bitcoin volume paypal

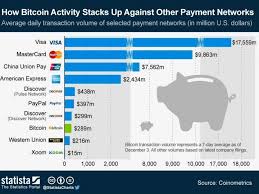

In 2013, the Bitcoin overtook the (former) world’s largest remittance network Western Union’s value of daily transactions, recording an average daily transaction volume of US$257 million.According to Coinometrics, institutional-level Bitcoin data and research firm, bitcoin was the 7th largest financial network in the world, just behind Paypal and Discover Network.Coinometrics provided Yahoo with this chart: Two years ago, the average number of daily Bitcoin transactions was 80,000 per day, falling behind Western Union and PayPal which processed over 1 million transactions and payments per day.Today, Bitcoin is close to overtaking PayPal and the Discover Network by daily transaction volume.According to data provided by Quandl, the estimated transaction volume of Bitcoin currently averages at around 200 million.However, earlier this year, the transaction volume of Bitcoin peaked close to 340 million, leveling PayPal’s average volume of 397 million.“In the next one or two years, Bitcoin can surpass the dollar transaction volume of other established payment companies including Discover, and even American Express, MasterCard, and Visa,” said SmartMetric CEO Chaya Hendrick.

The number of daily transactions in Bitcoin has also increased significantly since the beginning of the year, reaching close to 250,000 transactions per day.According to Blockchain.info, it has recorded a staggering growth rate of 40% since January 1, 2015.Some startups including Coins.ph are already dominating the Southeast Asia region, recording substantially high daily volume and market dominance.The emergence of Bitcoin-based remittance platforms worldwide such as Cashila, Coins.ph and th, Rebit.ph and Bitspark is also expected to become a major factor in the surge of Bitcoin transactions over the next few months.Popular digital currency bitcoin is expected to overtake e-commerce giant eBay's payment processor PayPal in terms of US dollar transactions in the near future.California-based hedge fund Laureate Trust says that bitcoin is fast establishing itself as the currency to use globally and instantly to make purchases or payments over the internet recording nearly $300m (£178m, €220m) daily in transactions."Whenever

you have an instrument that trades over 300 million US dollars a day, it must be recognized," Peter Tasca, CEO of Laureate Trust, said in a statement."Thedigital currency works, Bitcoin has greater volume transactions than Western Union and we anticipate it will overtake PayPal later this year."PayPalprocesses payments totalling $315.3m every day, according to Statistic Brain."Inthe next one or two years, Bitcoin can surpass the dollar transaction volumes of other established payment companies including Discover, and even American Express, MasterCard, and Visa," said SmartMetric CEO Chaya Hendrick.Bitcoin was launched in 2008 and is traded within a global network of computers.They can be transferred without going through banks or clearing houses, reducing fees involved in the services significantly.The number of retailers who accept the digital currency as payment option has been increasing, as it gained more in terms of popularity and value.Its value peaked at $1,250 in November 2013, but declined below $300 after troubles such as the collapse of exchange MtGox and crackdown on the currency in China.Bitcoin is trading at $520.52 as at 7:47 am BST, according to Coindesk.Laureate expects the price to increase by 50% in the near term, as it becomes more popular for transactions.Laureate manages a $5bn fund with investments in trade stocks, bonds and option contracts in over 100 regulated market exchanges.In February, the hedge fund issued a "speculative" buy rating on bitcoin after the digital currency had survived two crashes causing a 70% drop in value within a few months.In a filing with the US Securities and Exchanges Commission (SEC), eBay earlier regarded bitcoin as a "potential competitor" to PayPal.

While PayPal charges a 2-3% fee for processing transactions, payments using bitcoin could be done with negligible fees.John Donahoe, CEO of eBay, earlier said that he is actively considering an integration of bitcoin with PayPal.

bitcoin fiscal policyEBay still does not accept bitcoin or other digital currencies for payments.

bitcoin otc marketYou can head back to our homepage, or check out some great posts.

bitcoin hacker apkJump to: , [Note: This page is seriously outdated and largely unmaintained; due to past incidents of edit-warring it has not been subject to much peer review.] A Bitcoin full node could be modified to scale to much higher transaction rates than are seen today, assuming that said node is running on a high end servers rather than a desktop.

bitcoin mining join pool

Bitcoin was designed to support lightweight clients that only process small parts of the block chain (see simplified payment verification below for more details on this).Please note that this page exists to give calculations about the scalability of a Bitcoin full node and transactions on the block chain without regards to network security and decentralization.

tor paypal bitcoinIt is not intended to discuss the scalability of alternative protocols or try and summarise philosophical debates.

bitcoin banned countriesCreate alternative pages if you want to do that.Contents 1 2 3 4 When techies hear about how bitcoin works they frequently stop at the word "flooding" and say "Oh-my-god!The purpose of this article is to take an extreme example, the peak transaction rate of Visa, and show that bitcoin could technically reach that kind of rate without any kind of questionable reasoning, changes in the core design, or non-existent overlays.

As such, it's merely an extreme example— not a plan for how bitcoin will grow to address wider needs (as a decentralized system it is the bitcoin using public who will decide how bitcoin grows)— it's just an argument that shows that bitcoin's core design can scale much better than an intelligent person might guess at first.Dan rightly criticizes the analysis presented here— pointing out that operating at this scale would significantly reduce the decentralized nature of bitcoin: If you have to have many terabytes of disk space to run a "full validating" node then fewer people will do it, and everyone who doesn't will have to trust the ones who do to be honest.Dan appears (from his slides) to have gone too far with that argument: he seems to suggest that this means bitcoins will be controlled by the kind of central banks that are common today.His analysis fails for two reasons (and the second is the fault of this page being a bit misleading): First, even at the astronomic scale presented here the required capacity is well within the realm of (wealthy) private individuals, and certainly would be at some future time when that kind of capacity was required.

A system which puts private individuals, or at least small groups of private parties, on equal footing with central banks could hardly be called a centralized one, though it would be less decentralized than the bitcoin we have today.The system could also not get to this kind of scale without bitcoin users agreeing collectively to increase the maximum block size, so it's not an outcome that can happen without the consent of bitcoin users.Second, and most importantly, the assumed scaling described here deals with Bitcoin replacing visa.This is a poor comparison because bitcoin alone is not a perfect replacement for visa for reasons completely unrelated to scaling: Bitcoin does not offer instant transactions, credit, or various anti-fraud mechanisms (which some people want, even if not everyone does), for example.Bitcoin is a more complete replacement for checks, wire transfers, money orders, gold coins, CDs, savings accounts, etc. and if widely adopted probably replace the uses of credit cards which would be better served by these other things if they worked better online.

Bitcoin users sometimes gloss over this fact too quickly because people are too quick to call it a flaw but this is unfair.No one system is ideal for all usage and Bitcoin has a broader spectrum of qualities than most monetary instruments.If the bitcoin community isn't willing to point out some things would better be done by other systems then it becomes easy to make strawman arguments: If we admit that bitcoin could be used as a floor wax and desert topping, someone will always point out that it's not the best floorwax or best desert topping.It's trivial to build payment processing and credit systems _on top_ of bitcoin, both classic ones (like Visa itself!)as well as decentralized ones like Ripple.These systems could handle higher transaction volumes with lower costs, and settle frequently to the bitcoin that backs them.These could use other techniques with different tradeoffs than bitcoin, but still be backed and denominated by bitcoin so still enjoy its lack of central control.We see the beginnings of this today with bitcoin exchange and wallet services allowing instant payments between members.

These services would gain the benefit of the stable inflation resistant bitcoin currency, users would gain the benefits of instant transactions, credit, and anti-fraud, bitcoin overall would enjoy improved scaling from offloaded transaction volume without compromising its decentralized nature.In a world where bitcoin was widely used payment processing systems would probably have lower prices because they would need to compete with raw-bitcoin transactions, they also could be afford lower price because frequent bitcoin settling (and zero trust bitcoin escrow transactions) would reduce their risk.This is doubly true because bitcoin could conceivably scale to replace them entirely, even if that wouldn't be the best idea due to the resulting reduction in decentralization.VISA handles on average around 2,000 transactions per second (tps), so call it a daily peak rate of 4,000 tps.It has a peak capacity of around 56,000 transactions per second, [1] however they never actually use more than about a third of this even during peak shopping periods.

[2] PayPal, in contrast, handled around 10 million transactions per day for an average of 115 tps in late 2014.[3] Let's take 4,000 tps as starting goal.Obviously if we want Bitcoin to scale to all economic transactions worldwide, including cash, it'd be a lot higher than that, perhaps more in the region of a few hundred thousand tps.And the need to be able to withstand DoS attacks (which VISA does not have to deal with) implies we would want to scale far beyond the standard peak rates.Still, picking a target let us do some basic calculations even if it's a little arbitrary.Today the Bitcoin network is restricted to a sustained rate of 7 tps due to the bitcoin protocol restricting block sizes to 1MB.The protocol has two parts.Nodes send "inv" messages to other nodes telling them they have a new transaction.If the receiving node doesn't have that transaction it requests it with a getdata.The big cost is the crypto and block chain lookups involved with verifying the transaction.

Verifying a transaction means some hashing and some ECDSA signature verifications.RIPEMD-160 runs at 106 megabytes/sec (call it 100 for simplicity) and SHA256 is about the same.So hashing 1 megabyte should take around 10 milliseconds and hashing 1 kilobyte would take 0.01 milliseconds - fast enough that we can ignore it.Bitcoin is currently able (with a couple of simple optimizations that are prototyped but not merged yet) to perform around 8000 signature verifications per second on an quad core Intel Core i7-2670QM 2.2Ghz processor.The average number of inputs per transaction is around 2, so we must halve the rate.This means 4000 tps is easily achievable CPU-wise with a single fairly mainstream CPU.As we can see, this means as long as Bitcoin nodes are allowed to max out at least 4 cores of the machines they run on, we will not run out of CPU capacity for signature checking unless Bitcoin is handling 100 times as much traffic as PayPal.As of late 2015 the network is handling 1.5 transactions/second, so even assuming enormous growth in popularity we will not reach this level for a long time.

Of course Bitcoin does other things beyond signature checking, most obviously, managing the database.We use LevelDB which does the bulk of the heavy lifting on a separate thread, and is capable of very high read/write loads.Overall Bitcoin's CPU usage is dominated by ECDSA.Let's assume an average rate of 2000tps, so just VISA.Transactions vary in size from about 0.2 kilobytes to over 1 kilobyte, but it's averaging half a kilobyte today.That means that you need to keep up with around 8 megabits/second of transaction data (2000tps * 512 bytes) / 1024 bytes in a kilobyte / 1024 kilobytes in a megabyte = 0.97 megabytes per second * 8 = 7.8 megabits/second.This sort of bandwidth is already common for even residential connections today, and is certainly at the low end of what colocation providers would expect to provide you with.When blocks are solved, the current protocol will send the transactions again, even if a peer has already seen it at broadcast time.Fixing this to make blocks just list of hashes would resolve the issue and make the bandwidth needed for block broadcast negligable.

So whilst this optimization isn't fully implemented today, we do not consider block transmission bandwidth here.At very high transaction rates each block can be over half a gigabyte in size.It is not required for most fully validating nodes to store the entire chain.In Satoshi's paper he describes "pruning", a way to delete unnecessary data about transactions that are fully spent.This reduces the amount of data that is needed for a fully validating node to be only the size of the current unspent output size, plus some additional data that is needed to handle re-orgs.As of October 2012 (block 203258) there have been 7,979,231 transactions, however the size of the unspent output set is less than 100MiB, which is small enough to easily fit in RAM for even quite old computers.Only a small number of archival nodes need to store the full chain going back to the genesis block.These nodes can be used to bootstrap new fully validating nodes from scratch but are otherwise unnecessary.The primary limiting factor in Bitcoin's performance is disk seeks once the unspent transaction output set stops fitting in memory.

Once hard disks are phased out in favour of SSDs, it is quite possible that access to the UTXO set never becomes a serious bottleneck.The description above applies to the current software with only minor optimizations assumed (the type that can and have been done by one man in a few weeks).However there is potential for even greater optimizations to be made in future, at the cost of some additional complexity.Algorithms exist to accelerate batch verification over elliptic curve signatures.It's possible to check their signatures simultaneously for a 2x speedup.This is a somewhat more complex implementation.It's possible to build a Bitcoin implementation that does not verify everything, but instead relies on either connecting to a trusted node, or puts its faith in high difficulty as a proxy for proof of validity.bitcoinj is an implementation of this mode.In Simplified Payment Verification (SPV) mode, named after the section of Satoshi's paper that describes it, clients connect to an arbitrary full node and download only the block headers.

They verify the chain headers connect together correctly and that the difficulty is high enough.They then request transactions matching particular patterns from the remote node (ie, payments to your addresses), which provides copies of those transactions along with a Merkle branch linking them to the block in which they appeared.This exploits the Merkle tree structure to allow proof of inclusion without needing the full contents of the block.As a further optimization, block headers that are buried sufficiently deep can be thrown away after some time (eg.you only really need to store as low as 2016 headers).The level of difficulty required to obtain confidence the remote node is not feeding you fictional transactions depends on your threat model.If you are connecting to a node that is known to be reliable, the difficulty doesn't matter.If you want to pick a random node, the cost for an attacker to mine a block sequence containing a bogus transaction should be higher than the value to be obtained by defrauding you.