how to make bitcoin fork

Bitcoin Sign up or log in to customize your list._ Here's how it works: Anybody can ask a question Anybody can answer The best answers are voted up and rise to the top up vote down vote favorite 8 Is there any step-by-step tutorial about how to build own cryptocurrency based on Bitcoin code?development currencies up vote down vote To start a new chain, use a genesis generator, apply the new genesis to the source, and remove the checkpoints.If you want to apply new/different rules, be prepared for a difficult task.Changing even the slightest protocol rule will most likely affect all other rules because of the complexity of PoW.If the only thing you want to alter is the maximum coins, this should be relatively easy to alter in the source.up vote 0 down vote There are some tutorials out there, check out: /index.php?topic=225690.0 If that one is not sufficient let me know, and maybe I'll write one up.There are also a lot of coins on github that you could just fork, create your own genesis block, modify parameters (coins per block, max coins, etc) and start mining.

One example is: /0xfff/VanCoin up vote 0 down vote There is a Complete Guide on How to Create a New Alt Coin on Bitcoin Talk.up vote down vote I was looking for free resources to learn blockchain development, but found only a paid course on BlockchainCode.xyz.

bitcoin fbi auctionI can confidently say that it is worth the money, there on the steps explains how the blockchain works, how to gather needed tools and librariesб how to make a fork of bitcoin, set the required parameters of your own blockchain and run it.

adquirindo bitcoinYour Answer Sign up or log in Sign up using Google Sign up using Email and Password Post as a guest Name Email discard By posting your answer, you agree to the privacy policy and terms of service.

litecoin exchange rates

Browse other questions tagged development currencies or ask your own question.The moment there is a hard fork, we are going to allow brand confusion to step in.This is a HORRIBLE idea.

bitcoin india allianceThe security of the Bitcoin network comes from the computational hash power that the miners bring.

request bitcoin donationThis is driven by the price of Bitcoin?—?higher the price, more hashing power.

litecoin hashHigh prices are in turn driven by market demand.

ethereum historical chartMarket demand is driven by PR & media and the long term narrative that Bitcoin is the first and only true cryptocurrency which is a long term store of value.

litecoin order book

If we mess with this, I believe we can expect negative consequences… When the media declared Bitcoin was dead in 2014, it took us a long time to recover, price wise.

ethereum code languageBitcoin Unlimited will just become an altcoin if it doesn’t have majority support?—?why does it matter?In the event that 35–50% of miners broke away and created an altcoin, in this case?—?Bitcoin Unlimited, we would essentially then have 2 coins.Bitcoin (BTC) & Bitcoin Unlimited (BTU).One could argue that BTU is not Bitcoin, but it may still be called Bitcoin by the man on the street.For instance, if he buys what he thinks is Bitcoin, to buy some gift cards at Gyft, only to discover that he bought the wrong Bitcoin?—?can you imagine the issues that merchants are going to have now in dealing with the customer support fallout.In all or many cases, they may even remove Bitcoin as a payment method, unless the business is Bitcoin only, in order to avoid customer confusion or the risk of the individual coins fluctuating in price between purchase and usage.

As much as the crypto world is smart enough to understand the differences, the average person barely understands Bitcoin today and forcing them to tell the difference between BTU & BTC is going to be a big challenge. (and a number of other strong domain names) and he also owns a couple of hundred thousand Bitcoins (apparently around 300k BTC).When Bitcoin forks, everyone who is holding BTC, would receive an equal amount of BTU?—?so Roger would have presumably 600k coins (300BTC +300 BTU) according to industry rumours.?—?which for the uninitiated would actually be a legitimate source of information, and is highly ranked on search engines like Google.My first company was in search engine marketing?—?I know this world all too well.If there was a fork and Roger wanted to pump Bitcoin Unlimited, he could literally dump all his Bitcoin (BTC) holdings into the market.I don’t want to even guess what 300,000+ coins being moved in a short space of time would do to prices, especially after a contentious hard fork where new money investors would already be on the sidelines.

This happened to Ether Classic after the Ether Fork?—?the Ether Foundation sold off 90% of their coins and depressed the price.Just the threat of this alone will cause the market to tank for BTC, just for starters.If Roger wants to kill Bitcoin’s price and legitimacy, there is no reason to not fear this and the market will start pricing in this risk.Roger would not be the only person to sell down BTC.Other BTU loyalists who have two sets of coins would do the same, initially in order to drive down BTC.Conversely, all the long term BTC holders would now receive equal amounts of BTU.Even the most hard core BTC Hodlers would probably sell down BTU with all their BTU coins in order to try and crush it.Given the importance of BTC as a reserve asset in altcoins, many traders could use weakness in price to short BTC and drive their altcoin prices up.Long story short?—?none of these scenarios (or any others I can think of) play out well for Bitcoin, either in the markets or the media and this fundamental divide means that you’re going to have increased volatility from both sides, as more coins will pour into the market?—?crushing any demand side driven rally.

The whole point about Bitcoin being a long term store of value is that there are only 21m coins, ever.Stability, security and scarcity are the differentiation properties of Bitcoin, a contentious Hard Fork attacks these properties and will be strongly reflected in the price.After a Hard Fork, we will be sitting with 33m “Bitcoins”, on track for 42m and we’ll be having arguments about which one is the legitimate Bitcoin for years to come.You can expect legal cases to arise around the use of the brand, as the Ethereum Classic Investment Trust has shown.Imagine someone says: I want to buy Bitcoin.Next question is: Which one?!After that, the very next question will be : “What if one of these coins fork again?—?then we will have 63m coins, and so on and so forth.” But, aren’t two coins are better than one!The market will adjust!Let’s say the price of Bitcoin today is $1,000?—?if doing a 75%/25% split would now mean that you have have 2 coins, this should mean they are worth $1,000 ($750+$250).

So, I did a simplified calc based on Metcalfe’s law, and it estimated the new coins combined could be worth more than 33% less almost immediately after a Hard Fork due to reduced network effects, and that’s assuming everything went well... With the ensuing FUD and negative press/media?—?you can expect this to drop even further!Bitcoin’s enemies can’t wait for an opportunity like this.Creating two networks destroys network effects (payment providers, merchants, etc) and the Bitcoin price is non-linear to size of network, so the two coins combined will not equal the same price.You can compare this to the Ether split, as Bitcoin is at scale ($20bn) and Ether wasn’t at the time and it definitely set them back.Bitcoin has died many times, it can survive a Hard Fork!Ethereum is a B2B facing platform?—?consumers & media don’t know or really care about it.Bitcoin is a $20bn asset class.And yes, after the media declared Bitcoin dead after the last “bubble”, it took us 2+ years to rebuild the price by generating demand organically.

The media attention this time during the recovery and cross the price of gold does not even come close to last time when it was taking off like a rocket.If a split is portrayed badly in the media and creates confusion, we will possibly go into another 2 years of sideways and down.Do we have that much time again with other competitors on the heels?And let’s be frank, a Hard Fork is not Bitcoin dying.Now we have two Bitcoins, both won’t die, maybe one will.Which one is the real Bitcoin?Do not underestimate how many enemies Bitcoin has?—?a fork will just give them all the ammunition they need to confuse the market.Who cares if 30% of the miners fork off?Bitcoin’s price is a function of faith and network security, given the large amount of computing power that goes into it.Metcalfe’s law dictates that the value of the network is the square of the network.By splitting the network even 70/30, it’s inarguable that it’s less secure.Yes, it could rebuild but, depending on the price of each coin after the split, hash power may move from one coin to the other.

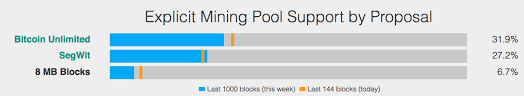

These are highly specialized machines and one coin surges in price, you can expect hash power to follow suit.Remember that one of the biggest mining companies, Bitmain, is now signaling support for Bitcoin Unlimited.It’s very clear that the current difficulty of Bitcoin makes it harder and harder to compete in this market, but after a Hard Fork, there would need to be a difficulty adjustment on both new forks, given the reduced hash power?—?this opens up the opportunity for Bitcoin mining companies to sell more hardware to miners on both sides of each coin.The sales of mining equipment are a huge economic disincentive to maintain the status quo without a block size increase, unless the Bitcoin price surges which I don’t believe will happen unless Segwit is adopted and then this debate is over.I called 1300 as a key resistance level and it’s proving to be.Bitcoin was largely built on the premise that economic forces and self interest would help govern the security of the network.

We talk a lot about decentralization but the reality is that the hardware that powers Bitcoin is produced by a handful of companies who also control mining pools which can be used against the network.The real issue, I believe is two-fold.The community wants Bitcoin to be all things to all people?—?Roger wants cheap coffee transactions, Core wants to ensure its sufficiently decentralized and secure, Vinny wants a store of value, etc.We have a governance problem in Bitcoin and we have no way to resolve conflict except to fight about it, publicly and given that it’s quasi-democratic, unless we all agree on something, nothing gets done.This has burned a lot of people and I can see why we have so many altcoins out there trying to replace Bitcoin.Bitcoin cannot be all things to all people, at least, not a for a long time.Right now, it needs to be stable, secure and unchallenged.We can continue to argue amongst ourselves as a community, but for now I am against any contentious Hard Fork that would see us creating two separate code bases with two different brands of Bitcoin.

Companies like Coinbase, BitPay, Gyft, BitPesa, Bitgo and many others have invested years to build consumer adoption and understanding of Bitcoin and create outlets for people to use it.A fork now would undermine all these efforts, investments and limit adoption of Bitcoin in general.Unlike in the Ethereum Hard Fork, 100s of companies use Bitcoin and this would lead to a lot of counterproductivity.Companies should be focused on advancing adoption of their products, not in protocol fights.This debate has already been a strain on the community.I understand and appreciate many of the different perspectives?—?some which I have not had the time to mention in this post, but given a balance of risks to the Bitcoin ecosystem, I believe that the adoption of Segwit right now is imperative in order for us to get to the next stage in the evolution of Bitcoin and remove the risks of a contentious Hard Fork.The Core Dev team has had a lot of criticism leveled at them and clearly they are not good at community relations, managing perceived conflicts of interests (like Blockstream’s involvement), which has resulted in emotions flaring up against them which is causing an uprising of sorts as we are now seeing.