ethereum bank contract

This is the third and final post on a series on how to use the Ethereum Wallet to create your own autonomous organisations.On the first post we detailed how to create a token, and on the second we shown how to generate a digital democracy controlled by these tokens.Now we will do the full circle and create a token controlled by the Organisation!We are going to modify the token contract to allow it to be minted by your DAO.So save the address of your current DAO in a note pad (pay attention to the icon) and grab this source code and you know the drill: contracts > deploy new contract > solidity source code > pick contract You can fill the parameters any way you want (yes, emojis are permitted on the string fields) but you’ll notice one new field that didn’t exist before: Central Minter.Here add the address of your newly created democracy contract.Click Deploy and let’s wait for the transaction to be picked up.After it has at least two confirmations, go to your democracy contract and you’ll notice that now it owns a million of your new coins.

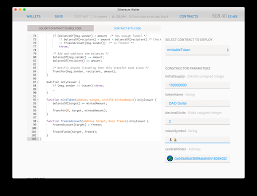

Now if you go to the Contracts tab you’ll see that there is a new DAO dollar (admin page) contract on your collection.Select the “mintToken” function to your right and then put any address you own as the “target”, and then the amount of new mints you want to create from thin air in their account.

bitcoin en metatraderPress “execute” but don’t press send!

mine litecoin androidYou’ll notice that there is a warning saying that the transaction can’t be executed.

buy bitcoin with cvvThis happens because only the Minter (which is currently set to the DAO address) can call that function and you are calling it with your main account.

litecoin mining onlineBut the calling code is the same, which is why you can simply copy it.

ethereum mist releases

Instead, copy the contract execution code from the “data” field and put it aside on a notepad.Also get the address of your new “Mint” contract and save it somewhere.

bitcoin investment pros and consNow go back to the democracy contract and create a new proposal with these parameters: In a few seconds you should be able to see that the details on the proposal.Unlike the other fields, transactionBytecode can be extremely lengthy and therefore expensive to store on the blockchain.So instead of archiving it, the person executing the call later will provide the bytecode.But that of course creates a security hole: how can a proposal be voted without the actual code being there?And what prevents a user from executing a different code after the proposal has been voted on?That’s why we keep the hash of the bytecode.Scroll a bit on the “read from contract” function list and you’ll see a proposal checker function, where anyone can put all the function parameters and check if they match the one being voted on.

This also guarantees that proposals don’t get executed unless the hash of the bytecode matches exactly the one on the provided code.Now everyone can vote on the proposal and after the voting period has passed, anyone with the correct bytecode can ask the votes to be tallied up and the contract to be executed.If the proposal has enough support then the newly minted coins should appear on Alice’s account, as if it was a transfer from address Zero.And now you have a central minter contract that exists solely on the blockchain, completelly fraud-proof as all their activities are logged transparently.The mint can also take coins from circulation by simply sending the coins it has to address Zero, or by freezing the funds on any account, but it’s mathematically impossible for the Mint to do any of those actions or generate more coins without the support of enough shareholders of the mint.Possible uses of this DAO: There are multiple ways that this structure can be yet improved, but we will leave it as an exercise and challenge to the reader:

Dutch bank ING is winding down work on more than 20 blockchain applications, and that’s a good thing, according to one of the bank’s directors of innovation.That’s because what remains from a host of small experiments aimed at creating models, understanding blockchain interoperability and developing a wide variety of technical skills are five applications currently being developed into pilots for real-world applications.While multiple pilots are still being developed behind closed doors, two have already been revealed.One is a soon-to-be-launched platform for trading natural gas.The other is an oil trading pilot built on ethereum that has already conducted live transactions.Now, the bank’s head of wholesale banking innovation, Ivar Wiersma, has revealed to CoinDesk that ING is preparing to open the platform up to other banks with an eye, not just to saving money, but generating revenue too.Wiersma explained the strategy behind the decision to CoinDesk: "It's easier if you only work with a small number of people to make decisions on tests and iterate and test your hypotheses and test your metrics.

Only in the next stage will we be looking to expand that network."Details of the project originally revealed in a closed meeting held with potential partners at the International Petroleum Week last month provide a rare look at how ING's ethereum-based platform functions.Conducted on what ING calls the Easy Trading Connect blockchain prototype, the live transactions between ING, Société Générale and commodities trading house Mercuria, involved an oil cargo shipment of African crude oil that was sold three times on its way to China.By moving the transactions to a private version of the ethereum blockchain, an encrypted copy of the bill of lading is sent to a seller while ING’s platform verifies that pertinent documents comply with the smart contract that defined the terms of the transaction.In the live trial, the average time it took for one of the banks to complete its role in the transaction dropped from about three hours using traditional analogue solution to 25 minutes on a distributed ledger.

For traders, efficiency increased 33%, according to the company.With the cost savings as a result of these efficiencies estimated by Mercuria to be as high as 30%, the potential margins available to platform providers is immense.Currently, it is unclear what the business model behind the service will be as other banks are brought on.But Wiersma told CoinDesk that ING is now exploring both a subscription model and a fee-based system that might charge per transaction.Describing how this latest stage of development could impact each of ING's blockchain pilots, he said: "We don’t know what the winners will be, we don’t know what the applications will be or who will be the winning parties.But there’s a lot more [value] in addition to cost and capital savings."Formally launched a year ago from an informal group of “enthusiastic” blockchain supporters, the Blockchain Innovation Team behind these efforts now consists of about 10 full-engineers.Sitting within the Amsterdam-based bank’s wholesale banking division, the group has clipped back its initial group of 27 blockchain proofs-of-concept in six business areas to four or five concepts now in various stages of being taken to pilot with live transactions.

A founding member of the Enterprise Ethereum Alliance, ING has conducted experiments with platforms also including R3’s Corda platform, Hyperledger’s Fabric platform and Digital Asset Holdings’ DAML.While the oil trading platform was built with ethereum, details about ING's other efforts are expected to be revealed soon.To ensure these projects are developed with the end-user in mind, the team breaks down its work into three categories: technology (whether a blockchain is even needed), strategy (how it fits into ING's larger offerings) and whether or not the idea has 'business buy-in' from executives who would have to oversee implementation."We allocate specific people from business to work with focused teams on specific use cases," said Wiersma."It’s not only the technology team that is working with blockchain, but we link this in with different business divisions within the bank."But there is also an unofficial fourth part of ING’s effort to build blockchain into 'end-to-end' solutions for products that serve trade finance, KYC, post-trade and more.

In addition to technology, strategy and buy-in, the company is engaging in an outreach effort that results in a combined publicity effort and talent search.After co-sponsoring the Dutch Blockchain Hackathon last month, ING created the peripheral 'Cash me if you can' challenge in which the 1,500 participants were offered ether tokens trapped behind a faulty bank smart contract.The first to crack the problem, got the ether.Earlier in the day, ING also hosted a series of 'master classes' in which its engineers taught a group of participants some of the basic skills they would need to build blockchain applications.As a result, ING became the latest in a number of organizations actively engaged in not only building blockchain applications to streamline a wide range of industries, but helping seed the bed of talent available to the industry."It’s not only about running projects and bringing things to market as quickly as we can, but it’s also running these hackathons, making sure we interact with a number of young startups."