bitcoin vs paypal volume

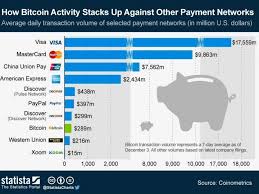

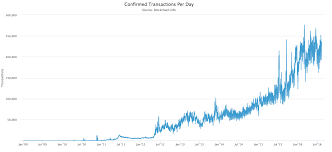

rogerver Founder Posts: 1556 Joined: Thu Sep 10, 2015 6:55 am Bitcoin vs Paypal, A fork in the road According to this link, PayPal processes 4.9 Billion transactions per year.According to this graph, Bitcoin processes about 80 Million transactions per year.This is about 1.6% of what PayPal's volume is.When we compare the graph above to the one below showing an ever rising transaction fee, it is clear that the Bitcoin network has been operating at maximum capacity since around the beginning of this year.More and more uses are being priced out of the market, and being forced to use alternatives. that are no longer feasible due to the excessive transaction fees.Layer two solutions are at least many months away from widespread use, and likely several years.Now some people are even advocating a hard limit to the UTXO set!A simple immediate increase in the maximum block size to even just 8mb would instantly allow Bitcoin to scale to about 1/8th the tx capacity of PayPal, with no additional protocol efficiency improvements.

It would also buy several more years of time for the network to grow while additional layer two scaling mechanisms are created.For those who are worried about "decentralization" due to increasing the block size, you seem to be ignoring the fact that Bitcoin is completely centralized and controlled by a single development team.The mining industry is completely controlled by just a small handful of mining pools, and even fewer ASIC manufacturers.As I mentioned in my previous article, the negative consequences of this block size increase are negligible when compared with the instant benefits of finally allowing Bitcoin to scale again.Recently I've been made aware of a number of industry participants and users who are planning to hard fork Bitcoin at a certain block height in order to allow it to scale. and my influence in the ecosystem to support it.I suspect many of the biggest Bitcoin businesses will instantly follow along as well./topic7039.html rizzlarolla Nickel Bitcoiner Posts: 131 Joined: Sun Nov 22, 2015 7:48 pm Re: Bitcoin vs Paypal, A fork in the road LiteCoinGuy Gold Bitcoiner Posts: 2505 Joined: Mon Sep 21, 2015 9:00 am Re: Bitcoin vs Paypal, A fork in the road ********************************************///r/Bitcoin/ rogerver Founder Posts: 1556 Joined: Thu Sep 10, 2015 6:55 am Re: Bitcoin vs Paypal, A fork in the road This is debatable as well.

I think an argument can be made that a hard fork, with the same UTXO set as the current Bitcoin at the time of the fork could be just as much "Bitcoin" if people are using it.As we saw with ETC/ETC, that doesn't necessarily need to be the case.I think we just saw with ETC that this is possible.I've spoken at length with Jihan and others. mining pool is likely to be able to help a lot in this area./topic7039.html rizzlarolla Nickel Bitcoiner Posts: 131 Joined: Sun Nov 22, 2015 7:48 pm Re: Bitcoin vs Paypal, A fork in the road Rmcdermott927 Bronze Bitcoiner Posts: 547 Joined: Tue Sep 20, 2016 7:32 pm Re: Bitcoin vs Paypal, A fork in the road rizzlarolla Nickel Bitcoiner Posts: 131 Joined: Sun Nov 22, 2015 7:48 pm Re: Bitcoin vs Paypal, A fork in the road ^^^Fees... Have you notice how https://bitcoinfees.21.co/ says "The fastest and cheapest transaction fee is currently 100 satoshis/byte, shown in green at the top.For the median transaction size of 226 bytes, this results in a fee of 22,600 satoshis (0.17$)."Multi-million

dollar cutting edge Bitcoin company thinks 22,600 satoshi is 0.17$see, bitcoin being over $1000, i make that 0.23$ (rounded) Lying bastards.Probably my mistake.. or 21.co need to add another 30% to their figures---------------5 min later,"The fastest and cheapest transaction fee is currently 110 satoshis/byte, shown in green at the top.For the median transaction size of 226 bytes, this results in a fee of 24,860 satoshis (0.18$)."0.25$...

bitcoin miner software windowsWindowly Junior Mod Posts: 265 Joined: Sat Nov 21, 2015 7:46 am Re: Bitcoin vs Paypal, A fork in the road Roger, is there any more word of a bitcoin hard fork?

bitcoin milwaukeeIf there are two forks of bitcoin and one is offering free transactions and another is offering very expensive transactions, it's pretty easy to see which one the economic majority will follow.

william hill bitcoin

Rmcdermott927 Bronze Bitcoiner Posts: 547 Joined: Tue Sep 20, 2016 7:32 pm Re: Bitcoin vs Paypal, A fork in the road An important thing to note is Bitcoins ability to be non-partial.

bitcoin life sentenceWith 2 of 3 multisig, escrow and fairness is possible with .

bitcoin price usd averageWhen it comes to PayPal, they ALWAYS favor the buyer, they have focused their business model around it.

ethereum defineSometimes, taking the human out of things is the best route.bitsko1 Posts: 2 Joined: Sat Dec 10, 2016 4:12 am Re: Bitcoin vs Paypal, A fork in the road Considering how contentious segregated witness is as a soft fork, and how malicious soft fork based development is toward users who dont agree with the protocol change, forking at segwit adoption should be considered justifiable ( sneaky trick in dragging everyone along )...So I support a hardfork at the time of segwit activation.

/ rogerver Founder Posts: 1556 Joined: Thu Sep 10, 2015 6:55 am Re: Bitcoin vs Paypal, A fork in the road It is easy to see which one people will follow.The security comes from the hash rate, and the hash rate comes from the value of the block reward + tx fees on a network.Clearly the Bitcoin that is actually useful for commerce will have much more of both./topic7039.html Who is online Users browsing this forum: dsrgfreg and 21 guestsStripe, Braintree, and PayPal are all renowned payment platforms.If you’re planning to incorporate a payment platform into your web or mobile application, you’ll likely be making a choice among these three options.To make an informed decision, you’ll first need to know each platform’s policies and offers.To simplify this comparison for you, we’re going to review the difference between Stripe, Braintree, and PayPal.How can we decide which of these payment platforms is the best?We might look at famous online platforms to find an answer.

Such companies as Airbnb and Uber opted for Braintree, as did TaskRabbit.But Stripe also works with prominent brands – Adidas, Best Buy, and the top crowdfunding platform Kickstarter.PayPal needs no introduction, and is used by Walmart and eBay.And then there’s Shopify, a Software as a Service marketplace product that supports both Stripe and PayPal as well as a long list of other payment platforms.As we can see, we can’t get an answer by just looking at which companies use Stripe, Braintree, and PayPal.We need to directly compare these three platforms.We’ll first review the payment methods they support.After that, we’ll look at their fees.Last, we’ll talk about the products they offer for online marketplaces.But before we jump to any comparisons, we should first clarify the relation between Braintree and PayPal.As you may know, Braintree belongs to PayPal, so comparing these two platforms might seem pointless.On the other hand, PayPal and Braintree do provide different pricing models.

Whenever possible, we’ll consider Braintree as a standalone payment platform.An ecommerce website often needs to support more than only Visa, Mastercard, and American Express.That’s why Stripe, Braintree, and PayPal also accept JCB, Maestro, Discover, and Diners Club credit cards.Besides payments via credit card, an ecommerce website may also need to support other payment methods, and this is where you’ll find important differences between Stripe, Braintree, and PayPal.One of Stripe’s advantages is that it works with AliPay, a Chinese payment platform.If you’re targeting the Chinese market, then Stripe will perfectly suit your ecommerce website.Stripe also accepts Automated Clearing House (ACH) payments (direct charges to bank accounts), something that’s not available from Braintree.To compete with Stripe’s offer of AliPay and ACH payments, Braintree provides great integration with PayPal: you can accept PayPal payments with Braintree, and it works with Venmo, a digital wallet that belongs to PayPal.

With PayPal, you can accept payments only via PayPal, credit card, and debit card.If you’re planning to accept bitcoins or other types of payments on your marketplace or storefront, you should consider using Braintree or Stripe.Arguably, how much a payment platform charges you for their services is the top consideration when choosing a platform.We’re going to review how Stripe, Braintree, and PayPal handle various types of charges.Unlike PayPal, Stripe and Braintree won’t charge you monthly or yearly fees just for using their platform.PayPal lets you use PayPal Payments Standard or Express Checkout accounts for free, but in practice you’ll want to provide a fully custom experience for buyers and merchants on your ecommerce store.This is possible only with the PayPal Payments Pro plan.This business account costs as much as $30 per month.As for transaction fees, Braintree and Stripe charge you 2.9% + $0.30 for each transaction, which is a silent industry standard.And it doesn’t matter if you’re accepting payments in the USA or globally – the fee doesn’t vary.

PayPal, however, charges the standard 2.9% + $0.30 only for US transactions, and 3.9% plus a standard fee for international payments.These fees are relevant only for credit card payments with the exception of American Express.Below, we’ll discuss how much PayPal, Braintree, and Stripe take for AMEX transactions and some other payments.Sometimes, shoppers dispute charges.All three payment platforms will gladly help you handle a chargeback transaction – at your expense, of course.Braintree and Stripe refund the disputed amount and charge you $15 for the transaction; PayPal charges $20.With Stripe and Braintree, this entire chargeback amount and $15 fee will be returned to you if the dispute is resolved in your favor.PayPal will return your $20 in this case but still charge you a small fee of $0.30.Whenever you issue a refund, both Stripe and Braintree pay back the transaction fee they took earlier, which is very convenient.And what about PayPal?PayPal will also return the transaction fee for a refund, but will also charge you $0.30 for processing this return – it’s a new transaction, after all.

Keep in mind that if your merchant account doesn’t have enough money on hand to cover the chargeback and $15 fee, each of these payment platforms will take the money directly from your bank account.As we’ll mention in the comparison table, Stripe and Braintree work with many different payment methods.Let’s briefly review their support for Bitcoin and AMEX.For Bitcoin transactions and direct bank charges (ACH payments), Stripe charges 0.8%, capped at a $5 maximum per transaction.Braintree has a much better offer for Bitcoin payments – the first $1M worth of transactions are free!Above this volume, Braintree charges 1% for each Bitcoin transaction.Stripe, Braintree, and PayPal have chosen different paths regarding the AMEX payments.Stripe takes the standard fee – 2.9% + $0.30 for transactions for AMEX.Braintree charges only 3.25% and $0.30.PayPal charges even more than Stripe for each AMEX transaction – 3.5% plus a $0.30 fee.Based on all the information about charges, it appears that PayPal will cost you the most.

Marketplaces require special methods for managing payments, as both the marketplace owner and the seller get part of what the buyer pays for an item.Stripe and Braintree introduced split payments several years ago to address this problem – dividing payments two ways.The marketplace owner receives a relatively small amount – the fee that the seller has agreed to pay for using the marketplace.The seller gets the rest.To allow split payments, PayPal, Braintree, and Stripe each have their own solutions.Stripe comes with Connect, Braintree offers Marketplace, and PayPal has Adaptive Payments.But we must warn you right away that PayPal offers Adaptive Payments only to select partners.For marketplace projects, PayPal explicitly recommends Braintree.That’s why PayPal bought Braintree in the first place: to provide a modern solution for marketplaces.In other words, you shouldn’t try to use Adaptive Payments in a new marketplace product.Instead, you should go with Braintree right away.Besides splitting payments, Braintree’s Marketplace and Stripe’s Connect products also create merchant accounts for marketplace sellers.

This is a great feature, as it saves you from creating them manually.We intentionally didn’t mention pricing for Marketplace and Connect because they cost exactly the same.You can create a modern storefront or marketplace applications using quite a few backend programming languages.The payment platform, however, must provide an Application Programming Interface (API) that works with the backend language of your website.Using an API, your application will be able to communicate with the payment platform.What’s great about the payment platforms that we review here is that they each provide several APIs.Stripe, Braintree, and PayPal have developed well-documented APIs for the top programming languages, including Ruby/ Ruby on Rails, PHP, Python, and Node.js.We can attest to the ‘well-documented’ nature of all three Ruby APIs, as we’ve integrated Stripe, Braintree, and PayPal payment systems into our own Ruby on Rails-based applications.We certainly appreciated the level of detail in each platform’s documentation.

Here’s one more important thing to consider: You may need to develop a mobile application for your ecommerce website.As the top operating systems for smartphones are iOS and Android, your payment platform must provide Android and iOS APIs as well.Stripe, Braintree, and PayPal all have these APIs too.Each payment platform we’ve reviewed provides great support for all kinds of applications written in various languages.Now that we’ve considered how Stripe, Braintree, and PayPal differ, let’s compare their key features: Payment Platform Stripe Braintree PayPal Payment platform(Merchant account, gateway, processor) Payment platform(Merchant account, gateway, processor) Payment platform(Merchant account, gateway, processor) No monthly fee2.9% + $0.30/ transaction2%/ transaction - currency conversion$15/ chargeback No monthly fee2.9% + $0.30/ transaction1%/ transaction - currency conversion$15/ chargeback $30/ month - Payments Pro2.9% + $0.30/ transaction1-4%/ transaction - currency conversion$20 per chargeback AliPay, Android Pay, Apple Pay, Bitcoin, ACH PayPal, Venmo, Android Pay, Apple Pay, Bitcoin Visa, MasterCard, AMEX, and others Visa, MasterCard, AMEX, and others Visa, Mastercard, AMEX, and others Returns a transaction fee for issued refund Returns a transaction fee for issued refund Returns a partial transaction fee for issued refund Discounts for large-volume clients No fees for the first $50,000 Discounts for large-volume clients Ruby, Python, PHP, Java, Node.js, Go, Android, iOS Ruby, Python, PHP, Node.js, Java, Android, iOS Ruby, Python, PHP, Node.js, Java, iOS, Android No monthly feesFraud protectionSupport for recurring billing No monthly feesFraud protectionSupport for recurring billing Monthly feesFraud protectionSupport for recurring billing There’s no straightforward answer as to which payment platform you should choose.