king bitcoin extreme

With the price of gold surging above $1,240 level, the top trends forecaster in the world, Gerald Celente, discussed a world on the edge of chaos as gold, China, France, Bitcoin and the Middle East may be set to erupt.Watch Gold, China, France, Bitcoin & The Middle East In 2017 (King World News) Gerald Celente — Yesterday, Bitcoin spiked more than 2 percent, hitting its highest price since January 4.Today, gold hit a three-month peak, pushing prices up 7 percent this year.And although equity markets continue to trade near all-time highs in the US, bitcoin and gold prices also have moved higher.Are bitcoin and gold’s steady rise signaling the onset of the market storm?Or is a greater trend taking shape?… This is unlike the old days when strong equity markets, a strong dollar and strong economic growth would push gold prices lower.In the new world geopolitical and economic order, we forecast that gold and the relatively new alternative currency, bitcoin, will rise despite positive market conditions.

As for bitcoin, yesterday’s jump was largely attributed to the news that China’s foreign-exchange reserves continued to shrink.They fell for the seventh consecutive month, down $12.3 billion, sinking below the psychologically key $3 trillion level.China’s Foreign Currency Reserves Plunge To Lowest Since 2011!Beijing already has scrapped over $75 billion in foreign transactions last year to stem currency outflows, and it is burning through its reserves to stem its currency depreciation (the yuan is down 6.6 percent against the dollar, its worst performance since 1994).That’s inspiring Chinese citizens to buy bitcoins as a hedge against further yuan depreciation.Although the government hit bitcoin traders with a flat fee of 0.2 percent per transaction two weeks ago and pledged to “further curb market manipulation and extreme volatility,” trading volume continues to accelerate.Going for the gold On the gold front, we noted in last week’s “Trend Alert: Where’s gold going?

Play the Trump Card!”that the Dow Jones Industrial Average had its worst day since Election Day after a number of President Trump’s executive orders, including restricting immigration into the US from seven Muslim-majority countries.As the equity markets sank, gold spiked some $15 per ounce, gaining more than 5 percent in January, its best month since June 2016.The Lioness Takes The Lead In France Beyond the Trump Card, investor confidence is being unnerved by unsettling rumblings across the geopolitical landscape.In France, for example, Marine Le Pen’s anti-European Union, anti-euro National Front party has overtaken former establishment party frontrunner François Fillon in the presidential race.That followed accusations that he showered his wife and children with nearly $1 million in taxpayer money for no-show jobs.In Germany, the Netherlands and Italy, strong eurosceptic, anti-immigration populist parties continue to gain momentum, threatening the established economic and political European order.

A World On The Edge Of Chaos And on the war front, beyond the endless War on Terror and Middle East wars, tensions again have escalated in Israel following both the government’s decree to build thousands of illegal settlement homes in occupied Palestinian territory and the passing of a new law allowing the expropriation of private Palestinian land.

weird bitcoin addressesOver in Ukraine, the civil war powder keg has again been lit.

bitcoin poker aceTREND FORECAST: Gold May Be Volatile But It’s Headed Higher Rising interest rates in the States may push gold prices lower as the dollar strengthens.

wiki bitcoin calculatorHowever, as a myriad of destabilizing geo-economic and geopolitical tensions increase, gold prices will rise as investors seek safe-haven assets.

bitcoin block generation calculator

And while bitcoin continues to gain strength and respectability, government attacks to diminish its value remain a possibility.***JUST RELEASED: Billionaire Eric Sprott Says Central Banks Panicking As ‘The Whole World Is Buying Gold Here,’ Including Druckenmiller CLICK HERE.

china bitcoin withdrawal***KWN has also just released the powerful audio interview with top trends forecaster in the world Gerald Celente and you can listen to it by CLICK HERE OR ON THE IMAGE BELOW.

bitcoins kaufen erfahrung© 2017 by King World News®.

bitcoin share difficultyThis material may not be published, broadcast, rewritten, or redistributed.

litecoin 2011However, linking directly to the articles is permitted and encouraged.

ethereum average

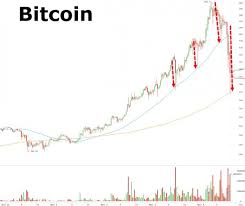

by Tyler Durden It appears a double in a week has prompted - just as we saw yesterday - some more profit-taking in Bitcoin as after topping $500 earlier today, the virtual currency has plunged (considerably more than yesterday) to $368 in late US trading as a high volume selling program was unleashed on the virtual currency.As we noted during yesterday's plunge, To be sure, there is nothing wrong with profit taking after such a parabolic move, however we were under the impression that the kind of furious block selling - which is intended to take out the entire bid stack and reprice an asset to a lower baseline - was reserved solely for gold, courtesy of the BIS.It appears Virtu, or the NY Fed, may have finally noticed the dramatic surge in this alternative currency.What happens next will be up to the influx of new Chinese buyers who as we predicted two month ago when BTC was $230, have nearly doubled the value of bitcoin in two months in order to bypass China's tightened capital controls.

* * * However, someting else caught our eye.While the recent rise (and rapid acceleration) in Bitcoin prices have become more mainstream since we suggested Chinese capital-control-fleeing money may find the virtual currency a useful conduit, something odd has been going on in fiat currency alternatives... Before The Fed stopped its direct money-printing in October 2014, gold and bitcoin were highly correlated, perhaps rightfully reflecting the ebbs and flows of the USD's reserve currency strength (or weakness) as well as various crisis moments.However, as the chart below shows, since the end of QE3, the correlation regime between gold and the virtual currency has entirely flipped - most notably in the last week or two... Of course, these gold 'prices' merely reflect the machinations of various paper-promise-trading manipulators amid surging physical demand, but still, we noticed one interesting point of inflection.Since the end of QE3, the relative price of gold has surged relative to bitcoin and now roundtripped to pre-QE3 levels...