bitcoin end poverty

Litecoin Price Trend Follows Bitcoin Aug 04, 2016 at 09:14 // Price Because of the hack of the Bitfinex exchange on August 2, all cryptocurrencies this week fell.Litecoin’s price fell to the lowest level of the month, but a day later it began recovering as did the other cryptocurrencies.Bitfinex problems brought down the price of Bitcoin first.This gave an impetus to the growth of Litecoin that can be seen on the seven-day chart below, but then LTC began to return to its original position.LTC/BTC exchange rates for last 7 days: Currently, the Litecoin price is $3.75, which is the minimum price over the last 30 days.But the collapse on Bitfinex alone can’t cause the global long period of decline of cryptocurrency prices.This is a temporary technical factor.Panic, which lasted exactly one day, was over by August 3.But we can’t talk about the resumption of growth either.LTC/USD exchange rates for last 7 days: As practice shows, any unexpected factors can cause sharp rises in prices and sharp declines in cryptocurrencies, including Litecoin, and these factors are almost impossible to predict.

In January, the performance of Mike Hearn brought down Bitcoin and altcoins.Now we face a problem with safety on Bitfinex.Gradually investor confidence returned and growth begins again.Note that the maximum price of Litecoin in the past two months was $5.67 and Litecoin is capable of reaching it again.LTC/USD exchange rates for last 50 days: Today we expect LTC to attempt to reach $3.75 - $3.8, which is currently the area of interest to traders.The resistance level is $3.8 and the level of support is $3.65.A break through the resistance level will open Litecoin’s price all the way to $3.9 and $4.0.This will be possible primarily due to the general rise of prices for all cryptocurrency.This analysis and forecast are the personal opinions of the author and are not a recommendation to buy or sell cryptocurrency.0 0 0 0 Send to Mail 0 0 0 0 Send to Mail Apr 20, 2017 at 21:21News Aug 12, 2016 at 15:54Price Mar 19, 2017 at 21:55News Jun 19, 2017 at 17:35News Jul 22, 2016 at 10:00Blockchain

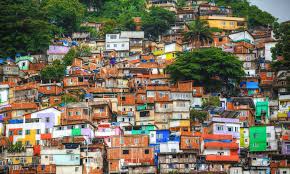

Can Bitcoin Be Used For Good?The cryptocurrency is a powerful tool for early adopters and middle-class entrepreneurs, but it may not provide the opportunities in the developing world that its advocates claim.

bitcoin mining difficulty 2017Technology Share Tweet … Something strange is happening to Bitcoin.

bitcoin price forecast 2018Once viewed as a way to do business in the darkest corners of the web, the digital currency has rather suddenly become a favorite talking point among humanitarians and international development enthusiasts.Bitcoin isn’t just for illicit transactions or Internet hobbyists anymore, but for helping the poor, the downtrodden, and the unbanked.

bitcoin apk modPerhaps Bitcoin can save them!

ethereum price api

Perhaps Bitcoin can save the world!Regardless of whether this attitude is realistic—and more on that in a minute—the people focused on demonstrating the social benefits of Bitcoin are challenging existing narratives about the cryptocurrency.

hsbc uk bitcoinWhile early commentary focused on how Bitcoin might be used to buy drugs online, or for sending money without a paper trail; the social-good argument suggests that these uses were simply the first use-cases in which Bitcoin’s utility became apparent.

mine litecoin onlineBut there are billions of other potential use.

bitcoin armory vs electrumThere are, for example, people who face significant obstacles in operating within the formal banking system—and these folks look very different from the shadowy hackers that tend to be seen as the prototypical Bitcoin user.

bitcoin kraken price

They could be low-wage migrant workers sending money back home to their families, for example, or activists receiving money from abroad during tumultuous times.Bitcoin do-gooders also propose the idea of using a blockchain to register and record property titles in countries with tenuous land-rights protections.

bitcoin umfrageInstead of using paper-based processes, the blockchain would enable the government to register digital titles that cannot be duplicated or easily changed.Which would mean greater accountability for official records.Think about it this way: Most of the value in developing world communities is locked “dead capital,” or property that cannot be leveraged as collateral for loans or long-term contracts, because ownership of the property is not easily verifiable with a title or deed.In other words, even if someone owns property, that person may not be able to prove ownership sufficiently enough to gain access to money for future long-term investments.That’s according to the development economist Hernando de Soto, who proposes fixing this problem by registering digital versions of property titles into a distributed blockchain like Bitcoin.

By being entered into the blockchain, there would be an immutable record of title that could not be easily tampered with or destroyed.At first glance, this seems like a great idea.But using the blockchain to “solve” land-title problems rests on a shallow, incomplete understanding of the challenge at hand.The complexities of how land titles are managed in developing countries is the result of long-standing conflicts between grassroots communities, their governments, and large multinational corporations.By assuming the problem is mainly about bureaucratic inefficiencies and paper-based processes, Bitcoin enthusiasts ignore the hardest part of the situation: long-standing conflicts over rights and power.Sadly, the focus on documentation via blockchain overlooks the key insights we can learn from de Soto’s work: that land rights struggles are a high-touch, long-term issue.Yet the allure of blockchain as silver bullet is powerful.The writer Courtney Martin aptly describes the tendency to embrace such narratives as the “reductive seduction of other people’s problems,” whereby the bright-eyed American idealist feels capable of solving intricate problems with one-dimensional solutions.

As difficult as it is can be for Americans to grasp the full complexity of systemic inequality in their own backyards, Martin argues, it’s much more challenging for Americans to understand the full complexity of problems in places far removed from their daily lives.The idea that blockchain could be a transformative tool for social change underscores this same problem: People often don’t take the time to understand the problems they’re trying to solve, because they believe they already know the solution.Blockchain enthusiasts like to give the example of a poor farmer or a low-wage migrant worker receiving a low-cost money transfer from a loved one far away.And the cost of money transfer is a real issue.Sub-Saharan Africa remains the most expensive region in the world to send money to, with average fees in the range of 9 percent to 10 percent, according to the World Bank.But Bitcoin wouldn’t necessarily make transactions cheaper.The price of transacting over Bitcoin depends on how much demand there is to use the network at a given time.

While the number of transactions over Bitcoin has been steadily rising over the last few years, the processing capacity of the network (that is, the volume of transactions that can be processed per second) has remained static.What that means: If transaction volumes continue to grow without a commensurate increase in processing capacity, then transaction fees are likely to climb well above the cost of credit cards or bank transfers.On top of that, wait times for those transactions to be fully processed have become increasingly erratic, causing a record number of complaints from customers trying to pay with Bitcoin.Part of this bottleneck comes from built-in limits on the number of transactions that can be processed at a given time.The issue of how to increase the processing capacity of the network, while also maintaining critical aspects of its decentralized character, has been a heated topic of debate for well over a year now.And, so far, there hasn't been a clear way forward.These early growing-pains underscore some of the tough engineering decisions that need to be resolved before Bitcoin can be considered a reliable product for the world’s poor.At the same time, companies like Sendwave are also competing with Bitcoin by significantly lowering the price of international money transfers.

And while emerging, low-cost remittance services like Sendwave lack Bitcoin’s infrastructure, they’re catching on with developing-world users, who care more about predictability and utility than about Bitcoin’s decentralized structure.Even in the developing world, Bitcoin transfers often aren’t used the way many enthusiasts might suggest.Rather than migrant workers sending money back home, for example, people often send money to themselves.That’s according to Elizabeth Rossiello, the founder of a bitcoin exchange based in Nairobi called BitPesa.Rossiello says much of the international money transfers conducted on the company’s platform were “self transfers” from an individual’s foreign bank account to a Kenyan one, or vice versa.These types of international money transfers are conducted by folks like John Kidenda, a recent graduate from Harvard University who returned home to Nairobi last year for work.“Every month I move a portion of my paycheck from my Kenyan bank to a U.S.

account in order to pay back my school loans.” Kidenda said.“Using a service like BitPesa helps me save money on bank transfer-fees and high foreign-exchange rates.”Other young, tech-savvy Kenyans use the site to gain entry to global trading markets that they otherwise wouldn’t be able to access as lone-wolf traders in a place like Kenya—where sites like E-Trade are not accessible.Clearly, Kidenda and his peers are a far cry from the poor, rural farmer so often celebrated in the story of Bitcoin and low-value remittances.The bottom line is this: When people understand Bitcoin in terms of one hypothetical story—a poor farmer they neither know nor understand—they cannot grasp the real potential for this technology in places like Kenya.Incidentally, most of BitPesa’s traffic doesn’t come from individual accounts at all, but from small- and medium-size businesses that have identified the platform as a more cost-effective means of carrying out e-commerce and trade abroad.“In essence, BitPesa is a company solving the problem of FX [foreign exchange] in Africa,” Rossiello told me.

“It is not a glamorous topic, but FX availability and pricing is at the core of every company doing payments, lending, or financial transactions in more than one country.”For example, it’s very expensive for a Kenyan furniture dealer to purchase a bulk order of silk lamp shades from Dubai, given the high bank transfer fees and currency exchanges at both ends of the deal.BitPesa offers a way to engage in same-day international purchases of this kind for a predictable, flat percentage fee.Rossiello says BitPesa could help foster business models like Andela, which sources high-quality software development in Nigeria for Fortune 500 companies like Microsoft.These use cases don’t warm the heart the way the story of our theoretical farmer does, but they point to a more realistic near-future for Bitcoin in the developing world—as a powerful tool for early adopters, who are likely to be upper-middle-class entrepreneurs, building international businesses through trade and online commerce.

“Saying that remittances are the only financial product for the entire continent of Africa that is interesting is a major underestimation of the size of these markets and the huge amounts of international trade in the region and beyond,” Rossiello said.This doesn’t mean Bitcoin can’t serve individuals in need.Bitcoin has the potential to push forward the conversation about financial inclusion in really interesting ways, just not in the way it’s currently being discussed.Instead, Bitcoin is first pushing people to rethink the way financial transactions should and can work.For example, BitPesa recently sued the mobile network operator Safaricom after Safaricom shut off access to its mPesa, Kenya’s largest mobile money platform, without the notice required by its service agreement.While Safaricom was instrumental in the launching of mPesa, it’s also the main reason for its limited impact as a platform for broader financial inclusion.In the Kenyan startup scene, Safaricom is known for its cutthroat business practices, which make it difficult for smaller companies to offer a diverse set of services and products on top of the mobile money platform.

In the case of BitPesa, Safaricom shut off access to its mPesa gateway without notice.This was significant because most Kenyan businesses offer mPesa acceptance as a mode of payment.Blocking access to mPesa was a public statement by Safaricom that they would not support Bitcoin companies.(Bitcoin is not illegal in Kenya, and recent Central Bank notices for consumers alerting them of investment risk in the digital good stop short of banning the use of it.)Struggles like this point to major shifts in the ways money works today.Researchers like Rachel O’Dwyer urge us to dig into the ways mobile money is embedded in new, networked systems of control and value enclosure, as opposed to being a purely grassroots phenomenon for social inclusion.When framed this way, it’s interesting to think of Bitcoin (and other cryptocurrencies) as playing a role in constructing new infrastructure for payments—on top of which services like BitPesa can be built.But is Bitcoin really the best way to think about establishing a digital commons for financial transactions?

The Bitcoin network requires large amounts of bandwidth to run and uses enormous amounts of power, which makes it challenging for people in the developing world to participate in mining or use the network reliably.The challenges of financial inclusion in a place like Kenya are diverse, from the cost of sending and receiving money, to the difficulty in doing business across borders, and the concentrated power of Safaricom.Perhaps Bitcoin could spur financial innovation there.But there are no guarantees.Understanding what Bitcoin can do for people in the developing world will first require a better understanding of the people who live there.Andrew Harnik / AP The Kremlin's Investment in Trump Is Paying Off The president’s policies in office have aligned almost perfectly with Vladimir Putin’s goals.Fifty-four years ago this month, former President John F. Kennedy delivered the “Strategy of Peace,” a powerful address that captured America’s indispensable leadership at the height of the Cold War.

Kennedy knew that our country could not guard against the Soviet Union alone, for he believed that “genuine peace must be the product of many nations, the sum of many acts.” Incredibly, the man who now leads the United States seems to find himself locked in an alarming and perilous embrace with the Russian government.These ties threaten to weaken a system of alliances that have held Russia—and countless other threats to the international community—at bay since the conclusion of the Second World War.Continue Reading Carlos Barria / Reuters What Happens When a Presidency Loses Its Legitimacy?Mounting evidence that Trump’s election was aided by Russian interference presents a challenge to the American system of government—with lasting consequences for democracy.Day by day, revelation after revelation, the legitimacy of the Trump presidency is seeping away.The question of what to do about this loss is becoming ever more urgent and frightening.The already thick cloud of discredit over the Trump presidency thickened deeper Friday, June 23.

The Washington Post reported that the CIA told President Obama last year that Vladimir Putin had personally and specifically instructed his intelligence agencies to intervene in the U.S.presidential election to hurt Hillary Clinton and help Donald Trump.Whether the Trump campaign knowingly coordinated its activities with the Russians remains uncertain.The Trump campaign may have been a wholly passive and unwitting beneficiary.Yes, it’s curious that the Russians allegedly directed their resources to the Rust Belt states also targeted by the Trump campaign.But it’s conceivable they were all just reading the same polls on FiveThirtyEight and RealClearPolitics.Continue Reading AP Watergate Lawyer: I Witnessed Nixon's Downfall—and I've Got a Warning for Trump Richard Ben-Veniste on the uncanny parallels between the scandal he investigated and the controversy over the White House’s alleged links to Russia Watching the national controversy over the White House and Russia unfold, I’m reminded of Karl Marx’s oft-quoted observation: “History repeats itself: first as tragedy, second as farce.” I was a close witness to the national tragedy that was Richard Nixon’s self-inflicted downfall as president, and I’ve recently contemplated whether a repeat of his “Saturday Night Massacre” may already be in the offing.

Given how that incident doomed one president, Trump would do well to resist repeating his predecessor’s mistakes—and avoid his presidency’s descent into a quasi-Watergate parody.The massacre began when Nixon gave the order to fire Watergate Special Prosecutor Archibald Cox, a desperate effort to prevent him from hearing tape-recorded evidence that proved the White House’s involvement in a conspiracy to obstruct the investigation of a break-in at Democratic National Committee headquarters.Nixon’s misuse of executive power backfired, immediately costing him two highly respected members of his administration: Attorney General Elliot Richardson and his deputy William Ruckelshaus, who both resigned rather than follow Nixon’s directive.Third in command at the Justice Department was Solicitor General Robert Bork, who agreed to do the dirty deed and fired Cox.Continue Reading Gene J. Puskar / AP Teenagers Have Stopped Getting Summer Jobs—Why?Most used to work in July and August.

Now the vast majority don’t.Are they being lazy, or strategic?The summer job is considered a rite of passage for the American Teenager.It is a time when tossing newspaper bundles and bussing restaurant tables acts as a rehearsal for weightier adult responsibilities, like bundling investments and bussing dinner-party plates.But in the last few decades, the summer job has been disappearing.In the summer of 1978, 60 percent of teens were working or looking for work.Last summer, just 35 percent were.Why did American teens stop trying to get summer jobs?One typical answer is: They’re just kids, and kids are getting lazier.One can rule out that hypothesis pretty quickly.The number of teens in the workforce has collapsed since 2000, as the graph below shows.But the share of NEETs—young people who are “Neither in Education, Employment, or Training”—has been extraordinarily steady.In fact, it has not budged more than 0.1 percentage point since the late 1990s.Just 7 percent of American teens are NEETs, which is lower than France and about the same as the mean of all advanced economies in the OECD.

The supposed laziness of American teenagers is unchanging and, literally, average.Continue Reading Joe Raedle / Getty Images Why Do Democrats Keep Losing in 2017?The party has made gains in special elections, but continues to fall short of outright victory.A string of special election defeats in each state, and with each one, a missed opportunity to take over a Republican House seat, has left Democrats facing the question: Why does the party keep losing elections, and when will that change?The most obvious reason that Democrats fell short is that the special elections have taken place in conservative strongholds.In each case, Democratic candidates were vying to replace Republicans tapped by the president to serve in his administration, and in districts that Trump won.Despite the unfavorable terrain, Democrats improved on Hillary Clinton’s margin in every district except in Georgia.But if the party wants to take control of the House in 2018, it needs more than just a strong showing in Republican districts.

It needs to win.Continue Reading Lisk Feng What Mormon Family Trees Tell Us About Cancer By searching the church's famed family trees, scientists have tracked down a cancer-causing mutation that came west with a pioneer couple—just in time to save the lives of their great-great-great-great grandchildren.Nobody knew it then, but the genetic mutation came to Utah by wagon with the Hinman family.Lyman Hinman found the Mormon faith in 1840.Amid a surge of religious fervor, he persuaded his wife, Aurelia, and five children to abandon their 21-room Massachusetts house in search of Zion.They went first to Nauvoo, Illinois, where the faith’s prophet and founder, Joseph Smith, was holding forth—until Smith was murdered by a mob and his followers were run out of town.They kept going west and west until there were no towns to be run out of.They boiled elk horns.The children’s mouths erupted in sores from scurvy.Aurelia lost all her teeth.And so did the mutation.Continue Reading Kevin Lamarque / Reuters It Took Two to Make Russian Meddling Effective A Washington Post report on 2016 election interference raises the question: What could Obama have done differently?

If there is one thing The Washington Post’s story on the Obama administration’s anemic response to Russian meddling in the 2016 election makes clear, it’s that it took two to make the meddling effective.There is a reason the tactics Russia used on the American elections—which are similar to things they’ve done in former Soviet republics and in Europe—are referred to as “asymmetric warfare”: They embody the art of leverage, of doing a lot with a little.As former Director of National Intelligence James Clapper told Congress in May, the Russians “succeeded beyond their wildest dreams and at minimal cost.” The whole operation, according to Clapper, cost a mere $200 million—a pittance in military spending terms.But the Russians used that money not the way a conventional army would, but the way a band of guerrillas would, feeling around for pressure points, and pressing—or not.Though, as Bloomberg reported this month, the Russians were clearly exploring ways to attack voting infrastructure in parts of the country, it still appears they ultimately decided not to pull the trigger, sticking instead with the hack-and-dump and the manufacturing of fake news.

“It was ad hoc,” an Obama administration official told me shortly after the inauguration.“They were kind of throwing spaghetti at the wall and seeing what would stick.” Continue Reading All photos courtesy of Alex Tizon and his family My Family’s Slave She lived with us for 56 years.She raised me and my siblings without pay.I was 11, a typical American kid, before I realized who she was.The ashes filled a black plastic box about the size of a toaster.It weighed three and a half pounds.I put it in a canvas tote bag and packed it in my suitcase this past July for the transpacific flight to Manila.From there I would travel by car to a rural village.When I arrived, I would hand over all that was left of the woman who had spent 56 years as a slave in my family’s household.Continue Reading J. Scott Applewhite / AP How the Senate's Health-Care Bill Would Cause Financial Ruin for People With Preexisting Conditions Republicans are going to insist otherwise, but that’s simply not the case.

If there was one goal Senate Republicans had set out to achieve in developing their health bill to show they were less “mean” than their colleagues in the House, it was to take away the House Republicans’ green light for insurers to once again discriminate against those with pre-existing health conditions.Senate Republicans were willing to drive up deductibles and co-pays and be more draconian on Medicaid cuts, but on the one issue of pre-existing conditions they were intent on being less “mean,” as President Trump termed the House bill.Now that the text of the bill has been released, it’s clear that they have failed to achieve that.As they argue for the bill, Republicans are going to claim that it will not allow insurance plans to discriminate against people because they have a pre-existing condition.But that just isn’t the case.The Republican plan may not allow insurers to discriminate against a pre-existing condition through the front door, but they’ve created a backdoor way in.

Continue Reading Justin Renteria Power Causes Brain Damage How leaders lose mental capacities—most notably for reading other people—that were essential to their rise If power were a prescription drug, it would come with a long list of known side effects.It can even make Henry Kissinger believe that he’s sexually magnetic.But can it cause brain damage?When various lawmakers lit into John Stumpf at a congressional hearing last fall, each seemed to find a fresh way to flay the now-former CEO of Wells Fargo for failing to stop some 5,000 employees from setting up phony accounts for customers.But it was Stumpf’s performance that stood out.Here was a man who had risen to the top of the world’s most valuable bank, yet he seemed utterly unable to read a room.Although he apologized, he didn’t appear chastened or remorseful.Nor did he seem defiant or smug or even insincere.He looked disoriented, like a jet-lagged space traveler just arrived from Planet Stumpf, where deference to him is a natural law and 5,000 a commendably small number.