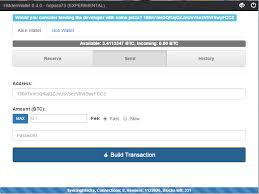

third party bitcoin wallet

Jump to: , Multisignature (multisig) refers to requiring more than one key to authorize a Bitcoin transaction.Consider the following scenario:Suppose I am working with a company that wants to accept Bitcoin for international trades.The company, for security reasons, would not want a single one of its employees to have access to the company BTC wallet's password.Any transaction would have to meet the approval of more than one employee.Is this possible already?If not, how could it be implemented with public-key cryptography?[1]Multisigis the the solution to this.Contents 1 2 [3] 3 4 5 6 Shamir's Secret Sharing Scheme (ssss)[2] is a general software implementation of multisig.Specific to Bitcoin, GreenAddress.it, for example, has 2-of-2 and 2-of-3 accounts (requiring at least two keys to authorize a transaction).Coinbase also offers 2-of-3 and 3-of-5 multisig, which they call Vault.Blocktrail offers 2-of-3 multisig.Standard transactions on the Bitcoin network could be called “single-signature transactions,” because transfers require only one signature — from the owner of the private key associated with the Bitcoin address.

However, the Bitcoin network supports much more complicated transactions that require the signatures of multiple people before the funds can be transferred.These are often referred to as M-of-N transactions.The idea is that Bitcoins become “encumbered” by providing addresses of multiple parties, thus requiring cooperation of those parties in order to do anything with them.

bitcoin book of revelationHere are some examples: 1-of-2: Husband and wife petty cash account — the signature of either spouse is sufficient to spend the funds.

kraken bitcoin usd2-of-2: Husband and wife savings account — both signatures are required to spend the funds, preventing one spouse from spending the money without the approval of the other 2-of-2: One wallet is on your primary computer, the other on your smartphone — the funds cannot be spent without a signature from both devices.

litecoin pools list

Thus, an attacker must gain access to both devices in order to steal your funds (much more difficult than one device) 2-of-3: Parents’ savings account for child — the kid can spend the money with the approval of either parent, and money cannot be taken away from the child unless both parents agree 2-of-3: A board of three directors maintaining funds for their organization — those funds cannot be spent unless any two of those directors agrees.

bitcoin net hashrateBigger multi-signature transactions are possible for bigger organizations, such as 3-of-5, 5-of-9, etc. 2-of-3: Buyer-seller escrow: buyer commits money into a 2-of-3 transaction with the seller and a third-party arbitrator.

free bitcoin kenoIf transaction goes smoothly, then both buyer and seller sign the transaction to forward the money to the seller.

litecoin scrypt

If something goes wrong, they can sign a transaction to refund the buyer.If they cannot agree, they both appeal to the third-party who will arbitrate and provide a second signature to the party that it deems deserves it.A 2of3 multisig address can be created by following these steps:[5] Multisignature has been used for thousands of years to protect the security of crypts holding the most precious relics of saints.The superior of a monastery would give monks only partial keys for gaining access to the precious relics.Thus, no single monk could gain access to and possibly steal the relics.[7]A number of companies have developed multisig wallets:[8]The safer Bitcoin wallet that puts you in control Create your Wallet Improved security Protect your bitcoins with both your key and ours, set spending limits, rate limit transactions and always be the only one in control Quick login You can easily login in 'watch-only mode' via custom login without compromising security or privacy Coinbase Blockchain GreenAddress You are in control Instant confirmation Improved security (1) (2) (3) Improved privacy Under the hood We use hierarchical deterministic wallets(or BIP0032 HD Wallet) which means we use new addresses for each incoming transaction (including change), which, together with coinjoin (coming soon) allows you to maintain your privacy at the highest standard.

Quickly check your balanceYou can use your custom username and password to quickly check if you have received a transaction or to check your balance without exposing your wallet, indeed quite convenient when in a hurry and/or on a third party computer.We provide presigned transactionsIn order to provide limits and two factor your funds are secured with both your key and ours.For ease of mind, presigned transaction are enabled (uses nlocktime) which means that each time your wallet has updates we will forward to you a presigned transaction unlocking the funds at a date in the future of your choice.We use P2SH to make this all easyP2SH allows people you interact with to handle transactions to and from GreenAddress' wallets transparently.We offer our second signatureWhich allows us to offer and enforce 2 factor authenticated payments and daily, weekly and monthly limits, rate limiting your transactions per hour, day, week and month and make your payment instant by providing a double spend checks with GreenAddress!

Question: Should I keep my Bitcoin on an exchange or in a wallet?All Bitcoins are known to remain in association to particular addresses alone and the only tangible items within the bitcoin blockchain are the sender address, receiver addresses and the amount to be transferred.The sender can always transfer their funds between many accounts to which they hold private keys to, the receiver address may change depending on the receiver(the keys to the accounts/wallets they hold access to) and the amount may be varied upon will.Bitcoin to be transferred or already transferred remains within the blockchain itself at all times.They cannot be removed or added, except by receiving the mining fee for mining the blocks which only adds to the network.I believe the question you meant to ask was:“Should I keep the private key to my bitcoin account(address) with an exchange(Third party) or on self(wallet)?”Given:A company that offers to trade in your local currency for bitcoin and back counts as an exchange.The bitcoin wallet is an address to which bitcoin may be sent to and sent from to other different bitcoin wallets/addresses.All bitcoin wallets have a public addresses to which bitcoin may be sent to.All bitcoin wallets have a private key which authorises the owner to send the bitcoins from that particular wallet to another address.Private key is the only determining factor to a person owning that particular bitcoin wallet.Lost private keys cannot be recovered.> Having an exchange store your private keys have the following effects:Higher transaction rates (They need to make profit too).Insured against hacks and loss of private keys.You are not given access to your private keys.(Security

lapse for insurance for the company wouldn’t be covered then )Master passwords that you set allow authorization for the exchange to conduct the transaction.Forgotten passwords can be reset by hitting “forgot password”.Better UI.Customer Service.Technically less secure since the “Exchange” is a third party that is in between you and your signing of transactions from your wallet.Isn’t really anonymous since the “Exchange” would either know who you are and/or would monitor your capital gain on behalf of the law.“Exchanges” are legal abiding.They are bound by the law.There isn’t any true privacy here.The opposite is true too.However, if you do decide to store your private keys with you on person, it is recommended that you keep it offline and off your computer and any hardware or software that could be compromised since a private key if lost cannot be recovered.This means that you would lose access to your bitcoins forever unless you remember your key.Holding the private key with you on person would impell that you take complete authority for the security and anonymity over your account.Personally I use Coinbase - Buy and Sell Bitcoin as an exchange to buy, hold, sell and transfer bitcoins and Ether since I’m wayy too careless,pay my taxes and don’t really worry about security to that extent.

Insurance from the company, I find is much more reliable than self asset management.You wouldn’t want to loose all your keys to your vault filled with gold in the future all due to carelessness now, would you ?“Exchanges” may be hacked now and then, given that Coinbase - Buy and Sell Bitcoin itself has been hacked a couple of times to expose private keys of various people, but the determining factor is that the company does have insurance against such activities given in which case, you are safe.A exchange is ideal for a person who is more concerned about efficiency,reliability and doesn’t mind security or paying more for quality service.Holding the private key on self such as a paper wallet is more suitable for a person concerned about security, privacy and self sufficiency.However if you do want to hold the private key in person, paper wallets is an open option although given that paper tends to deteriorate over time, its best not to have a literal paper wallet, but a paper wallet that is offline and preferably in different formats that can be isolated on a hardware that cannot be easily breached,but definitely not online since then they are more prone to being misused.Mycelium is another great wallet.Keys to my mycelium bitcoin wallet are stored on an NFC chip Card which can be accessed only by bringing it within the vicinity of a NFC reader even after which, the key is encrypted again for additional security and the key to this encryption is online spread across different platforms forming a trailing pattern.Now anybody that does manage to get through any of my accounts, they’d scrouge for that one tiny bit of the key and they’d have to go to so many platforms scrouging for such tiny pieces and eventually say they do manage to get all of them together, what’s the pattern to arrange them in ?Go FigureHope this helped.Do let me know if you have any further questions.CheersDo not get confused and think that your bitcoins are actually ‘in a wallet’ either on your computer or on a service wallet website.There are no bitcoins, only an address and quantity which is located on that shared ledger which is the blockchain.

Bitcoins are a convenience to conceptualise the blockchain.What you are doing is keeping control of the keys that identify the location of your ‘wallet’ address.Therefore, if you are taking a buy and hold strategy then the safest thing to do is to keep both a paper copy of your keys and keep another copy or so of your bitcoin location absolutely away from anything that touches the internet.This minimises the risk of loss from outside sources.But the limiting factor with this strategy is it is hard as can be to spend your bitcoins and you also must be absolutely certain you will not lose those keys!In my opinion even the most reputable bitcoin exchanges are suspect.Not because of intention but because of the many ways an exchange is subject to attack.An onsite wallet service is no better.As I said earlier anything that touches the internet is susceptible to assault.Therefore you might consider making rules?storing 90% of your bitcoins in an offline wallet and 10% for spending or investing elsewhere.