ethereum worth investing 2017

"Ten percent of my net worth is in this space," Novogratz said at a forum held at the Harvard Business School Club of New York Wednesday.He declined to say exactly how wealthy he is, but he's a former hedge fund manager at Fortress Investment Group and a Goldman Sachs partner who made the Forbes billionaire list in 2008.It's the "best investment of my life," Novogratz said.Bitcoin was worth under $500 a year ago.Today the digital currency trades at over $1,200.Back in 2013, Novogratz predicted Bitcoin's value would soar.He remembers people laughing at him at the time.Since then, Bitcoin's price has been on a wild run.It surged to nearly $1,000 in late 2013 and then fell to under $250 in 2015.It started to fly again last year, around the time of the Brexit vote.It surpassed $1,000 in January of this year again and has kept climbing.Now Novogratz is saying Bitcoin will go to $2,000.But he also warned the Harvard Business School Club crowd that there will "likely be a bubble" in digital currencies.

The best way to handle it, he argues, is the old Wall Street trick of diversification.Put a little money in a lot of different plays in digital currency.For example, Novogratz was also an early investor in Ether.It's another digital currency that has quickly emerged as the No.2 rival to Bitcoin.Novogratz says he bought Ether when it was trading for about $1.Today it's worth over $48.

bitcoin sender feeNovogratz met Vitalik Buterin, the young Russian brainchild behind Ether at a dinner party at a prominent CEO's home.

bitcoin amd benchmarkHe recalls that Buterin, then 21, showed up late, which struck him as shocking -- and a bit ballsy.

bitcoin ventures canadaHe figured it was worth paying attention to Buterin.

bitcoin 100 cnbc

Ether is a currency with a "smart contract" function that gives users additional security and abilities to transfer information in addition to monetary value.We're witnessing the "3rd inning" of this digital asset revolution, Novogratz predicts.He's not exactly sure how it will play out, but he plans to continue investing in digital currencies and Blockchain, the revolutionary technology behind the scenes that makes Bitcoin work.

wonderland bitcoinBlockchain is literally a digital ledger to record and track transactions.

bitcoin atm scanWhat makes it so technologically advanced is that multiple companies or parties can access the Blockchain and see the history of what happened to an asset.

bitcoin wallet ipadNovogratz has emerged as one of the biggest Wall Street cheerleaders of Blockchain, but his bets haven't always gone so well.

beyond bitcoin what to do with blockchain

He exited Fortress in 2015 after the company shut down his Marco Fund for poor performance.It lost around 20% in its final year after his investments in emerging markets, especially Brazil, tanked."We have had an extremely challenging two years, and I do not believe the current environment is conducive to achieving our best results," Novogratz said at the time.Bitcoin and other virtual currencies are on a tear this year, surpassing the returns seen in stocks, bonds and most other investments.

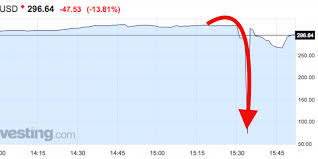

ethereum setup private blockchainThe price of bitcoin has tripled since the beginning of the year, surging above $3,000 for the first time Sunday before dropping by more than 10 percent the next day.Returns for ethereum — a lesser known but quickly growing cryptocurrency — have been even more dramatic: It’s gained nearly 5,000 percent, touching a record price of $407 Monday before coming down.Meanwhile, the amount of cash in virtual currencies has ballooned.

So what is going on?Some recent events may have convinced investors that these currencies are here to stay — including a move from the government of Japan to make bitcoin legal.But that only explains part of the rise, cryptocurrency experts say.Investors have been clamoring for a slice of the virtual market based on potential uses that have yet to materialize, says Garrick Hileman, a research fellow at the Cambridge Center for Alternative Finance.For instance, the currencies have the potential to disrupt the way start-ups raise money or how certain financial transactions are handled, experts say.But they’re also known to be volatile.To give you a better understanding of the digital currency world, we answered some key questions about these tools and highlight some of their perks and risks: A cryptocurrency is a digital alternative currency.That means it doesn’t have physical bank notes or coins and is not issued by a government.Bitcoin, one of the best-known cryptocurrencies, was started in 2009 by a software developer using the pseudonym Satoshi Nakamoto.

Bitcoin gained popularity as a way to send money quickly and pretty much anonymously, because transactions don’t need to be linked to a certain identity.Transactions are tracked on an online database called blockchain.People use bitcoin to send money to friends and relatives in other countries.But bitcoin has also been used for illicit transactions, such as to buy and sell drugs or to pay hackers during ransomware attacks.[What you need to know about bitcoin after the WannaCry ransomware attack] Toronto native Vitalik Buterin developed a younger cryptocurrency called ether in 2013, but most people refer to the digital currency as ethereum, the name for the blockchain it trades on.Ethereum sets itself apart for its ability to incorporate “smart contracts,” or computer-based contracts that only pay parties after certain conditions have been met and verified.(Imagine if you could set up an algorithm that automatically pays your dog walker only after you have evidence that your dog has been walked the agreed-upon distance, Hileman says.)

Investors are excited by the potential for these smart contracts, which could make it easier for start-ups to raise money and for businesses to complete international transactions, says Eric Piscini, a principal at Deloitte Consulting who focuses on cryptocurrencies.One common use for the smart contracts is for companies to raise money through what’s known as an initial coin offering, which give investors a chance to buy a new kind of digital token.(More on that later.)Why are prices so high for these cryptocurrencies?Demand for bitcoin and ethereum has soared over the past few months after a few changes contributed to their legitimacy.In April, Japan recognized bitcoin as a legal currency, boosting demand for the virtual coins.Some investors expect that other countries in Asia, including South Korea and Malaysia, may follow Japan’s regulatory framework and begin to accept bitcoin as a legitimate currency, says Dmitry Lazarichev, co-founder of Wirex, a platform where people can send and receive digital currencies.

[$100 of bitcoin in 2010 is worth $75 million today] But some experts say the rising prices of these cryptocurrencies may be based on speculation.Investors are focusing on what they the digital currencies will be worth in the future — and not on how they are being used today.Because the market for cryptocurrencies is still small, the price of these digital currencies can swing wildly up — or down — after a big development like what happened with Japan, experts say.Cryptocurrencies are also decentralized, meaning there is no government or central bank regulating the currency or taking steps to make sure it doesn’t move too much in anyone direction, Hileman says.Prices for bitcoin and ethereum have also jumped this year in part because there’s been a flurry of initial coin offerings, or ICOs, which start-ups use to create new digital currencies.Similar to a company issuing stock for the first time through an initial public offering, investors can use ICOs to purchase tokens issued by the company.

But instead of buying ownership in the company, investors are buying access to the company’s product or service, Hileman says.Tokens can become more valuable if a start-up — say a company trying to develop a new online storage system — is successful, he says.The tokens can also become worthless if the start-up fails.Where can I track their prices?[Why bitcoin just had an amazing year] What are the risks of these cryptocurrencies?Because the market for cryptocurrencies is still small when compared with traditional currencies, prices can be extremely volatile.That means people who own the currencies could face sudden losses.“There is no guarantee that the exchange rate for virtual currencies will be the same or higher the next day — or the next minute,” Lazarichev said.Because the currencies are virtual and unregulated, the transactions and exchanges can be vulnerable to hacks.The lack of government oversight also means that investors have no guarantee that they’ll get their money back if something happens, Lazarichev says.

People storing money in a traditional bank account, however, have up to $250,000 of their deposits at each bank insured by the Federal Deposit Insurance Corporation.The latest run-up in prices also has many experts worried that some of the cryptocurrencies, including bitcoin and ethereum, may be in a bubble that’s ready to pop.Don’t put any money into virtual currencies that you can’t afford to lose, Piscini says.And if you can, you should diversify by buying more than one currency, he says.Investors should also be skeptical of the start-ups trying to raise money through ICOs, experts say.If the creators don’t provide a detailed white paper explaining their plans that should be a red flag, Piscini says.How do you buy cryptocurrencies?The easiest way for people to buy cryptocurrencies is to use an online platform, such as Coinbase, Blockchain and BitGo, which lets you exchange dollars for digital currencies.Investors can also buy cryptocurrencies from other owners using peer-to-peer networks such as LocalBitcoins.