bitcoin inr trend

Please Confirm Two-Factor Authentication Need some help?Bitfinex is the world's largest and most advanced bitcoin trading platform OPEN ACCOUNT VIEW DEMO Read More Read More Read More Read More Read More Read More Visualize your orders, positions, and price alerts Drag to change price Tap to modify order properties See your position profits TradingView Stay Connected We've created the mobile tools youneed for trading on the go.View Bitfinex API Documentation 24 hour 7 day 30 day BTC/USD 8,092.50 115,245.85 714,514.02 ETH/USD 25,523.43 594,600.56 4,102,223.11 ETH/BTC 43,290.82 488,964.75 2,044,886.79 ETC/USD 97,744.45 2,102,745.19 13,959,022.72 ETC/BTC 36,741.80 1,077,894.19 6,863,305.11 ZEC/USD 1,274.50 27,706.31 214,859.72 More market data Total active funding Amount used in margin pos.

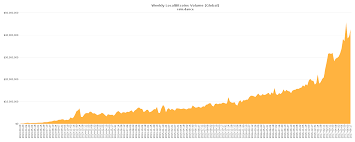

USD 67,682,871.49 67,361,618.30 BTC 14,205.41 14,173.51 ETH 351,945.02 351,120.94 ETC 40,319.12 39,617.31 ZEC 12,126.26 11,714.24 XMR 39,310.72 39,243.06 LTC 107,658.82 106,345.04 DASH 54,722.50 54,385.40 More market data Start trading within minutesDiscover the world's largest and most advanced bitcoin trading platform now.Open Account VIEW DEMOCoin Dance LocalBitcoins Volume Charts trending_up Updated weekly.The Revolution Will Not Be Centralized.new_releasesRecently Implemented Added new volume charts (additional currencies).Added proposal support breakdown by company.Added currency colouring to market cap table.Added 'weighted' view for company proposal voting.Overhauled Blocks page to focus more in proposals.buildCurrently in Development Overhaul Nodes page, adding proper support for all implementations.New LocalBitcoins Volume Charts (additional currencies).

Detailed explanation of split key addresses (Coin Dance Vanity).Another source for free historical bitcoin data is Quandl: Bitcoin Prices and Charts .We consolidate prices, volumes, transaction activity, mining activity and other indicators from dozens of primary sources and aggregators.There's also a free API if you want structured data.Disclaimer: I'm the co-founder of Quandl.Bitcoin Charts - Blockchain.info Tread carefully, their data tracking seems to have momentary (like a couple of days) pauses.

bitcoin foundation spainSIGN UP FOR NEWSLETTER NOW

bitcoin offline vaultThe above graph is line chart of Bitcoin from 1st September 2016 to till date.The value of digital currency Bitcoin surged to $1290 on news that the US Securities and Exchange Commission is likely to approve the first bitcoin based ETF as early as March 11.

litecoin mining pool software

Bitcoin has gained over 33 percent this year and achieved our target of $ 1216 set out in the Mecklai Graph of the week dated on 29th December 2016.The currency has steadily rallied after US President Donald Trumps election and investors belief that Trumps economic plan will increase spending, which would grow the US economy.Indias bank note ban and Chinas crackdown on outflows also saw many investors moving into Bitcoin to shield themselves from currency devaluation and cash shortages in the market.However Bitcoin plunged in the first week of January after Chinas yuan rose sharply and Peoples Bank of China urged investors to take a rational and cautious approach to digital currency.

situs bitcoin gratisAs per Chinese exchange, they account for more than 90 percent account of global Bitcoin trading.

winning poker network bitcoinGoing ahead, any approval from US SEC would open opportunities for new investors with around $ 300 million expected to pour into the ETF.

btc bitcoin robot

Currently, the SEC has a deadline of 11th March to decide on whether to approve or reject the ETF.The decision could even come at any time before deadline, which could create panic in the markets.We expect prices to continue to rise in 2017 and likely test next level of $2000.However the trade remains volatile and unpredictable, with news in China primarily driving prices.

silk road bitcoin priceLONDON 2016 could prove to be the year that the price of bitcoin surges again.

bitcoin johannesburgNot because of any dark-web drug-dealing or Russian ponzi scheme, but for an altogether less sensational reason - slower growth in the money supply.Bitcoin is a web-based "cryptocurrency" used to move money around quickly and anonymously with no need for a central authority.

steam bitcoin confirmation

But despite being championed by some as the digital money of the future, it is often dismissed as a currency that is too volatile to invest in.The reason 2016 looks set to be different is that bitcoin's price is likely to be driven in large part by similar factors to a traditional fiat currency, following the age-old principles of supply and demand.Instead of being controlled by a central bank, bitcoin relies on so-called "mining" computers that validate blocks of transactions by competing to solve mathematical puzzles every 10 minutes.In return, the first to solve the puzzle and thereby clear the transactions is currently rewarded with 25 new bitcoins, worth around $11,000 BTC=BTSP.But when it was invented in 2008 by the mysterious "Satoshi Nakamoto", who has yet to be identified, the bitcoin program was designed so that the reward would be halved roughly every four years, in order to keep a lid on inflation.The next time that is due to happen is July 2016.Bitcoin was also designed to emulate a commodity by having a finite supply of 21 million bitcoins, which will be reached in around 125 years, up from around 15 million today.

Hence, also, the use of the term "mining".Daniel Masters, co-founder of Jersey-based Global Advisors' multi-million dollar bitcoin hedge fund, started his career as an oil trader at Shell in the mid-1980s and spent 30 years trading commodities before crossing over to bitcoin.Now he reckons the price of bitcoin could test its 2013 highs of above $1,100 next year and then pick up speed to rise to $4,400 by the end of 2017.That would be due to a number of factors, Masters said, including an increased acceptance of payments in bitcoin by big companies and authorities, rapidly growing interest and investment in the "blockchain" technology that underpins bitcoin transactions, and also more demand from China as its currency weakens and the economy slows.But taken in isolation, the halving of the mining reward will increase the price of bitcoin by around 50 percent from where it is now, Masters reckons.That is despite the fact that the halving of the reward has always been inevitable - a factor that would already have been accounted for in pretty much every other market.

"If OPEC (Organization of the Petroleum Exporting Countries)came out tomorrow and said, 'in six months' time we're going to halve oil production', the oil price would instantaneously react.But the bitcoin market is still in its infancy, and I don't think that factor is discounted into the price fully," he said.Bitcoin's price has already almost doubled in the last three months, putting it on track for its best quarter in two years.It hit $500 last month for the first time since August last year, with Chinese demand for a pyramid scheme set up by a Russian fraudster cited as a reason for the price surge.But Bobby Lee, the chief executive of one of the leading bitcoin exchanges in China, BTCC, reckons there is scope for the cryptocurrency to go much further.He thinks the price could increase by as much as eight times in the time up to the reward halving, taking it as high as $3,500 by next summer."Today the worth of bitcoin is $1 per capita in the world (population)," Lee said, referring to the value of all the bitcoins in circulation, around $6.5 billion.