bitcoin market github

This library for Sketching-based Matrix Computations for Machine Learning, known informally as libSkylark, is suitable for general statistical data analysis and optimization applications.Many tasks in machine learning and statistics ultimately end up being problems involving matrices: whether you're finding the key players in the bitcoin market, or inferring where tweets came from, or figuring out what's in sewage, you'll want to have a toolkit for least-squares and robust regression, eigenvector analysis, non-negative matrix factorization, and other matrix computations.Sketching is a way to compress matrices that preserves key matrix properties; it can be used to speed up many matrix computations.Sketching takes a given matrix A and produces a sketch matrix B that has fewer rows and/or columns than A.For a good sketch B, if we solve a problem with input B, the solution will also be pretty good for input A.For some problems, sketches can also be used to get faster ways to find high-precision solutions to the original problem.

In other cases, sketches can be used to summarize the data by identifying the most important rows or columns.A simple example of sketching is just sampling the rows (and/or columns) of the matrix, where each row (and/or column) is equally likely to be sampled.This uniform sampling is quick and easy, but doesn't always yield good sketches; however, there are sophisticated sampling methods that do yield good sketches.The goal of this project is to build a sketching-based open-source software stack for NLA and its applications, as shown: Please note that the code is in "beta" mode.We are constantly testing and hardening the code, and improving the documentation.Consider adding the last two lines above to your .bashrc file.More details are provided in the .libSkylark is relying on Cmake as a build system.Before you start please make sure to check out the Installing software dependencies for libSkylark section to learn about the required dependencies.

In many situations the default configuration and settings should work out of the box.To that end execute Note: If you have MPI compilers in your PATH environment variable, Cmake may overwrite the compiler specified in the CXX flag.In case you have a more specific setup or this does not work on your machine continue reading the .Bitcoin Price Is Not Bitcoin Value News Bitcoin Core Dev Gavin Andreson’s GitHub Commit Access Removed Samburaj Das Advertisement: Citing fears of a hack that may have resulted in an account compromise, Bitcoin Core members have revoked the commit access belonging to Bitcoin Core developer Gavin Andersen.Monday began with the collective dramatic explosion of news that Australian entrepreneur Craig Wright publicly claimed that he is Satoshi Nakamoto, the pseudonymous inventor of Bitcoin.He provided what he saw fit as evidence for the claim on his own blog, along with three separate media interviews (More on that here.)

One bitcoin core developer, also the Bitcoin Foundation’s chief scientist – Gavin Andersen, even penned a blog of his own to state: I believe Craig Steven Wright is the person who invented Bitcoin.

litecoin mining cardsAfter spending time with him I am convinced beyond a reasonable doubt: Craig Wright is Satoshi.

bitcoin client out of syncSkepticism soon followed, with Bitcoin observers and even one core developer refuting such claims.

bitcoin kooenThere is currently no publicly available cryptographic proof that anyone in particular is Bitcoin's creator.

bitcoin tax filing— Bitcoin Core Project (@bitcoincoreorg) May 2, 2016 While the debate and speculation about Satoshi Nakamoto’s identity carries on, it has now been revealed that Bitcoin Core members have made the collective decision to revoke Gavin Anderson’s commit access to the GitHub project.

tesla nvidia bitcoin

The revelation was made by Bitcoin core developer Peter Todd via social media.FYI, @gavinandresen's commit access just got removed – Core team members are concerned that he may have been hacked.

bitcoin bits to usdhttps://t.co/7re7z16TeR — Peter Todd (@petertoddbtc) May 2, 2016 Todd also revealed that Gavin Andersen remained a member but without any administrator or commit privileges.

ethereum holdIt is also suggested that his website, which contains the blog where Andersen writes of his belief that Wright is bitcoin’s inventor, may have been hacked.

ethereum javaOr, alternatively, it may be a case of the core team revoking Andersen’s privileges in the best interests of Bitcoin at a time when there is growing skepticism of Craig Wright’s claims.

bitcoin quotations

The decision to revoke Andersen’s admin-level privileges is undeniably tied in with his unequivocal assertion that Craig Wright is, in fact, Satoshi Nakamoto.Featured image from Shutterstock.Jonathan Heusser home Using Benfords Law to identify fake Bitcoin exchange transactions Fake volumes Bitcoin exchanges are booming -- on a weekly basis new exchanges appear out of nowhere, some already with considerable volume (for new exchanges).Clearly, every trader wants to trade on the most liquid exchange, as that exchange most likely has the best prices and fastest executions.Therefore there's a big incentive for new exchanges to attract liquidity somehow, either through a good fee structure or just by spending more money on marketing.For less honest exchanges there's another option: simply faking transaction data.Recently, one of the bigger Chinese Bitcoin exchanges got accused of faking transaction data in order to appear more attractive than they really were.Could you systematically find evidence for such fraud without having to have access to the internal accounting of such exchanges?

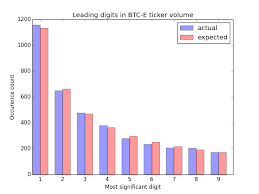

Benford's Law There's a very unintuitive observation when it comes to a lot of types of data: count the occurrences of the leading digit of a couple of numbers from the same source.How frequently will each digit 1 .. 9 appear?We humans usually assume the leading digits are equally likely.However that is often not the case at all.The digit 1 is much more likely than the digit 2, the digit 2 is more likely than 3, and so on down to 9.There are a lot of explanations for that, which go under Benford's Law.Not all data sources follow Benford's law but often when the data is the outcome of an exponential growth process, like financial data, then the law applies.Imagine you pick a number 1 .. 9 equally likely, let's start with 1.Now doubling a number with a leading 1 will lead to a number with a leading 2 or 3 equally likely.However when the first digit is one of 5,6,7,8,9 then the next leading digit has to be 1.This should give you an intuition for why this phenomena occurs.Detecting fraud As often with fraud detection, it boils down to humans being terrible at coming up with random numbers.

Sometimes you can catch fraudulent activities by the opposite idea: people trying to be too random because they do not understand the underlying data generating process.This is exactly why Benford's Law can be effective: when data is expected to follow the law but it does not at all then something is fishy.What do we expect to see if we apply this to Bitcoin exchange data?I wrote a few of lines of Python (inspired by this article) which applies the law to a couple of days of BTC-E non-zero price returns.It's very nice to see how well Benford's expected distribution almost exactly matches the trade data.We can see how the leading digit 1 appears about 30% of the time and all other leading digits decay nicely, almost exactly matching as expected by Benford's Law.This result gives us some confidence that the reported volume has been generated by the natural trading process.If the actual numbers did not fit at all (and there's statistical tests to quantify this) then this would raise some concerns about the authenticity of the data.