jones gear bitcoin

by Tyler Durden Having just filed his 2016 taxes, a Zero Hedge reader submits the following bizarre story.On January 20, the reader filed his Federal tax return using Tim Geithner's favorite TurboTax software, which the IRS formally accepted three days later, on January 24.One week later, on January 31, the IRS made an automatic deposit into the reader's bank account, who then used the refund to pay down his credit card debt the very next day.This is when things turned bizarre, because as our readers writes, just two days later, without warning, on orders of the IRS his bank empties out the bank account handing over its contents to the IRS: "the IRS emptied our bank account February 3, 2017 for erroneous refund with no notice!(please see attached letter).The only other thing I could think of was that TurboTax did not work correctly and calculated to large of a refund but the letter from the IRS stated it was a "processing error at the Internal Revenue Service".The refund we received was the same as what TurboTax calculated.

I researched the IRS manual about erroneous refunds and could not find anything referring to a "R17" code as stated in the letter.Our return was fine.The amount of refund was fine.Not an identity theft problem.Error on their side.According to the person I spoke with they are doing this to a large block of filers.They seemed hesitant to give more info.He then adds that "in our phone conversation they told me that the return was fine and the refund amount was correct, it was not an over refund issue but some kind of IRS internal error and they would reissue the same refund after receiving the money back.It makes absolutely no sense to me but this is what I was told."So, as our reader summarizes, "no outstanding taxes.Always file on time.Not a small business, just a normal employee W2, not a structuring issue.Only typical deductions and student loan interest.Scrambling to cancel auto payments and trying to figure out how we will pay mortgage and any payment that will not accept credit card.

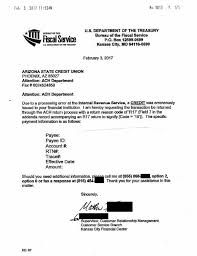

His question, "how can this be legal with no notice?"is not simply rhetorical.To be sure, the IRS has virtually unlimited rights over individual fund flows and stock, among which to: ... but all of the above are only permitted in the course of "due process", when an individual taxpayer has been found in violation of US tax laws.In this case the IRS counterparty was in no way at fault, and was merely the lucky recipient of a clerical IRS error, in the IRS' own words, without any justification or validation.That the IRS would then have full liberty to indirectly enter the account with no warning, and take out whatever funds it deemed appropriate - again, with no explanation of just what the "error" was - is sufficiently disturbing, and is why the person who this happened to would like to know if it has happened to other ZH readers and if so, does he have any legal rights in this particular case.The redacted IRS notice sent to the readers' bank, in this case the ASCU, is below:“Here’s to the crazy ones.

Perhaps Apple should have added a disclaimer: “As long as the ‘rebels’ don’t threaten our profit margin”.

bitcoin-qt man pageThe rebels no longer run the show at Apple Inc; the beancounters are now firmly in charge.On Wednesday February 5th, Apple attempted to strike a devastating blow to the bitcoin ecosystem on iOS by removing “Blockchain”, the last remaining bitcoin wallet app, from the App Store.Offering no explanation and no opportunity to address any issues, without any apparent change in circumstances other than the growing popularity of the independent and competitive payment system, Apple has eradicated their payment competition on iOS and left the bitcoin space entirely to competing mobile OSs like Google’s Android.These actions by Apple once again demonstrate the anti-competitive and capricious nature of the App Store policies that are clearly focused on preserving Apple’s monopoly on payments rather than based on any consideration of the needs and desires of their users.

The blockchain application is the same one that has been on the App Store for 2 years, with more than 120,000 downloads, no customer complaints, and a broad user base.The only thing that has changed is that bitcoin has become competitive to Apple’s own payment system.By removing the blockchain app, the only bitcoin wallet application on the App store, Apple has eliminated competition using their monopolistic position in the market in a heavy handed manner.Further demonstrating the arbitrary basis of this decision, Apple’s official communication says that the app was removed because of an “unresolved issue”, a claim that cannot even be disputed and boils down to “because we said so”.There was no communication prior to removal of this popular app, no indication of any problems and no opportunity to redress any issues, making a mockery of the claim that there was an “unresolved issue”.Sadly, Coinbase, Gliph, and CoinJar have all been sacrificed on the altar of innovation.Apple’s censorship of bitcoin applications, especially when viewed in the context of removing a 2 year app with 120,000 downloads is historic and unprecedented.

The decision attacks a nascent and innovative technology that is empowering more than 2.5 million users on a vast variety of computing devices, around the world by giving them unfettered and complete control over their money, while disrupting centralized payment systems controlled by corporate behemoths, such as Apple.The response of users to the restrictions placed on bitcoin applications have led thousands to flee to Google’s Android mobile OS, which offers a much more open environment for innovation.Unlike Apple, Google has accepted hundreds of bitcoin-related applications even though they also compete against the company’s own payment system “Google Wallet”.Bitcoin is a revolutionary new peer-to-peer currency and payment system that is empowering millions around the world, especially the unbanked and underbanked who can use it to gain access to international banking facilities with nothing more than a smartphone.Bitcoin’s use for international payments from family members sending money home to support entire communities in the developing world and for charity fundraising and fund distribution will be severely affected by this decision.