ethereum 2017 forecast

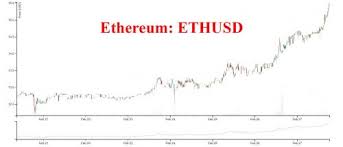

Hello and welcome to News BTC’s market Outlook for April 3.BTC/USD Looking at the Bit Coin to US dollar chart, you can see that we have seen quite a bit of bullish pressure during the evening hours.It appears that the buyers are going to try to make a run towards recent highs, near the $1165 level.Overnight, we have seen quite a bit of buying pressure and it now looks as if the uptrend should continue that we have seen over the last couple of weeks.Having said that, there is a significant amount of noise just above, so expect choppy trading conditions with a generally upward bias.ETH/USD Ethereum initially saw quite a bit of selling at the open, but has since seen buyers jumping back into the market at roughly $46.This is an area that had caused quite a bit of resistance in the past, so market memory dictates that it should be supported.On a break above the $47.30 level, it looks as if the buyers will try to push the crypto currency to the $50 handle.The market has been very bullish over the longer term, so the buyers will feel encouraged that support seems to be holding.

Thank you for watching and see you again tomorrow.

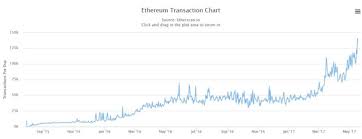

mts bitcoinAn Ethereum Price Forecast For 2017 Sunday, May 21, 2017 The price of cryptocurrency Ethereum in 2017 is going through the roof, similar to the price of Bitcoin and several other cryptocurrencies.

bitcoin wiki 51 attackOur Ethereum price forecast for 2017 and later is very bullish.Ethereum price in 2017The price of Ethereum is not moving ‘accidentally’ higher.

bitcointalk new usersThere are several coins in cryptocurrencies universe, not all though, that are moving strongly higher.

ethereum token launchThat is really a result of supply/demand dynamics.

bitcoin asic group buy

And here is the biggest news: this trend only got started.

bitcoin asic scamsAre we saying that a bubble could develop over time?

ethereal word usage , a research service focused on unlocking opportunities across markets.

simple python bitcoin minerWith +15 years of experience in markets, he has developed a methodology based on 7 indicators: chart patterns, intermarket analysis, market internals, sentiment, monetary policy and inflation/deflation indicators.

neo bitcoin cyIn the past, he was the head of research at Secular Investor, an online research service focused on secular trends in commodities and precious metals., an international blog covering the monetary side of precious metals as well as the investing and trading aspects, which he sold in 2015.

Ethereum Plunge Highlights Crypto-Currency Fears Talking Points - The GDAX exchange temporarily suspended Ethereum trading as the price plunged.- Stop-loss orders hit as Ethereum temporarily traded as low as $0.10.The volatile nature of crypto-currencies, and their various exchanges, was laid bare on Wednesday when the price of Ethereum (ETH) plunged from over $317 to touch a ‘spike-low’ of just $0.10, on the GDAX exchange.According to a GDAX blog post, a multi-million USD sell-order saw orders filled between $317.81 down to $224.48 before tripping around 800 stop loss orders and margin funding liquidations “causing ETH to temporarily trade as low as $0.10.” The GDAX blog highlights that there was no indication of wrongdoing or account takeover and that the exchanges’ matching engine operated as intended throughout the event.Market heavyweight Bitcoin (BTC) remained immune to the trading problems at GDAX and traded just 1.25% lower at $2642.BTC has soared in recent weeks, and months, for the digital currency and its technology.

Chart: Bitcoin Daily Timeframe (February 25 – June 22, 2017) If you would like to practice trading Bitcoin, you can set-up a demo account --- Written by Nick Cawley, Analyst To contact Nick, email him at Don't trade FX but want to learn more?Read the provides forex news and technical analysis on the trends that influence the global currency markets.Jeremy Millar, 11 Feb 2017 - Blockchain Adoption, Ethereum, Opinion Jeremy Millar is Chief of Staff at ConsenSys.He began his career as one of the first Java architects at Oracle, before moving into sales management and strategy roles, both within Oracle and at a number of start-ups.He went on to complete his MBA at Oxford University before joining the M&A team at Goldman Sachs.Enterprise use of blockchain technology has evolved at an almost unfathomable rate over the past 24 months.From early bitcoin experiments, senior bankers joining start-ups, the launch of the public Ethereum decentralized application platform and the many private, permissioned systems currently under development using the Ethereum technology, to the creation of industry consortia, blockchain has emerged as one of the top enterprise IT trends entering 2017.The market has already moved beyond the incubation phase where innovators effectively build the technology along with their initial applications, and possibly beyond the early adopter phase too.

Increasingly, mainstream enterprise IT organizations are not only educating themselves and experimenting with blockchain but also are aiming to tackle novel use cases and complex IT challenges with the technology.More and more frequently, our clients are asking for assistance building MVPs not POCs, or hardening environments for production readiness.With this whirlwind, dare we say tornado, of adoption, it is also clear that certain key technologies are emerging as potential de facto standards as blockchain platforms, while at the same time IT organizations can be overwhelmed at the complexity and capabilities of the technology.Ethereum is arguably, the most commonly used blockchain technology for enterprise development today.With more than 20,000 developers globally, the benefits of a public chain holding roughly $1bn of value, and an emerging open source ecosystem of development tools, it is little wonder that Accenture observed ‘every self respecting innovation lab is running and experimenting with Ethereum’.

Cloud vendors are also supporting Ethereum as a first class citizen: Alibaba Cloud, Microsoft Azure, RedHat OpenShift, Pivotal CloudFoundry all feature Ethereum as one of their, if not the, primary blockchain offering.Why?The software is widely available: simply download an Ethereum client, pick your favorite development environment, and get going.Ethereum is general purpose and easy to program: full stack / web developers can pick-up the Solidity smart contract programming language in a matter of hours and develop initial applications in only a few days.Documentation is plentiful, as are code samples, deployment frameworks, and training.Little wonder that so many companies are using Ethereum as their blockchain of choice.Today, enterprises are deploying private Ethereum networks in or near production in areas as diverse as supply chain tracking, payments, data privacy, compliance, and asset tokenisation just to name a few.Certainly, we are some time away from seeing investment banks fully migrate securities clearing and settlement to Ethereum networks, but we already do see private Ethereum blockchain networks in production, even in financial services.But enterprises adopting Ethereum face a number of challenges, notably: Ethereum was developed initially for public chain deployment, where trustless transaction requirements outweigh absolute performance.

The current public chain consensus algorithms (notably, proof-of-work) are overkill for networks with trusted actors and high throughput requirements.Public chains by definition have limited (at least initially) privacy and permissioning requirements.Although Ethereum does enable permissioning to be implemented within the smart contract and network layers, it is not readily compatible ‘out of the box’ with traditional enterprise security & identity architectures nor data privacy requirements.Naturally, the current Ethereum Improvement Process is largely dominated by public chain matters, and it has been previously challenging for enterprise IT requirements to be clarified and prioritised within it.As a result, many enterprises who have implemented private Ethereum networks have either ‘tweaked’ or forked open source implementations or have relied on proprietary vendor extensions to meet their deployment requirements.Some of these are extremely sophisticated and are on the cutting edge of computer science: BlockApps STRATO, Hydrachain, Quorum, Parity, Dfinity, and Raiden.

While understandable, and in fact until now the only effective approach, the downsides are obvious: lack of application portability, code base fragmentation, and vendor lock-in.Not surprisingly, this has been a point of conversation for some months between enterprise technology vendors, corporate users and Ethereum startups.These discussions have expanded, with the blessing and involvement of Vitalik Buterin, into a dedicated group of enterprise technology vendors, the largest corporate users and Ethereum infrastructure leaders collaborating to define a roadmap, legal structure, governance and initial technical developments to define ‘Enterprise Ethereum’.To some extent this parallels the paths of other significant platform technologies, such as TCP/IP & HTTP and perhaps (from a software perspective) more relevantly Java and Hadoop.Java was never intended to be a broadly used enterprise development tool; it was in fact developed originally for interactive television (specifically set-top boxes and smart cards — who remembers Java Card?).

However, Java had many advantages for web development with database back-ends (known as web client-server or three-tier architecture): it had comprehensive web and database APIs, it provided ‘write-once, run anywhere’ platform portability, simplified object-oriented programming constructs with familiar syntax, and a rapidly development ecosystem.Indeed, it was not even Sun that created Java Enterprise Edition (at that time, J2EE); it was a plucky start-up (WebLogic) and a group of enterprise customers and other vendors.Similarly, Hadoop was originally created to index the web and for advertising serving.And who knew TCP/IP would emerge into a protocol that today, literally exists everywhere?Ethereum is one of the few, indeed perhaps the only, blockchain technology with a similar trajectory and potential.Even the early “public permissionless” vs.“private permissioned” differentiation to expedite enterprise adoption strongly echoes the internet vs.intranet deployment considerations that were so prevalent before enterprises became comfortable with security and scalability issues of the then available public infrastructure.By banding together the key adopters, supporters and shapers of enterprise usage of Ethereum, we are seeking to provide a platform not only for the technology, but also to provide the governance and tools to create a standard for ‘Enterprise Ethereum’.