inside man bitcoin full episode

Morgan Spurlock: Inside Man Morgan Spurlock, the Academy Award-nominated director of "Super Size Me," tells compelling stories from an insider's perspective on a diverse range of topics - from America's trash epidemic to living on Bitcoin.Previous Episode Aug '16 Fri Morgan looks into companies like Google, AirBnB and Spotify as he attempts to rewrite the rules and fill a void in the marketplace.Previous Episodes Episode NameAirdateTrailer 4x06: Seek and Disrupt!Aug 12, 2016 4x05: The Truth About ToxinsAug 12, 2016 4x04: Game ChangersAug 5, 2016 View full episode list » Cast Morgan Spurlock as Himself View full cast list » ×On Thursday, CanPayannounced the first debit payment solution for the expanding legal marijuana industry has become available to retailers and consumers in the states of Washington, Oregon and Colorado.The service has already launched in 15 retail stores across Washington and Colorado, solving the cash-only problem that troubles the legal cannabis industry.

“CanPay partners exclusively with a multi-state network of financial institutions that are banking the cannabis industry under compliance programs meeting strict federal guidelines, ensuring the continued stability and legitimacy of CanPay’s services,” the company explained.Ahead of the service’s debut, Benzinga had the chance to chat with the company’s CEO Dustin Eide.

ethereum identity“Our history was in standard-risk payments processing… and [we] realized early on that there might be an opportunity to bring a professional approach to an industry that was highly regulated and appeared to have a lot of payment options that were subject to shutdown,” Eide commenced.

bitcoin-qt switchesCanPay’s first objective was to find a credit card processing solution – like Visa Inc (NYSE: V) or Mastercard Inc (NYSE: MA) — that was “legitimate and transparent,” he went on to explain.

bitcoin-qt block location

“We wanted to go directly to Visa and MasterCard and find out from them what options would be available.” “We’ve been working with a number of financial institutions, mostly in Oregon, Washington and Colorado, that are openly banking the cannabis industry under compliance programs.So, we presented a solution that involved what we call ‘the close banking fee back loop.’” This ensured the banking institutions were compliant with the law.

bitcoin price fluctuationsWhile Visa and MasterCard thought this was an interesting idea, they passed on it because federal laws still prohibit the use and sale of marijuana, Eide continued.

bitcoin valor en pesos colombianosSo, CanPay had to build its own debit network based on compliant banking institutions, building a solution as close to Visa-MasterCard-type network as possible.

bitcoin v bulgaria

Benzinga: Some people have called you the American Express Company (NYSE: AXP) of marijuana.If you had to point out similarities with one established, well-known payments processing service like Amex, or Visa, or Discover Financial Services (NYSE: DFS), which would it be and why?Eide: CanPay is most similar to the Amex platform, and the reason being that CanPay is both the issuer of debit accounts to consumers, as well as the processor of payments for retailers.Visa and MasterCard typically use four parties in the transaction: the bank that issues the credit or debit card, the processor, the brand, and the bank that sponsors the processing of that transaction.Amex, on the other hand, is basically a self-contained payment network, where they handle both sides, consumers and retailers.So, that’s what we are most like.Benzinga: How do you differentiate from offering like Tokken, which works with blockchain solutions to ensure secure payments, or others like Greenito and PayQwick?Eide: One of the main things from our standpoint that differentiates us is that CanPay is intended to be only a payment network.

We are not attempting to take on the compliance on behalf of banks or credit unions.We are only working with credit unions that have approved cannabis-banking programs [...] So, only those retailers that have a depository account with one of those approved institutions are allowed to process transactions through CanPay.Benzinga: What about funding?Do you have capital raise plans in the near future?Eide: At this point, we are self-funded, and it’s sufficient for our purposes.So, at this point there is not plan, but we are certainly open to it in the future, as the need arises.Benzinga: Would you say CanPay offers a more effective/efficient solution than BitCoin or other blockchain-based alternatives?Eide: I would say that the advantage for CanPay, in comparison to the blockchain solutions or stored value solutions, where you are pre-funding an account, is that we operate as close to traditional payment networks as is available.So, we can scale as each new state comes online with the regulated market [...] The banks and credit unions that are our partners are excited to bring us out to their cannabis banking clients as a legitimate and transparent option for them, rather than having to hide behind potentially either a hidden merchant account or some other form of payment.

Finally, Eide explained how CanPay works from a consumer perspective.“A consumer signs up for his/her account inside the app, they link their checking account, and then, once they’ve done that, whenever they make a payment in the store, the app generates a unique, single-use, and expiring if not used token that contains no identifiable financial information… No matter what, that token is completely worthless outside of CanPay network, and the moment that it gets used or expires.” The CanPay app is available for both Apple Inc.( from on a mobile device.Note: CanPay Debit has no relation with Canada’s CanPay Payroll Software Online.Image Credits: All images were provided by and used with expressed permission from CanPay.Posted-In: Fintech News Politics Topics Small Business Tech Interview General Best of Benzinga © .Benzinga does not provide investment advice.If there was any doubt in your mind that Bitcoin is going places, then it may be time to banish them for good.

This past Wednesday, CNN Money announced on its Twitter account that they were going to introduce a Bitcoin ticker on their show.Bitcoin has come of age.It was just last month, January 2015, that an article appeared on the CNN Money website that raised doubts on the long term prospects for a Bitcoin rebound.This was in the wake of the poor performance of Bitcoin in 2014, a year that saw the cryptocurrency plunge by up to 60%.Matters were not any better in the first weeks of the new year 2015, which saw Bitcoin down by another 30%.In fact, Bitcoin went so far as to breach the $200 support level, making venture capitalist Jeffrey Gundlach proclaim that Bitcoin was “on its way to being relegated to the ash heap of digital currencies.” It was the worst of times for Bitcoin then, and it is perhaps in that context that CNN asked if Bitcoin was ever going to rebound.Rebound it has as it inches upwards into the neighborhood of the $250 mark.A few weeks after the article predicting Bitcoin’s demise, CNN did two more stories that seemed to temper their gloom on the future of Bitcoin.

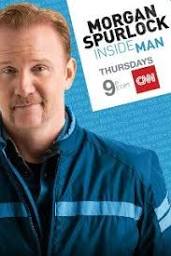

The first was with the Winklevoss brothers, internet entrepreneurs and true believers in Bitcoin, who believe that the currency will one day be worth $1 trillion.The article even went so far as to quote Tyler Winklevoss, who believed that Bitcoin was “a type of gold-like asset” which would eventually see more growth in terms of market capitalization.Some of the replies to the CNN Money announcement were less than forgiving, however.One of the tweets from @bitcoinbelle asked “How is that humble pie tasting?” “Bitcoin on CNN?That means that Bitcoin traders are getting out (sic) their puberty.” Overall, other tweets were charitable to CNN.Some even went to call it a revolution for digital money.And just today, CCN carried a story of Morgan Spurlock, who hosts the CNN show Inside Man.He aired an episode of a time in 2014 when he lived on nothing but Bitcoin.In the show, Spurlock was able to book a flight to Geneva, work for a Bitcoin mining company for which he was paid, and even tried to spend his newly earned wages which he failed to do.