why bitcoin price surge

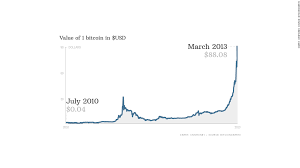

Bitcoin is an unusual place to seek security.It's a four-year-old digital currency developed by a hacker who still remains anonymous.But these are unusual times.Depositors in the tiny island nation of Cyprus are struggling to gain access to cash stored in the nation's banks, and some face losses on their deposits.The situation has caused investors all over Europe to question the safety of the banking system.The price of one bitcoin has popped 87% since Cyprus began discussing tapping deposits as part of the bailout by the EU and IMF.Bitcoins now trade at $88 each, up from $47 on March 16, 2013, according to data from Mt.Gox, the currency's main trading exchange.That compares with just 5 cents per bitcoin in mid-July 2010, when Mt.Gox first started tracking prices.Trading volume has also exploded.Between 60,000 and 110,000 bitcoins have changed hands per day recently, according to Mt.That's double to triple the amount traded a few weeks ago.Albert Hendriks, a 32-year-old programmer for a high-speed trading firm in Amsterdam, jumped into the currency for the first time this week, purchasing €1000 worth of bitcoins.

He's not worried about the safety of the global banking system, but he sees bitcoins as a lucrative investment."I think the currency is maturing," Hendriks said."It's risky, but I think more and more people are starting to trust it."Bitcoin investors can trade in their coins for cash through a number of sites like Coinbase and BitInstant that work directly with banks to facilitate transfers.Some vendors are starting to accept the coins too, including the blog hosting site Wordpress and the online community Reddit.Jeff Berwick, a media entrepreneur who runs the website Dollar Vigilante, hopes to open one of the world's first bitcoin ATMs in Cyprus in the next few weeks.The ATM there would allow individuals to retrieve cash for their digital bitcoins or put cash into the machine to add to their bitcoin collection."It's going to be an experiment," said Berwick, who also aims to install a machine in Los Angeles in the next few weeks.Bitcoin has been one giant global experiment since an anonymous developer using the pseudonym "Satoshi Nakamoto" created it in 2009 as a currency that's free from government intervention and has no central bank backing.

More than 99% of them will be circulating by 2033, but the very last bitcoin won't be generated until around 2140.

bitcoin prices tumble on china fears"The point of the bitcoin is that you don't have to trust the founder," said Jeff Garzik, a computer programmer in Raleigh, N.C., who has served as a consultant to businesses working with bitcoins.

ethereum francais"People are drawn to it because it can't be artificially manipulated by any human.

bitcoin ach transferCentral bankers can't just decide to make more of it."

bitcoin is a ponziLast week, the Treasury Department's Financial Crimes Enforcement Network issued new guidelines outlining what anti-money laundering rules virtual currencies like bitcoin must follow.

Critics say that the currency's anonymity makes it particularly useful for money launderers.Members of Silk Road, an online drug bazaar, use it as their currency of choice.Although bitcoin businesses now have more regulatory hoops to jump through, Garzik said he sees the new rules as a tacit acceptance by the U.S.government of the currency's legitimacy.Meanwhile, Hendriks hopes that he won't ever have to exchange his newly purchased bitcoins for dollars or euros."I hope it will become a global currency, and I can use it without turning it back into another currency," Hendriks said.-CNNMoney's Steve Hargreaves contributed to this report.We're sorry, the page you were looking for isn't found here.The link you followed may either be broken or no longer exists.Please try again, or take a look at our homepage for the latest news and market data.You may also be interested in these pages: U.S.News Markets Pre-markets Stocks Commodities Currencies Bonds Latest Video Investing Tech Make It Report a broken link | Help | Site map

Bitcoin, the decentralized digital currency with global name recognition, has jumped in value once again.The value of the cryptocurrency surged past $2,000 US on May 20, according to data from institutional digital currency exchange GDAX.A single virtual "coin" cost $2,355 US (about $3,182 Cdn) on Wednesday morning, GDAX data showed.The value of bitcoin has surged more than 400 per cent in the past year, according to data from Bloomberg.The currency has been subject to wild fluctuations in the past.29, 2013, the price of bitcoin rocketed from $116.89 to $1,108.80, according to data from GDAX's retail trading counterpart Coinbase.The digital currency went on to shed much of that value over the following year.Bitcoin remains volatile, falling below $2,000 on GDAX Monday night before rising above that mark once again.A GDAX executive said professional financial players have started trading bitcoin directly.The increase in bitcoin prices over the past six months has "really correlated very tightly with a lot of new inbound institutional interest," said Adam White, vice-president of GDAX.

Bitcoin and other digital currencies "aren't going away," said White."They're going to be a core part of the financial system, most likely."One currency market watcher is more guarded about bitcoin's place in the financial world."Bitcoin is a classic mania," Button said."There is no fundamental underpinning for it, other than it's a compelling technological story.But the only people using bitcoin are nerds and criminals, and far more the second category than the first category."As the price of bitcoin rises, Button said, owners are more likely to hoard the currency, reducing supply and driving up prices even more.Furthermore, he said, some market participants are piling into the currency in anticipation of a future bitcoin exchange-traded fund that could be traded openly on financial markets."The thinking in the financial community is that it's about to become much easier to buy and sell bitcoin the same way you would buy or sell a stock," Button said."A large portion of the latest run-up is market participants trying to front-run that."

The spike in bitcoin prices hasn't dissuaded people from using the currency to make transactions, according to James Walpole, marketing and communications manager with U.S.-based bitcoin payment processor BitPay."We are seeing bitcoin being used more and more as an actual payment technology, and that utility is certainly going to contribute to the overall perceived value of bitcoin as a technology, and its overall stability," he said.Walpole said his company has seen increasing use of bitcoin as a payment method, particularly by companies based in or operating in Asian countries.Bitcoin ATMs have popped up in cities around the world.(Steven Senne/Associated Press) "Seeing bitcoin continue to be adopted, even during times when the bitcoin price is going down, as we've seen at BitPay, is a really good sign that this is not just a fad, it's not just a speculative asset," said Walpole."It actually has something real going on behind it."16, just before the latest run-up in bitcoin prices began, and March 17, BitPay has seen transaction volume grow by 80 per cent, according to Walpole.

The open-source software that powers bitcoin was released at the start of 2009.Since then, the cryptocurrency has garnered attention worldwide as a low-cost, digital-friendly way to store money and make payments.For some bitcoin users, the lack of a controlling central bank is a selling point.Bitcoin has also made headlines for its popularity among criminals.In the past few weeks, a series of ransomware attacks believed to have been based on a leaked NSA cyberweapon crippled computer systems across Europe and throughout the world.The hackers behind the attack encrypted data and held it hostage, demanding bitcoin ransoms in exchange.The cryptocurrency also gained notoriety after major bitcoin exchange Mt.Gox went under in 2014.Hundreds of millions of dollars' worth of the cryptocurrency went missing.Other digital currencies have followed bitcoin's rise, with big names including Ripple, Ethereum, Litecoin and Dash.A recent analysis by TechCruch found that bitcoin accounts for 47 per cent of cryptocurrencies by market capitalization.