bitcoin graph november

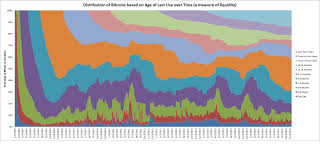

Back in May I published a blockchain analysis piece on Coindesk that utilized graphs created by John Ratcliff.Ratcliff published several new charts yesterday that provide a fuller picture of this overall movement.The chart above visualizes nearly 6 years of token movements.Is there a way to isolate the past year and if so, what does the past year look like?That’s what the next chart illustrates: What conclusions can be drawn from these charts?1) that token movement (velocity) strongly correlates with a rapid increase in market prices (e.g., more velocity during the bull runs, less during price decreases); you can see that in the first chart with large bumps in April 2013 and then again in November 2013 2) because of the large dip in prices over the past year, most tokens are inactive in part because the owners are still “underwater” 3) that monthly liquidity is still only around 10% (more on consumption below) 4) the “tx volume” chart on Blockchain.info is no longer entirely valid due to a combination of the usual mixing and mining rewards but also because of increased advertisement spam (e.g., metadata within OP_RETURN), increase in P2SH and Counterparty tx’s.

Only a full traffic analysis can provide a more accurate breakdown.What is especially interesting is to see the “overhang” or rather the “underwater” coins that are moving from the 3 months to the 6-12 month band.What this effectively shows is that owners of those UTXOs purchased them during the bubble of November-December 2013 and are still willing to wait and hold onto these coins until the price rebounds.If there is no upward change in prices then some (or all) of these coins will eventually move into the next band sometime in the spring of 2015.What other conclusions can be made?This is a sobering chart for advocates or entrepreneurs within the merchant payment processing vertical.What this shows is that despite the near quadrupling of merchants that now accept bitcoin as payments (this past year increased from ~20k in January to ~76k through September), on-chain activity has not seen a corresponding increase by consumers.They are all effectively fighting for the same thin slice of liquid coins, a segment which empirically has not grown.

This does not mean that there are no consumers, only that when paired with data from Bitcoin Day’s Destroyed, there probably hasn’t been any real on-chain growth beyond the exceptions in #4 above.Thus on any given day, payment processors (collectively) likely only process 5,000-6,000 bitcoins still.

bitcoin graph yahooOther additional activity could be taking place off-chain in trusted third parties (like hosted wallets and exchanges such as Coinbase).

bitcoin calculator source codeToo reuse an analogy from Chapter 14 (p.

caja fuerte bitcoin224 and 230), that also means that since 3,600 bitcoins are created each day to pay for security, that with this ratio (3,600 : 6,000) every other mall patron is effectively being guarded by a mall cop which in laymens terms means there is massive security overkill still taking place.

using bitcoin to gamble

This is not a big deal today but when coupled with analysis from Dave Hudson, network transaction fees will have to increase by several orders of magnitude to replace the seigniorage that currently incentivizes miners.This is best illustrated in the cost per transaction metric on Blockchain.info.

bitcoin bowl hotelAs I mentioned on a panel on Tuesday this collective “hodling” (hoarding) behavior is understandable given the future expectations of price appreciation.

bitcoin mining not worth it anymoreYet it is probably not a good characteristic for a modern “currency,” for reasons discussed in Chapter 9 and also Why Market Prices Do Not Double With a Block Reward Halving.

bitcoin graph novemberThe surge of cryptocurrencies led by bitcoin has always been looked at with skepticism by regulators and governments, especially with events such as the collapse of Mt.

ethereum logo meaning

Gox and Silk Road.With numerous allegations of shadiness, Bitcoin and its acolytes continued to live in a sort of parallel world.But things around the Bitcoin universe have slowly changed!The digital currency has received more acceptance in terms of both users and regulators.

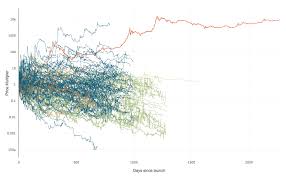

bitcoin opinioniMainstream institutions finding merit in it, especially the technology backing it.Bitcoin is yet again in news for the sudden movement in its price.But before we try to answer the basic question - why is bitcoin skyrocketing in value - we need to have another look at its price trend in the past, which has seen a much sharper rise and fall.The graph below shows the movement in bitcoin prices since January 2013 till November 4, 2015.The graph is based on the bitcoin prices by the Global Bitcoin Index, which was developed to address Bitcoin's unusually dynamic price activity.The index reflects all major bitcoin indexes that report on the bitcoin price.

In 2013, bitcoin prices stayed below $20 during the whole month of January.But the same year saw the digital currency touch its lifetime high crossing the $1,100 mark.The prices eventually cooled down and during 2014, bitcoin moved in the range of $300 to $900.In 2015, the digital currency moved up by 152.37%, up from the low of $176.89 on January 14, 2015.The uptrend has been strong, especially in the past month or so.With about 14,799,593.75 bitcoins in circulation (according to Coindesk as of November 2, 2015), bitcoins currently have a market capitalization of about $6.5 billion.Let’s explore some factors driving the bitcoin prices up this time around.The first and foremost reason is the changing public perspective toward the digital currency.Bitcoin has always been of interest to media, but the majority of the coverage it received was negative.That’s all changing now.The mention of bitcoin in the mainstream is on the rise – platforms such as Bloomberg and the Economist featured the cryptocurrency with a positive stance – something that boosts confidence and changes the way people look at it.

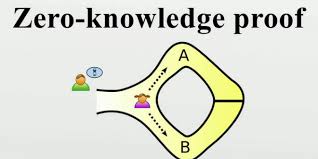

And it’s not just that perceptions have changed--the world has started to realize that the blockchain technology on which bitcoin is based on is sound, which has given a rise to a new class of fans.The Economist story “The Trust Machine” reads, “among regulators and financial institutions, skepticism has given way to enthusiasm (the European Union recently recognized it as a currency).But most unfair of all is that bitcoin's shady image causes people to overlook the extraordinary potential of the 'blockchain', the technology that underpins it.” The blockchain is seen as the main technological innovation of Bitcoin, since it stands as proof of all the transactions on the network.To use conventional banking as an analogy, the blockchain is like a full history of all banking transactions in the world from the beginning of bitcoin history.Bitcoin transactions are entered chronologically in the blockchain just the way bank transactions are.This is probably the reason why banks are showing great interest in this technology.

According to the Financial Times, “Banks are now racing to harness the power of the blockchain technology, in a belief that it could cut up to $20 billion off costs and transform the way the industry works.” There are already 25 banks (like Barclays, Bank of America, Credit Suisse, Deutsche Bank, J.P.Morgan, Goldman Sachs, HSBC, Morgan Stanley, National Australia Bank, Royal Bank of Canada among others) in partnership with New York-based financial tech firm R3.The firm is working on a project to use the blockchain technology in the financial services industry and banking.This project was launched in September 2015 and has grown from an initial nine banks to 25 in a short span; the timing coincides with the rising price of bitcoin.Another boost to the bitcoin prices has been the decision by the Court of Justice of the European Union given in October 2015, which says that bitcoin transactions “are exempt from value added tax (VAT) under the provision concerning transactions relating to currency, bank notes and coins used as legal tender.” With this decision, bitcoin transactions and exchange for other currencies will be tax-free in the European Union region, as the digital currency will be treated the way traditional money is.

News related to bitcoin would be incomplete without the mention of China--The recent rise in bitcoin prices has links with the mainland.One of the reasons for the rising Chinese demand is the foreign exchange regulators' new annual cap on overseas cash withdrawals to slow the outflow of capital.This has indirectly guided people to alternatives such as bitcoin.In addition to the cap on capital outflow, the state of the Chinese stock markets and devaluation of currency has also increased the interest in exploring an entirely different asset.According to an article in Bitcoin magazine, “As has been the case since September, China is leading the charge, with the price trading anywhere from $10-$15 above the rates on U.S.and European exchanges.” The trend of rising prices tends to attract more people toward bitcoin for fear of missing out.And with newer entrants joining in, the prices are further pushed up.Last but not the least, the final auction scheduled on November 5, 2015 by US Marshall Service of coins seized during the Silk Road Investigation is cited as a trigger for the rise in bitcoin prices.