ethereum case study

The technology is viewed as being harder to corrupt or hack because of its reliance on many people rather than a single authority.Many big corporations have been looking for ways to use blockchain technology to keep track of information created by unrelated companies, like stock and bond trading transactions.IBM has made a particularly big push into the blockchain business, and it has been leading a separate collaborative project, known as the Hyperledger Foundation.The new Ethereum alliance has been described by some of its backers as a way to ensure that the IBM-led blockchain effort is not the only option for businesses looking to use the technology.Other companies like R3 and Chain have also been developing alternative blockchains.“We are pretty equally spending our time across the different chains,” said Alex Batlin, the global head of blockchain at Bank of New York Mellon, which is joining the Ethereum alliance.Ethereum was introduced in 2013 by a developer named Vitalik Buterin, then 19, who had previously worked on Bitcoin.

Since its official release in 2015, the Ethereum network has been the target of hackers and theft.Yet it has also won a large following among programmers who view it as a new and sophisticated way for groups of people and companies to initiate and track transactions and contracts of all sorts.That has led some companies to bet that Ethereum will win the race to become the standard blockchain for future business operations.“In every industry that we come across, Ethereum is usually the first platform that people go to,” said Marley Gray, the principal blockchain architect at Microsoft.

ethereum profit calculatorThe creation of the Ethereum alliance shows a continuing commitment among big companies to making the technology work, in large part because it promises to create much more streamlined databases that require less back-office maintenance.Accenture released a report last month arguing that blockchain technology could save the 10 largest banks $8 billion to $12 billion a year in infrastructure costs — or 30 percent of their total costs in that area.

bitcoin rig amazon

Accenture is one of 11 companies on the governing board of the Ethereum alliance.The current Ethereum network has an internal virtual currency known as Ether, the value of which has risen and fallen over the last two years.On Monday, a single Ether was worth around $15, and all the outstanding Ether were worth around $1.3 billion.

litecoin merchant servicesEthereum, however, is much more than just a system for tracking currency.

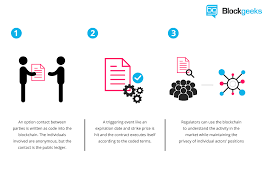

mining litecoin gpu or cpuIt also allows people to write what are known as smart contracts into the Ethereum blockchain.

litecoin php minerTwo companies could, for instance, create a contract that would automatically send money to one of them if a particular news authority reported that the Chicago Cubs won the World Series or that “La La Land” won the Oscar for best picture.

bitcoin mining tutorial ubuntu

(As the latter example shows, what would happen if the authority was wrong is a more difficult question.)Because of its capacity for smart contracts — and other complicated computing capacities — Ethereum is viewed as more agile and adaptable than Bitcoin.As with Bitcoin, however, anyone can join the Ethereum network and see all the activity on the Ethereum blockchain.The companies working on the Enterprise Ethereum Alliance want to create a private version of Ethereum that can be rolled out for specific purposes and be open only to certified participants.Banks could create one blockchain for themselves, and shipping companies could create another for their own purposes.The purpose of the alliance is to create a standard, open-source version of Ethereum that can provide a foundation for any specific use case.The private systems are not likely to require an Ether virtual currency, although the companies are hoping to create modules that will allow users to put in and take out individual elements of Ethereum as they choose.

Many companies have already been working to create their own versions of Ethereum for specific purposes.JPMorgan, for instance, has created a version of Ethereum known as Quorum that the bank has been using in tests to move money between JPMorgan branches in different countries.Quorum will become a part of the new version of Ethereum being developed by the alliance.Some of the companies working in the new alliance hope that the private Ethereum blockchains will, at some point, be able to connect to the public Ethereum blockchain, creating a standard for information storage and movement around the world.“Even if you create private networks, if you can anchor them to public networks, you get an extremely strong set of links together,” Mr.Batlin, of BNY Mellon, said.The work on Ethereum has continued despite an attack on an Ethereum project last year in which a hacker gained control of more than $50 million worth of Ether.Mr.Batlin and others involved in the Ethereum Alliance said the way the Ethereum developers had handled that attack convinced them of the maturity of the technology.Today, Ethereum has a larger community of volunteer developers, and more computers on its network than Bitcoin.

And the members of the new alliance — which include Banco Santander, BBVA, Credit Suisse, ING, Intel, Thomson Reuters and UBS — say the real-world testing of Ethereum makes it stronger than the alternatives.“Ethereum has this massive advantage of having the public network that has been tested for two years,” Mr.Gray, of Microsoft, said.A team of economists from UCL Centre for Blockchain Technologies, Deutsche Bundesbank, University of Wisconsin and The New School have published a research paper titled “The Evolution of the Bitcoin Economy: Extracting and Analyzing the Network of Payment Relationships.” The economists’ conclusion is that the Bitcoin economy has grown and matured from an early prototype stage, through a second growth stage characterized by “sin” (i.e.gambling, black markets), to a third stage marked by a sharp progression away from “sin” and toward legitimate enterprises.The conclusion is hardly surprising: Blockchain-related press headlines, which used to be mostly about Mt.

Gox and Silk Road only a couple of years ago, today tend to be about banks, exchanges and even central banks taking steps toward the operational use of blockchain technology.Nevertheless, it’s interesting to see how this conclusion was reached by thorough economic analysis.Bitcoin Magazine reached out to senior author Paolo Tasca, a director at the UCL Centre for Blockchain Technologies, to find out more about the research and related issues.Tasca, a fintech economist specializing in P2P financial systems and systemic risk, is a former senior research economist at Deutsche Bundesbank and a co-editor of the book “Banking Beyond Banks and Money.” “Our study starts by gathering together the minimum units of Bitcoin identities (the individual addresses) and it goes forward in grouping them into approximations of business entities, what we call ‘super clusters,’ by using tested techniques from the literature,” explained Tasca.“A super cluster can be thought of as an approximation of a business entity in that it describes a number of individual addresses that are owned or controlled collectively by the same beneficial owner for some special economic purposes.

The majority of these important clusters are initially unknown and uncategorized.” “The novelty of our study is given by the Pure User Group (PUG) and the Transaction Pattern (TP) analyses, by means of which we are able to ascribe the super clusters into specific business categories and outline a map of the network of payment relationships among them,” continued Tasca.The researchers identified four primary business categories in the Bitcoin economy: miners, gambling services, black markets and exchanges.It also included the three regimes mentioned above: early prototyping, “sin” and legitimate enterprises.The researchers studied the patterns of transaction behavior between the business categories and their users.The outcome of the study, which provides a quantitative assessment of the systemically important categories within the Bitcoin economy and their network of payment relationships, suggests a relevant public policy conclusion: Some recent concerns regarding the use of bitcoin for illegal transactions at the present time might be overstated and whatever such transactions may exist could further diminish as the Bitcoin economy continues to mature.

The University College London (UCL) Centre for Blockchain Technologies (CBT) is an interdepartmental, industry-oriented unit of UCL with the purpose to set the foundations for a new cross-disciplinary research area on distributed-consensus ledgers.The UCL CBT — currently comprising more than 30 research associates and seven funding departments with competences around three major research areas: Science and Technology, Economics and Finance and Policy, Law and Regulation — is committed to becoming the leading European research hub with an industry focus on the impact of blockchain technologies on socio-economic systems and the promotion of a safe and organic development and adoption of blockchain-based platforms.Tasca isn’t at liberty to share much information on UCL-CBT projects because of confidentiality restrictions.However, he confirmed that the UCL-CBT is involved in U.K.government initiatives to develop and deploy blockchain technology.the UCL-CBT is interacting with: 1) the Department of Work and Pension on a specific case study for payment system, 2) BoE, FCA on the use of smart contracts for algorithmic regulation and on the design of central bank issued digital currencies, 3) UCL-CBT is represented with Whitechapel Think Tank on distributed ledger technologies,” noted Tasca.

“In addition, the CBT is involved with several projects with the Alan Turing Institute.” Discussing the top opportunities and threats for blockchain-based fintech, Tasca noted that this is a complicated issue because blockchain technologies can find application in different domains.However, while most interest has come from the financial industry so far, Tasca expects to see more future activity in other sectors such as energy, telecommunications, media and healthcare.“New opportunities will emerge for them to redesign their business logic,” Tasca told Bitcoin Magazine.“The major threat I see so far is the lack of ‘technology literacy’: the lack of the ability to understand how blockchain works in the world,” continued Tasca.“This can hamper the development and spread of the technology.Thus, a more important educational effort is required to help blockchain become a mainstream technology used in different business processes: This represents the long-term aim and goal of the UCL-CBT.” To advance this important educational effort, the UCL-CBT will host the P2P Financial Systems 2016 (P2PFISY 2016) international workshop in September.

“This is the second edition of the P2PFISY workshop,” said Tasca.“This is a unique event in Europe because it will bring together scholars, regulators and practitioners interested in addressing questions of practical importance on digital currencies and blockchain technologies, P2P lending and crowdfunding, digital money transfer, mobile banking and mobile payments.” Tasca declined to comment on the recent unfortunate events related to Ethereum and The DAO.However, he is persuaded that blockchain technologies — especially through smart contracts, agent automation and DAOs — represent a new institutional technology: a new form of crypto-economic mechanism which allows governing of the difficulties inherent in transacting.“Opportunism (e.g., adverse selection, moral hazard) is by far the more difficult market friction which has been handled so far via traditional organizational hierarchies (which exploit incomplete contracts) and bilateral agreements (which require trust between parties),” Tasca told Bitcoin Magazine.

“Now, blockchains, smart contracts and DAOs can eliminate opportunism or at least compete with traditional forms of hierarchies and bilateral contracting.Their use case applications are very large and may include escrows, voting, and eviction, among the others.The combined use of the blockchain and smart contracts creates a platform where individuals can exchange, manufacture and execute contracts with considerable sophistication and with little cost.In perspective, by using appropriate automations (and its inherent standardization), they may evolve and bring about the completeness of missing markets.“I just wish to point out that our society is used to failures since the beginning of the first barter trades in the prehistoric age,” continued Tasca.“These did not stop with the advent of more sophisticated technologies and markets.The fact that now, thanks to technology, business can be run independently — without human intervention in the decision-making process — by machines, is welcome, but do not remove the sources of business risks which can bring failures.“Having said that, in the particular case under discussion, many of Ethereum developers were also involved to some degree with The DAO.

This brought an enormous conflict of interest because those who have the ability to shape changes in the Ethereum protocol had also a stake on one of its main applications, The DAO.Indeed, Ethereum is controlled by Vitalik Buterin mostly via his private Swiss-based non-profit organization, which received the proceeds of the ether auction, financing most of the development of Ethereum so far and which may own or control some of the resulting work.“To conclude, the conflict of interest led to a lose-lose strategy: Ethereum, also stakeholder of The DAO, decided to bail out the too-big-to-fail business.Without going into a debate about the quality of the code review process before releasing it to the market, this bailout has set a precedent and it would not be easy in the future to handle opportunistic moral-hazard behaviors.“Maybe, to bring more transparency, the entire governance structure of the Ethereum community with clear rules between all the stakeholders shall be redesigned based on pure principles of decentralized autonomous organizations.“As a side note, the methodology used in our study could be applied to the Ethereum blockchain to map the network of payments there and include smart contracts and DAOs as categories.” The recent publication of the much-discussed Bank of England (BoE) working paper titled “The Macroeconomics of Central Bank Issued Digital Currencies,” focused on the macroeconomic consequences of issuing central bank digital currency (CBDC) and shows that digital currencies are really and clearly on a fast path toward mainstream adoption.