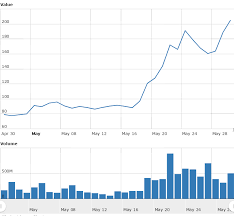

Two leading virtual currencies achieved fresh record highs on Monday, stimulated by the increasing interest from investors around the world.The price of bitcoin reached a new record high today, being driven by the growing demand from traders looking to invest into alternative assets.Earlier today, the cyptocurrency for the first time hit $2303.90 level, while the total market cap increased to $37 billion.On Friday, bitcoin price broke through $1,900 barrier, before surpassing $2000 mark on Saturday.The cryptocurrency is now valued at $2266.38, rising by 9.64% over the last 24 hours, according to CoinMarketCap.Simultaneously, the value of Ethereum is showing significant gains as well, hitting $200 mark today’s morning.The digital currency is currently trading at $190.02, according to CoinMarketCap.">

Ethereum Price Drop 2017

ethereum price drop 2017

HomeTrendwatching Want to join InvestingHaven’s research team?Interested in analyzing markets, charts, stocks?Contact us >> Ethereum Price At New All-Time Highs Investing Haven Newsletter ">Two leading virtual currencies achieved fresh record highs on Monday, stimulated by the increasing interest from investors around the world.The price of bitcoin reached a new record high today, being driven by the growing demand from traders looking to invest into alternative assets.Earlier today, the cyptocurrency for the first time hit $2303.90 level, while the total market cap increased to $37 billion.On Friday, bitcoin price broke through $1,900 barrier, before surpassing $2000 mark on Saturday.The cryptocurrency is now valued at $2266.38, rising by 9.64% over the last 24 hours, according to CoinMarketCap.Simultaneously, the value of Ethereum is showing significant gains as well, hitting $200 mark today’s morning.The digital currency is currently trading at $190.02, according to CoinMarketCap.

This is a major growth in value, as only a week ago Ethereum was worth about $100 per coin.The total market cap of digital currencies demonstrated a significant growth over the last few weeks, now accounting for more than $79 billion.If compared, the combined value of all cryptocurrencies amounted to $20 billion in the beginning of the year.Currently, the total market cap, excluding bitcoin, totals $42 billion.Amid the overall growth of digital currencies, bitcoin’s share of the cryptocurrency market is reducing.

bitcoin video faucetFor the first time in its history, bitcoin’s share of all blockchain assets dropped below 50%.

litecoin пулAs of January 1, bitcoin comprised 87% of the total market cap and is now accounting for 45-46%.

bitcoin cours du

Meantime, ethereum’s share reached almost 20% of the total market cap, with ripple and litecoin accounting for 17.38% and 1.78%, respectively.Today, the cryptocurrency community is celebrating a Bitcoin Pizza Day, which marks the day when the first real-world bitcoin transaction occurred.A developer Laszlo Hanyecz bought two pizzas for 10,000 bitcoin, what was equal to $30 at the time.But taking into account the current prices, the pizzas would worth more than $21 million right now.

bitcoin blockchain pdfThere are various factors that have contributed to the growth of the cryptocurrency.

bitcoin melhor precoA huge bitcoin demand now comes from Japan, which handles about 40% of all bitcoin trading volume.

ethereum asset exchangeThe government in Japan has recently passed legislation to enable merchants accept bitcoin as a legal currency.

bitcoin wie verdienen

Meantime, political instability urges investors to acquire bitcoin and other digital currencies as safe haven assets.Political scandals in the US and Brazil caused investors to seek alternative assets, as US and Brazilian stock prices dropped.Also, the ongoing debates on the future of bitcoin’s underlying technology raised interest in the cryptocurrency.There is a fear that bitcoin will be divided into two currencies after implementing hard fork solution.However, it seems that the bitcoin network is not yet ready for wider adoption.

bitcoin billionaire online gameLast week, over 214,000 bitcoin transactions were stuck unconfirmed, with users having to pay higher fees per transaction.

bitcoin nutzerA few days ago, the decentralized management platform for companies, Aragon, completed 4th highest funded crowdsale ever, raising $25 million in the first 15 minutes of its ICO.

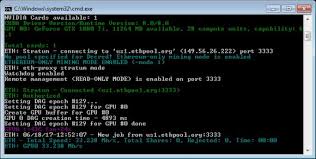

READ MORE ON » worldtechnologySoftware engineeringplaceMicrosoftJPMorganIBMMona El Isa, a former Goldman Sachs trader who runs Melonport AG, which builds software for fund managers who invest in digital assets on Ethereum, is confident that developers can work out any kinks with Casper.By Olga Kharif Marco Streng’s computer servers are what make Ethereum tick.Thousands strong, they whir day and night, solving the complex math riddles that are essential to verifying transactions on the hottest new platform in the world of cryptocurrencies and blockchains.Without these machines, or those deployed by Streng’s biggest rivals, there would be no Ethereum.But mining, as the practice is called, is costly and inefficient and, frankly, a bit weird.And Ethereum’s developers have always envisioned a time in which the cumbersome process of brute-force computing would be replaced by a system that relies simply on collateral.That time, some four years after the network was first proposed, is now.

The developers want to put this “proof-of-stake” model, called Casper, into place by year-end.The stakes are high.If Ethereum is going to take advantage of the potential that companies like JPMorgan, Microsoft and IBM see in its underlying transaction technology, the blockchain, as the potential backbone that could reshape modern business and finance, it needs to gain wide adoption to become something of a de facto standard.Without mining, Ethereum “will be more usable, more secure and more scalable too,” said Vlad Zamfir, who’s been working on Casper since 2014.Secure Transactions The main draw of the blockchain is that it’s a cryptographically secured list of transactions that can be shared, which backers say could dramatically improve how financial services, supply-chain and health-care industries are run.(Think immediate settlement of bank transfers and securities trades, as well as near-real-time tracking of food products or research samples.)Ethereum also allows for the use of “smart contracts,” or pieces of computer code that make the terms of such agreements operate automatically.

Miners have been critical to the growth of Ethereum.The market for ether, the digital currency used to pay miners who support the network, has soared 90 per cent this year alone.It’s the second-most popular cryptocurrency behind bitcoin, which has gained 24 per cent in the same span, setting records almost every day as investors look to hedge against potential global uncertainty and hope for a bitcoin-based exchange-traded fund to get regulatory approval.Even before Ethereum was first released in 2015, developers had envisioned moving away from the mining-based model, known among tech geeks as “proof-of-work.” Tougher Computations As the network gets more popular, the computations the miners need to complete to validate transactions get harder and harder.Not only has this created the potential for bottlenecks, like those already plaguing bitcoin, but it’s also set off an environmentally taxing arms race among the biggest miners, which run server farms consuming vast amounts of electricity.

And to many techno-utopian enthusiasts, using all that computing power to continually solve what amounts to pointless problems is a big waste.That’s where Casper comes in.Rather than rewarding miners with the most computing power, the “proof-of-stake” model requires that users put up collateral if they want to collect fees for validating transactions.The more collateral you put up, the more money you can get paid for verifying transactions.It would take power away from miners like Streng, who have to approve software changes, and make it easier to implement improvements on the fly.A handful of bitcoin miners in China have already hamstrung some attempts to increase that cryptocurrency’s capacity.(Miners can’t vote against the switch.)The move will make Ethereum “more attractive in large-scale applications,” said William Mougayar, author of “The Business Blockchain.” Hyperledger, a blockchain venture with more than than 100 members including IBM, JPMorgan and American Express, could adopt Ethereum’s “proof-of-stake” model if it’s successful, according to Brian Behlendorf, the consortium’s executive director.

It could also help put the network in “a league of our own,” Andrew Keys, head of global business development at startup ConsenSys, the world’s largest Ethereum-centric blockchain software engineering company.No Sure Thing Making “proof-of-stake” work is hardly a foregone conclusion.Casper’s rollout has been delayed before.And the use of deposits potentially increases the risk of hacking.(While Zamfir said he’s working to make sure hackers can’t steal deposits, he couldn’t rule out the possibility, however remote, that an attack could, in effect, delete the money.)Streng, who stands to lose out if Casper is implemented, is wary.“There’s a lot of incentive for people to game the system,” he said.Trust in Ethereum was badly shaken last summer, when a hacker stole millions from a project called the DAO.Developers had to rush to implement a software change, which ended up splitting the Ethereum community in two.Now, each operates its own, separate blockchain.Zamfir says the benefits outweigh the risks.

One of the biggest is “transaction finality.” Unlike most blockchain technologies, which require multiple verifications, settlement on Casper can occur much faster.With some enhancements, the feature could ultimately enable Ethereum to process more payments faster -- a key selling point for financial companies.‘Early Stages’ Mona El Isa, a former Goldman Sachs trader who runs Melonport AG, which builds software for fund managers who invest in digital assets on Ethereum, is confident that developers can work out any kinks with Casper.“In these early stages of this new technology, you can’t expect everything to go right,” El Isa said.If Casper ultimately happens, Streng says it won’t be the end of the world.He can redeploy his servers to mine other cryptocurrencies or become a depositor on Ethereum instead.But he isn’t holding his breath just yet.Implementing such a sweeping change isn’t going to be easy and it’s still possible the plan could be scrapped altogether, he says.