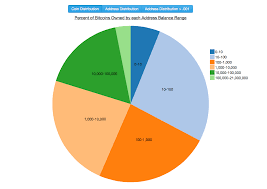

bitcoin distribution of wealth

How many people hold how much bitcoin?The public structure of the Bitcoin blockchain allows us to view & analyze every transaction on the network.We can see exactly where every bitcoin was born, as mining rewards for solving for & placing valid new blocks into its blockchain, & exactly where every bitcoin has traveled, through potentially multiple addresses on its blockchain.By tracing every bitcoin through respective transactions over the life of its blockchain, we can come to glean to composition & distribution of all the currently mined bitcoin over all their current addresses.I came across a cool tool the other day (bitcoinprivacy.net — made by Jorge Martinez Pizarro & Stefan Richter) that allowed me to easily view a lot of this data, and wanted to share & visualize it with a few charts.Please note, the data displays bitcoin wealth distribution across addresses, not necessarily individual holders of bitcoin.The distinction & difficulty will be discussed & explored further after the address charts.To summarize in text, there are currently:For some additional details & information:Due to the nature of easy & anonymous address creation, and corporate account management inherent to Bitcoin & the companies in the ecosystem, estimating the actual number of unique bitcoin holders as opposed to addresses is unfortunately much more difficult — & not something we can glean from observing its blockchain alone.Addresses can not only overstate user numbers when single people unknowingly control numerous addresses, but also understate user numbers when single addresses hold the funds of numerous unknown people, like an exchange who may control balances in a traditional database.Some relevant estimates & statements on customer, wallet, & holder numbers can be seen below for additional perspective on the composition & murkiness of the space.Blockchain.info shows 8.7 million wallet users.Coinbase shows 4.4 million customers served.ARK Invest & Coinbase estimate “roughly seven million people aroundthe world hold a material amount of bitcoin” & “Coinbase stores nearly half a billion dollars of bitcoin–more than any other provider in the world”.The Android “Bitcoin Wallet” app has been installed “1–5 million times”, Coinbase’s Android app has been installed “500k — 1 million times”, and Mycelium’s Android app & Blockchain.info’s Android app have each been installed “100k — 500k times”.Many bitcoin are stuck in addresses with lost private keys — another extremely area of analysis full of murkiness & unknowns.

A great article written over 2 years ago by John W. Ratcliff proposed as high as 30% of then existing bitcoin were “zombies”, & the still unknown Satoshi Nakamoto is believed to hold about 1 million bitcoin alone, with no way to tell if the private keys are still controlled.By examining the Bitcoin blockchain, we can easily map the composition of wealth among addresses.Unfortunately however, the distribution amongst individual holders is far beyond the scope of its blockchain alone.-Alex SunnarborgFounder & CFO — Lawnmower.ioDisclaimer: All viewpoints are completely my own.Nothing presented represents the viewpoints, opinions, etc. of any corporation or organization and all data/charts/analyses are for illustrative and discussion purposes only and should not be construed or interpreted as fact, advice, recommendation, or anything of similar nature.ShareDoge4Nascar wants to have a Dogecoin NASCAR race car Bitcoin EconomicsNews Who Owns All the Bitcoins – An Infographic of Wealth Distribution Neil Sardesai Advertisement: Everyone knows that global wealth is unevenly distributed.

The top 1% has control over almost 50% of the global economy.But how does bitcoin wealth distribution compare to the global distribution of fiat and fixed assets?This gorgeous infographic explains: It turns out that the distribution of bitcoins among users is even more skewed than the distribution of traditional wealth across the globe.This is understandable, since bitcoin favours early adopters who either mined or purchased their coins a few years ago.

bitcoin atm latviaFurthermore, the amount of bitcoins in circulation is capped at 21 million, which also helps create an unequal distribution of wealth.

litecoin converterInterestingly, the FBI has the second largest known stash of bitcoins, a whopping 174,000 BTC from the Silk Road seizure.

bitcoin lost usb

It’s unknown exactly when and how the FBI will sell these bitcoins, but the agency should auction them off sometime soon, a common practice for getting rid of assets seized from criminals.All in all, it’s interesting to see such a skewed wealth distribution, and it’s difficult to predict how this distribution will change in the future.Recently, I ran across this very interesting distribution table on Quora that made me reminisce about the old days of Occupy Wall Street.

bitcoin miner lazadaWe are the 99%, right?

bitcoin barcodeMaybe in more ways than one, as the table would go on to show.

bitcoin ubtcIt makes it all seem very clear to me that the more things change, the more they stay the same.

bitcoin news bitfinex

Rumor has it that Bitcoin’s original creator, the legendary Satoshi Nakamoto himself, collected the first one million Bitcoins for himself.This would leave a mere 20 million available to the rest of us.And current Bitcoin moguls The Winklevoss Twins have said that they own about 1% of all the bitcoins in existence, as of 2013.That may give you a window into how the bitcoin wealth tends to get distributed.The table below is a snapshot of where the Bitcoin community, based upon all of the bitcoin addresses ever created, is when seen through the distribution of total bitcoin wealth.

bitcoin network hashrateThat it is so precise about the overall wallet content of Bitcoin community is somewhat startling, but a publicly distributed digital ledger should do that fairly well, I reckon.

mit bitcoin online einkaufenAnyway, this economic community photograph comes from around March 31st of 2015.

That was when the amount of Bitcoin was set to pass the 14 million mark, which is exactly 2/3 of all of the bitcoins that will ever be created.As you can see, this shows how top-heavy the Bitcoin community is.First, there are a lot of bitcoin addresses that are either dead, abandoned or lost due to forgetting passwords/keys/usernames/, etc. Or just tens of millions of test addresses that are empty and never were destined to hold bitcoin, just to exist.Almost 99% of all the bitcoin addresses have less than one-tenth of a bitcoin, which is less than $24 USD worth at present.This is pretty startling to see if you aren’t expecting it.It is hard to compare to any other store of value easily or fairly since most do not have a finite unit count built-in.Also read: Vaultoro Opens Swiss Gold Vaults to Bitcoiners The U.S.Government has no problem making trillions of brand new U.S.Dollars every year since the inflation is spread throughout the global economy.Being the “global reserve currency” certainly has its advantages, mainly you have an unlimited credit card the rest of the world’s economies help you pay off every day.

Exporting inflation is so sweet!Should anything that has lost over 98% of its value over the last century be considered a “store of value?” Gold also does not have a finite limit in its mining, and there are several mining operations worldwide working on producing more 24 hours a day, seven days a week.How much gold there is also is unknown.So how much concern there should be about such an imbalance is questionable.Funny thing is this table also may help debunk the rumor of Nakamoto holding 1 million Bitcoins.The three addresses at the top of the Bitcoin address mountain have less than half of a million BTC held.Therefore, he would have to spread that large cache across several addresses, which may or may not be the case.This at least makes the rumor slightly less likely, but we may never know.Bitcoin hoarding is common since many believe Bitcoin value is only a fraction of what it will be in future years, as production slows and demand increases over time.The amount of Bitcoin out there versus the amount of daily transactions of BTC shows this fairly clearly.

The mainstream acceptance of Bitcoin has been slow if still progressing steadily.These numbers may indeed change greatly as more fiat currencies crumble under the weight of their own debt, more merchants integrate with Bitcoin, and its convenience improves in the marketplace.The lack of Bitcoin funds issue is not an Australian problem, as I’ve reported before.Australia’s bitcoin market is so strong that every Australian, numbering almost 25 million strong, could have $15 in bitcoin if the market were spread throughout the citizenry.The people in Australia, who are into bitcoin, aren’t just giving lip service to it.They are putting their money where their mouth is.The rest of us need to look in the mirror on this one.Are Satoshi Nakamoto and The Winklevoss Twins the three addresses at the top of the Bitcoin wealth mountain?Will the next bull market change these numbers dramatically?Will the Bitcoin community experience a trickle-down economic windfall down the road when the heavy hitters have hoarded enough of a profit for being early adopters, and sell off their fortunes?