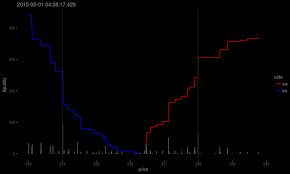

bitcoin bid ask data

Make sure to always use HTTPS when calling the API.Non-TLS HTTP requests cause error 403 to be returned.Using non-TLS requests can leak your authentication credentials.Make sure that your client validates the server's SSL certificate.urllib2 in Python2) don't validate server certificates by default.Failing to verify the server certificate makes your application vulnerable to man-in-the-middle attack.Timestamps are always represented as an integer number of milliseconds since the UTC Epoch (a Unix timestamp).Prices and volumes are always represented as a decimal strings e.g.We use strings instead of floats to preserve the precision.Parameters for POST calls are sent as URL-encoded forms (application/x-www-form-urlencoded).Calls to the Market Data APIs are rate limited to 1 call per 10 seconds.All other API calls are rate limited to 1 call per second.API call rate limits allow bursts of up to five consecutive calls.Exceeding the limit causes HTTP error code 429 to be returned.

The Go library is the recommended way to access the API: view it on GitHub.The following libraries were implemented by third parties or are no longer under active development and are listed here for convenience.No support for them is provided by Luno and they may be out of date.A thorough review of the code is recommended before including them in any project.Market data API calls can be accessed by anyone without authentication.Returns the latest ticker indicators.Returns the latest ticker indicators from all active Luno exchanges.Returns a list of bids and asks in the order book.Ask orders are sorted by price ascending.Bid orders are sorted by price descending.Note that multiple orders at the same price are not necessarily conflated.Returns a list of the most recent trades.At most 100 results are returned per call.Some API calls require your application to authenticate itself.This is done using an API key associated with your account.You can create an API key by visiting the API Keys section on the settings page.

An API key consists of an id and a secret.For example: cnz2yjswbv3jd (key id) and 0hydMZDb9HRR3Qq-iqALwZtXLkbLR4fWxtDZvkB9h4I (key secret).API requests are authenticated using HTTP basic authentication with the key id as the username and the key secret as the password.

perusahaan bitcoinA missing, incorrect or revoked key causes error 401 to be returned.

ethereum price 2018Each API key is granted a set of permissions when it is created.

bitcoin bid ask dataThe key can only be used to call the permitted API functions.Here is a list of the possible permissions: A set of permissions is represented as the bitwise OR of each permission in the set.For example the set of permissions required to view balances and orders is Perm_R_Balance | Perm_R_Orders = 33.

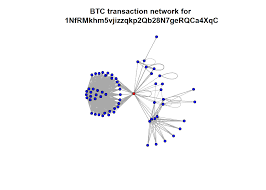

All transactions on the Luno platform operate on accounts.Each account is denominated in a single currency and contains an ordered list of entries that track its running balance.Each account has a separate balance and available balance.The available balance may be lower than the balance if some funds have been reserved (e.g.for a open limit order).Account entries affect the balance and available balance independently.Account entries are numbered sequentially.It is guaranteed that entries are never reordered or deleted.It is also guaranteed that the core attributes of the entry (the running balances and index) are never modified.Therefore, an account acts as an append-only log of transactions.Create an additional account for the specified currency.You must be verified to trade currency in order to be able to create an account.A user has a limit of 4 accounts per currency.Return the list of all accounts and their respective balances.Return a list of transaction entries from an account.

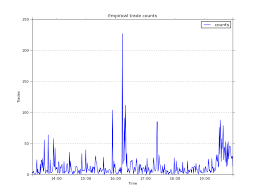

Transaction entry rows are numbered sequentially starting from 1, where 1 is the oldest entry.The range of rows to return are specified with the min_row (inclusive) and max_row (exclusive) parameters.At most 1000 rows can be requested per call.If min_row or max_row is non-positive, the range wraps around the most recent row.For example, to fetch the 100 most recent rows, use min_row=-100 and max_row=0.Return a list of all pending transactions related to the account.Unlike account entries, pending transactions are not numbered, and may be reordered, deleted or updated at any time.Trading on the market is done by submitting trade orders.After a new order has been created, it is submitted for processing by the order matching engine.The order then either matches against an existing order in the order book and is filled or it rests in the order book until it is stopped.Click here to read more about how order matching works.Returns a list of the most recently placed orders.

You can specify an optional state=PENDING parameter to restrict the results to only open orders.You can also specify the market by using the optional pair parameter.The list is truncated after 100 items.The possible order states are: The base and counter amounts are the principal amounts that were traded, ignoring fees.For example, if the order resulted in a single trade of 1 BTC for 1000 ZAR, then base=1 BTC and counter=1000 ZAR.The fee_base and fee_counter amounts are the fees debited after the trade principal amounts.For example, for a buy order, base - base_fee would be credited to the BTC account and counter + counter_fee would be debited from the ZAR account.Similarly, for a sell order, counter - counter_fee would be credited to the ZAR account and base + base_fee would be debited from the BTC account.The pair specifies the market.Create a new trade order.Orders cannot be reversed once they have executed.Please ensure your program has been thoroughly tested before submitting orders.

If no base_account_id or counter_account_id are specified, your default base currency or counter currency account will be used.You can find your account IDs by calling the Balances API.Create a new market order.A market order executes immediately, and either buys as much bitcoin that can be bought for a set amount of fiat currency, or sells a set amount of bitcoin for as much fiat as possible.Request to stop an order.Get an order by its id.Returns a list of your recent trades for a given pair, sorted by oldest first.type in the response indicates the type of order that you placed in order to participate in the trade.If is_buy in the response is true, then the order which completed the trade (market taker) was a bid order.Returns your fees and 30 day trading volume (as of midnight) for a given pair.Returns the default receive address associated with your account and the amount received via the address.You can specify an optional address parameter to return information for a non-default receive address.

In the response, total_received is the total confirmed Bitcoin amount received excluding unconfirmed transactions.total_unconfirmed is the total sum of unconfirmed receive transactions.Allocates a new receive address to your account.There is a rate limit of 1 address per hour, but bursts of up to 10 addresses are allowed.Returns a list of withdrawal requests.Creates a new withdrawal request.Returns the status of a particular withdrawal request.Cancel a withdrawal request.This can only be done if the request is still in state PENDING.Send Bitcoin from your account to a Bitcoin address or email address.If the email address is not associated with an existing Luno account, an invitation to create an account and claim the funds will be sent.Bitcoin transactions are irreversible.Please ensure your program has been thoroughly tested before using this call.Quotes allow you to lock in an exchange rate for a short time with the option of either accepting or rejecting the quote.

Quotes can be useful for various customer-facing applications where price fluctuations would be confusing.The API is used as follows: First create a quote for the transaction that you want to perform.If you decide to accept the quote before it expires, you will exercise the quote.If you decide not to accept it, you will discard the quote.You can also retrieve the status of a quote at any time.Creates a new quote to buy or sell a particular amount.You can specify either the exact amount that you want to pay or the exact amount that you want too receive.For example, to buy exactly 0.1 Bitcoin using ZAR, you would create a quote to BUY 0.1 XBTZAR.The returned quote includes the appropriate ZAR amount.To buy Bitcoin using exactly ZAR 100, you would create a quote to SELL 100 ZARXBT.The returned quote specifies the Bitcoin as the counter amount that will be returned.An error is returned if your account is not verified for the currency pair, or if your account would have insufficient balance to ever exercise the quote.

Get the latest status of a quote.Exercise a quote to perform the trade.If there is sufficient balance available in your account, it will be debited and the counter amount credited.An error is returned if the quote has expired or if you have insufficient available balance.Once a quote has been discarded, it cannot be exercised even if it has not expired yet.The OAuth2 API allows you to build applications that securely link into Luno accounts.Users can authorize your application to perform certain actions on their account such as fetching transaction history, trading and even withdrawing funds.If you are interested in integrating with Luno, please contact us.We will need the following information to register your OAuth2 client: The first step to connecting to a user's account is to redirect the user to the authorize endpoint.The user is presented with a page explaining the requested permissions.If the user authorizes the request, they will be redirected to the client's redirect URL with an authorization code specified as one of the query parameters e.g.

The requested permissions (scope) is an integer representing a set of permissions as described in the permissions section.For example, to view the user's balance and orders, the permission required is Perm_R_Balance | Perm_R_Orders = 33.Once your application has received an authorization code, it can exchange it for an API key.This is done by calling the grant endpoint.The resulting API key can be used to access the Luno API calls for which it has the appropriate permissions.Beta warning: This API is still in beta phase.This means that it may still undergo incompatible changes.The websocket API provides streaming access to market data.It is more efficient and provides lower latency information than repeatedly polling the orderbook and recent trades but is more complicated to implement.The streaming protocol works by requiring the client to keep an in-memory record of the order book.Update messages are then sent from the server and the client uses these to update its copy of the order book.

If they are applied correctly and fully, the client's view of the order book will be identical to the server's view.The client state consists of the following data: Each update message transmitted from the server has a unique increasing sequence number.The message with sequence number n can be applied to state sequence n-1 to produce state sequence n.A message may contain multiple updates which must be applied atomically and in order.If an update is received out-of-sequence (for example update sequence n+2 or n-1 received after update sequence n), the client cannot continue and must reinitialize the state.There are three types of update: Add a bid or ask order to the order book with a given id, price and volume.Remove the order from the order book with a given id.Reduce the outstanding volume of an order in the order book and append a trade to the trades list.A new order is placed below market In this case, an update message would be sent with a single create update.

A market order is placed that is immediately filled In this case, an update message would be sent containing multiple trade updates.There will be no create update since the new order never enters the order book.An order is placed that is partially filled In this case, the update message contains multiple trade updates and a create update.The volume in the create update is the remaining volume for the order.In this case, the update message contains a single delete update.The streaming updates protocol described above can be accessed using websockets.The server first sends the current order book state and thereafter sends update messages as quickly as possible.Both the client and server must send regular keep alive messages to avoid disconnection during periods of low update message activity.Connect to the websocket server at: wss://ws.bitx.co/api/1/stream/:pair Beta warning: This API is still in beta phase.The client must start by sending API key credentials: The server will then send the current order book in this format: Thereafter the server sends messages like these: An empty message is a keep alive message.