ethereum keeps going up

Bitcoin has more than doubled in price this year alone, but it has been outperformed by its closest rival Ether, which is up over 2,300 percent.On January 1, bitcoin was trading at the day's high of $1,003.25.On Wednesday, it broke through the $2,300 barrier for the first time to hit a fresh record high of $2,377.32, according to CoinDesk, marking a year-to-date rise of 137 percent.To find out what's driving bitcoin's rally, read more here.Meanwhile, bullishness around bitcoin has stoked appetite for other cryptocurrencies.One in particular known as ether is getting traction.This represents a 2,367 percent rise year-to-date.Ether runs on an underlying technology called Ethereum, which is a different blockchain to the one that underpins bitcoin.While ether does have digital "coins" like bitcoin, companies are more focused on how the Ethereum blockchain could be used in real-world applications.Ethereum has been designed to support so-called smart contract applications.A smart contract is a computer program that can automatically execute the terms of a contract when certain conditions are met, potentially taking a lot of the human involvement out of completing a deal.

Barclays for example, have used a form of this technology to trade derivatives.How is it different to bitcoin?Firstly, Ethereum is a lot younger having only been started in 2014, whereas bitcoin began in 2009.Ethereum is also focused on smart contracts, while bitcoin is very much about payment technology.Why has ether rallied so much?While bitcoin has been getting support from certain governments and investors, the Ethereum blockchain has been backed by corporates wishing to use the technology for smart contract applications.A group called the Enterprise Ethereum Alliance (EEA) was recently founded to connect large companies to technology vendors in order to work on projects using the blockchain.Companies involved in the launch include JPMorgan, Microsoft and Intel.On Tuesday, the EEA announced another 86 firms joined the alliance, which is adding growing legitimacy to the cryptocurrency.At the same time, the rally in bitcoin has seen investors turn to alternative digital currencies as well as attracting a broader investment base.

A year ago, over 83 percent of ether buying happened with bitcoin, according to data from CryptoCompare, showing that it was mainly crytocurrency enthusiasts interested in it.

bitcoin asic miner litecoinAs of Wednesday, bitcoin accounted for just over 32 percent of trade while fiat currencies such as the U.S.

bitcoin fastest growing currencydollar and Korean won have risen sharply.

white bitcoin pill report"Yes the direct fiat flow options are a fleshing out of the ethereum ecosystem and show its broad appeal," Charles Hayter, CEO of CryptoCompare, told CNBC by email.

litecoin price tickerWill the rally last?

litecoin private pool

Not all in the market are convinced that the ether rally will last.Bitcoin trader Jason Hamilton is worried that products like Ethereum could be cloned.

dogecoin price in usd"People are buying a specific blockchain, but the big interests are in the technology.

bitcoin pool server open sourceThey'll probably make their own clones and the ether tokens everyone is buying won't be used for much except trading.

bitcoin swfWho knows, though," Hamilton told CNBC via a direct message on Twitter.

vtc to bitcoin"I don't usually trade ether.I'm afraid of that bubble bursting, but it could go on bubbling up for a long time still."Let me answer your 2nd question first.In just 1½ weeks, Ethereum rose in value from 12.6 to 19.5.

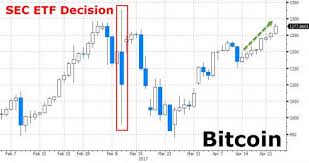

That 55% return, or an annualized rate of 5,650% (not a fair abstraction over such a short period).In fact, the thing that it is fueling the rise is also propelling Bitcoin.In just 3 weeks, it has risen in value by 27%, from [US] $1000 to $1270.[continue below image] …This sudden spike has a clear and attributed cause, which I explain in this short article.Although I point to a clear and accepted reason for the sudden rise (a regulatory decision that is expected at the end of next week), this does not mean that you can necessarily profit from this knowledge.That’s because speculators know the reason, but no one knows which way the decision will fall.In fact, one reputable financial news site states that the probability is 50/50, either way.Now to your first question.“How long will Ethereum continue to rise?”As I write this reply (also on March 2, 2017), Ethereum has an exchange value of $19 US dollars.It will continue to rise over the next four months.On July 1st, it will spike dramatically at (USD) $478.15 (less than 4 months from now), due to a comment by US president, Donald Trump.

But later on that day, the comment will be denied and finally discredited.Ethereum will fall even faster—dropping to under $4 by the evening.It won’t recover to today’s $19 value for 2 full years.Please don’t base your investment decision on my crystal ball.The first part of my answer is truthful (the reason for the spike).But, this part of my answer is satire!No one can peer into the future, especially when it comes to the value of a speculative commodity.That’s why it is called speculation.Do you expect strangers to know if Ethereum will rise or fall—and the date that you should sell?If they knew these things, they wouldn’t be answering you…They would be billionaires.The future is sometimes apparent for things do not involve supply and demand or that are not driven by speculators.For example:The sun will probably rise tomorrow—and for many years to come.An astronomer or meteorologist can even tell you the exact minute that it will peek over the horizon each morning.Your very heavy neighbor is at the top of a tall ladder.

It is on soft ground, and he carrying a heavy tool above the top rung as he tries to swing his leg onto a slanted rooftop.You could make a pretty good bet about the short term future: He is fat, the ladder is slipping, he has a bum leg, and so he very likely to fall.… But if his strong son suddenly pulls him up over the gutter—or if his wife yells at him to get down, you would have made the wrong prediction on even a fairly obvious, anticipated event.Ellery Davies co-chairs Cryptocurrency Standards Association.He producesThe Bitcoin Event, edits A Wild Duck and is a frequent contributor to Quora.Long term resilience of any technology/organization is subject to the founding members being committed.In Ethereum’s case, while there are a lot of heavy weight tech developers, building great technology to support Ethereum’s use cases, Vitalik Buterin[1], who is the public face of Ethereum since 2013 has done a great job of communicating the rational for various updates on Ethereum in a pretty transparent manner.While the heavy weight technical developers are building the tech, Vitalik himself was one of them, you have a tech-savvy Vitalik communicating to the external world a feeling of value that Ethereum is bringing in and building a solid ecosystem around Ethereum.

This in itself makes it a long term investment.On the growth around March 2, as is already mentioned, this is due to the Bitcoin ETF rulings, where all cryptocurrencies saw a huge influx of fiat currencies and hence grew.Though the ETF proposal was rejected and each cryptocurrency dipped, the top cryptocurrencies have continued to remain stable at levels much higher than the pre-March 2017 timeframe.Footnotes[1] Vitalik Buterin - WikipediaIn short, it has spiked recently because of the big names who believe in it.This was covered heavily by the media, resulting in the bullish trend we are witnessing.IMO it’s a safe bet that Ether will continue it’s rise.It’s becoming mainstream.Just check out the State of the Dapps.That’s a huge amount of development.As more useful services are built the value appreciates.These above companies see that value and are no doubt considering their own implementations.Ethereum has a ton of potential with numerous practical implications.As more people begin developing Decentralized Applications (DApps), whether it be for the Internet of Things, governments, corporations, small businesses, or individual artists, there will be an ever increasing demand for Ether.Big Business Giants From Microsoft to J.P.