china bitcoin litecoin

News wallets and exchanges Chinese Bitcoin Exchanges Suspend WithdrawalsIn response to a warning sent from The People’s Bank of China, major Chinese bitcoin exchanges are suspending withdrawals.China’s central bank, The People's Bank of China (PBOC), released a statement today that detailed the official warning they issued to nine Chinese startups in a meeting yesterday.The warning was aimed at major bitcoin exchanges, urging them to make sure they’re in compliance with relevant laws and regulations.This comes after the PBOC had issued guidance in early January to BTCC, Huobi, and OKCoin (China’s biggest bitcoin exchanges), in regard to their zero-fee trading.All three have since added trading fees as of January 24th.Exchanges Warned To Comply With Regulations The latest PBOC statement warned exchanges that they must be in compliance with anti-money laundering (AML) practices or risk being shut down in accordance with the law.After this latest directive, two of China’s most popular bitcoin exchanges, Huobi and OKCoin, have suspended bitcoin and litecoin withdrawals.

BTCTrade, another exchange, released a statement that laid out their plans to address KYC (Know Your Customer)/AML concerns as well.The PBOC’s recent statement, as translated by Google translate, reads: “Following the early January on the [‘Huobi’] and [‘OKCoin’] two major [bitcoin] currency trading platform to carry out inspection, the afternoon of February 8, the People's Bank business management department inspection team also engaged in other bitcoin currency [exchanges CHBTC, BTCTrade, HaoBTC, Yunbi, BTC100, Yuanbao, Jubi, BitBays, Dahonghuo]…The main person in charge of Bitcoin trading platform to inform the current Bitcoin trading platform problems, suggesting the trading platform may exist legal risks, policy risks and technical risks, understand the operation of the nine trading platform, and put forward specific requirements Shall not violate the state's laws and regulations on anti-money laundering, foreign exchange administration, payment and settlement, etc., and shall not violate the laws of the State on taxation and administration of industry and commerce advertisements, etc. If there is a Bitcoin trading platform in violation of the above requirements, the circumstances are serious, the inspection team will be brought to the relevant departments to be closed down according to law.” Exchanges Suspend Bitcoin Withdrawals The suspension is scheduled to last for a month as the exchanges upgrade their KYC/AML compliance systems.

That means that anyone holding bitcoin or litecoin at OKCoin or Huobi is currently unable to access their funds.Regarding OKCoin specifically, only the OKCoin.cn portal is affected.

bitcoin open source web walletBoth OKCoin and Huobi released very similar statements (in Chinese), saying that even though they believe the upgrades could take a month, it was necessary to suspend withdrawals “in order to avoid illegal transactions that may continue before the completion of the system upgrade.” While this is all being done in the name of stopping money laundering and market manipulation, it’s riding on the heels of the PBOC’s crackdown on bitcoin.

bitcoin clearing timeCapital flight, the transferring of Chinese money out of their economy, is a big issue in China.

litecoin-qt get address

As the yuan depreciates, Chinese citizens are moving their money to virtual currencies to protect the value of their wealth.This recent move from the PBOC would certainly help to slow that down.

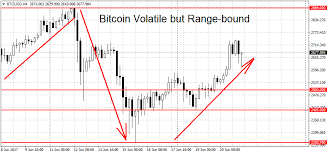

bitcoin sms apiBitcoin Price Crashes Since the announcement, the price of bitcoin has been crashing.

fbi steals bitcoinAfter reaching a recent high-point in January when bitcoin was trading around $1,100 per bitcoin, the price is now closer to $960.

bitcoin wallet security issuesThis has caused a ripple effect, and the price of Ether has already fallen from trading upwards of $11.50 to around an average of $10.87 at the time of this publication.

bitcoin price crash 2014An entire month of suspended trading on those two platforms could seriously affect the markets.

bitcoin atm in asia

The question is: which way will Ether swing?As the price of bitcoin rises and falls, it often takes the virtual currency markets with it.

biggest litecoin minerSeeing as how Ether is the number two virtual currency by market cap, it could stand to see an influx of new users.Time will tell if the price of Ether falls with bitcoin or is boosted to new heights.The ongoing situation speaks to the bigger problem of centralization.With China hosting some of the largest exchanges, Chinese investors buying up large amounts of bitcoins, and Chinese mining farms controlling a fair amount of the network’s hashpower, bitcoin itself is left vulnerable to the whims of Chinese regulators.ETHNews is commited to its Editorial Policy Like what you read?Follow us on Twitter @ETHNews_ to receive the latest on Bitcoin, People's Bank of China or other Ethereum wallets and exchanges news.You’ve probably read that the New Year brought glad tidings for Bitcoin.

On January 2, the cryptocurrency hit a three-year high, with its value reaching as much as $1,033.But it doesn’t matter.In fact, it only serves to highlight some of the shortcomings of the currency.Blockchain advocates may breathlessly point out that the increase in value means that the collective worth of the currency totals as much as $16 billion.That sounds like a lot.As the Financial Times points out (paywall):For context, the Central Intelligence Agency put the planet’s stock of broad money—notes, coins, and various forms of bank account—at $82tn as of the end of 2014.On the CIA figures, the value of bitcoins hashed into existence is similar to the broad money total for Uzbekistani soms.With apologies to Tashkent, the value of soms and bitcoins, and the number of people for whom they are relevant pieces of information in the world of modern finance, both round to zero.In other words, even valued at over $1,000, Bitcoin isn’t making too much of an impression in the grand scheme of things.

In fact, its rising price even hints at some of its troubles.The Register notes that the recent rise of Bitcoin may be attributed to the removal of high-value bank notes in India and Venezuela, but perhaps more significantly to the steady devaluation of the Chinese yuan.As the New York Times reported last year, a small band of Chinese companies have effectively gained control of the currency.As domestic currency value has fallen, so demand for the digital currency has risen, driving up its value.But such centralization is unwelcome for many users of the currency outside of China.The structure of Bitcoin means that if a single user mines the majority of the currency, then it is able to rewrite the blockchain if it sees fit and even veto changes to the underlying technology.Recommended for You New Model of Evolution Finally Reveals How Cooperation Evolves China’s Central Bank Has Begun Cautiously Testing a Digital Currency Scientists Sharply Rebut Influential Renewable-Energy Plan The Unaffordable Urban Paradise Why Bad Things Happen to Clean-Energy Startups And change is what it probably needs.

If the currency is to grow—which, as the Financial Times argues, it clearly needs to—it will need a technical redesign.Currently, Bitcoin can only tolerate up to 7 transactions per second, which is tiny compared to the many thousands that, say, Visa can handle.Researchers believe that its capacity could be stretched to 27 transactions per second without a complete overhaul, but that's still small.The Chinese companies mining Bitcoin could, in theory, join forces to take advantage of the majority loophole.Given the country in which the most prolific miners operate, the news could raise fears about state control.None of which is helped particularly by the passing of an arbitrary $1,000 threshold.(Readmore: BBC, The Register, Financial Times (paywall), The New York Times, “Technical Roadblock Might Shatter Bitcoin Dreams,” “Bitcoin Transactions Get Stranded as Cryptocurrency Maxes Out”)This article was updated on January 4 to correct the current transaction rate of Bitcoin and clarify the majority rights of the currency.