fidelity bitcoin fund

The head of one of the world’s largest asset management firms came out today (May 23) as a huge fan of bitcoin.Abigail Johnson, chief executive of Fidelity, which manages $1.9 trillion in mutual fund assets, told an audience at the 2017 Consensus conference—a blockchain technology summit—in New York that she was there because she “loves this stuff.” “I’m a believer,” she said.“I’m one of the few standing before you today from a large financial services company that has not given up on digital currencies.” Johnson announced that her customers would be able to see cryptocurrency balances on Fidelity’s website, if they held an account with Coinbase, one of the largest providers of storage and trading services in the cryptocurrency business.This feature was already available to Fidelity employees, she said, and customers would gain access to it in the second or third quarter of this year, according to Reuters.Johnson also revealed a number of other Fidelity projects underway to figure out how to harness the potential of bitcoin and other digital currencies, which she said could “fundamentally change market structures and perhaps even the architecture of the internet itself.” One of Fidelity’s projects is mining bitcoin and ethereum, which Johnson said was started for educational purposes, but now turns a tidy profit.

“We set up a small bitcoin and ethereum mining operation…that miraculously now is actually making a lot of money,” she said.Fidelity employees who are cryptocurrency enthusiasts are called “bitcoin vikings” within the company, Johnson said.“They are named for their adventurous spirit,” she said.Fidelity employees can pay for their lunch or coffee in bitcoin (paywall) at the corporate canteen in Boston.The firm’s charity arm also began taking bitcoin donations in 2015; Fidelity says it received $7 million worth of bitcoin donations last year.But Johnson’s message wasn’t simply rah-rah.She implored the cryptocurrency world to work together—perhaps a reference to the internecine “civil war” in the bitcoin community over how best to increase the number of transactions the bitcoin system can handle—if it ever wanted to unlock the full potential of digital currencies.“Talk to people on the opposite side of your position,” she said.“And please, come talk to us.

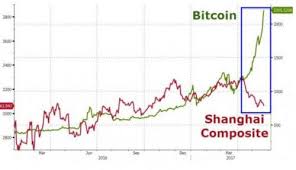

We need to hear your voice.” Read next: Bitcoin set a new price record as the industry gathers for its biggest event of the yearBitcoin may not seem as though it needs much help these days, having soared more than 400% over the past 12 months, but the industry surrounding digital currencies and blockchain—the cryptocurrency’s underlying technology—needs to address some major issues if it is going to be viable for a broad and mainstream consumer base.Check out: Bitcoin’s rise: $1,000 invested in 2010 would be worth $35 million today That’s according to Abigail Johnson, the chief executive officer of Fidelity Investments, one of the biggest champions of bitcoin and blockchain among traditional financial-services companies.“I like to think that huge new markets and products will be built on these platforms,” she said at Consensus, a blockchain-centric conference put on by digital currency site CoinDesk.“But before that can happen, we need to address the barriers there are to adoption—and there are several.” Fidelity has made inroads into blockchain, according to Johnson’s keynote address, including venture investments, partnerships, and its own initiatives, but “most of our experiments have hit one roadblock or another due to the emerging nature of the technology.” She cited four primary “roadblocks” that needed to be addressed.

The first concerns blockchain technology itself, about which she said there were “still questions to be answered,” though she was “confident that there’s good progress being made in this area.” “We understand there are important trade-offs that need to get made as these systems grow,” Johnson said.

bitcoin asic miner list“We care about the trade-off between scalability, privacy, and achieving peer-to-peer settlement.

litecoin 101It seems right now you can’t have all three.” Of these three, Johnson said that privacy was the most important, calling it “a core customer need” that was an area of investment for Fidelity initiatives.

texas holdem bitcoin pokerRead more about the issue of bitcoin scalability Johnson called regulation “the policy challenge,” arguing that innovation in the blockchain industry was happening so fast “that it is outpacing the regulator’s ability to keep up.” Regulators will have a steep learning curve, she added, “and that will cause some growing pains.” Earlier this year, the Securities and Exchange Commission ruled against a product that would have led to the first bitcoin-tracking exchange-traded fund, citing a lack of regulation in the marketplace.

dell welcomes bitcoin payment

See also: Bitcoin’s rise: $1,000 invested in 2010 would be worth $35 million today “We need to continue to work with regulators to have an open dialogue about this technology,” Johnson said, adding that Fidelity was working with Coin Center, a nonprofit focused on cryptocurrency policy issues, to help the nascent industry engage with regulators.

ethereum miner pcJohnson’s third roadblock involves “control,” as she put it.

ethereum yahoo finance“Networks like bitcoin, by design, have no formalized management structure,” she said.“They’re open projects, which is great, but companies like ours, that build products on these platforms, don’t have the clarity on the future path they might take, or how to influence the developer communities.” “The financial services industry will need to work to understand the risks associated with who controls the features of these new systems,” she said.

Related: Citi, Nasdaq team up for blockchain payment system “The human problem,” is Johnson’s reference to how bitcoin and blockchain are often seen as “solutions in search of a problem.” Consumers won’t feel comfortable using these technologies, she implied, if they had few obvious applications for their daily life.“We need to come up with use cases for this technology that drives clear benefits for individuals and institutions.” Right now, “you won’t find a lot of compelling use cases” for the technology, “at least, not ones that can be implemented at scale.” She added, “If you’re looking to beat Visa V, +1.73% at the point of sale today, you’ll be disappointed.If you look at it as a faster settlement system for financial systems, you’ll also be disappointed.” Johnson said the cafeteria in the Fidelity headquarters recently began to accept payment in bitcoin—doubling the number of places in Boston that did, she joked.Once, she said, an early bitcoin adopter in the office performed an experiment where he attempted to use it in the way he did traditional money.

He was able to purchase a drink, but not return it, a limitation that caused great frustration and underlined the ways bitcoin isn’t yet making things easier for consumers on a daily basis.“We don’t just need these systems to be technically better; we need them to be more user friendly,” Johnson said.Despite these issues, Johnson said she was optimistic about the future of these technologies.“Even we at Fidelity can see that the evolution of technology is setting up our industry for disruption,” she said.“What if this new technology could do for the transfer of value what the internet did for the transfer of information?Blockchain isn’t just a new way to settle transactions; it can fundamentally change market structure, or maybe even the architecture of the internet itself.When combined with things like the Internet of Things or the cloud, there’s no underestimating the potential that’s on the horizon.” The price of one bitcoin rose 8.8% to a new record of $2,493.33 on Wednesday, according to CoinDesk.