bitcoin fx arbitrage

This is by far the most comprehensive diagnosis to the potential for bitcoin arbitrage, How To Arbitrage Bitcoin* titled: Is arbitrage across exchanges really as easy as it looks?by Peter SellisHe breaks it down into 4 step:Buy on Bitstamp.Transfer to Mt.Gox.Sell on Mt.Gox.Transfer the money back to Bitstamp."Buyon Bitstamp.Buying on Bitstamp will require you to have money in a Bistamp account that has been verified.Verification involves waiting a few days while someone, somewhere looks at some very personal information from you (a passport, income tax form, utility bill, etc.).At this point, you need to transfer funds to Bitstamp.A boat carries a load of Bitcoin to Bitstamp’s HQ in Ljubljana, SloveniaWhile this carries only a modest 0.1% fee, you’ll be transferring your funds to Bitstamp’s bank in beautiful Ljubljana (via the U.K.).In many cases it will cost you some money on your side, since it will be an international wire transfer.Once the funds do hit your account, look for a 0.5% fee to purchase on the exchange.

But now you’ve got the BTC in hand…or whatever passes for a hand in this case.Difficulty: Medium.Time: Up to a week.Near instant once funded.Transfer to Mt.Gox.Transferring BTC is the fast and easiest part of this.While there are sometimes small fees for processing the transaction, they are currently minuscule; hence two of the main reasons people are so excited about bitcoin.Difficulty: Very Easy.Time: Near instant.Sell on Mt.Gox.Selling BTC on Mt.Gox is relatively easy.You should once again have a verified account — at this point your passport has traveled significantly more than you have — but the order is relatively simple.Difficulty: Easy.Time: Near instant.Transfer the money back to Bitstamp.Neither exchange will allow you to send money directly to the other one — you must withdraw it to your own bank account and then resend it.An international withdrawal will cost you 2000 JPY on Mt.Gox, if it goes through.Assuming this is a $10,000 transaction, that is about 0.2%.

It will also take a few business days, and you’ll initially be limited to $1,000 every 24 hours — but we’ll assume you smooth talked your way to a higher limit (you dog).And we already know to expect about 0.5% costs and another few days to get the money to Bitstamp again.Difficulty: Very Hard.Time: 1-2 weeks.Essential arbitrage is proved to be impossible when inefficiencies, taxes, and asset base are taken into account."Givingit a try.So yes, there exists a spread among exchanges for an identical asset, net of fees — a definition of arbitrage.And you might be able to take advantage of it.But even to achieve the 1.5% arbitrage above from the 5% initially observed, we:Assumed an asset base 20x our daily trading amount;Assumed away some early limits that all accounts will be subject to;Assumed that every transfer would occur without error;Assumed no taxes.The four of these things together make the perfect scenario impossible.Taxes alone will reduce your take by up to half.

And while the addition of currencies, altcoins, and more exchanges creates more scenarios, the problems highlighted at each step (fees, timing, limits, and depth) increase more than proportionally.And after all that sweat, you might look back and wonder why you had labored over a 63% return while buying $200,000 of BTC would have led you to a 6800% return."Note:

bitcoin mining lotteryDaily trading volume in currency exchange markets often exceeds $1 trillion.

bitcoin est il un bon investissementWith the advent of new crypto-currencies, your knowledge of algorithms, and a good pair of sound-canceling headphones, you're convinced that there could be some profitable arbitrage opportunities to exploit.

bitcoin dovizSometimes, these currency pairs drift in a way that creates arbitrage loops where you can convert through a certain sequence of currencies to return a profit in your base currency.

This is referred to as an arbitrage loop.For example, you could do the following trades with $100 US and the exchange data below: In this puzzle you'll be working in a market where prices are independent of supply and demand.Also, the currency exchange broker is a close friend of ours, so all trading costs are waived.Your job is to write a program that efficiently finds the best arbitrage opportunities.To access real-time exchange rates, use our API: Output will look like the JSON below, where USD_JPY is the quantity of JPY that you can purchase for 1 USD.These are not real actual market prices; we've set them algorithmically.They change every second and contain both a periodic and noise component to them.You only have to pull the data once per run of your algorithm.Given these exchange rates and the promise of riches, write a program (in any language of your choice) that discovers arbitrage opportunities.You can use any technique you'd like, but we like solutions that would scale with larger sets of currencies.

In addition, please share a little about your background and interests, the position you're interested in, and what excites you about Priceonomics in your message.If you are an investor or a digital currency aficionado, you may have heard about a bitcoin-trading technique known as exchange arbitrage.The theory goes that, because bitcoins are bought and sold on many different exchanges and sometimes at many different prices, it should be possible to buy relatively undervalued bitcoins and sell them at exchanges where they are relatively overvalued.While there is a lot of information on the web about the opportunities of bitcoin arbitrage, you need to clearly understand the obstacles and challenges involved.Arbitrage is the term for when an investor buys and then quickly sells an asset in order to profit from a difference in prices.It is a simple and important process that helps prevent assets from being over- or under-priced in different markets.For example, suppose you could purchase shares of The Coca-Cola Co.

(NYSE: KO) for $50 in New York and then sell them on the London Stock Exchange for $60.In this circumstance, the investor would earn a risk-free $10, or 20% profit, on the trade.Similar logic can apply to bitcoin exchanges, such as Bitstamp, Bitfinex or Bitcurex.If you could purchase one bitcoin on Bitstamp for $465 and then immediately sell it on the Bitcurex market for $470, it appears that you could make a $5 profit with no risk.The price of Bitcoin arbitrage cannot function in exactly this way because of challenges in the bitcoin exchange model, but this is the essential method.Classic arbitrage opportunities in currency markets involve taking out a short position in one exchange and then going long on another, simultaneously using the long account to transfer currency over and cover the short position.Most bitcoin exchanges do not allow short selling.Certain ones, such as AvaTrade and Plus500, do allow short positions, but this still means that the majority of arbitrage opportunities involve a lengthier process.

Even though bitcoin is a digital cryptocurrency, arbitrage treats each bitcoin as nothing more than an investment asset with different market prices.Spotting an arbitrage opportunity is as simple as finding different bitcoin exchanges where there are material differences in bitcoin market prices.Performing the actual arbitrage follows this method: use fiat currency to make payment for bitcoins at the first exchange, withdraw bitcoins, transfer bitcoins to a second exchange where pure profit opportunity exists, sell the bitcoins on the second exchange and finally withdraw fiat currency out of the second exchange.Interested investors can also purchase bitcoin arbitrage-specific software to spot or automatically trigger trades.Arbitrage opportunities are normally most feasible and profitable inside small or illiquid markets.Pure arbitrage can work well in futures markets or with spot contracts, largely because the same transaction agent, or broker, can immediately accept the results of both sides of the arbitrage trade.

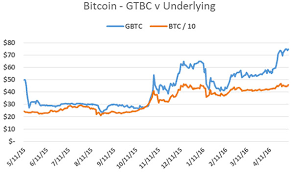

Bitcoin now has a market capitalization of over $7 billion, so it can hardly be called an illiquid asset.Yet major price discrepancies do exist between bitcoin exchanges.It is not uncommon to see Bitcoinity show 30-day highs and lows that are very different than the 30-day highs and lows at Mt.The first hurdle is that many bitcoin sites have expensive withdrawal processes and charge fees for trading bitcoins against fiat currencies, such as U.S.dollars, euros or Japanese yen.The fees and transfers of trading can quickly erode any spread that might exist between competing bitcoin exchanges.In a lot of cases, the process of bitcoin arbitrage creates net losses, not profits.Also, the bitcoin exchange market has a slower settlement mechanism because all orders must be processed through the exchanges and the blockchain.Blockchain transactions on exchanges can take up to an hour to receive sufficient confirmation, and the blockchain does not let you transfer funds without the necessary confirmation.