bitcoin network hashrate

Warning: Since this post was published, we have learned that GBMiners are associated with a Ponzi scheme of Bitcoin’s overall is now pointed at a mining pool in India, putting it in the top ten of mining pools in the world.This Indian mining pool, known as , recently received an undisclosed amount of funding from , who is also a co-founder of the the new venture.The vast majority of mining hardware currently pointed at the GBMiners mining pool is owned by Bhardwaj.Although other news outlets have GBMiners is the largest bitcoin mining pool outside of China, both and , which aren’t based in China, still have a greater share of the overall network hashrate.In addition to their interest in bitcoin mining, GBMiners also plans to mine on the and networks.According to GBMiners’s Sanjay Goswami, the mining pool mined their first block on August 30th.Goswami explained how GBMiners came together when two of the founders of were introduced to Bhardwaj at a party:“ and were introduced by someone to Amit [Bhardwaj] at a party, and Amit ran huge amount of mining power, spread across all major pools,” said Goswami.

“We had just got interested in cryptocurrencies and were trying to decide our first product, and seeing our energy and enthusiasm, Amit said, ‘I have an idea we can work on together.’”According to Goswami, this is an offer that could not be refused, mainly due to Bhardwaj’s relatively long history in Bitcoin.As someone who had been mining on multiple mining pools connected to the Bitcoin network, Bhardwaj was able to share some ideas on how a new pool could improve the efficiency of his own hashing power.“We started researching, put out some of our test servers, and most of what he said resonated with our findings,” claimed Goswami.Although there are some other independent miners using GBMiners right now, a significant portion of the mining hardware currently pointed at the pool is owned by Bhardwaj.According to Bhardwaj’s personal website, his Amaze Mining & Blockchain Research Ltd.owns and operates bitcoin mining hardware that represents more than 5 percent of the overall network hashrate.Although the mining pool is based in India, the hardware pointed at the pool is located in China.

“We are still discovering in India about the machine setup and all,” said Goswami.is a software client that intends to hard fork the Bitcoin blockchain after a certain amount of support for an increase in the block size limit is perceived on the network.

bitcoin/altcoin scrypt mining rigand are the two major mining pools currently pushing the hardest for a hard fork initated by Bitcoin Unlimited.In a recent AMA, ViaBTC founder and CEO Haipo Yang GBMiners and a few other mining pools are planning to switch from (the current reference implementation of the Bitcoin protocol) to Bitcoin Unlimited.

bitcoin bowl 2014 tvHowever, when asked directly for GBMiners’s views on Bitcoin Core and the block size limit debate, Goswami responded, “We are still forming a concrete opinion about it, but we are really positive about Bitcoin Unlimited.”GBMiners came out of Darwin Labs, which is also working on a bitcoin bank currently operating in stealth mode.

litecoin asic vs gpu

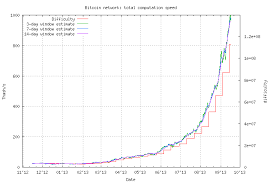

The total network hashrate of the Bitcoin network has reached another major milestone, passing over 1 Exahash per second or 1000 Petahashes per second peaking at 1,008,642,232 GHS according to the data from Blockchain.info.

new jersey bitcoin regulationInterestingly enough the total network hashrate at the previous difficulty adjustment on January 13th was just about 811 Petahashes and back in November last year the hashrate was just about 500 Petahashes per second or half than what it is now.

dogecoin futureThis is really serious and fast growth of the total network hashrate that Bitcoin is experiencing doubling in just about two months.

why bitcoin value droppingSo what comes next after Exahashes per second, can you guess when the network hashrate will get to Zettabytes or Yottabytes… maybe we are going to see these in the near future if it continues to grow at such fast pace.

cara ngehack bitcoin

The hash rate of the bitcoin network has exceeded (or is very close to) 1 Petahash per second (PH/s), according to various charts online.TradeBlock, which runs its own mining dashboard, reported that the computational power on the bitcoin network exceeded 1,000,000GH/sec over the weekend.

bitcoin core to electrumAs of last night, it was showing that the hash rate had crept down again to just under 914,000GH/s (914TH/s).

leaked bitcoin walletsBlockchain.info had a lower estimate, suggesting a hash rate of a little under 950TH/s last night, while Bitwisdom put it at 955TH/s at the time of writing.Bitcoincharts had it at less - around 847.25TH/s (dropping to 802 by the time we finished writing).This in-depth chart set the hash rate's upper boundary at 881.7TH/s on Sunday.All of these charts show two things: firstly, how difficult it is to arrive at an exact consensus of performance on a highly decentralised network of autonomous devices.

And secondly, how quickly the hash rate can fluctuate.While 1PH/s is a psychologically significant number, the important thing is the general upward trend of network hashing power, which has accelerated at breakneck speed.TGB’s mining dashboard shows the hash rate soaring through 420-440TH/s a month ago, and continuing to rise.It can’t go on forever, says Tuur Demeester, editor of economic newsletter Macrotrends, who has also been handling PR for ASIC mining firm CoinTerra during its launch.He said: “The first ASICs, which came out last year, were using ancient technology (+100nm transistor chips).The reason why the network difficulty is going up so fast, is that we are catching up with present day technology: 28nm is pretty much the industry standard."The question worrying most people who are still waiting for their miners is what the increasing hash rate will do to network difficulty.“It's a crap shoot,” said Charles Hoskinson, founder of the Bitcoin Education Network.The network difficulty doesn't change in a linear fashion.

Instead it increases in a single jump every time 2,016 blocks have been mined.“They want six blocks per hour, or 2,016 every two weeks,” he says of the core development team that manages the Bitcoin protocol.“But we have seen blocks produced every five minutes.” This happens when the difficulty adjustment consistently lags the increase in network hash rate.We saw network difficulty more than double in August, reaching 65,750.On Sunday 15th September, it leaped again, rising to 112,600,000.Sam Cole, co-founder of CoinTerra competitor KnCMiner, argues that this can't continue forever.He said: “Mathematically, for it to continue rising like this is nigh-on impossible.For network difficulty to double there has to be a doubling in hashing on the network.” He says this because network difficulty is calculated based on the amount of time that it took to solve the last 2,016 blocks (also here).To halve the time taken to solve those blocks means adding the same amount of hashing power to the network again.

That’s fine when you’re increasing the total hash rate from 500TH/s to 1PH/s, or even to 2PH/s, he says.“But to jump to 20 to 40PH/s, I have to release 10,000 boxes.You can’t do that in two weeks.So it can't double this often forever, because there isn’t that much manufacturing in the world dedicated to ASICs.” This means that while we’re seeing huge increases in difficulty now, we can expect to see it slow over time, say experts.“Its almost impossible to predict more than a month or two into the future,” said Cole.“We have simulations where all competition ships, and we have simulations where half of them ship.The numbers vary way too much, and long-term approaches are very varied to say the least.” But we do know that large amounts of hashing capacity are due to hit the market in the next couple of months.Websites are littered with stories of how much hashing capacity people expect to ship.KnCMiner was originally looking at 450TH/s by the end of next month, and that figure may have grown (Cole isn’t saying).

CoinTerra expects to ship 2PH/s of ASICs in December, which would triple the current network hash rate.Bitmine reckons it’ll drop 4PH/s onto the network by March.Then, there's BitFury, and Alydian, which hopes to offer up to 1PH/s in single blocks to bit-ticket miners as of next month.All of this would push network difficulty substantially at least through the end of the year, and probably early into next.There are unknown variables, however.For example, it's possible that people could turn off significant amounts of computing power between them for various reasons.If prices drop substantially, and people are spending expensive energy mining bitcoins, it may make sense to stop doing so until prices rise again, for example.That is a distinct possibility, because the bitcoin market is still relatively volatile thanks to a need for more liquidity.One thing is pretty certain, said Demeester: GPU miners at this point are basically running their cards for nothing, at least on the bitcoin network.

He explained: “GPU mining is no longer profitable.We are seeing a switch happen to Scrypt-based coins.But also in that sphere I know of specialized software and hardware initiatives that will make life hard for GPU mining in the future.” Perhaps he is speaking of FPGA miners, which some are configuring to mine Scrypt-based coins.KnCMiner is planning one of these.To confuse matters, it isn't just the number of ASIC mining units being shipped that affects hashing power; it's also how well these units perform.28nm ASICs may be the new 'norm' this month, but things are moving quickly, and sub-20nm is just round the corner, say commentators.“I think all ASIC manufacturers are looking at sub-20 in some form that will produce another spike in hash rate, maybe by mid 2014,” says Cole.HashFast, which will itself dump significant amounts of hashing power onto the network this quarter, is also taping out its next-generation FinFet chip this quarter, which will up the ante yet again.