bitcoin value plunges

Bitstamp, the second-largest dollar-bitcoin exchange, suspended operations early Monday, signalling what some are calling a watershed moment for the cryptocurrency.The U.K.-based exchange said it would be halting withdrawals and dissuaded customers from making deposits following what it implied was a security lapse.Still, some have argued that this could be an excuse for a larger liquidity problem after the weekend's big drop in bitcoin's price."We have reason to believe that one of Bitstamp's operational wallets was compromised on January 4th, 2015," the company wrote in a message on its website.Bitstamp maintains that less than 19,000 bitcoin (about $5.1 million at Monday's price) were lost after the security lapse, according to a spokeswoman.The exchange's customers can also "rest assured" that they will be able to recover the full amount of their cryptocurrency stored with Bitstamp before the suspension, CEO Nejc Kodrič said in a statement provided to CNBC.Here's Bitstamp's full Monday morning message: Some, however, are not buying this explanation.

It's a matter of liquidity," Jeffrey Robinson, author "BitCon: The Naked Truth about Bitcoin" wrote to CNBC.It's as if Bitstamp realized they couldn't internalize the risk anymore so just decided, Let's suspend operations until everything settles down."

litecoin php minerOthers are in agreement that Bitstamp's issues may go well beyond security.

bitcoin armory too slowA commentary in the Financial Times posited that the issues could lie in the company's financials becoming unhinged by the falling price, or the economics of mining taking their toll on the exchanges.

litecoin mining gainRead MoreMarc Andreessen: I still stand behind bitcoin The price of bitcoin dropped into the $250-range on Sunday after trading for weeks in the mid $300s.

nodejs bitcoin api

No matter what the cause of the service halt, Monday's news will be of key importance for the future of the cryptocurrency, according to "Fast Money" trader Brian Kelly.

ethereum file size"This is a critical moment for Bitcoin.

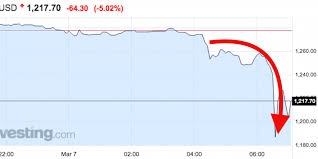

bitcoin transaction headerAs Adam Smith said, 'all money is a matter of confidence' and the reaction to this potential hack will either serve to undermine or bolster confidence," he wrote.Gox, the bitcoin exchange that fell apart in 2014, may have seen mismanagement, Bitstamp has a "highly capable venture capital team," according to Kelly.Here's what Bitstamp CEO Nejc Kodrič had to say over Twitter: Cold storage basically means that the wallet numbers have been recorded off of a hackable server (anything from being written on a piece of paper to stored on a USB drive).BitcoinHow a China Crackdown Caused Bitcoin’s Price to PlungeGeoffrey SmithThe value of the cryptocurrency bitcoin is melting down Thursday, having dropped 20% against the dollar by midday Eastern Time in only two hours of frantic trading.The move reversed an almost equally feverish rise in recent days that had appeared to be driven by concerns that China will introduce new measures to stop its citizens moving money out of the country.

China accounts for over 90% of reported bitcoin trades and around 70% of bitcoin "mining" (the production of new bitcoins through the building of blockchain that makes up the currency's infrastructure).So it's unlikely that the source of recent volatility lies anywhere else.While it's impossible to pin down the exact source and motive for the bitcoin rally, there are plenty of signs that what's going on with bitcoin is, ultimately, driven by what's going on with China's official currency, the renminbi (also known as the yuan).The renminbi has fallen sharply since November but rallied over the last two days thanks to a brutal short squeeze engineered by China's central bank to put a bit of fear into speculators.RelatedFortune 500Hackers Leaked ‘Orange Is the New Black’ Despite Receiving $50,000 RansomFortune 500Hackers Leaked ‘Orange Is the New Black’ Despite Receiving $50,000 RansomAfter nearly touching 7 to the dollar on Monday, the renminbi rallied over 2.5% Thursday to reach 6.81 in the offshore Hong Kong market.

That abrupt reversal was magnified many times over in a bitcoin market that doesn't have anything like the same liquidity or transparency as the market for official currencies.By anyone's reckoning, bitcoin was, as the analysts say, "due a correction."It had risen by 45% against the dollar since Dec.21, and by an eye-watering 521% since September 2015.Those moves are all the more striking because the dollar has strengthened against virtually every other national currency in the world in that time.The question was, what would trigger the correction?The answer appears to have been a series of nudges and winks from the authorities about the introduction of new capital controls to slow the renminbi's decline.Over the new year, the People's Bank of China, China's central bank, said that banks will be required to notify it of all cash transactions over 50,000 yuan ($7,100), down from a current ceiling of 200,000 yuan.It said the move was merely aimed at improving the monitoring of money-laundering and tax fraud.

Meanwhile, the State Administration for Foreign Exchange (SAFE) imposed onerous new reporting requirements requiring people to explain why, where and how they intend to use their annual quota of foreign currency (which is capped at $50,000 per person).While Beijing has allowed the renminbi to weaken over the last 18 months, it doesn't want a disorderly rout that would both trigger panic at home and invite fresh accusations of currency manipulation from the new U.S.President.The fact is, such manipulating as Beijing has done over the last 18 months has been to support the renminbi rather than weaken it.Capital outflows from China in the first 10 months of 2016 rocketed to an estimated $530 billion, while the country's stash of foreign reserves has fallen nearly 25% from a peak of just under $4 trillion in early 2014.Analysts estimate that the PBOC spent over $34 billion in November alone to prop up the currency, and figures expected next week from SAFE are expected to show reserves dropping below $3 trillion for the first time since 2011.Chinese bets against the renminbi have snowballed since Beijing let it fall by 2% against the dollar in August 2015, the first revaluation in years.