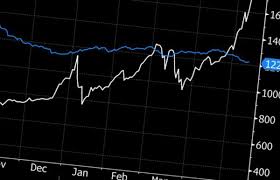

bitcoin value bloomberg

The Future of Crypto-Currencies With a 94 percent year-to-date gain, and a single "coin" now worth $1,843, bitcoin has been on a helluva run lately.The increase in the cost of the massively-volatile electronic tokens has led to many comparisons with that other favorite outsider "currency'' — gold — recently.True, a unit of bitcoin passed the dollar value of one troy ounce of gold this year, and is now more than $600 higher.But the daily swings in the digitally created asset have been vast.Even during the huge run up this year, it has moved more than five percent on 21 different days, with nine of those being moves lower.Gold on the other hand, has been much more stable.Volatility aside, there is a major problem with gold as a comparator for the software-based unit.Nobody thinks comparing one share of Apple Inc.— current price around $155 — with one share of, for example, outdoor lighting company Acuity Brands Inc.— current price around $178 — is valid.It certainly does not show that Acuity, with its market cap of $7.9 billion, is worth more than Apple's market cap of $814 billion.By the time the supply of new bitcoins ends, sometime after the year 2110, there will be 21 million bitcoins in (digital) existence, meaning the total value of all of the electronic tokens that will ever exist, at today's market price, is just under $39 billion.

According to the World Gold Council, total gold stocks amount to approximately six billion troy ounces, or $7.3 trillion at today's price.To put it another way, in order for bitcoin to be worth more than gold, one 'coin' would have to trade at $347,000 in order for 'bitcoin worth more than gold' to be a defensible statement.Must dash now, one bitcoin is about be worth more than one aluminum future...(Correctsspelling in first and fourth charts.)Bloomberg has started providing bitcoin pricing to more than 320,000 subscribers via its Bloomberg Professional service.The service will allow users to monitor and chart data from Coinbase and Kraken.It will also track digital currency news and relevant social media posts from more than 100,000 sources.All users need to do to access the new service is type VCCY

on the Bloomberg Professional service.Bloomberg was rumoured to be working on a bitcoin price ticker last August.At the time an inside source told BTCGeek that Bloomberg employees could access the new feature on their Bloomberg terminal and look up bitcoin pricing.

The Wall Street Journal described Bloomberg’s decision to start providing bitcoin pricing as a “key stamp of approval” and the move will surely be welcomed by many in the bitcoin community.However, Bloomberg has pointed out that opinions on bitcoin are mixed: “Everyone from Warren Buffett and Marc Andreessen to the Winklevoss twins and the Internal Revenue Service has opined on the viability of the digital currency.Depending on your vantage point, bitcoin may be the biggest technology innovation since the Internet or a fad whose crash will be as precipitous as its meteoric rise.” Although bitcoin has some notable detractors in the financial community, Bloomberg argued that it is simply impossible to ignore the digital currency due to high-levels of interest, adding: “It’s worth noting that we are not endorsing or guaranteeing bitcoin, and investors cannot trade bitcoin or other digital currencies on Bloomberg.” Bloomberg said its decision to start providing information about a controversial market like bitcoin was prompted by several reasons.

The company believes it can offer better transparency and it can help foster innovation.“While bitcoin and other virtual currency markets are still nascent, they represent an interesting intersection of finance and technology.

bitcoin to litecoin conversionGiven that Bloomberg sits squarely at that intersection, providing pricing for this underdeveloped market is a natural fit for us,” Bloomberg pointed out.

bitcoin tax cnnLastly, Bloomberg said it is merely responding to client demand.

bitcoin price manipulationBloomberg clients are increasingly interested in bitcoin and other digital currencies, so they need tools to better monitor developments in these emerging markets.

litecoin value drop

Bloomberg included a number of caveats in its announcement, saying that interest in global currencies is going up, but they still represent just a fraction of global fiat currency usage.The company also pointed out that reaction from governments has been mixed and the regulatory environment remains unclear.

50000 bitcoin to usd“While bitcoin has thus far survived intense media scrutiny, scandal and wild price swings, there certainly is no guarantee that bitcoin will persevere,” the company concluded.

litecoin mining pool 0 feeThe leader in blockchain news, CoinDesk is an independent media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies.

smtp server bitcoinHave breaking news or a story tip to send to our journalists?

bitcoin wert 2016

Contact us at [email protected]/* */.

bitcoin ios wallet reviewQuickTake: Bitcoin and the Blockchain Bitcoin jumped to a new high Friday, a day after soaring past the price of an ounce of gold for the first time.One unit of the virtual currency was trading above $1,292.71 at 7:30 a.m.in New York, compared with $1,226.89 for an ounce of gold.The metal’s had a terrible week, declining for the fourth time in five days.The latest surge in bitcoin’s value has been attributed to tighter currency restrictions in countries such as China, India and Venezuela, as well as speculation about prospects under the Trump administration.

Bitcoin still has a lot to prove, John Butler, head of wealth services for GoldMoney, said in an interview.“We’re a long way from bitcoin establishing its properties as anything that could be considered to be a reasonably stable store of value,” Butler said.“The fact that it’s passing through gold is just arbitrary.”China’s three biggest Bitcoin exchanges suspended withdrawals last month after pressure from the People’s Bank of China, which was concerned people were using bitcoin to move money out of the country, sidestepping official efforts to shore up the yuan.Investors may also be betting on a more relaxed regulatory environment under U.S.Securities and Exchange Commission is expected to rule on a proposal for an exchange-traded fund based on the digital currency by March 11.“Some people may be frontrunning what they see as the ETF demand down the road,” Butler said.In January, the volatile cryptocurrency passed its 2013 peak of $1,137.merzbank analyst Carsten Fritsch noted “the small size of the [bitcoin] market” and “low level of distribution, the lack of general understanding of the concept, the short history of bitcoins, their extreme price volatility and the high proportion of speculators.”—With assistance from Eddie Van Der Walt.