ethereum token price

The price of ether, the token that powers the ethereum blockchain, reached a new all-time high today, rising to what has become the latest in a string of record advancements.Ether's price rose to as much as $236.97 at roughly 12:15 UTC, an increase of more than 35% in 24 hours, according to CoinMarketCap.At press time, the alternative asset protocol had fallen back very slightly, trading at an average of $235.01.The price boost comes during an overall surge in the price of ether, climbing roughly 1,400% over the last three months amid the growing visibility of ethereum and a broader mainstream interest in cryptocurrencies.Markets are also being buoyed by word of additional exchange listings.Huobi, one of the largest bitcoin exchanges in China, started offering trading in the CNY/ETH pair.The major Chinese exchange spoke to ether's potential, asserting that the cryptocurrency could surpass bitcoin in several areas in its official announcement.While ether has been making progress toward greater adoption, its price has surged as cryptocurrencies in general have been drawing significant inflows, causing the total market cap of these assets to surpass $91bn earlier this month.

Amid this broader trend, ether has been differentiating itself from other cryptocurrencies, as its market cap recently surpassed 50% that of bitcoin's, a historically high figure.By contrast, ether's market cap was less than 5% of the market cap of bitcoin at the start of the year.

bitcoin gh/s wikiThe following is a list of App Tokens that we actively track.

nvidia opencl bitcoin minerYou may also Search and Track All Other ERC20 Token contracts on the Ethereum Blockchain

bitcoin lost dumpThe price of ether rose a meteoric 65% in April to touch $80, but already analysts are predicting that the digital token could pass $100 – and soon.

bitcoin nutzer deutschlandIn remarks to CoinDesk, cryptocurrency hedge fund managers were perhaps the most bullish about this projection, stating that they believe it will hit this mark in coming trading sessions.

raspberry pi bitcoin usb

Opened to the market in 2015, ether tokens, which power the ethereum blockchain, are up 2,800% from their original sale price during a fundraiser for the platform."I told my head trader two days ago that ether was going to hit $100, and probably hold there for a while," Tim Enneking, manager of Crypto Currency Fund, told CoinDesk.

litecoin one year chartArthur Hayes, operator of the cryptocurrency derivatives exchange BitMEX, agreed, predicting that ether's "massive bull run" will likely end with its price reaching $100, though he believe active traders will likely take profits and reassess the asset at this point.Still, not everyone believes that ether's price movements are worthy of the spotlight.Jacob Eliosoff, an algorithmic trader, pointed to what he called the "general hysteria" around the market for publicly traded cryptographic assets.(Data from Coinmarketcap reveals the total market added $11bn in April, compared to just $3.6bn in March.)

Such a development points to a broader narrative that suggests as bitcoin's price gains become more narrow, traders are seeking profit elsewhere."When ether is barely outperforming dogecoin, it's a strong sign that ethereum itself is not the real story here."Indeed, the price of tokens on the dogecoin blockchain has risen 133% over the last month, though dogecoin, founded as a joke project, has seen less institutional or developer traction.Other respondents pointed to the general trend of positivity around the ethereum platform as the reason for ether's gains.Ethereum has of late become the subject of interest of institutions including Bank of America and JP Morgan, as well as a budding ecosystem of decentralized applications that use the blockchain for automated operations.The result, according to Eliosoff, is that there is a growing belief ethereum will be among the platforms that prevail when market fervor settles."I give ether a good chance of being among the keepers."Track the price of ether on CoinDesk's new ethereum price page.

$100 bill image via Shutterstock The leader in blockchain news, CoinDesk is an independent media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies.Flash Crash and ICO Fever If you blinked yesterday, you may have missed something that sent some investors – briefly – into panic.The price of Ether experienced a flash crash on the GDAX exchange, falling from $328 to a temporary trading price of as low as $0.10.A “multi-million dollar” amount of Ether was dumped on the market, buying up orders between $317.81 to $224.48 and triggering a cascade of liquidations that sent the price plummeting.Despite quickly recovering, the event (which has happened before and will happen again) highlighted how much the market can be moved by a single whale – of which there are now many.The timing wasn’t ideal, as the price of Ether had already been experiencing significant volatility following the Status.im token sale.Status, which was raising funds to develop its mobile “gateway to the decentralized world of Ethereum” had raised so much money (exact amount to be confirmed) in such a short period of time that the Ethereum network ground to a near-halt.

At the time of writing, nearly 100,000 transactions have been sent to the Status.im token sale contract which opened 48 hours ago – this does not take into account the many tens of thousands of transactions that were not even broadcast through 3rd party services like MyEtherWallet.To put that figure into perspective, the entire network averaged only 50,000 transactions per day this time last year.The falling price may well have been a wake up call to those unaware of just how challenging Ethereum’s scaling problem is.With a maximum network throughput of roughly 15 transactions per second, there is desperate need for a scaling solution if Ethereum is to become the “world computer”.However, unlike Bitcoin’s scaling debate which has lasted a number of years, the solutions to scaling the Ethereum blockchain are generally agreed and may be realized in the coming months.These solutions include “offchain” payment channels like Raiden and the shift to a Proof of Stake consensus mechanism and “sharding“.

A proposal by the Ethereum Foundation’s, Nick Johnson also highlighted the potential for running token sales through an “offchain auction-based smart contract” which could dramatically reduce the pressure on the network.The honeymoon period of 1000% returns for Ethereum investors may be showing signs of fading.And with a very possible split in the Bitcoin blockchain in August, there is plenty of uncertainty ahead.Go to top Welcome to Crypto & V1.3 Release Notes Thanks to a sky rocketing price, Ethereum has grabbed the attention of many hundreds of thousands of new investors.Those same investors are no doubt looking at the last 48 hours in disbelief – possibly renewing some initial scepticism about the future of crypto. are – quite frankly – a bloody mess.But hardened cryptoasset investors will be drooling at the sight.We have been here before.We’ll be here again.And the fundamentals of Ethereum and others remain unchanged.For those looking for some speculation as to what happened in the last 48 hours: This Senate bill in the United States grabbed mass attention.

Bitcoin may split in two in the first week of August.V1.3 Release notes: Graphing updated to allow for more granularity Timeframe preferences are now available at the top right; no longer forced to only “Today’s” changes Users can now reset cookies from the preferences menu – deletes all cookies and resets to standard ETH/USD weighted average price 5-minutely data will now be available for up to 1 month (collecting from now) I will be adding some useful information to help new users purchase and secure Ethereum in the coming weeks.Go to top Bitcoin’s Blockchain May Split In Two.Amidst the wall-to-wall hype in the cryptoasset space, a storm is brewing in Bitcoin that may setback much of the recent gains.Those new to Bitcoin will be unaware of an impending hard fork (blockchain split) and what its implications may be on the price of not just Bitcoin, but Ethereum too.It is worth taking the time to understand what is set to happen in the next 2 months so as to avoid being caught up in the panic.

Bitcoin is having difficulty scaling to meet its increasing demand.The network cannot scale because each Bitcoin “block” (set of validated transactions with a 1mb limit) is full.As a result, transactions are being left in situ for hours and days before squeezing their way into a block.A side effect of this is that users are spending more and more on transaction (tx) fees in the hope that it will incentivize a miner (who receives the tx fee as a reward) into including their tx in a block.There are solutions to this problem, however these solutions are contentious.So contentious that a community of Bitcoin idealists, developers, and business leaders have created an orgy of character assassination and conspiracy theories.After more than 2 years of debating these solutions, it appears that the route forward may be coming to a head in the very near future.Bitcoin Splits I want to avoid details of the different scaling solutions, and instead look at a likely split in the Bitcoin blockchain as a result of a grassroots user activated soft fork (August 1st) or a proposed SegWit-2Mb hard fork which has widescale commercial agreement.

Both will put Bitcoin in a better position to scale, however they are also both likely to create 2 versions of Bitcoin.Those who have been following Ethereum, will know that – following a large scale exploit of an Ethereum smart contract – the Ethereum chain split in two.Due to sustained support for both the existing and new Ethereum chains, two coins were born from one – Ether and Ether Classic.The same is looking more and more likely to happen to Bitcoin; but will “Bitcoin Classic” survive in the same way that ETC has?Here’s a likely timeline for a Bitcoin chain split.For simplicity, we are going to call the second Bitcoin chain, “Bitcoin Classic”: Users get both coins First, it’s essential to point out that if you are a proud owner of Bitcoin, then you’ll also be a proud owner of Bitcoin Classic.When a blockchain splits, the number of coins you have (at the time of the split) on the Bitcoin chain are mirrored on the new one.Instructions on interacting safely with both chains will become available nearer to the time.

Users/miners/nodes choose a chain For a period of time there will be economic activity on both chains.It may be that 100% of activity moves almost immediately towards one of the two chains and peace is restored in the world.Or perhaps economic activity splits across both chains in some fashion.The reality is we don’t know if both chains will survive, and at what capacity they will survive.However, we do know that this will become very clear in the hours and days following a chain split.Those with Bitcoin can then decide what to do with their new Bitcoin Classic coins.Critical mass takes hold Once it becomes clear which chain is “winning” – ultimately which has the most hash (mining) power – then a bigger migration towards the winning chain may occur, potentially dismantling what is now considered the “old” chain.In Ethereum’s case, we saw that following the split, the vast majority of support moved to Ethereum and Ethereum Classic was left at a fraction of the value of Ethereum (7% as of today).

Bitcoin Classic Given that any meaningful support towards either chain would result in its survival, I would suggest that it is likely we will see an established “Bitcoin Classic” coin following a chain split.I would also speculate that a split will happen in the next few months, with a “crypto run” occurring in the build up to the event, fuelled by uncertainty and confusion.Such a run would heavily reduce the price of not just Bitcoin, but Ethereum and dozens of altcoins.Billions could be wiped off of the cryptoasset market cap in a matter of weeks, resulting in a short period of uncertainty followed by a several month long period of stability and then growth.Alternatively – and possibly most worryingly – there may be no scaling implementation at all.Bitcoin may go on for another year of high fees and slow transactions.Who knows what that might mean for Bitcoin’s already waining dominance on the crypto market cap.Where does this leave us?None of this takes away from the fundamentals of public blockchain based cryptoassets.

A short term panic will only make the asset class more appealing to new and existing investors.Even if Bitcoin and Bitcoin Classic are total failures and the currency crashes into oblivion, another cryptoasset will take its place.Whilst I am extremely bullish on Bitcoin over the long-term (Bitcoin Classic or otherwise), it is more apparent than ever that a diverse cryptoasset portfolio is essential.Go to top Is Ethereum in a Bubble?Some Fundamentals With such a rapid increase in the price of Ethereum over recent weeks, concerns have been raised over whether this current level ($230-$260) is sustainable, or whether we are witnessing a bubble that may pop dramatically in the weeks ahead.I am not one for analyzing graphs, Fibonacci sequences or “reading the technicals” – a quick way to go broke – but I can talk a bit about the fundamentals of Ethereum and the outlook ahead.Remember, I am not a qualified financial advisor – always tread with caution in the crypto-sphere, this is just my opinion.

Proof of Stake In early 2018 the Ethereum Foundation is expected to move the network consensus model from Proof of Work to Proof of Stake.Both of these consensus models are capable of securing massive distributed networks through incentive structures (hence the need for a public blockchain to use a cryptocurrency), however Proof of Stake differs greatly.In Ethereum’s proposed Proof of Stake consensus model, the network is secured by staking Ether in a specialized smart contract and “voting” on valid blocks.Those staking in an attempt to attack the network (“voting” for invalid blocks) will lose their stake, whilst those who act honestly will receive “interest” payments.This not only has great environmental advantages when compared to Proof of Work (no massive consumption of electricity), but PoS has the following price implications: An enormous volume of Ether will be time-locked in staking contracts and taken out of supply indefinitely Fewer coins will need to be issued per block as cost of mining (electricity) is tremendously reduced Full details on Ethereum’s Proof of Stake.

Sharding One problem that all public blockchains face is the issue of scalability.Every transacation that is made must be validated by every node on the network, resulting in enormous congestion when the network is under heavy use (as we saw recently with the Mysterium and BAT token sales).How can the Ethereum blockchain scale to allow hundreds of transactions per second (currently limited to 7-15 tx/s) without compromising security, speed or decentralization?Many look to “off-chain” solutions, where 3rd party payment channels like Raiden can be opened and closed with a single “on-chain” transaction – without the need to account for every transaction inside the payment channel.However, these payment channels have their own limitations (security and usability), hence the need for “sharding”: a strategy to segment and validate the Ethereum blockchain in “chunks”.Leadership Sharding and Proof of Stake are two network upgrades that were proposed and outlined by the Ethereum Foundation from the very beginning.

One of the dominating forces behind Ethereum is this clear roadmap for the development of the technology.Having this agreement in place from day 0 has helped to avoid unanticipated and contentious scaling debates like those which have been seen in Bitcoin.Leadership has without a doubt been a contributing factor in driving the rapid growth of the Ethereum network, however on the contrary, it does also highlight a centralization risk.How would the price of Ether be affected in the event of a lead developer’s unexpected death, or the possibility of “going rogue” – admittedly the latter would likely be futile.Crpytoasset Competition Many users, investors and those new to the industry consider the blockchain space to be in heated competition.A price rise of Ether must come at the expense of Bitcoin or others and vice versa.Which currency “will win”?This is simply not the case, as Andreas Antonopolous puts so elegantly at this Silicon Valley Ethereum meetup: Is Ethereum in a Bubble?

Fundamentally, I do not believe that Ethereum is in a bubble.Multi-billion dollar corporations are adopting Ethereum, new Ethereum tokens are being distributed and used, smart contracts are demonstrating purpose, demand for fiat-alternatives is increasing globally and new use cases are being realized on a weekly basis.If you believe that blockchain, like the Internet, will transform social, economic and political landscapes, then consider that investing in Ether is analogous to investing in HTTP requests of the early Internet – the Internet itself is on sale.For the first time in history, it is possible for anyone anywhere in the world to invest in the underlying protocol of a global infrastructure.And at the time of writing, the market capitalization of one such infrastructure is $22bn – or about 5% of Facebook.Cryptoasets are enormously volatile, never invest more than you can afford to lose Go to top Touching $200 What a month it’s been… The irrational exuberance in me is desperate to rattle off a hundred reasons why Ethereum, Bitcoin and others are going to change the world, but now is not the time.

We are seeing a bubble that dwarfs the Bitcoin rally and subsequent crash of 2013… But the famous last words – “this time it’s different” – may actually have some merit, as for the first time ever, a number of cryptoassets are demonstrating value beyond simple speculation.This week was awash with major industry conferences in the United States; including Ethereal 2017, Consensus 2017 and Token Summit (New York – May 25th).These conferences, combined with recent global developments seem to have fuelled the latest explosion in cryptoasset and Ethereum adoption.Ethereum’s price and “market cap” has near quadrupled in weeks.Here’s my take on a handful of the latest developments: 1.Enterprise Ethereum Alliance This week started as it was meant to go on.The EEA, which held a summit earlier this year, announced that they had added a handful of new founding members to their board, including Credit Suisse, ING and BP among others.The EEA sets out to collaborate on blockchain use-cases in a private (“consortium”) setting, however new innovations and technologies are openly shared with the public blockchain (and vice versa).

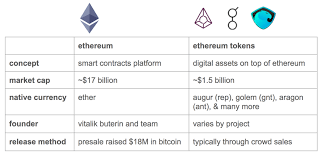

ShapeShift announces Prism Popular cryptoasset exchange ShapeShift – which allows frictionless trading of tokens like Ethereum and Bitcoin – announced earlier this week that it had launched its Prism exchange (currently in beta).Prism is a cryptoasset portfolio platform which operates on a network of smart contracts with no counter-party risk (smart contracts are – in theory – highly secure).The base currency of this new platform is Ethereum, which is used as collateral for making trades on the platform.Bitcoin is also expected to be integrated following the live release of Rootstock (expected later this year) which enables smart contracts on the Bitcoin blockchain.Token sale hype Those looking to invest in blockchain startups and platforms are able to do so through a “token sale”, often referred to as an “initial coin offering” (ICO).Access to these investments require that the investor sends Ether (or Bitcoin) to a specific address in return for tokens of the business or platform.

A number of hugely successful token sales from the likes of Gnosis, TAAS, Aragon and Storj.io has attracted new investors and in-turn increased demand for Ether and Bitcoin.Note, these platforms have yet to generate any “real” return beyond trader speculation.Update May 25th: Mystery “mainstream” initiative revealed Chat service Kik announced its plans for launching a new token built on the Ethereum blockchain.Kik’s token – “Kin” – will be launched as an ICO in summer 2017 in an effort to generate a new “ecosystem of digital services” for its millions of users.The full story can be found on the Kik blog.As we touched upon earlier in May – there are plenty of other stories to be excited about.Here are a couple more noteworthy mentions: Fidelity CEO explains why blockchain will ‘change’ markets Bistamp exchange has announced plans to list Ethereum in the coming months How to buy Ethereum Over the last few weeks I’ve received several emails per day requesting details on how best to purchase Ethereum.

Unfortunately, it really is not straightforward.For that reason, I am currently working on some short documentation that will provide information on purchasing and securing this cryptoasset.The docs will also provide high level insight into the basics of Ethereum, why it has value and the protocol’s development roadmap for the months ahead.To sum up the exciting future in front of us, I’d like to share this quote from Erik Vorhees – ShapeShift Founder and CEO… Some day, we imagine, nearly all financial infrastructure will be built upon open, objective, non-discretionary code.The ability of a human to decide not to fulfill a transactional obligation (either by mistake or malice), will seem quaint.Inevitably, an economy is more efficient, honest, productive and fair to the extent it is built upon the laws of code and mathematics, instead of the laws of men.Pre-blockchain, that was impossible.Upon products like Prism (itself built upon the pioneering work of blockchain protocol engineers), it is our hope that some day it won’t merely be possible, but indeed the expectation, that finance itself becomes provably fair; not by the decree of politicians, but by the demanded security and supplied innovation of a marketplace set free.