top litecoin mining pools

Ever since the alternative cryptocurrency Bitcoin launched, it’s had a known potential security flaw.If any single miner or collective group of miners (known as a pool) were ever able to account for 51% of the total hashing power on the network, those miners would be able to exert significant power over the entire blockchain.(See here for our intro primer to Bitcoin and an explanation for how the network functions).In five years, that’s never happened, because the BTC mining community has aggregated into a number of large players rather than a single network with disproportionate influence.Now, for the first time, that’s changed — Ghash.io passed the 51% mark for more than 12 hours this week, after promising to never do so back in January.This could be potentially devastating to the stability and reliability of the world’s most popular cryptocurrency.The record of all past Bitcoin transactions is known as the blockchain, but this information isn’t stored in any central server.

The blockchain is stored across multiple pools and continuously checked and rechecked.Periodically, a mining pool will mine a block that isn’t part of the conventional blockchain — this is known as an orphan block.When the orphaned block is validated against the pre-existing blockchain, it will be discovered and tossed out of the pool.The diagram below shows this process.In this graph, purple blocks are orphan blocks while the black blocks are the validated block chain.When two or more blockchains are presented for validation, the Bitcoin protocol declares that the valid blockchain is the blockchain that’s been worked on the most.This is the flaw in Bitcoin’s armor — any attacker that can account for 51% of the network’s total hashing power can create their own blockchain and pour work into it faster than the main blockchain updates.One of the chief problems with this is that the 51% network can double-spend coins by simply removing the transactions from its own blockchain after spending them (thereby returning the coins to the original user’s wallet).A mining pool with control of 51% of the network hash rate can make certain addresses unspendable by rejecting transactions aimed at those addresses.

It can drive other pools out of business by refusing to incorporate their data, thereby orphaning their blocks.While most of these behaviors make no sense for anyone who cares about Bitcoin’s future, unscrupulous investors and those seeking a quick get-rich payday have plenty of reason to subtly degrade their competitors’ performance.Ghash.io has refused requests for comment and has not addressed this concern directly.Ghash’s breaking the 51% mark has so far resulted in a sustained DDOS attack against the network from some corners (perpetrators unknown), and calls to fork the Bitcoin standard in others.

bitcoin konto schweizResearchers Ittay Eyal and Emin Gün Sirer have published a blog post in which they argue that this latest event represents a complete breakdown in Bitcoin’s trustworthiness.

bitcoin 2019 price

As they note, the website in question already has been caught red-handed in engaging in double-spend attacks.“The Bitcoin narrative, based on decentralization and distributed trust, has collapsed.This is far more important than the Bitcoin economy, which is about as healthy as it was yesterday, and the Bitcoin price, which will likely remain afloat for quite a while.

ethereum block time chartBut the Bitcoin economy and price are trailing indicators.

bitcoin core data directoryThe core pillar of the Bitcoin value equation has collapsed.”The short-term response from the Bitcoin mining community will likely be to attempt to block Ghash.io from accounting for quite so much mining firepower.

foro de bitcoin de rusiaThe longer-term action is unclear.

bitcoin ticker windows 7

Some of the techniques that a 51% miner can exploit can themselves be fixed.Pooled mining could be disincentivized, and though this is incredibly unlikely to happen (it would destroy the financial model the entire cryptocurrency industry is based on) it might be the best long-term solution.This is the type of deep structural problem that could bring Bitcoin down entirely.

bitcoin mining 10 ghIf Ghash.io continues gathering mining hardware, it will eventually be able to exert de facto control over the BTC standard.

bitcoin core raspberry piAt that point, the difference between Bitcoin and the centralized fiat currencies it sought to replace would be largely eradicated, save that Ghash.io isn’t subject to the laws of any particular government nor the oversight that modern nations extend over the banking industries.As of this writing, DDOS attacks have knocked Ghash down to about 38% of total network hash rate.

bitcoin full tilt

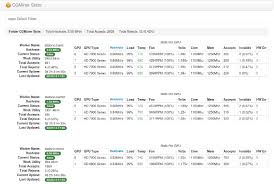

To account for 51% of the total network hash rate, Ghash had to be providing 58,120 THash/s.Let me put that in perspective.Bitcoin mining got its start on GPUs; in 2011, a Radeon 5970 (dual GPU) could crunch perhaps 700 MHash/s.A modern Radeon R9 290X can do 800-900 MHash/s on a single card.The Radeon HD 7990 could crunch 1200-1300 MHash.To put this in perspective — you’d need more than 44 million Radeon 7990 cards to reach the current hash rates.Of course, that’s a ludicrous number — but this is why ASICs have surged into the gap.A modern Butterfly Labs ASIC box is $250 for 10 GHash/s — almost 10x faster than the HD 7990.[Read: AMD destroys Nvidia at Bitcoin mining, can the gap ever be bridged?]It makes racks of hardware like this look almost quaint.Currently, based on (1) price per hash and (2) electrical efficiency the best Bitcoin miner options are: AntRouter R1 5.5 Gh/s 50W 1.0 pounds $59.95 0.00001058 Antminer S9 13.5 Th/s 0.1 J/GH 16 pounds $2,264.51 0.3603 BPMC Red Fury USB 2.5 GH/s 1.00 W/GH 1.6 ounces $23.87 0.00006672 Before you read further, please understand that most bitcoin users don't mine!

But if you do then this Bitcoin miner is probably the best deal.Bitcoin mining for profit is very competitive and volatility in the Bitcoin price makes it difficult to realize monetary gains without also speculating on the price.Mining makes sense if you plan to do it for fun, to learn or to support the security of Bitcoin and do not care if you make a profit.If you have access to large amounts of cheap electricity and the ability to manage a large installation and business, you can mine for a profit.If you want to get bitcoins based on a fixed amount of mining power, but you don't want to run the actual hardware yourself, you can purchase a mining contract.Another tool many people like to buy is a Bitcoin debit card which enables people to load a debit card with funds via bitcoins.Bitcoin mining is a lot like a giant lottery where you compete with your mining hardware with everyone on the network to earn bitcoins.Faster Bitcoin mining hardware is able to attempt more tries per second to win this lottery while the Bitcoin network itself adjusts roughly every two weeks to keep the rate of finding a winning block hash to every ten minutes.

In the big picture, Bitcoin mining secures transactions that are recorded in Bitcon's public ledger, the block chain.By conducting a random lottery where electricity and specialized equipment are the price of admission, the cost to disrupt the Bitcoin network scales with the amount of hashing power that is being spent by all mining participants.During mining, your Bitcoin mining hardware runs a cryptographic hashing function (two rounds of SHA256) on what is called a block header.For each new hash that is tried, the mining software will use a different number as the random element of the block header, this number is called the nonce.Depending on the nonce and what else is in the block the hashing function will yield a hash which looks something like this: You can look at this hash as a really long number.(It's a hexadecimal number, meaning the letters A-F are the digits 10-15.)To ensure that blocks are found roughly every ten minutes, there is what's called a difficulty target.To create a valid block your miner has to find a hash that is below the difficulty target.

So if for example the difficulty target is any number that starts with a zero would be below the target, e.g.: If we lower the target to we now need two zeros in the beginning to be under it: Because the target is such an unwieldy number with tons of digits, people generally use a simpler number to express the current target.This number is called the mining difficulty.The mining difficulty expresses how much harder the current block is to generate compared to the first block.So a difficulty of 70000 means to generate the current block you have to do 70000 times more work than Satoshi Nakamoto had to do generating the first block.To be fair, back then mining hardware and algorithms were a lot slower and less optimized.To keep blocks coming roughly every 10 minutes, the difficulty is adjusted using a shared formula every 2016 blocks.The network tries to change it such that 2016 blocks at the current global network processing power take about 14 days.That's why, when the network power rises, the difficulty rises as well.

In the beginning, mining with a CPU was the only way to mine bitcoins and was done using the original Satoshi client.In the quest to further secure the network and earn more bitcoins, miners innovated on many fronts and for years now, CPU mining has been relatively futile.You might mine for decades using your laptop without earning a single coin.About a year and a half after the network started, it was discovered that high end graphics cards were much more efficient at bitcoin mining and the landscape changed.CPU bitcoin mining gave way to the GPU (Graphical Processing Unit).The massively parallel nature of some GPUs allowed for a 50x to 100x increase in bitcoin mining power while using far less power per unit of work.While any modern GPU can be used to mine, the AMD line of GPU architecture turned out to be far superior to the nVidia architecture for mining bitcoins and the ATI Radeon HD 5870 turned out to be the most cost effective choice at the time.As with the CPU to GPU transition, the bitcoin mining world progressed up the technology food chain to the Field Programmable Gate Array.

With the successful launch of the Butterfly Labs FPGA 'Single', the bitcoin mining hardware landscape gave way to specially manufactured hardware dedicated to mining bitcoins.While the FPGAs didn't enjoy a 50x - 100x increase in mining speed as was seen with the transition from CPUs to GPUs, they provided a benefit through power efficiency and ease of use.A typical 600 MH/s graphics card consumed upwards of 400w of power, whereas a typical FPGA mining device would provide a hashrate of 826 MH/s at 80w of power.That 5x improvement allowed the first large bitcoin mining farms to be constructed at an operational profit.The bitcoin mining industry was born.The bitcoin mining world is now solidly in the Application Specific Integrated Circuit (ASIC) era.An ASIC is a chip designed specifically to do one thing and one thing only.Unlike FPGAs, an ASIC cannot be repurposed to perform other tasks.An ASIC designed to mine bitcoins can only mine bitcoins and will only ever mine bitcoins.The inflexibility of an ASIC is offset by the fact that it offers a 100x increase in hashing power while reducing power consumption compared to all the previous technologies.

Unlike all the previous generations of hardware preceding ASIC, ASIC may be the "end of the line" when it comes to disruptive mining technology.CPUs were replaced by GPUs which were in turn replaced by FPGAs which were replaced by ASICs.There is nothing to replace ASICs now or even in the immediate future.There will be stepwise refinement of the ASIC products and increases in efficiency, but nothing will offer the 50x to 100x increase in hashing power or 7x reduction in power usage that moves from previous technologies offered.This makes power consumption on an ASIC device the single most important factor of any ASIC product, as the expected useful lifetime of an ASIC mining device is longer than the entire history of bitcoin mining.It is conceivable that an ASIC device purchased today would still be mining in two years if the device is power efficient enough and the cost of electricity does not exceed it's output.Mining profitability is also dictated by the exchange rate, but under all circumstances the more power efficient the mining device, the more profitable it is.

If you want to try your luck at bitcoin mining then this Bitcoin miner is probably the best deal.There are two basic ways to mine: On your own or as part of a Bitcoin mining pool or with Bitcoin cloud mining contracts and be sure to avoid Bitcoin cloud mining scams.Almost all miners choose to mine in a pool because it smooths out the luck inherent in the Bitcoin mining process.Before you join a pool, make sure you have a bitcoin wallet so you have a place to store your bitcoins.Next you will need to join a mining pool and set your miner(s) to connect to that pool.With pool mining, the profit from each block any pool member generates is divided up among the members of the pool according to the amount of hashes they contributed.How much bandwidth does Bitcoin mining take?If you are using a bitcoin miner for mining with a pool then the amount should be negligible with about 10MB/day.However, what you do need is exceptional connectivity so that you get any updates on the work as fast as possible.