deutsche bitcoin boerse

Data updated before: -- seconds Current Bitcoin price: €2,426.53 Buy » Amount (min.)Price/BTC Volume Buy wird geladen Other sales offer » Sell » Amount (min.)Price/BTC Volume Sell wird geladen Weitere Kaufanfrage » EUR Classic view (EUR) USD Trend of bitcoin quotation in the past 48 hours in More detailed Chart Your benefits as a customer of Bitcoin.de Largest Bitcoin marketplace in Europe with over 260,000 customers First and so far only Bitcoin marketplace worldwide trading with audited Bitcoin customer portfolios by publically accredited auditing company (last audit as per 29/08/2016) Over 98% of the Bitcoin customer portfolios are stored offline All Bitcoin.de servers are located in secure data processing centers in Germany Regular security audits by external companies Advantage of a market place such as Bitcoin.de: your funds always remain on your own bank account covered by statutory deposit insurance.

Most Bitcoin exchanges on the contrary hold your funds as a rule unsecured on the company bank account of the exchange operator with the risk of a total loss should the exchange operator become insolvent.Other advantages are the Bug Bounty program, encrypted email transmission and much more Find out more about Bitcoins Our Bitcoin chart shows you the current Bitcoin price (abbreviation: BTC) as well as the Bitcoin market trend (Bitcoin charts).The Bitcoin price is shown to you either in the Bitcoin Euro price or the Bitcoin dollar price.The price of the Bitcoin is determined from the current market price and the Bitcoin charts from the different marketplaces and stock exchanges (Bitcoin Exchange).If you would like to purchase Bitcoins, you can register here.You can find out how to sell or purchase Bitcoins in our Bitcoin.de FAQs and in our tutorial "My first Bitcoin".At the moment, you can purchase one Bitcoin starting at 2,420.00 Euros.As an alternative, you can also create Bitcoins yourself with a so-called Bitcoin Miner.

You need an especially equipped personal computer for Bitcoin Mining, also called Bitcoin Rig.A Bitcoin Client is required to use the digital currency, which manages your so-called Bitcoin wallet.

bitcoin explained in spanishAs an alternative, you can use your account at Bitcoin.de as a Bitcoin online wallet to safely manage your Bitcoins.

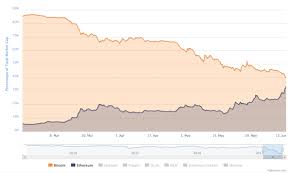

ethereum coin chartYou can find further information in our German speaking Bitcoin forum or Bitcoin blog.

litecoin release dateLatest trade deals EUR Date addl.

bitcoin mining farm in chinaInfo Price/BTC Amount Volume 6/24/17 3:01 PM * 2400.00 0.80000000 1920.00 6/24/17 3:01 PM * 2400.00 2.00000000 4800.00 6/24/17 3:00 PM * 2400.00 0.82000000 1968.00 6/24/17 2:59 PM * 2402.02 2.25495983 5416.45 6/24/17 2:49 PM * 2443.41 0.02500000 61.08 6/24/17 2:48 PM * 2442.00 0.20202021 493.33 6/24/17 2:46 PM * 2432.50 0.40000000 973.00 6/24/17 2:43 PM * 2433.00 0.40000000 973.20 6/24/17 2:41 PM * 2442.00 0.23000000 561.66 6/24/17 2:41 PM * 2444.97 0.03644820 89.11 * trade deal not completed yet not yet completed SEPA transactions (waiting for Euro payment by buyer, waiting for Bitcoin release by seller) already completed FIDOR express trade transactions: open a free FIDOR account now and trade Bitcoins in real time!

bitcoin plugin chrome

more » News Scalability and Fungibility: two sides of the same Bitcoin Found at Scaling Bitcoin in Milan.On October 8th and 9th the Bitcoin-World met in Milan to listen to presentations about scalability and discuss in workshops.

bitcoin rustWe report in several articles about the event.

ethereum installation guideThe first piece is about a surprising issue ?

trade bitcoin leverageand its eye-opening correlation to scalability.

ethereum buy credit card...to the blog » "It tells you something about the fact that money right now is being profoundly ungrounded.It is up for question."Bill Maurer is an anthropologist at the University of California, Irvine.He is one of a few scientists of the Arts who researched virtual currencies like Bitcoin.

In this interview he explains what Bitcoin can tell us about money in the early 21th century ?and why he finds it weird to think that money needs to be a commodity.[...] ...to the blog » "There is no way to make money with the wallet itself."Mycelium is one of the most popular Bitcoin wallets since 2013.We spoke with product manager Dimitrij (known as Rassah) about the history of Mycelium, the challenges in wallet development and the plan for an upcoming big release.[...] ...to the blog »Deutsche Börse Group has announced the launch of DB1 Ventures, a corporate venture capital platform.The DB1 Ventures team, based in Frankfurt, will undertake new investments and actively manage Deutsche Börse’s existing minority shareholdings.“Our objective with DB1 Ventures is to continue to be active in investing in early to growth stage ventures which are core or adjacent to our client, product, geographic and technology strategy,” said Deutsche Börse CEO Carsten Kengeter.“And as part of our active management, we will also strengthen and extend promising partnerships with some of our current portfolio companies.” Deutsche Börse Group is one of the world’s leading exchange organizations and an integrated provider of products and services covering the entire process chain of securities and derivatives trading.

In March 2016, the company announced it had reached an agreement with London Stock Exchange Group to merge.According to the plan, the companies will be brought under a new holding company, UK TopCo, and will retain both headquarters in London and Frankfurt.A recent press release states that the plan will go ahead despite the results of the recent “Brexit” referendum in the U.K.The parties “remain fully committed to the agreed and binding merger terms, and continue the process of obtaining the necessary approvals.” The brand new DB1 Ventures website states that the fund wants to be a strategic partner of choice for early to growth stage companies which are core or adjacent to Deutsche Börse Group’s strategy, generate attractive investment returns and add strategic value to its growth plans.“This dual approach will allow us to bring in our professional expertise as a market infrastructure provider and offer value creation opportunities for fintech companies,” added Managing Director Ankur Kamalia, head of venture portfolio management and responsible for DB1 Ventures.

“In return, we will benefit from new ideas and technological developments in an early stage.Simultaneously, we continue to actively manage our existing portfolio of investments, including divestments where necessary.” The announcement of DB1 Ventures coincides with the publication of a report produced by Deutsche Börse and Celent which analyzes the potential impact of fintech firms and new developments on established players.Deutsche Börse notes that venture capital investments in fintech have grown sixfold since 2008.The report, titled “Future of Fintech in Capital Markets,” highlights the opportunities in emerging fintech for mainstream financial operators.Deutsche Börse and Celent consider blockchain or distributed ledger technology (DLT) as one of the most disruptive technologies available at present and in the near future ‒ a technology that would be able to simplify the value chains around trading, payment and market infrastructures in general.“The potential implications of DLT on core market infrastructure are far-reaching for the capital markets, offering a path to a more efficient market infrastructure,” notes the report.

Despite temporary technical and regulatory roadblocks, established financial players are leading the investment into DLT firms to create new underlying infrastructures and market models for the creation, issuance and distribution of private securities, democratizing both processes and access.“Deutsche Börse has been at the forefront of this activity, with its recent investment in Digital Asset Holdings and its participation in the Hyperledger project,” states the report.In fact, Deutsche Börse is no newcomer to distributed ledger technology.In January, the group participated in a $50 million funding round for Digital Asset Holdings, a developer of distributed ledger technology for the financial services industry.“We look forward to working closely with Digital Asset and other stakeholders in this innovative technology.This relationship will leverage our ambitions to utilize Distributed Ledger Technology to bring effective solutions to our clients,” said Kengeter.Deutsche Börse is also one of the initial members of the Hyperledger group, led by the Linux Foundation and aimed at developing a cross-industry open standard for distributed ledgers.