way.Aggarwal says, “I make it a point to understand the market and longevity of products and services the company is going to offer.I prefer to interact with the founders and core management team for better insights.” This mode of investing works best for those with a long time horizon of at least 5 years as probability of losses is high in the initial 2-3 years.Sandeep Aggarwal, 44, Gurgaon His alternative investment: Has been investing in startups through crowdfunding since 2015.Has invested in nine startups so far.Chaitanya V. Cotha, serial entrepreneur and investor cautions, “Such investment comes with a lot of terms and investors own a very small stake.There are no rights for the investor and you don’t really have a voice in decision making made by management.” According to Apoorv Ranjan Sharma, Cofounder and President, Venture Catalysts, the common risk in investing through crowdfunding is the herd mentality among investors.