ethereum float

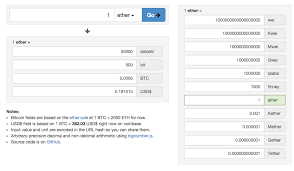

Try going back to the homepageNatural Units Jump to: navigation, search Numbers in the Ethereum blockchain are represented by integers.Currently floating point numbers are not supported.The "natural unit" is the basic integer that represents a number.ETH, or ethers, are represented by a natural unit with 18 decimal places.1 ETH = 1,000,000,000,000,000,000 or 10^18 natural units.The ETH natural unit is also called a wei.ERC20 tokens on the Ethereum blockchain also have a natural unit where 1 unit of token is represented by {x} natural units.This is represented by the decimal variable commonly written into the token smart contract.See Ethereum Based Tokens for further information.For example: DGDb and UNI both have 0 decimal places, where 1 unit of token is represented by 1 natural unit.REP, GNT and many others have 18 decimal places, where 1 unit of token is represented by 1,000,000,000,000,000,000 or 10^18 natural units.000Why Casper may sink Ethereum (self.ethereum)submitted by In my view, it's a commonly held misconception that "speculation" accounts for the high marketcaps of cryptocurrencies with "little or no use cases".

Many believe it's based on speculation of "possible future use cases", and whilst I'm sure that this does account for some of the price, it does not account for most.

bitcoin for centosSo what does account for the marketcap of such cryptocurrencies?

bitcoin kurs 2009After many years in the trenches in many coins, I'm of the view its cryptoeconomics, not speculation.

bitcoin mining on teslaThe price of a cryptocurrency mirrors the underlying, intrinsic mini-economy of that coin and miners are at the root of this.

ethereum technology stackFor example, miners need more hash power, creating demand for specialised hardware.

bitcoin telegram channel

Miners tend to sell their yield, which creates demand for fiat exchange resulting in all sorts of other exchanges.

github bitcoin traderMiners add constant supply side liquidity which attracts small speculators and new actors who in turn virally promote the ecosystem further.Constantly growing userbase creates demand for wallet providers and various other infrastructure who in turn require specialised software and people.All of the above requires investment and creates jobs.Most importantly of all, all of the above tends to feed back into itself via those same actors buying the coin itself which completes the circle - THIS IS WHY COINS WITH NO USE CASES HAVE LARGE MARKETCAPS!It's the internal economy of that coin that you're seeing, it's "cryptoeconomy", the speculation comes after!Now, take miners out of that equation and what happens?The cryptoeconomy of that coin collapses and something else is needed to offset it, if the price is to maintain.

So even if Casper is technically successful, the price of Ethereum may drop hard because a large chunk of its economy will be excised and there still won't be large enough use cases in place to justify it's current marketcap.However, if projects like Augur or Arcade City turn out to be a massive successes, then obviously this should offset it and more.That said, if Casper were released tomorrow, I think people would see how much value was actually being created by miners and how much was really just "speculation" (the leftover market cap).π Rendered by PID 12981 on app-234 at 2017-06-24 10:53:28.589641+00:00 running 3522178 country code: SG.BitcoinBitcoin and Ethereum Just Crashed, Taking Coinbase Down With ThemJen WiecznerAfter both hit all-time highs earlier this week, Bitcoin and Ethereum prices plummeted as much as 25% Thursday — but many investors were unable to trade for much of the selloff.Coinbase, a leading cryptocurrency exchange, confirmed that it was completely offline by 9:35 a.m., though the outage appears to have begun several hours earlier, with investors reporting problems on Twitter throughout the night.

The company blamed "sustained heavy traffic," likely caused by intense Bitcoin and Ethereum trading, for crashing the Coinbase website and mobile app, which remained completely down for at least four hours.As has become a familiar frustration to blockchain enthusiasts in recent days, Coinbase went offline at the worst possible time, just as extreme price swings in the cryptocurrencies made investors desperate to buy or sell.Around 10 a.m.Thursday, the Bitcoin price fell as low as $2079, a more than 30% drop since breaking the $3,000 milestone last weekend (and a 19% decline in the previous 24 hours alone).Relatedhealthcare billWhy the Senate Healthcare Plan Looks Like Obamacare 2.0healthcare billWhy the Senate Healthcare Plan Looks Like Obamacare 2.0At the same time, Ethereum, a rival cryptocurrency whose eye-popping 40-fold gain this year has far outpaced Bitcoin's returns, was down as much as 25% from its price a day earlier.The Ethereum price dipped below $274, just three days after it traded above $400 for the first time.Coinbase had a similar outage in late May while Bitcoin was trading at record highs, illustrating that new systems for trading blockchain currencies are not yet as reliable as traditional stock market exchanges — a lesson a number of investors were learning the hard way, based on their tweets.

(While Coinbase initially said it had restored full access to the exchange by mid-afternoon Thursday, it was still trying to repair service for at least some users after 5 p.m., according to a status report on its website.)$BTC is down.$ETH is down.@Coinbase is down.--All the feels.//4tERCTPHLi- MONETARY MAYHEM™ (@MONETARY_MAYHEM) June 15, 2017Does anyone have a reliable alternative to #Coinbase?It seems to be down at every critical moment- Jeffrey Schmidt (@JeffSchmidt9) June 15, 2017Bearish comments by influential investors have triggered several recent selloffs in Bitcoin and Ethereum, such as when Mark Cuban said he thought they were "in a bubble" last week.Morgan Stanley likely contributed to this week's declines by publishing a couple of research notes casting doubt on whether the surge in cryptocurrency prices is justified."Market likely getting ahead of itself as we have not seen exponential rise in use case yet, but value is rising exponentially," Morgan Stanley analysts wrote in a note Wednesday.That followed an even more skeptical research report the bank released a day earlier titled "Blockchain: Unchained?"