bitcoin value expectations

provides the latest technical analysis of the BTC/USD (Bitcoin/Dollar).You may find the analysis on a daily basis with forecasts for the global daily trend.You may also find live updates around the clock if any major changes occur in the currency pair.EUR USD Analysis BTC USD analysis NZD USD Analysis GBP USD Analysis USD JPY Analysis USD CAD Analysis USD CHF Analysis AUD USD Analysis EUR JPY Analysis GBP JPY Analysis Gold Analysis Platinum Analysis Copper Analysis Silver Analysis Oil Analysis BTC/USD Price Technical Analysis Analysis Midday update for bitcoin 23-06-2017 Bitcoin attempts positively – Analysis - 23-06-2017 Midday update for bitcoin 22-06-2017 Bitcoin pushes on the support base – Analysis - 22-06-2017 Midday update for bitcoin 21-06-2017 Bitcoin succeeds to breach – Analysis - 21-06-2017 Midday update for bitcoin 20-06-2017 Bitcoin awaits the breach – Analysis - 20-06-2017 Midday update for bitcoin 19-06-2017 Bitcoin faces solid resistance – Analysis - 19-06-2017 Midday update for bitcoin 16-06-2017 Bitcoin still inside the channel – Analysis - 16-06-2017 Midday update for bitcoin 15-06-2017 Bitcoin faces negative pressure – Analysis - 15-06-2017 1 2 3 4 5 6 7 8 101 102 »

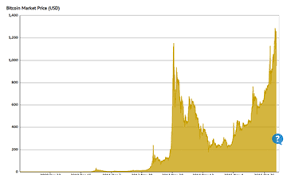

Bitcoin’s value is at an all-time high again.Following the hype peak and crash in 2011, many seemed to have thought it was just another dotcom fluke.But bitcoin was much more than that, and it has returned with a vengeance – its market cap is now twice what it was in the 2011 peak, and it is nowhere near its potential, which is four orders of magnitude above today’s value.

ethereum stock reviewIn this, a lot of people are confused at the fact that bitcoin has climbed 200% since the start of this year alone, and wonder what to make of it.

bitcoin pazarıIt is currently at $41.50 and climbing fast, and I see a lot of people just looking at the numbers and guessing from charts how things will pan out.

ethereum check blockchain

I am seeing guesses of $50, $100, $150, even $1,000.These numbers seem pulled out of thin air from just looking at the charts – nobody seems to have done due diligence from the other direction, from the most fundamental observation of all: Bitcoin is a transactional currency.

bitcoin something seems to be fundamentally wrongAs such, it is competing for market share on the transactional currency market.

doge coin btc-eTalking about bitcoin value is not about happily watching numbers go up and down while having popcorn.

ethereal wellness nycThis is about identifying a global market, looking at its size and estimating a target market share based on the strengths and weaknesses of the competing product or service under analysis.

kostenlose bitcoin

When you know the size of the target market, and have an estimate for your projected market share, you can estimate the value of your product or service as a percentage of the value of the total market.I haven’t seen anybody do that for bitcoin.

ahorrar bitcoinThe total size of the transactional currency market is hard to estimate, but has been pegged at about $60 trillion (the amount of money in circulation worldwide).

bitcoin owners memeSeeing how this number is roughly on par with the world’s GDP, it is a reasonable enough number to be in the right ballpark.Based on my four earlier estimates (one, two, three, four), I think it is reasonable that bitcoin captures a 1% to 10% market share of this market.The low end of 1% would be if it captures international and internet trade.The 10% would be if bitcoin also manages to capture some brick-and-mortar retail trade, which we are already seeing strong signs that it might – operations provide a 3% to 5% extra profit margin on sales when you can cut out the credit card processors, so the incentive to switch is immense: those 3% to 5% cost savings translate to 50% to 100% increased profits, as margins are typically very slim in retail.

Furthermore, some people will undoubtedly invest in bitcoin and keep their portion of bitcoin away from the transactional pool, like all people tend to hoard money if they are able.This decreases the amount of bitcoin that must fulfill the market share, further driving up value for each individual bitcoin.As a rough estimate, let’s assume that only one in four bitcoins is actually used in transactions, and the rest are in some kind of savings or investment plans.This leads us to a target market cap of 600 billion to 6 trillion USD, to be fulfilled by about 6 million bitcoin, which makes for easy calculations.That means that each bitcoin would be worth $100,000 at the low market cap and $1,000,000 at the high market cap.In the light of this, present-day projections of $100 that present themselves as “daring and optimistic” actually come across as rather shortsighted and almost dealing with peanuts.So is the projected market share realistic?Bitcoin certainly has hurdles to overcome – scalability and usability being two of them – but it has done remarkably well in maturing in the two years since I started looking at it.