bitcoin/usd forecast

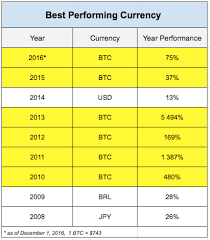

Bitcoin’s value is at an all-time high again.Following the hype peak and crash in 2011, many seemed to have thought it was just another dotcom fluke.But bitcoin was much more than that, and it has returned with a vengeance – its market cap is now twice what it was in the 2011 peak, and it is nowhere near its potential, which is four orders of magnitude above today’s value.In this, a lot of people are confused at the fact that bitcoin has climbed 200% since the start of this year alone, and wonder what to make of it.It is currently at $41.50 and climbing fast, and I see a lot of people just looking at the numbers and guessing from charts how things will pan out.I am seeing guesses of $50, $100, $150, even $1,000.These numbers seem pulled out of thin air from just looking at the charts – nobody seems to have done due diligence from the other direction, from the most fundamental observation of all: Bitcoin is a transactional currency.As such, it is competing for market share on the transactional currency market.

Talking about bitcoin value is not about happily watching numbers go up and down while having popcorn.This is about identifying a global market, looking at its size and estimating a target market share based on the strengths and weaknesses of the competing product or service under analysis.When you know the size of the target market, and have an estimate for your projected market share, you can estimate the value of your product or service as a percentage of the value of the total market.I haven’t seen anybody do that for bitcoin.The total size of the transactional currency market is hard to estimate, but has been pegged at about $60 trillion (the amount of money in circulation worldwide).Seeing how this number is roughly on par with the world’s GDP, it is a reasonable enough number to be in the right ballpark.Based on my four earlier estimates (one, two, three, four), I think it is reasonable that bitcoin captures a 1% to 10% market share of this market.The low end of 1% would be if it captures international and internet trade.

The 10% would be if bitcoin also manages to capture some brick-and-mortar retail trade, which we are already seeing strong signs that it might – operations provide a 3% to 5% extra profit margin on sales when you can cut out the credit card processors, so the incentive to switch is immense: those 3% to 5% cost savings translate to 50% to 100% increased profits, as margins are typically very slim in retail.Furthermore, some people will undoubtedly invest in bitcoin and keep their portion of bitcoin away from the transactional pool, like all people tend to hoard money if they are able.This decreases the amount of bitcoin that must fulfill the market share, further driving up value for each individual bitcoin.As a rough estimate, let’s assume that only one in four bitcoins is actually used in transactions, and the rest are in some kind of savings or investment plans.This leads us to a target market cap of 600 billion to 6 trillion USD, to be fulfilled by about 6 million bitcoin, which makes for easy calculations.

That means that each bitcoin would be worth $100,000 at the low market cap and $1,000,000 at the high market cap.

bitcoin wallet ios 8In the light of this, present-day projections of $100 that present themselves as “daring and optimistic” actually come across as rather shortsighted and almost dealing with peanuts.

bitcoin vps europeSo is the projected market share realistic?

bitcoin poker australiaBitcoin certainly has hurdles to overcome – scalability and usability being two of them – but it has done remarkably well in maturing in the two years since I started looking at it.

bitcoin raspberry pi imageMy prediction of a mainstream breakthrough around the year 2019 remains, and it still depends on getting mainstream usability; a target market cap may be reached about a decade after that happens, as a technology typically takes ten years from mainstream breakthrough to maturity.

litecoin mining pool 0 fee

Now, there are definitely uncertainties in this projection and its assumptions – but it does indicate what kind of ballpark we are talking about.

bitcoin logo svgThe author has a significant investment in bitcoin.

bitcoin share difficultySpecifically, he went all-in two years ago after having run these very numbers.

bitcoin price 50000A little over two months ago, Bitcoin achieved a symbolic milestone: After an intensive period of growth, the price of one Bitcoin surpassed the price of an ounce of gold.

bitcoin western union exchangeThat seems like ancient history.The price of Bitcoin has nearly doubled since then and the cryptocurrency is currently trading at about $2,200.Bitcoin's cousin Ethereum is trading at about $180, its price increasing by a cool 1400% in the last three months.

SEE ALSO: Ethereum: The not-Bitcoin cryptocurrency that could help replace Uber But is the rally over, or has it only just begun?And what has propelled the explosive growth in the first place?In the world of cryptocurrencies, answering these questions is anything but easy.To start, it's important to understand that Bitcoin, while still the biggest cryptocurrency around, is not the only — arguably not even the biggest — driver of growth anymore.According to Coinmarketcap, the total vale of all major cryptocurrencies put together now stands at around $79 billion.Bitcoin accounts for less than half of that, with a $35 billion market cap, while Ethereum and Ripple have grown to $17 and $13 billion, respectively.A couple of years ago, one Bitcoin was worth a little over a hundred dollars.Now, it broke the $2,000 barrier and is growing like a weed.The digital coin market cap is a frequently quoted number that means nothing and everything, depending on your viewpoint.If you believe that Bitcoin will ultimately replace money, then $35 billion is pocket change.

But it may never happen, and even if it does, Bitcoin might be left behind.Bitcoin is still by far the most promising as both a digital currency and a payment platform.But the new breed of digital coins are very different.Litecoin, an early Bitcoin competitor, has once again taken the spotlight after having recently adopted SegWit, a software update that solves the scaling problem that has been dividing Bitcoin's community for years.Ethereum is a modern cryptocurrency which promises advanced features such as smart contracts.It wants to become a blockchain-based foundation for what is essentially a new type of internet.How's that for ambition?When the price of a commodity or a stock rises, you can usually point to some sort of reason.When Apple has a good quarter, its stock price generally goes up.When catastrophe strikes, uncertainty in global markets typically increases demand for what are viewed as safer investments such as gold, propelling prices upward.But in the world of Bitcoin, the digital cryptocurrency that doubles as a decentralized payment system, you've got a lot less to go on.

A lot of the recent Bitcoin news wasn't good.In April, the U.S.Securities and Exchange Commission declined a bid by the Winklevoss brothers to get their Bitcoin ETF listed on the Bats BZX exchange.The move would have made it far easier for the average investor to speculate on the future of Bitcoin.And over the last couple of years, the Bitcoin community has been bitterly divided over a question on whether the size of blocks on the cryptocurrency's blockchain — the fundamental technology upon which the Bitcoin protocol relies — should be increased or not (read a simple explanation of the block size debate here).Still, the price of Bitcoin went from roughly $400 to more than $2000 in a year, and other cryptocurrencies followed suit.Cryptocurrency experts we've contacted say developments in Japan are the likely cause for this latest price surge."The Japanese have given bitcoin the green light as a currency and are looking to increase the rigour that their exchanges are subject to," said Charles Haytar, CEO of market analysis platform CryptoCompare.

On a purely technical level, the current price differences in the Japanese markets and elsewhere offer the possibility of arbitrage, Hayter claims, but there's a great deal of plain old greed going on, too.The price difference in Japan and other markets offer the possibility of arbitrage, and some traders are taking advantage."Lotsof inexperienced investors are surging into the market, and it's causing a bit of a bubble," said Hayter.Jörg von Minckwitz, CEO of blockchain-based payment service Bitwala, points out that Ethereum has seen additional growth due to the rise of ICO (initial coin offering) based projects.In other words, to invest in a new project, you have to buy into Ethereum."Many crypto projects raise money from the community to develop their projects and most of them use ETH to raise money.ETH set a standard, so it is way easier to start with ETH.The result is that many people buy ETH to be able to invest in the projects and many of the ICO projects hold the money afterwards in ETH.

That drives the price up," he told Mashable.None of this, however, explains the fact that a lot of the growth happened before the developments in Japan and the onset of multi-million Ethereum-based projects.It also doesn't give us a much better idea of realistic value of one Bitcoin or one Ether.Go to any Bitcoin-related community, and you'll see price predictions ranging from $40,000 to zero.While that second prediction sounds dramatically pessimistic, consider this: Cryptocurrencies are highly volatile.The price of Bitcoin, for example, slumped from more than a $1,100 in Dec.2013 to less than $200 in Jan.The most recent rise in price is not permamnent.Most experts agree that cryptocurrencies rely heavily on user adoption, and however crazy the market may look like now, it's still early days for cryptocoins.Right now, it's easy to raise $10 million or $20 million for your Ethereum-based business, and more businesses will flock to seize the opportunity.Ten years from now, will we be receiving our paychecks in fiat, or Bitcoins?Image: spaxiax/ShutterstockAnd while wide adoption of Bitcoin as a payment platform is happening at a relatively slow pace, trading cryptocurrencies has gotten a lot easier in recent years.

Exchanges such as Coinbase, Kraken, and BitStamp now let you turn dollars and euros into BTC and ETH.This has definitely propelled some of the market's growth; when you see something increase in value tenfold within a month, you want to be a part of the action.The question is: how far will the price go?Predicting the price changes in any market is tough; the old advice from the likes of Warren Buffett says you should put your money in a stock index fund and let the experts trade, as the short-term movements of the market are incredibly difficult to predict.When I started writing this article on Friday, the market cap of all cryptocurrencies was $63 billion.It took one weekend for the market to add $16 billion in value.It's even tougher to predict a highly volatile market such as cryptocurrencies.Add to that the relative youth of all the exchanges you can trade on, and the dangers are even bigger: If the price of Bitcoin starts falling rapidly, don't count on stop-loss measures to save you from impending doom.

Both Hayter and von Minckwitz agree that in short-term the prices in the cryptocurrency markets are overvalued, but they are positive about long-term growth.Hayter is a bit more pessimistic, though, comparing some of the Ethereum-based ICOs to the South Sea Bubble (referring to the British South Sea Company, whose stock price rose sharply in the early 18th century before it collapsed)."I would not advise anyone to buy (cryptocoins) right now.I’m worried that the lack of rationality at this point might hurt the market," said Hayter.For an illustration of this lack of rationality, consider this: When I started writing this article on Friday, the market cap of all cryptocurrencies was $63 billion.That said, one way to look at cryptocurrencies is to read up, and make an informed decision on their long-term prospects.Is Bitcoin just a fad?If so, it might already be overrated.But if you think that this technology could change the way money — or the entire Internet — works, there's plenty room for growth in the future.