ethereum price july 2016

When we first heard Vitalik Buterin was learning Chinese, it was a clue to his ambitions in China.Less than two years later, the platform he co-founded is now a growing force in the Middle Kingdom.Since he joined the ChinaLedger Alliance (May 2016) and announced the expansion of BlockApps, an Ethereum building-blocks platform, in China (September 2016), there has been a movement in cities and among companies in big industries all throughout China.This is in some part due to the efforts of Wanxiang Blockchain Labs, which has made it their mission in China to bring Ethereum to the mainstream, and also in part to the savvy and persistent efforts of Buterin himself.At a recent Ethereum meetup in Hong Kong, Buterin said that "Wanxiang Blockchain Labs are making good inroads into China."Headquartered in Hangzhou, Wanxiang has led the Ethereum charge in China for more than a year.Having partnered with Ethereum early on for the Global Blockchain Summit following Devcon2 in Shanghai in July of 2016, Wanxiang is now China's top funder of promising blockchain projects.

With its BlockGrantX sponsorship program, it has allocated funds to Ethereum startups including iEx.ec (for fully distributed cloud computing), Proof-of-Identity (for KYC, wallets, multisig, voting, authentication and reputation systems), Golem (P2P computation), Casper (a proof-of-stake consensus protocol), the Raiden Network (an Ethereum off-chain state network) and Micro Oracles (blockchain identity verification).

bitcoin horror storiesAnd this month, Wanxiang launched its WanCloud platform for Chinese developers, giving them access to tools for building applications on open-source blockchains.

bitcoin valor maximoSince the recent Global Blockchain Financial Summit in Hangzhou, China's rapid technological developments on the Ethereum platform has been garnering attention.

bitcoin mining dubai

One blog post in particular, from ConsenSys's Head of Global Business Development Andrew Keys, gave some insight into the rapid rate of Chinese adoption. and Meituan utilizing Ethereum technology for aggregated payments services Establishment of the Jiangsu Huaxin BIockchain Research Institute (JBI) in Nanjing, which Keys writes "will be a powerhouse in the Ethereum ecosystem and will become a beachhead for corporations outside of China."

bitcoin mining hosting ukExperimenting with Ethereum technology by Ant Financial, Alibaba's $60 billion financial arm, to improve their global payment platforms In Hong Kong, there has also been a surge of new interest in Ethereum.

litecoin wallet sendJehan Chu is the founder of the Ethereum meetup there and a partner at Jen Advisors, a Hong Kong-based early-stage blockchain VC firm.

bitcoin ltc price

Though the technology is still very young, Chu has seen a huge uptick in activity."Ethereum in Southern China has been on a rampage of growth," Chu told Bitcoin Magazine, "with the local HK meetup growing by 50 percent to nearly 800 members in the last six months, and ether trade skyrocketing.Banks, corporates and even casual investors have all heard about Ethereum's white-hot growth and mounting challenge to Bitcoin dominance.More importantly, Ethereum startups worldwide from Status.im and Ox to Golem and MakerDao have made HK's environment of high-level industry professionals a can't-miss stop on their Asia business development and capital raising tours."Recently the Enterprise Ethereum Alliance ( EEA ), connecting Fortune 500 enterprises, startups, academics and technology vendors with Ethereum, announced its expansion into China with a new office in Hangzhou.At the Global Blockchain Financial Summit in Hangzhou, EEA China said that its main objectives are to "explore and develop new standards and technologies using blockchains, so that Chinese enterprises can more easily meet domestic market needs."

Founding members of the EEA include JP Morgan, Banco Santander, CME Group, Microsoft, Intel, Accenture and blockchain startup ConsenSys.Over the past week, the price of ether has surged from $85 on May 17 to a high of around $211 on Coinbase on May 25.While many credit this rise to the announcements of the EEA, it is also notable that ETH trading was added to some of China's digital asset exchanges. added ETH trading to its platform.It has also been confirmed that China's top Bitcoin exchange OKCoin will soon add ETH trading.[Note: I neither own nor have any trading position on any cryptocurrency.The views expressed below are solely my own and do not necessarily represent the views of my employer or any organization I advise.] If you’re bored of catching Pokemon and happen to have a lot of butter stored up, now is the time to break out the premium organic popcorn kernels and enjoy Fork Wars: Summer 2016 Edition.As mentioned in the previous post: last week many miners, exchanges, and developers coordinated a hardfork of Ethereum.

At the time there were lots of celebrations for having done something that flew in contrast to the views prominently held by the Bitcoin Core development community: namely that a fast hardfork can’t be done safely on a public blockchain.Well, it has been done, but there were also some consequences.Some intended and others unintended.The biggest consequence — which was touched on in my last post too — was that there were now parallel universes: Ethereum Core (ETH) and Ethereum Classic (ETC).If you owned a coin on pre-hardfork Ethereum, you now own not just the ETH facsimile but also the Classic coin (ETC) too.Two for the price of one!This also opens up the very real possibility of replay attacks which was also a possibility when Ethereum moved from Olympic to Frontier.A replay attack predates cryptocurrencies such as Bitcoin and Ethereum: [I]s a form of network attack in which a valid data transmission is maliciously or fraudulently repeated or delayed.This is carried out either by the originator or by an adversary who intercepts the data and re-transmits it, possibly as part of a masquerade attack by IP packet substitution.

In this case, it is the retransmission of a transaction (not IP packet).Or in the Ethereum world, a replay attack would be to take a transaction from one Ethereum fork and maliciously or fraudulently repeating it on another Ethereum fork.Check out: Sirer, Rapp, and Vessenes.At first most of the Ethereum community assumed that Classic would effectively become deprecated and fade away into history much like Olympic.After all, so went the argument, who would want to use or support a network in which at least one participant owned/controlled roughly ~10% in now “hot” ether?Sidebar: recall that the main motivating force behind the hardfork was spurred on by the successful attack on The DAO, an investment fund created by Slock.it who did not adequately test the smart contract for security vulnerabilities (among other issues).Well, it seems that Classic will not go silent into the night, at least not yet.From a technical integration standpoint, while all of the large exchanges initially supported ETH, one altcoin exchange based in Montana — Poloniex — began supporting both forks.

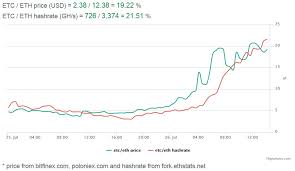

Traders — seeing a potential arbitrage opportunity — began doing what they do best: speculating and driving up demand for ETC via posts on social media.As a consequence of their marketing efforts, the price of ETC dramatically rose over 380% in one 24-hour period alone.In return, some of the miners that had abandoned the original Ethereum chain (ETC) to mine on the ETH hardfork have now begun mining on both which means that the original ETC network actually has once again begun seeing an increase in its hashrate (recall that it had dramatically dropped a week ago). — a large mining pool — announced he would undertake a 51% attack on the ETC blockchain because of the decision by Poloniex to support it.Chandler later announced he would not carry it out.Incidentally, it is likely that the noise that was created from this threat actually drew more attention to the Poloniex arbitrage opportunity, creating a type of Streisand Effect.What does this situation look like?Above is a line graph that is auto-generated and reflects the past 48 hours of two types of ratios: the Ethereum Classic (ETC) to Ethereum Core (ETH) price; and the ETC to ETH hashrate.

Price is derived from the two largest exchanges in terms of ether liquidity (Bitfinex and Poloneix).This is actually not surprising behavior, we empirically observe the same type of trend with other cryptocurrencies: when price increases more hashrate comes on-board and vice-versa.Over the past several days there has been much guessing as to which chain will live or die, but rarely do people suggest that both will live on in the long-run.And I think that is short-sighted.While not a fully direct comparison, even though they’re effectively based on the same code, we have seen how Litecoin and Dogecoin have permanently conjoined at the hip via merged mining: they co-exist via the Scrypt Alliance.In addition, we have seen for years the continued existence of multiple multipools, which automatically direct GPU-miners to the most profitable cryptocurrency usually with a payout in bitcoin.I cannot predict who which chain outlasts the other.Perhaps now that ethcore has said it will also support Ethereum Classic, the two (or more!)

chains will both continue to exist and grow.Either way, we do know that the maximalist thesis, that there is a “coming demise of altcoins,” continues to be empirically incorrect and I suspect that it will remain incorrect for as long as there is continued speculative demand for cryptocurrencies in general.This includes both ETH and ETC. Who else gains from this phenomenon?In the short run, anyone interested in trading will probably be able to find some kind of arbitrage — assuming demand grows or at least stays at the same level.Other cryptocurrency communities that see Ethereum as a competitor could believe they now have an incentive to support multiple forks too, as it draws hashrate and potential mindshare away one chain at the expense of the other.And the more that the Ethereum community is painted as being “chaotic” the less of a threat it is seen to other public blockchains.But maybe this is shortsighted too and will simply enlarge the Ethereum community because they now end up as ETC holders and want it to appreciate in value.

Either way, it sounds like the makings of some kind of TV miniseries staring Jean-Luc Bilodeau as Vitalik Buterin (they’re both Canadian).Want to read more on the topic?Ignoring the above quasi-illustration of the many-worlds interpretation, surprisingly not much has been discussed regarding the analog world of when fiat currencies are created or even removed at certain exchange rates and the unintended consequences therein.For instance, in the comedy Good Bye, Lenin!we see the repercussions for those who were unable to convert East German marks for West German marks after the fall of the Berlin Wall.More recently we have seen multiple Iraqi dinar scams, in which individuals were deceived and conned into acquiring pre-war dinar (a deprecated fiat currency) with the fraudulent pitch that at some point in the future, the previous pre-war exchange rate would somehow be reached.However, one of the biggest differences with the Ethereum-based chains above is that cryptocurrencies are anarchic — without terms of service or ties to the legal system.