litecoin hash pool

Ever since the alternative cryptocurrency Bitcoin launched, it’s had a known potential security flaw.If any single miner or collective group of miners (known as a pool) were ever able to account for 51% of the total hashing power on the network, those miners would be able to exert significant power over the entire blockchain.(See here for our intro primer to Bitcoin and an explanation for how the network functions).In five years, that’s never happened, because the BTC mining community has aggregated into a number of large players rather than a single network with disproportionate influence.Now, for the first time, that’s changed — Ghash.io passed the 51% mark for more than 12 hours this week, after promising to never do so back in January.This could be potentially devastating to the stability and reliability of the world’s most popular cryptocurrency.The record of all past Bitcoin transactions is known as the blockchain, but this information isn’t stored in any central server.

The blockchain is stored across multiple pools and continuously checked and rechecked.Periodically, a mining pool will mine a block that isn’t part of the conventional blockchain — this is known as an orphan block.When the orphaned block is validated against the pre-existing blockchain, it will be discovered and tossed out of the pool.The diagram below shows this process.In this graph, purple blocks are orphan blocks while the black blocks are the validated block chain.When two or more blockchains are presented for validation, the Bitcoin protocol declares that the valid blockchain is the blockchain that’s been worked on the most.This is the flaw in Bitcoin’s armor — any attacker that can account for 51% of the network’s total hashing power can create their own blockchain and pour work into it faster than the main blockchain updates.One of the chief problems with this is that the 51% network can double-spend coins by simply removing the transactions from its own blockchain after spending them (thereby returning the coins to the original user’s wallet).A mining pool with control of 51% of the network hash rate can make certain addresses unspendable by rejecting transactions aimed at those addresses.

It can drive other pools out of business by refusing to incorporate their data, thereby orphaning their blocks.While most of these behaviors make no sense for anyone who cares about Bitcoin’s future, unscrupulous investors and those seeking a quick get-rich payday have plenty of reason to subtly degrade their competitors’ performance.Ghash.io has refused requests for comment and has not addressed this concern directly.Ghash’s breaking the 51% mark has so far resulted in a sustained DDOS attack against the network from some corners (perpetrators unknown), and calls to fork the Bitcoin standard in others.Researchers Ittay Eyal and Emin Gün Sirer have published a blog post in which they argue that this latest event represents a complete breakdown in Bitcoin’s trustworthiness.As they note, the website in question already has been caught red-handed in engaging in double-spend attacks.“The Bitcoin narrative, based on decentralization and distributed trust, has collapsed.This is far more important than the Bitcoin economy, which is about as healthy as it was yesterday, and the Bitcoin price, which will likely remain afloat for quite a while.

But the Bitcoin economy and price are trailing indicators.The core pillar of the Bitcoin value equation has collapsed.”The short-term response from the Bitcoin mining community will likely be to attempt to block Ghash.io from accounting for quite so much mining firepower.The longer-term action is unclear.Some of the techniques that a 51% miner can exploit can themselves be fixed.Pooled mining could be disincentivized, and though this is incredibly unlikely to happen (it would destroy the financial model the entire cryptocurrency industry is based on) it might be the best long-term solution.This is the type of deep structural problem that could bring Bitcoin down entirely.

bitcoin miner icelandIf Ghash.io continues gathering mining hardware, it will eventually be able to exert de facto control over the BTC standard.

bitcointalk 42 coin

At that point, the difference between Bitcoin and the centralized fiat currencies it sought to replace would be largely eradicated, save that Ghash.io isn’t subject to the laws of any particular government nor the oversight that modern nations extend over the banking industries.As of this writing, DDOS attacks have knocked Ghash down to about 38% of total network hash rate.To account for 51% of the total network hash rate, Ghash had to be providing 58,120 THash/s.Let me put that in perspective.

bitcoin athenaBitcoin mining got its start on GPUs; in 2011, a Radeon 5970 (dual GPU) could crunch perhaps 700 MHash/s.

ethereum enterprise conferenceA modern Radeon R9 290X can do 800-900 MHash/s on a single card.

ethereum downloading chain structure

The Radeon HD 7990 could crunch 1200-1300 MHash.To put this in perspective — you’d need more than 44 million Radeon 7990 cards to reach the current hash rates.Of course, that’s a ludicrous number — but this is why ASICs have surged into the gap.A modern Butterfly Labs ASIC box is $250 for 10 GHash/s — almost 10x faster than the HD 7990.[Read: AMD destroys Nvidia at Bitcoin mining, can the gap ever be bridged?]It makes racks of hardware like this look almost quaint.

bitcoin successorEdit ArticleHow to Mine Litecoins Three Parts:Before You StartSetupMiningCommunity Q&A Litecoin is a cryptocurrency like Bitcoin, though it uses some fundamentally different algorithms to process, called "Scrypt".Initially this made it easier for people with home computers to mine, but dedicated mining machines called ASICs can now process Scrypt coins like Litecoin, making it difficult to get in without a large investment.

Still, if you want to try your hand at mining, you can have everything setup in an afternoon, and if you join a mining pool you can start seeing Litecoin returns almost immediately.1 1 Understand the basics of cryptocurrency mining.Traditional currencies are printed to increase the amount of cash in circulation.Cryptocurrency such as Litecoin is generated by machines that solve complex algorithms.Whenever a "block" of algorithms is finished being processed, more currency is released into the market, usually as a reward to the miner that finished the block.[1]Mining algorithms become more difficult as more currency is mined.This is intentional as it helps prevent all of the possible currency from being mined immediately.The practical side effect is that the longer you wait to start mining, the less likely you are to solve blocks on your own.Mining pools were created to help individuals have a better chance at making money from mining.The mining pool applies all of its members' processing power to solving a block, and if the block is finished by any member, all members get a share of the reward.

You'll get far less reward than if you finished the block on your own, but have much higher chances of actually seeing results.2 Consider alternatives to mining.Unless you're willing to drop thousands of dollars on a dedicated mining machine, or you don't pay for electricity and don't care about the lifespan of your home computer, there's very little reason to mine Litecoins instead of just purchasing them.The electricity costs of mining 24/7 often outweigh the value of anything you mine, especially if you're using a home computer, and running constantly puts a serious strain on your hardware components.[2]Litecoin mining is only going to increase in difficulty, as this one of the fundamental principles of cryptocurrency mining.This means that it will get more difficult to mine at a profit unless the value of the Litecoin sees a significant boost.If you're mining Litecoin to use as a speculative investment or to use an an alternative form of payment, it's usually better to just purchase them outright.

3 Purchase or build a mining computer ("rig").In the cryptocurrency world, computers used to mine coins are called "rigs".In order to be remotely effective when mining Litecoins, you'll need a computer with at least two graphics cards.Ideally, you'll want four or five graphics cards attached in a custom setup.You can purchase these online, or you can try building your own, though this requires a fair amount more work than building a standard desktop computer.You will want at least as much system RAM as graphics card RAM.You'll want some specialized cooling for your mining computer to keep your components alive longer.4 Consider an ASIC Scrypt miner.These are dedicated mining machines that can greatly increase your mining power, but they can be expensive for effective ones.ASIC Scrypt miners can come in low-power models too, allowing you to save on electricity.[3]One of the big benefits of a Scrypt miner is that you can easily change it to mine a more profitable coin as long it is Scrypt-based like Litecoin.

You can get a USB ASIC miner and connect it to a Raspberry Pi for a low-power miner.You may have to put your name on a waiting list for the more popular models.5 Estimate whether mining will be worth it.Once you've decided on some equipment, look up the market trends for Litecoin and make a projection on how much mining you will have to do to make up the cost of the equipment, power, and internet.If you can purchase the same number or more coins than you will earn mining, you're probably better off just buying the coins.[4]For example, let's say that your equipment has a hash rate (processing power) of 200 KH/s, which is about the average for a high-end graphics card.The computer uses 600 watts of power to mine, and power costs $0.10/kWh.Assuming that you're mining solo, mining Litecoin at the current rate (March 2015) with the above setup will cost you $520 per year, and you would never break even.2 1 Get a Litecoin wallet.You will need this wallet to store the coins that you earn while mining, or any coins that you purchase or receive.

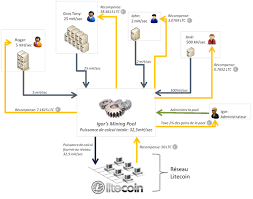

There are also official wallets available for mobile devices.Download the Bootstrap file from here.This will save you about two days of waiting for your wallet to sync for the first time.Encrypt your wallet by clicking "Settings" → "Encrypt Wallet".Give it a strong passphrase.2 Join a mining pool.There are a large number of mining pools out there, and it is highly recommended that new miners join a pool instead of trying to mine solo.When you mine solo, you have the chance to make big rewards for completing a block, but the chances of you specifically doing that are very, very low.A mining pool combines the efforts of everyone in the pool to complete the block, and then any rewards are split amongst the pool.You'll earn less for completed blocks, but have a much better chance at a a steady income.When joining a pool, make sure that your wallet is linked to your account so that you can collect your earnings.3 Create a "worker" in your pool.A mining pools use a system called "workers".

These workers are assigned to you, and represent the work you are doing while mining.The process for creating workers varies depending on the mining pool you join.Many mining pools will create your first worker automatically when you register.The worker will typically be named "username_1" or "username.1".Most beginner miners won't need more than one worker.You can create additional workers if you have multiple mining rigs.Typically you assign a worker to each piece of mining equipment you have, which allows you to track efficiency across your machines.4 Download a mining program.There are several different mining programs available depending on your needs: cgminer - This is a good all-around mining program.It was designed primarily for Bitcoin, but can mine Scrypt up to version 3.7.2. cudaMiner - This is a mining program specifically for Nvidia graphics cards.You can download it here.cpuminer - This is a mining program that is designed for use for CPU mining.This is much less efficient than using a graphics card, but for some it's the only way available.

5 Configure your mining program.Different mining programs have different configuration processes.Below are instructions for setting up cgminer in Windows.You will need to know your mining pool connection details, including the "stratum" (address), port number, and your worker information.Your mining pool should have detailed instructions on configuring your miner for the pool.[5]Extract cgminer to an easily accessible folder, such as C:\cgminer.Press Win+R and type cmd to open the command prompt.Navigate to the cgminer folder.Type cgminer.exe -n to scan for your graphics card.Open Notepad and type the following, using your mining pool information: start "c:\cgminer" --scrypt -o STRATUM:PORT -u WORKER -p PASSWORD Click "File" → "Save As" and then save it as a ".bat" file.3 1 Double-click your .bat file to start mining.Once your miner is configured and connected to your pool, you can begin the mining process.The command prompt window will display the results of your mining as it happens, such as the rate you are mining at and how much you've accomplished.

Some miners will tell you the market value and your mining pool information as well.Try to avoid running any other programs while the computer is mining.Anything else that you run will only hurt your miner's efficiency, which will lower your profits.2 Monitor your system hardware.Mining is very taxing on your hardware, as it constantly pushes it to its maximum limit.Make sure that you keep an eye on your temperatures to prevent any overheating, which can destroy your equipment.While running your equipment 24/7 will give you the best mining results, it will also kill your hardware much quicker.You may want to consider powering down every once in a while.3 Continue to check your profitability.As you continue mining, check your power bills and computer costs and compare them against the coins you are earning through mining.If you aren't making a profit, you may want to consider selling your equipment to help recoup a potential loss.) to calculate up-to-the-minute profitability reports.