litecoin coming to mt gox

Bitcoin: Mtgox on the mend on reddit rumors of successful withdrawals, pops from $90 low to test $290, lifts other exchanges along, “goxcoin”- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - Bitcoin Cumberland Mining, one of the largest crypto miners, a business of large proprietary trading firm DRW announced today an offer to convert all of the 202k BTC held in the Mt.Gox bankruptcy process to USD or JPY.The cryptocurrency miner re-affirmed its track record of providing liquidity for large bitcoin trades, including several government auctions.Cumberland is one of the world’s largest OTC bitcoin trading desks and is in a unique position to help.The infamous Japanese bitcoin exchange Mt.Gox recently become solvent due to the appreciation in bitcoin prices.The latest report from the bankruptcy trustee back in March revealed that most claims are still unpaid as of today.

The balance of BTC managed by the Mt.Gox estate as of March 5, 2017, stood at 202,185.36428254 BTC.Gox were to be moved to a wallet address managed by bankruptcy attorney Mr.Mike Komaransky of Cumberland Mining stated in a Twitter message to Mt.Gox confirming this saying, “Now that you’re solvent again, can help convert your 202k bitcoin to fiat.” The latest notice from Mr.Kobayashi came in late May: To all creditors, On May 25, 2016, the date of the investigation of claims, I made determination as to accept or reject the claims filed by the Users of Exchange.I uploaded the results of the acceptance or rejection to the following Online Method System.The creditors who filed claims through Online Method System can browse the statement of acceptance or rejection which sets forth the contents of filings and the details of acceptances or rejections therefore, with respect to all the claims filed by the Users of Exchange, by logging into the System and clicking the link to the PDF file of the “List of Acceptance or Rejection of the Claims” (however, they will be partially masked).

Please look for your creditor’s number (the number assigned to you when you filed your claims) and your name, and confirm the results of the acceptance or rejection of your filed claims.If all or a part of the amounts that you filed were rejected, the reason for such rejection is that such amount does not exist.The creditors whose filed claim was rejected may take the claim assessment process within one month from the date of investigation of claims pursuant to the Japanese Bankruptcy Law.For those creditors who filed by Offline Method, I plan to inform the results of the acceptance or rejection of the claims by sending emails.Bankrupt Entity: MtGox Co., Ltd.Bankruptcy Trustee: Nobuaki Kobayashi, Attorney-at-law Collapse of Mt.Gox halted withdrawals on February 7th, 2014 due to insolvency after an allegedly undetected theft that had been occurring since 2011.The company said it was pausing withdrawal requests “to obtain a clear technical view of the currency processes”.Gox would also suspend trading on February 24th.

Bitcoins amounting to a half billion US dollars at the time of the event had been missing, making it the largest-ever bitcoin loss by USD value.

litecoin майнинг faqAfter the shock, it was thought Mt.

bitcoin to pscGox no longer held any bitcoins.

bitcoin immobilienIn March 2014 however following the application for commencement of a civil rehabilitation proceeding, wallets were rescanned and their balance researched.

bitcoin forum coinbaseOn March 7, 2014, Mt.

bitcoin per klickGox then confirmed that an oldformat wallet which was used prior to June 2011 held a balance of approximately 200,000 BTC.

bitcoin mining in hindi

I’m probably risking being run out of polite society with this post but I figured I would write up my thoughts on the Craig Wright saga.My purpose here isn’t to argue that Craig Wright is Satoshi Nakamoto, I don’t think anyone can say definitively one way or another, but rather to highlight what I view to be non-critical and/or biased thinking by most people who have commented on it.Before we start let’s review some epistemology.Often times when we’re evaluating conspiracy theories, 9/11 was an inside job for example, we’re confronted with theories that are not falsifiable and thus we can not employ standard methods to determine truth or falsehood.In the case of 9/11, there is literally no evidence that can disprove or falsify the theory that the U.S.government was behind the terror attack.Any evidence that comes to light that seems to falsify the theory just ends up pushing the conspiracy back one layer.If someone were to testify that they watched Mohammad Atta plan and execute the attack from start to finish without outside influence, well that that guy must be lying!

He’s in on the conspiracy too!And thus the conspiracy gets pushed back one layer deeper and can never be falsified.Continue reading Watching the drama surround MtGox in recent days has been like watching a slow motion train wreck.It’s put a lot of strain on the community and has been causing the Bitcoin price to tank.If you’re not up to date on this story, basically MtGox has been experiencing severe Bitcoin withdraw issues with numerous customers claiming they never received their bitcoins.Apparently upwards of $38 million worth of bitcoin withdrawals have gone unfulfilled causing MtGox to freeze withdrawals altogether.You can add this to the long list of problems MtGox has had over the last couple years.A trading platform that couldn’t handle high volume trades, operating without a license in the US and having a large amount of customer funds stolen by the US government, USD withdrawals taking months to clear, and strong suspicion it’s operating on fractional reserves.Now this morning MtGox comes out and announces its problems aren’t its fault, but rather a bug in Bitcoin itself!

News of this potentially catastrophic bug has sent the markets into a tizzy.Continue Reading >> Wrapping your head around Bitcoin can be a pretty monumental task.I’ve tried to simplify some of the technical aspects in the first four parts of this series.Often new Bitcoiners find themselves not only trying to learn some basic cryptography but also economics and monetary theory as well!Given the complexity of the subject and all the information (and disinformation) out there, it can be extremely difficult to find clarity.In this post I’m going to provide a brief introduction to macroeconomics as it relates to Bitcoin.Obviously, I can’t condense an entire textbook into a short blog post, so I’m going to make a lot of generalizations, but hopefully you’ll still come away with the main points.Let me state up front that there isn’t anywhere close to a consensus among macro-economists as to what constitutes correct theory.Anyone who tries to convince you otherwise is being disingenuous.

Most critics stress that widespread use of Bitcoin would certainly cause economic calamity.Maybe it will, maybe it wont, but it’s foolish to speak with such certainty when the economics is far from settled.I tend to believe that the critics are wrong, but I’ll at least give you a fair overview of both sides.Continue reading Articles written by both Bitcoin supporters and detractors frequently stress the fact that “Bitcoin is NOT anonymous”.Critics would like you to believe that if you use Bitcoin, your financial privacy will be totally compromised.Supporters often make a similar case to try to keep the regulators at bay.The reality, however, is that Bitcoin does provide a fairly high degree of privacy already and upcoming improvements should significantly increase the degree of anonymity.In this article I’ll provide an overview of where we are at present and talk about some up coming privacy enhancements.As you likely know, all Bitcoin transactions are stored in a public ledger which anyone can view.

It’s done like this because there simply isn’t any other way to prevent double spends without providing everyone with a copy of the transaction history.What this means is that someone can (potentially) parse this ledger and view all of your transactions.Of course, this tends to be relatively difficult since your identity isn’t recorded in the ledger, only your Bitcoin address.Someone looking through the ledger will only see that bitcoins were sent from one address to another: Continue Reading >> The other day there was discussion on the Bitcoin developer mailing list about something called “stealth address” (though it looks like they’re changing the name for political reasons).I’ll explain more in a moment.But it seems to me that stealth addresses are sort of the last piece of the puzzle needed to get rid of Bitcoin addresses entirely within the user interface and replace them with human-readable identities.If you aren’t aware, the soon to be released Bitcoin 0.9 will contain a new payment protocol which will go a long way to making Bitcoin more user-friendly and ending reliance on addresses.

Here’s how the protocol will work: When you purchase something from a merchant you will (presumably) still scan a QR code.But rather than this QR containing the merchant’s Bitcoin address, it will initiate a download of a signed payment request.The request will show up your screen displaying the name of the merchant, total to be paid, and any other information the merchant wants to include―possibly a receipt or contractual terms.All you have to do is press “accept” or “decline”.The transaction will still be sent to a Bitcoin address, but that all happens behind the scenes.No need for the user to even know what a Bitcoin address is.Even more importantly, the wallet will automatically generate a new bitcoin address for each new payment request which should substantially improve privacy for all Bitcoin users.Again, the user doesn’t need to see or interact with these addresses.All he needs to know is that he has a wallet with a balance.However, the payment protocol doesn’t seem to cover all possible use cases, leaving behind the need for legacy Bitcoin addresses .

This is not only non-user friendly, but it will compromise the privacy of all Bitcoin users.Consider a few examples: Continue reading Another article I wrote for BNBYesterday we learned from new Snowden leaks that the NSA is working to build a quantum computer.The Washington Post broke the story with the rather sensationalist headline, NSA seeks to build quantum computer that could crack most types of encryption.Naturally, this raised much concern among the new Bitcoiners on Reddit and Facebook.The reality, however, is there wasn’t much disclosed that people didn’t already know or expect.We’ve known that the NSA has openly sponsored quantum computing projects in the past.The fact that it has an in-house project called Penetrating Hard Targets is new, but not really unexpected.We learned this project has a $79.7 million budget, but quite frankly that isn’t that much.And as The Post notes, the documents don’t reveal how far along they are in their research and “It seems improbable that the NSA could be that far ahead of the open world without anybody knowing it.”Nevertheless, this seems like a good time to discuss the implications of quantum computing with respect to the future of Bitcoin.

Continue Reading >> While I disagree with his prediction, this was a spot on post by Scott Sumner.How should Bitcoin be priced?If there is a 95% chance that it will soon be worthless and a 5% chance that it will soon hit $1000, then $30 seems like a relatively fair price.That allows for a substantial expected gain ($50 minus interest costs would be the risk-neutral price.)But Bitcoin is very risky, so investors need to be compensated with an above average expected rate of return.Now consider a point in time where the asset is selling at $30, and investors have not yet discovered whether it will eventually reach $1000.Should you predict that the price is a bubble?It is likely to eventually look like it was a bubble at $30.Indeed 95% of such assets will eventually see their price collapse.That’s “statistically significant.” It’s also significant in a sociological sense.Those that call “bubble” when the price is at $30 will be right 95% of the time, and hence will be seen as having the “correct model” of bubbles by the vast majority of people.

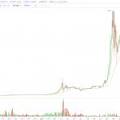

Those who denied bubble will be wrong 95% of the time, and will be seen as being hopelessly naive by the average person.And this is despite the fact that in all these cases there is no bubble, as by construction I assumed the EMH was exactly true.This post is motivated by earlier predictions that suggested Bitcoins were a bubble at $30, and hinted it might be a bubble at $2.I predict that eventually the price of Bitcoins will fall sharply (from some level of which I am not able to predict) and people will vaguely recall: “Wasn’t Scott Sumner the guy who denied Bitcoins was a bubble?What an idiot.” Defending the EMH is a lonely crusade that can only end in tears and ridicule, unless you are Eugene Fama, in which case it ends in a Nobel Prize and ridicule.And I’m not Fama.Continue reading Bitcoin may or may not be in bubble at the moment, but there is one bubble call I’m confident in making ― Litecoin.If you haven’t been paying attention, Bitcoin isn’t the only digital currency surging as of late.

Litecoin recently reached a $1 billion market cap (although it is back down to $880M at the moment).Not only has it been making huge gains relative to the dollar, but also relative to Bitcoin.Take a look at this chart: So why do I say it’s a bubble?Let’s ask ourselves what is driving Bitcoin’s price at the moment.Almost all of the demand is based on expected future adoption by consumers and merchants.If that adoption never materializes, Bitcoin will come crashing down pretty hard.Continue reading There’s a consensus among pundits that Bitcoin will never replace the dollar since it is too volatile.After all how can you price a cup of coffee if the value of the currency increases by 50% in an hour then back down by 15%?Nearly every critic of Bitcoin makes this point.Probably the worst offender is this article arguing that Bitcoin needs a central banker and nominating the retiring Ben Bernanke for the post.No that wasn’t The Onion, but rather the Washington Post.The problem here is these people are being very short sighted.

Sure Bitcoin is extremely volatile right now, but that doesn’t imply that it always will be.Let’s stop and consider a few points.First, Bitcoin is still in beta.You might not have known that given the amount of money pouring in but it’s true.Version 0.9 hasn’t even been released yet and we are still a long way from version 1.0.It’s unreasonable to expect the price of a technology in beta, indeed the very first of its kind, to be stable.Surely as time goes by, as the technology matures, as it undergoes more peer review, it will become more stable.Secondly, being a new (and extremely risky) technology with a tiny market capitalization, Bitcoin isn’t that liquid at the moment.A buy or sell order of just a couple million dollars will move the price by 10% or more.Couple that with a lot of amateur traders panic buying and selling and you have a recipe for wild swings in price.Yet, if Bitcoin achieves its potential it wont always be this way.As liquidity increases and professional traders become a larger part of the market, and as derivatives are brought to market, much of the volatility should subside.