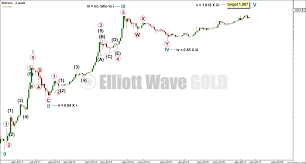

bitcoin forecast 2013

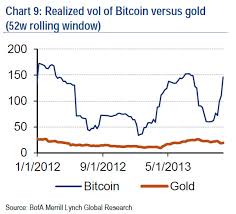

Bitcoin is now the rich man’s gold.Trading at over the $1,300 price level, Bitcoin now has a $38.00 premium over bullion.No small feat, especially when you look at the roller coaster ride Bitcoin has been on since the start of 2017.But is the current Bitcoin rally just an echo of 2013, where Bitcoin bulls had to stomach an 80% plunge in prices?Despite the so-called altcoin bubble, the outlook for Bitcoin prices and other cryptocurrencies remains bullish in 2017 and 2018.On the technical front, it’s been a great time to be a cryptocurrency trader with Bitcoin, its arch-nemesis Ethereum, and other altcoins touching record levels.Bitcoin, the undisputed (for now) leader in cryptocurrency, has a market cap of $22.3 billion, followed by Ethereum at $7.3 billion, and Ripple at $2.1 billion.(Source: “CryptoCurrency Market Capitalizations,” CoinMarketCap, last accessed May 1, 2017.)Over the past week, Bitcoin prices have advanced seven percent, while Ethereum prices have soared 36% and Ripple is up 34%.

The growing attraction of altcoins has, for the first time, sent the total market cap of the cryptocurrency market to over $37.0 billion.In fact, it will probably top $40.0 billion in the coming weeks.For those that fear an altcoin meltdown like 2013, in addition to the technical factors, there are major fundamental issues that will see the altcoin rally soar significantly higher in 2017.

cotizacion actual bitcoinBack in 2013, the cryptocurrency market was only worth about $15.0 billion.

bitcoin per paysafecardIt sounds like a lot, and it is, but the altcoin market was dominated by Bitcoin, accounting for more than 95% of the total cryptocurrency market.

bitcoin value expectationsMoreover, most of the Bitcoin trading was done by the Mt.

quadro bitcoin mining

Gox exchange, which handled roughly 70% of all Bitcoin transactions.Things didn’t go well for Bitcoin prices when the exchange filed for bankruptcy in early 2014.In fact, Bitcoin prices plunged.It took three years for the cryptocurrency market to recover from the 2014 crash.

bitcoin miner amd radeonInterestingly enough, it only took four months for the cryptocurrency market to double from $15.0 billion in December 2015 to $30.0 billion in April 2017.

bitcoin death singaporeSome analysts see the altcoin market hitting $300.0 billion by 2020.

ethereum filmsTherein lies the problem, most Wall Street analysts think the recent rally has created an altcoin bubble that will burst like it did in 2013.

bitcoin transaction world map

But a lot has changed since 2013; there are a lot more players and a lot more exchanges.First, Bitcoin still has a huge market cap of $22.3 billion, but because of increased competition and, some would say, better ways to mine, Bitcoin’s dominance has fallen from 95% of the market to just 62% of the market share.

bitcoin bombersBack in 2013, there were only really 30 cryptocurrencies garnering any attention.Bitcoin was the largest with a market cap of $11.6 billion while Luckycoin was a distant 30th with a market cap of $230,043.(Source: “The Top 30 Crypto-Currency Market Capitalizations In One Place,” Forbes, November 27, 2013.)Fast forward to 2017, and there are more than 800 cryptocurrencies.The top 173 have market caps of at least $1.0 million.Bitcoin still tops the list, but the 30th slot now belongs to BitShares with a market cap of $35.9 million.To find a cryptocurrency with a market cap similar to Luckycoin, which is no longer with us, you’d have to look to PostCoin, which sits at number 259 with a market cap of $229,042.

Just like stocks on the S&P 500, cryptocurrencies will come and go.Cryptocurrency is also seen as being much more legitimate than it was in 2013.Four years ago, cryptocurrency was a fringe subject that received little legitimate air time.Today, there are designs to get a Bitcoin exchange-traded fund (ETF) approved.The most recent effort for a Bitcoin ETF, led by the Winklevoss twins, was denied by the U.S.Securities and Exchange Commission (SEC) in March.However, the SEC recently announced plans to review its decision, which could open the door for the first U.S.ETF that tracks Bitcoin.Regulators to Review Decision Denying Bitcoin ETF Filing,” Fortune, April 25, 2017.)Already some have said Bitcoin could top $3,200 if a Bitcoin ETF does get the green light.Barring any news on an approved ETF, in the current environment, investors should expect to see Bitcoin top $2,000 in 2017 with additional gain in 2018.Bitcoin was born out of fear, and for the same reasons, cryptocurrencies will continue to find traction.

Bitcoin was born in 2008, just as the global markets were crashing, the U.S.dollar was tanking, and the Federal Reserve was just about to launch its first round of quantitative easing, a monetary policy that flooded the market with trillions in U.S.How can you not like a currency that doesn’t need a bank, doesn’t rely on the Federal Reserve, and doesn’t care what the global reserve currency is?Cryptocurrencies like Bitcoin and Ethereum are certainly more attractive than a fiat currency that can be seized, like the government of Cyprus did in 2013 when it snatched 10% of all savings and deposits.In 1933-34, while the U.S.was in the depth of the Great Depression, the U.S.government decided that it was the perfect time to seize the gold holdings of the American people.Executive Order 6102 was signed by Franklin D. Roosevelt on April 5, 1933 and gave American citizens (that were in possession of gold coins, bullion, and gold certificates) less than a month to turn them into any Federal Reserve Bank or member bank of the Federal Reserve system.

(Source: “Franklin D. Roosevelt,” The American Presidency Project, last accessed May 1, 2017.)Back then, the U.S.dollar was tied to the value of gold, so the U.S.government thought confiscating gold was a great way to protect the dollar.When all was said and done, the U.S.dollar had been devalued by around 40%.But that was then.Until 1975, it was illegal for Americans to own gold, unless it was in jewelry or collectors’ coins.This doesn’t mean the U.S government is going to take away our right to buy gold.But it does go to show that the government can and will do whatever it wants to get what it wants.The Federal Reserve can print off trillions of dollars, manipulate interest rates, and even go into negative interest rate territory if it wants.Anything to “help” the economy.Cryptocurrency, like Bitcoin, is the perfect foil and way to store value.Judging by the incredible rise in Bitcoin and altcoin prices, more and more investors are seeking cryptocurrency as a safe place to park their money, a safe-haven investment.