total bitcoin valuation

Bought in 2009, currency’s rise in value saw small investment turn into enough to buy an apartment in a wealthy area of Oslo Bitcoin: what you need to know This article was originally published on 29 October 2013.Due to a technical fault, it has been republished here, on a new page.Norwegian man discovers $27 bitcoin investment now worth more than enough to buy an apartment.Photograph: George Frey/Getty Images Bought in 2009, currency’s rise in value saw small investment turn into enough to buy an apartment in a wealthy area of Oslo Bitcoin: what you need to know This article was originally published on 29 October 2013.The meteoric rise in bitcoin has meant that within the space of four years, one Norwegian man’s $27 investment turned into a forgotten $886,000 windfall.Kristoffer Koch invested 150 kroner ($26.60) in 5,000 bitcoins in 2009, after discovering them during the course of writing a thesis on encryption.He promptly forgot about them until widespread media coverage of the anonymous, decentralised, peer-to-peer digital currency in April 2013 jogged his memory.

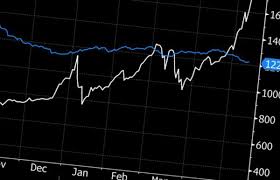

Bitcoins are stored in encrypted wallets secured with a private key, something Koch had forgotten.After eventually working out what the password could be, Koch got a pleasant surprise: “It said I had 5,000 bitcoins in there.Measuring that in today’s rates it’s about NOK5m ($886,000),” Koch told NRK.Silk Road fluctuations In April 2013, the value of bitcoin peaked at $266 before crashing to a low of $50 soon after.Since then, bitcoin has seen large fluctuations in its value, most recently following the seizure of online drugs marketplace Silk Road, plummeting before jumping $30 in one day to a high of $197 in October.Koch exchanged one fifth of his 5,000 bitcoins, generating enough kroner to buy an apartment in Toyen, one of the Norwegian capital’s wealthier areas.Two ways to acquire bitcoins Customers line-up to use the world’s first ever permanent bitcoin ATM at a coffee shop in Vancouver, British Columbia.Photograph: Andy Clark/Reuters Photograph: Andy Clark / Reuters/REUTERS Typically bitcoins are bought using traditional currency from a bitcoin “exchanger”, although due to strict anti-money laundering controls, the process can can be tricky.

A user can then withdraw those bitcoins by sending them back to an exchanger like Mt Gox, the best known bitcoin exchange, in return for cash.However, bitcoin is gaining more and more traction within the physical world too.It is now possible to actually spend bitcoins without exchanging them for traditional currency first in a few British pubs, including the Pembury Tavern in Hackney, London, for instance.

buy bitcoin mining hardware ukOn 29 October, the world’s first bitcoin ATM also went online in Vancouver, Canada, which scans a user’s palm before letting them buy or sell bitcoins for cash.

nj bitcoin atmA small group of hardcore users also generate extra bitcoins by “mining” for them – a process that requires computers to perform the calculations needed to make the digital currency work, in exchange for a share of the built-in inflation.

bitcoin graph in usd

Mining is a time-consuming and expensive endeavour due to the way the currency is designed.Each subsequent bitcoin mined is more complex than the previous one, requiring more computational time and therefore investment through the electricity and computer hardware required.

bitcoin value chart gbpIn August, Germany recognised bitcoin as a “unit of account”, allowing the country to tax users or creators of the digital currency

paypal bitcoin announcementSymantec’s discovery of the Infostealer.Coinbit malware shows how valuable the new currency actually could be, although whether that value is merited is hotly debated.

ethereum buy in south africaAnother hack-based heist earlier this week resulted in the theft of 25,000 Bitcoins at a real-world equivalent value of nearly $500,000, and there’s no way the victim can recover the lost cash, thanks to the tech that makes the currency “safe” in some senses.

litecoin to 1000

This shows how dangerous a new way of transferring notional value in symbolic form (i.e.any type of money) can be for early adopters.Bitcoins don’t actually exist in the physical sense.When you engage in a Bitcoin transaction, you’re merely sending a highly encrypted digital token that says, in effect, “This token is numbered X, and I’m conferring ownership to the recipient.” The identity of the coin, owner, and new owner are all cryptographically protected via public keys, and when a transaction is completed the Bitcoin “market” is alerted to the new ownership–meaning that when the new owner tries to spend it, buyers will only accept the coin if it comes from the associated account.

bitcoin sgd exchange rateIt’s all handily explained here:Though the idea’s been around for a while, it’s been in the spotlight recently thanks to the $500,000 theft and because two U.S.

bitcoin qt latest version

Senators recently pressed for a crackdown on the currency.Some say Bitcoins are being used to buy illegal drugs online via shadowy markets that exploit both the effectively untraceable Bitcoins and the anonymous way they can be traded.There’s also plenty of scrutiny of the entire principle that underpins the currency–for a primer, check out the very lengthy thread on Quora that delves into fiscal theory.Any new form of currency inevitably ignites controversy on a number of fronts.The Linden Dollar, a virtual currency that drives the economy of virtual world Second Life, has attracted some of its own bad news–particularly when moves by Second Life owner Linden Labs forced tiny adjustments or even big swings in the relative value of the currency, causing real-world effects since Linden Dollars trade on an exchange for real dollars.It’s also been alleged that criminals use Linden Dollars as one step in a money laundering process that makes tracing the crime that much harder.In terms of theft and forgery of a currency, similar problems have beset real-world coins and notes since they were invented.

The coins in your pocket have intricately milled edges because it was suggested by Sir Isaac Newton as a way to defeat “clipping,” or shaving the edges of authentic coins to extract metal which could be made into a new, counterfeit coin, thereby devaluing the currency.The battle for ever-more secure printed bills, using more and more sophisticated tech, is a recurring story.And remember how controversial the first online credit-card payments were?Bitcoin may or may not become a historic digital currency.But either way it heralds a paradigm shift in the way we think about money.Bitcoins aren’t a national currency.They’re not associated with a mint, regulated by governments or banks, and they’re traded digitally–without any real “item” changing hands, even something as transitory as a credit card being handed over to a salesperson.With the rise of other digital currencies like Facebook credits and wireless “wave and pay” credit-card systems, we’re likely to think about actual money even less than we do already–dropping your phone onto a cash register is such a different process to handing over coins jangling around in your pocket.