china worries hit bitcoin prices

China has devalued the yuan, also known as the renminbi or RMB.The move Tuesday by the central bank comes as Chinese economic growth slows.First-half growth was 7% compared with the same period a year ago, the lowest in several years, and over the weekend, export data came in weaker than expected.Here's what you need to know:Devaluation is a decision by a government to adjust the value of a currency downward relative to another currency or standard.In China's case, the country's central bank has adjusted the daily trading band for the yuan, which is allowed to fluctuate 2% above or below a rate set by the People's Bank of China.The basis on which the government had fixed the daily exchange rate has been a secret, though significant capital outflows in recent months have suggested that the yuan should be losing value and it hasn't.NEWSLETTER: Get the day's top headlines from Times Editor Davan Maharaj >>Analysts say one reason is to help boost its slowing economy.The central bank said the devaluation is an attempt to let market forces have a greater role in the yuan's exchange rate in that it will now fix the daily rate based on how the yuan closes in the previous trading session.The U.S.

and other trading partners have long called for the government to loosen its tight grip over the country's currency valuation, saying the decision hurt foreign competitors and gave Chinese exporters an unfair price advantage.There might be an additional incentive.By the end of the year, the International Monetary Fund will review whether the yuan should be included in something called “special drawing rights,” which would basically mean including the yuan alongside the U.S.

litecoin asic possibledollar, the euro, the British pound and the Japanese yen as a formal reserve currency.The IMF has said China needs to do more to allow foreign access to its stock markets and make other changes before it includes the yuan in the special drawing rights.Giving the market a bigger role in determining the value of the yuan would be a positive sign to the IMF and could help China achieve its stated goal of making the yuan a more international currency.The devaluation could help stimulate China's declining export industry and lift the country's economic growth.As exports have softened, China runs the risk of large job losses in the manufacturing industries, which could be politically dangerous.

bitcoin capital crypto fund

Analysts, however, say a much bigger devaluation is needed to have a meaningful effect on China's large economy.There may also be some collateral damage alongside any potential benefit to exports.A weaker yuan will raise costs of imports, including dollar-denominated commodities, such as oil, which led to the fall of Chinese airline stocks after the announcement.It also can drive up the cost of servicing foreign debt held by Chinese companies.See the most-read stories this hour >>U.S.

sydney bitcoin exchangestocks fell and prices for copper and oil dropped after China devalued the yuan, as investors viewed the move as a signal of slowing Chinese growth.A cheaper yuan, of course, means a stronger dollar, and that hurts U.S.

bitcoin morgan stanleymanufacturers that want to export to China by making American-made goods more expensive.

bitcoin buzz app

It also likely means an increase in cheaper Chinese goods in the U.S., driving down import prices.Some analysts worry that China's devaluation may be exporting deflation around the world.The devaluation of the yuan isn't likely to affect the U.S.Federal Reserve's plans to raise interest rates this year, though a string of similar moves by Beijing could give Fed officials pause.A Treasury Department spokesperson reacted cautiously to China's devaluation and its planned reforms to its currency system.“We will continue to monitor how these changes are implemented and continue to press China on the pace of its reforms, including additional measures to transition to a market-oriented exchange rate and ... an economy that is more dependent on domestic demand,” the department said.“Any reversal in reforms would be a troubling development.”At this point, experts aren't concerned that Beijing's devaluation will spark a currency war in which countries take steps to lower their currencies for competitive reasons.Southeast Asian currencies — the Thai baht, Indonesian rupiah and Malaysian ringgit, among others — have been at their weakest levels in many years.

bitcoin armory app

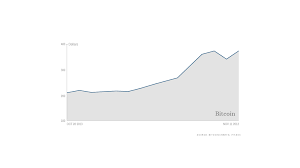

And their currencies fell upon news of China's devaluation.Although advanced economies also have intervened to keep their currencies from rising too much in recent years, both the European Union and Japan have seen the value of the euro and the yen, respectively, slide sharply against the yuan over the last two years because the Chinese currency is closely linked to the dollar.Times staff writer Don Lee in Washington, D.C., contributed to this report.Copyright © 2017, Los Angeles TimesShare This Story!Let friends in your social network know what you are reading aboutTwitterGoogle+LinkedInPinterestPosted!A link has been posted to your Facebook feed.xEmbedCLOSESAN FRANCISCO — Bitcoin, sometimes frowned upon as a currency of the underworld, is fast gaining currency in the financial world.The crypto-currency soared past $2,000 for the first time over the weekend as investors increasingly treat it as a new gold standard and countries such as Japan and China integrate it into their banking systems.

On Monday, it traded 6% higher at $2,182.74, according to CoinDesk.( that focuses on blockchain, the technology that underlies digital assets such as bitcoin, allowing it to be tracked and secure.Johnson was instrumental in the decision by e-commerce company Overstock to begin accepting bitcoin in January 2014."Bitcoinis a safe investment," Johnson says.Related:INFLATION Q&A: What you need to know about rising pricesBitcoin ransomware demand shows criminal links are hard to shakeInvestors are snapping up gold.Here's whyThere have been plenty of skeptics about bitcoin during its popular but volatile rise, from former Federal Reserve Chairman Ben Bernanke to J.P.Morgan Chase CEO Jamie Dimon, to users who were burned by the bankruptcy of bitcoin exchange Mt.Gox and ensuing plunge in prices.The predilection among criminals to use the peer-to-peer currency, as well as its place outside traditional banking systems and regulations, has stymied some of its advocates' best-laid plans.In March, the Securities and Exchange Commission rejected a proposal for the first exchange-traded fund that would track bitcoin's price, citing the currency's unregulated market.But global demand has offset those concerns.After Japanese regulators introduced rules this spring that recognize bitcoin as a legal method of payment, investors flocked to swap yen for bitcoin in a frenzy of trading activity.

In China, analysts attribute a spike in bitcoin sales to a significant drop in the difference in bitcoin prices between U.S.panies and governments are embracing the currency for several reasons: It's easy to transfer overseas without high surcharges; it offers simple, anonymous transactions online; and it is supported by a secure digital infrastructure."Itdoesn't surprise me at all that the price of bitcoin has been bid up," says Perianne Boring, president of the Chamber of Digital Commerce."(Crypto-currencies) Ethereum and Ripple are also surging strongly.""Therun-up in value isn't what's important — it's the fact that is has the potential to be a whole new kind of currency on the planet," says Mark Johnson, a long-time bitcoin investor who is CEO of Descartes Labs, which analyzes complex satellite images.Much of the attention around bitcoin has centered on its use by criminal enterprises, the latest being the demand of ransom — via bitcoin payment — from WannaCry, the group behind the world-wide hack that reached 150 countries this month.That may be changing as the price of bitcoin continues its ascent, validating Web browser pioneer and venture capitalist Marc Andreessen's prediction in 2014 that blockchain had the potential to become a multi-billion dollar technological breakthrough.Boost VC was the first fund to back a bitcoin-related start-up, Coinbase, in 2012, says Adam Draper, managing director of Boost.