ethereum china reddit

Litecoin Price Trend Follows Bitcoin Aug 04, 2016 at 09:14 // Price Because of the hack of the Bitfinex exchange on August 2, all cryptocurrencies this week fell.Litecoin’s price fell to the lowest level of the month, but a day later it began recovering as did the other cryptocurrencies.Bitfinex problems brought down the price of Bitcoin first.This gave an impetus to the growth of Litecoin that can be seen on the seven-day chart below, but then LTC began to return to its original position.LTC/BTC exchange rates for last 7 days: Currently, the Litecoin price is $3.75, which is the minimum price over the last 30 days.But the collapse on Bitfinex alone can’t cause the global long period of decline of cryptocurrency prices.This is a temporary technical factor.Panic, which lasted exactly one day, was over by August 3.But we can’t talk about the resumption of growth either.LTC/USD exchange rates for last 7 days: As practice shows, any unexpected factors can cause sharp rises in prices and sharp declines in cryptocurrencies, including Litecoin, and these factors are almost impossible to predict.

In January, the performance of Mike Hearn brought down Bitcoin and altcoins.Now we face a problem with safety on Bitfinex.Gradually investor confidence returned and growth begins again.Note that the maximum price of Litecoin in the past two months was $5.67 and Litecoin is capable of reaching it again.LTC/USD exchange rates for last 50 days: Today we expect LTC to attempt to reach $3.75 - $3.8, which is currently the area of interest to traders.The resistance level is $3.8 and the level of support is $3.65.

comprar bitcoin visaA break through the resistance level will open Litecoin’s price all the way to $3.9 and $4.0.

ericsson bitcoinThis will be possible primarily due to the general rise of prices for all cryptocurrency.

1 bitcoin equal to usd

This analysis and forecast are the personal opinions of the author and are not a recommendation to buy or sell cryptocurrency.0 0 0 0 Send to Mail 0 0 0 0 Send to Mail Apr 20, 2017 at 21:21News Aug 12, 2016 at 15:54Price Mar 19, 2017 at 21:55News Jun 19, 2017 at 17:35News Jul 22, 2016 at 10:00BlockchainThe Chinese cryptocurrency market is showing signs of a major overhaul.The digital currency platforms in the country have made some drastic changes to their offerings in the recent days following PBOC’s inspection.

litecoin blockchain dataIt all started a few weeks ago after Bitcoin’s price experienced a sudden fall.

cs go bitcoin miningThe situation caused traders to panic and start logging into their accounts on cryptocurrency platforms trying to execute stop-loss trades.

ripple send bitcoin

Unable to handle the sudden rush, the platforms malfunctioned, preventing a significant number of traders from accessing their accounts.It resulted in few users reporting losses.The Chinese central bank, aware of the issue decided to take a look into the trading practices of these platforms.The inspection resulted in these platforms withdrawing their leveraged and margin trading features.BTCC, one of the popular platforms in the country has also announced a possible rollback of its zero-fee trading feature.

bitcoin polska facebookA recent report by one of the social media users on Reddit indicates OKCoin’s crackdown on foreign accounts.

litecoin quoteThe China-specific version of the platform has allegedly frozen accounts belonging to people who aren’t residing in Mainland Chinese territories.

buy bitcoin edmonton

The user going by the name “fiat4lyfe” had to verify his personal details including passport information and residence info to get the funds released.Fiat4lyfe also reported that the OKCoin representatives agreed to unfreeze the account to enable him to make the withdrawal, following which the account was permanently closed/frozen.This new development on OKCoin caught many by surprise, and some believe that the similar policies will soon be adopted by other mainland Bitcoin exchanges as well.The blockade on international Bitcoin trades on domestic platforms may just be the beginning.While it only impacts those outside China, the country’s government is also implementing restrictions on VPN services within the country.With unauthorized VPN services gone, the Chinese could potentially lose access to international cryptocurrency market as well.All these factors serve as indicators of future restrictions that are about to impact the cryptocurrency industry in China.Yao Qian, the Deputy Director of the Science and Technology Department at the People’s Bank of China, China’s central bank, recently authored an extensive report on digital currencies.

In the report, Yao Qian highlights many of the advantages and disadvantages of digital currencies, focusing much of his analysis on how bitcoin (and by extension, all cryptocurrencies) are more of a quasi-currency.The report was loosely translated into English using Google translate but Redditor u/qwertyubb, a native Chinese speaker, filled in some of the more nuanced statements.Quoting Yao Qian in the report: At present, this country (China) is very harsh on bitcoin, but in a certain sense, on top of the basis of prudence, we should also give special consideration and open to the top ten ICO companies based on market value.On one hand, (being open to cryptocurrency) will provide everyone with an opportunity to invest – it’s possible to invest in a black technology, but it’s better than buying some junk stocks (prevalent in China’s stock markets).On the other hand, from a national perspective, neighboring countries, including Japan, South Korea, and Singapore, are encouraging the development of bitcoin, which they consider to be quality assets.

Not to mention this can promote the financial technology industry innovation, at least holding high-quality assets is in line with nationalinterests.[B]ecause of Ethereum, the smart contract side (in contrast to traditional payment blockchain) has relatively fast breakthrough – taking into account the rising momentum of the currency, it is possible to surpass the bitcoin.(parentheses added by u/qwertyubb) I’ve highlighted and emphasized two portions of the statement that could have huge implications for the cryptocurrency market going forward.First, the most surprising aspect of the report is the fact that for probably the first time ever, a senior Chinese banking official has spoken of China’s national interests as it relates to the burgeoning cryptocoin market.It might be just a coincidence that just last week, the three largest cryptocurrency exchanges in China resumed allowing investors to withdraw coins after a four-month moratorium.Some have speculated that the moratorium was ended after the exchanges agreed to new restrictions imposed by China, which makes sense given China’s interest in regulating a market it now sees as a “national interest”.

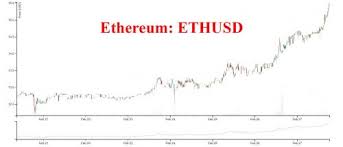

u/qwertyubb speculates that China could very well be using these exchanges to secretly purchase cryptocurrency as reserves.Yao Qian’s belief that Ethereum may one day surpass bitcoin also coincides nicely with many exchanges adding Ether, the cryptocoin based on Ethereum, to their trading platforms last week as well.Ethereum is clearly gaining steam not only in China but on a global level.More and more businesses and countries are getting involved and developing new technologies based on Ethereum.Clearly, China’s confidence in Ethereum is a positive sign for the technology and for blockchain technology in general.With all this talk of China’s interest in bitcoin and cryptocurrencies, it begs the question: when will the United States get involved.The US has yet to officially weigh in on cryptocoins except for a couple SEC denials of ETFs related to bitcoin.Now that China is moving quickly to stay on top of growing cryptocoin market, hopefully the US will see it as a sign that they better act fast, otherwise they might be left in the dust.